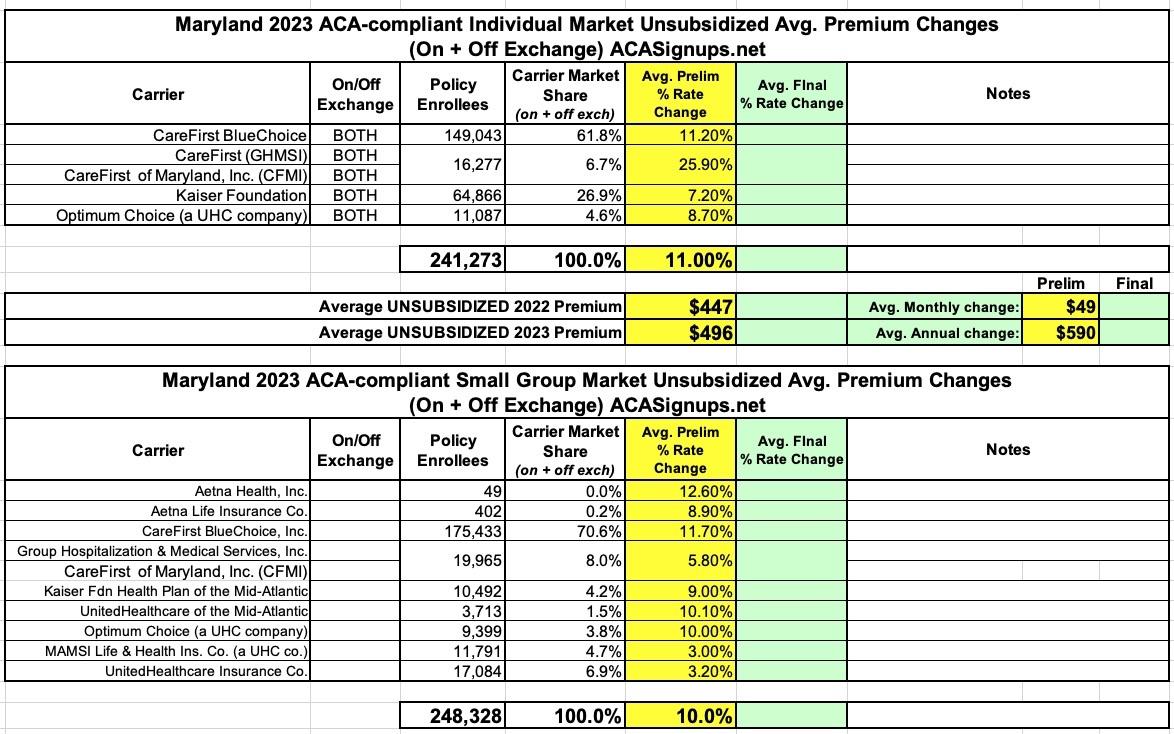

Maryland: (Preliminary) Avg. Unsubsidized 2023 #ACA Rate Change: +11.0%

via the Maryland Insurance Administration:

Health Carriers Propose Affordable Care Act Premium Rates for 2023

Public Invited to Submit Comments

BALTIMORE – The Maryland Insurance Administration (MIA) has received the rate filings containing the proposed 2023 premium rates for Affordable Care Act (ACA) products offered by health and dental carriers in the Individual, Non-Medigap (INM) and Small Group (SG) markets.

The carriers’ requested increases are reviewed by the MIA and rates must be approved by the Commissioner before they can be used. Before approval, all filings undergo a comprehensive review of the carriers’ analyses and assumptions. By law, the Commissioner must disapprove or modify any proposed premium rates that appear to be excessive or inadequate in relationship to the benefits offered, or are unfairly discriminatory. The MIA will hold a public hearing on the ACA proposed rates in July and expects to issue decisions in September 2022.

In the INM market, carriers have requested an overall average rate increase of +11%, with averages by carrier ranging from +7.2% to +25.9%. In the SG market, carriers have requested an overall average rate increase of +10%, with averages by carrier ranging from +3% to +12.6%. In the INM, stand-alone dental market, carriers have requested an overall average rate increase of +2%, with averages by carrier ranging from -4% to +9.4%.

The overall average rate increases requested for 2023 are higher than in the last several years. That change appears to be tied to increased health claim cost trends associated with the COVID-19 pandemic. In general, across all markets, filings by carriers have made no explicit adjustments to accounts for differences between the experience period and the projection period with respect to COVID-19. The MIA will be asking for additional data and analysis to determine what portion of 2021 claims are attributable to COVID and whether adjustments are necessary. There are several adjustments which may be appropriate, from accounting for differences in treatments, testing, and vaccine utilization, to accounting for the portion of 2021 claims, which represent deferred care from 2020, to accounting for new enrollees who are expected to enter the market when the COVID public health emergency ends and Medicaid disenrollment resumes.

“It is clear from our ongoing monitoring of industry experience that 2021 claims were heavily influenced by COVID-19, and that the significant differences between where we were in 2021 and where we are likely to be in 2023 must be modeled and taken into account in rate development” noted Insurance Commissioner Kathleen A. Birrane. “Obtaining more detailed information on how COVID-19 claims experience has influenced cost and trend models for 2023 will be the primary focus for our actuarial team."

Commissioner Birrane will hold a quasi-legislative virtual public hearing on this matter on Monday, July 11, 2022, at 10 a.m. (See details below.)

“Feedback from the public and all of our stakeholders is very important and we urge everyone to participate in the public hearing,” Commissioner Birrane said. “Health insurance costs impact everyone and we want to give all Marylanders the opportunity to be heard as we consider the carriers’ proposed rates.”

The rates submitted by the carriers for the INM market include the estimated impacts from the Hogan administration’s innovative, state-based reinsurance program, which was established in 2019. The program was intended to result in a reduction of rates by 30% within three years with future rate changes tied to increases or decreases in health care claim trends. As of January 2021, the Reinsurance Program had resulted in a 32% overall average reduction in rates from the rates approved in 2018, and the average increase of +2.1% in the INM market approved for 2022 was below the actual trend. Even if INM rates, as requested, were approved, the net effect would be a 22.3% average decrease in rates since 2018.

The rest of the press release makes it crystal clear how big of a deal NOT extending the American Rescue Plan's enhanced ACA subsidies would be:

In the INM Marketplace, enrollment has increased 10.9% in 2022, a gain of almost 24,000 members. This is on top of 18,000 new members who joined in 2021. The new entrants in 2021 were observed to be younger, healthier, and helped to drive down the morbidity of the single risk pool in 2021. The MIA’s expectation is that the same will be true of 2022 entrants. A major driver of the enrollment gains has been enhanced Advanced Premium Tax Credits (APTCs) under the American Rescue Plan Act (ARPA), which were first made available in May 2021, and are in effect until the end of 2022 under current federal law. There is uncertainty with respect to 2023, as the enhanced subsidies are set to expire under current law, which may lead to a portion of the younger and healthier members to lapse and the enrollment to decline and the morbidity to worsen. However, drafted bills in Congress would extend the enhanced ARPA APTC 2025, in which case higher enrollment and lower morbidity would be expected to be maintained. The MIA is closely monitoring federal legislation.

All illustrative premiums are the full unsubsidized premiums that would be payable prior to application of the APTC. Almost 80% of applicants who purchase a plan on marylandhealthconnection.gov receive APTCs and will not pay the full premiums shown here. APTCs vary by income and are linked to the unsubsidized cost of the second lowest cost silver plan available to a member. Unlike the past 2 years, there have not been any new market entrants into any county and while the second lowest cost silver plan is expected to change slightly, there should be minimal impact to APTC in 2023 from this factor. As noted above, the largest uncertainty for those with APTC is whether the enhanced APTC level under ARPA will be extended an additional three years or not.

Commissioner Birrane made it clear, however, that the existence of these subsidies is not a consideration when reviewing rate filings. “Rates in all markets, including the individual market, must be justified without regard to whether some policyholders receive assistance in paying the premium derived from those rates. Rate increases cannot be justified on the ground that the consumer may not be paying the actual full premium.”