Happy 12th Birthday #ACA: CMS releases final 2022 OEP report (part 4)

As noted this morning, today marks the 12th Anniversary of President Obama signing the ACA into law. To mark the occasion, the Centers for Medicare & Medicaid Services (CMS) has released the final, official 2022 Open Enrollment Period (OEP) report, which I'll be breaking into several entries.

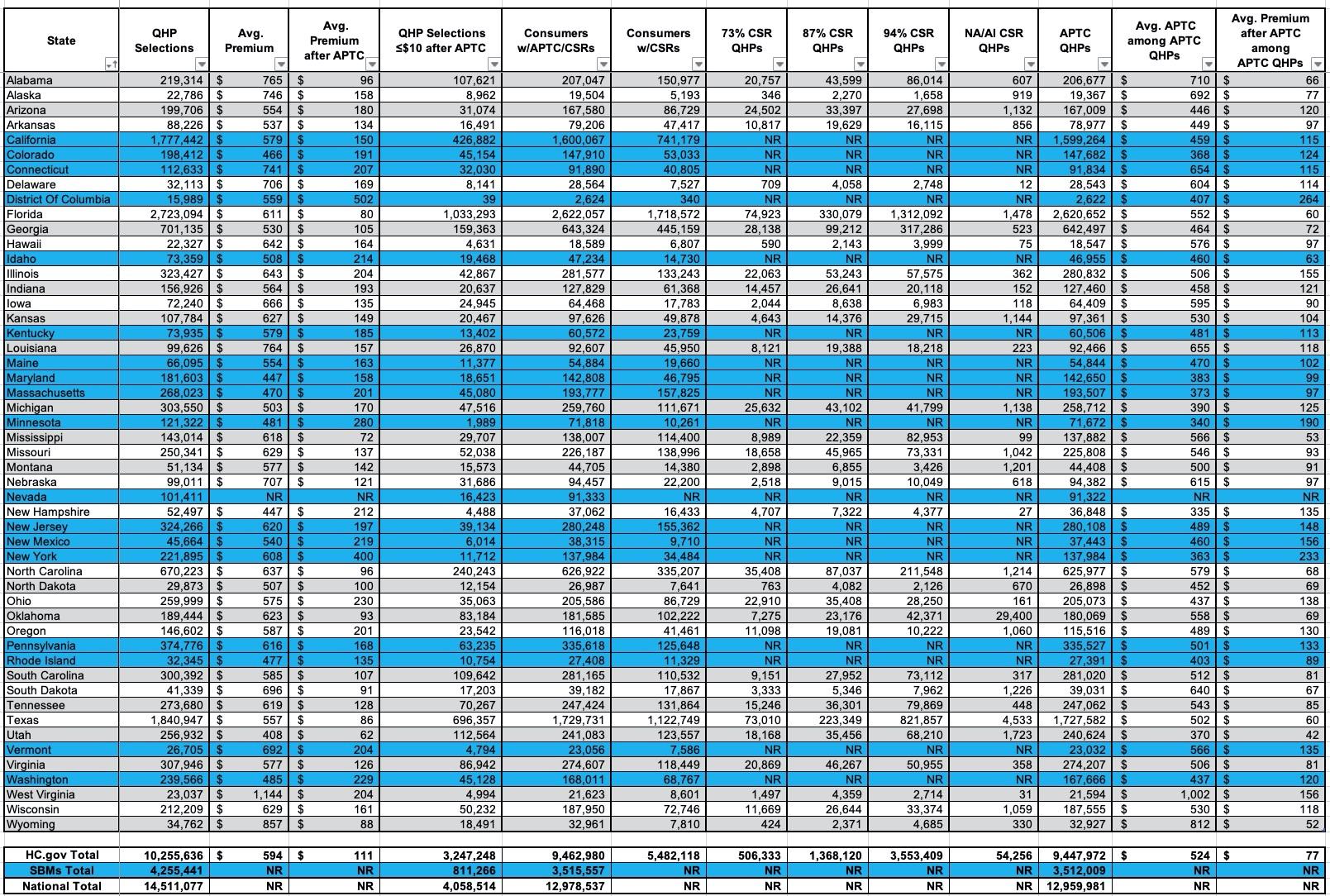

In this entry, I'm looking at the financial aid breakout for Qualified Health Plan (QHP) enrollees. ACA financial assistance falls into two categories: Advance Premium Tax Credits (APTC) and Cost Sharing Reductions (CSR). APTC reduces enrollees monthly premium costs; CSR reduces their deductibles, co-pays and other out-of-pocket expenses.

Thanks to the American Rescue Plan, APTC financial assistance is far more generous for most enrollees in 2022 than in prior years, as you can see by looking at the 3rd & 4th columns (avg. premium and avg. premium after APTC):

Nationally, 89.3% of all 2022 OEP enrollees are now receiving APTC assistance. While this is up from the ~83-85% which was typical in previous years, it's actually not as high as some healthcare wonks were predicting when the American Rescue Plan (ARP) was passed last year. Some figured it would be in the mid-90%s or so.

It's also worth noting that 53.5% of 2022 OEP enrollees in the 33 federal exchange states are receiving CSR assistance this year. Unfortunately it looks like the CSR info isn't available for the 18 state-based exchanges.

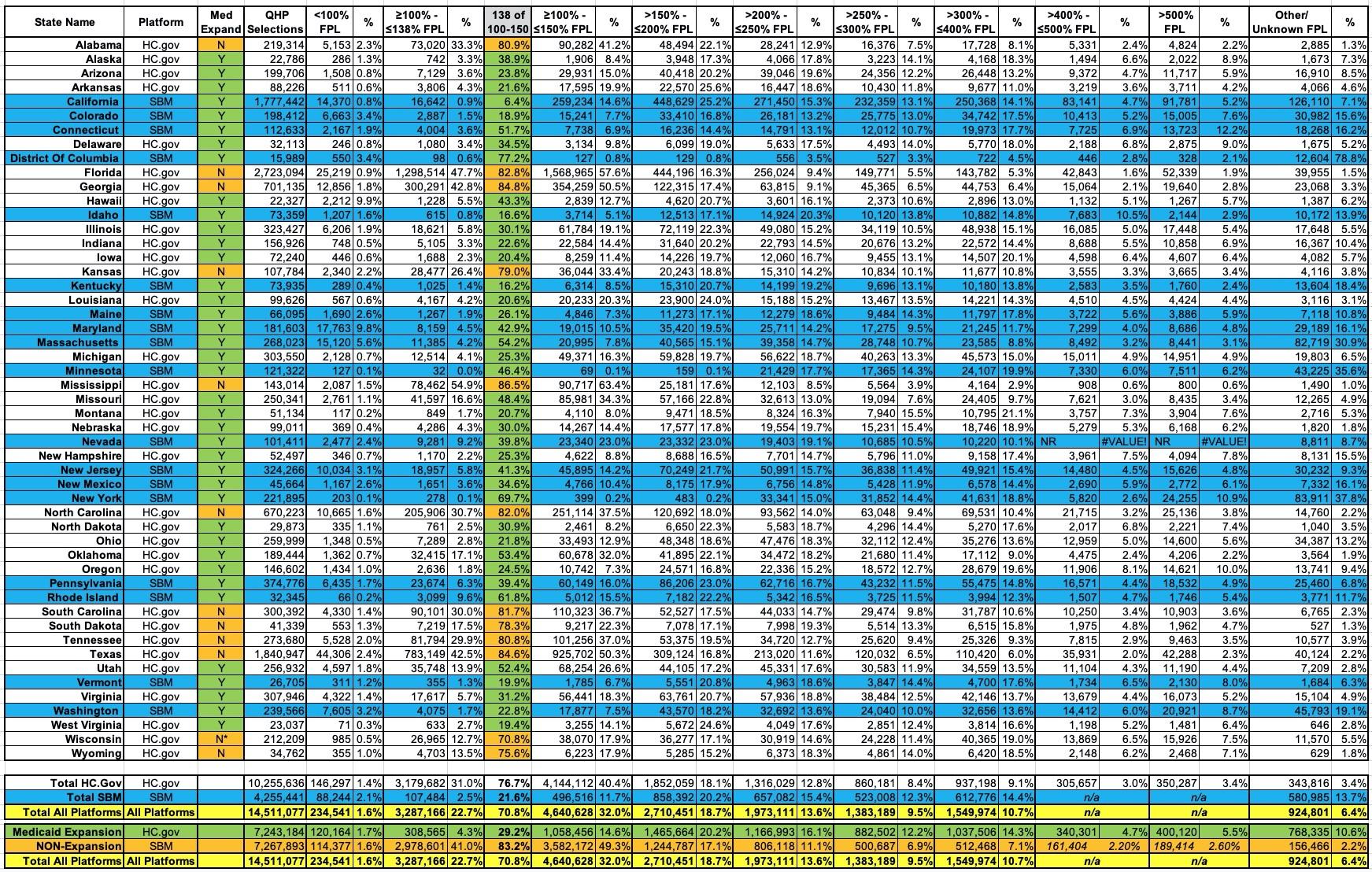

Next, here's the household income breakout of all ~14.5 million ACA exchange enrollees nationally. In a move which is making healthcare wonks everywhere cheer, CMS is finally breaking the income brackets out in more detail than prior years.

For the first time, the report states how many earn less than 100% FPL (only 1.6%, which is understandable given that only an extremely small number of people below the federal poverty line are even eligible) and how many earn 100 - 138% FPL (as a sub-set of the 100 - 150% FPL range).

The latter figures are useful because of the Medicaid Non-Expansion situation. 32% of all 2022 enrollees earn between 100 - 150% FPL, but of those, 71% actually earn 100 - 138% FPL, which means they're normally supposed to be enrolled in Medicaid...in states which have expanded the program.

A couple of important things stand out here: First, as you'd expect, there's a huge discrepancy in what percent of enrollees fall into the 100 - 138% FPL range between expansion and non-expansion states: It's only 4.3% of all enrollees in expansion states vs. a full 41% of total enrollees in the 12 non-expansion states.

Having said that, even that 4.3% seems a bit high to me--that's over 300,000 enrollees who, on paper, you'd expect should be enrolled in Medicaid in those states instead of ACA exchange plans, and yet here they are.

I'm assuming these folks are in special situations, just as the 234,000 nationally who earn less than 100% FPL are; it'll be interesting to find out what the story is in both cases. Some of them (most of them?) are likely legally-present immigrants who haven't been in the U.S. for more than 5 years:

‘‘(A) IN GENERAL.—The term ‘applicable taxpayer’ means, with respect to any taxable year, a taxpayer whose household income for the taxable year exceeds 100 percent but does not exceed 400 percent of an amount equal to the poverty line for a family of the size involved.

‘‘(B) SPECIAL RULE FOR CERTAIN INDIVIDUALS LAWFULLY PRESENT IN THE UNITED STATES.—If—

‘‘(i) a taxpayer has a household income which is not greater than 100 percent of an amount equal to the poverty line for a family of the size involved, and

‘‘(ii) the taxpayer is an alien lawfully present in the United States, but is not eligible for the medicaid program under title XIX of the Social Security Act by reason of such alien status, the taxpayer shall, for purposes of the credit under this section, be treated as an applicable taxpayer with a household income which is equal to 100 percent of the poverty line for a family of the size involved.