Biden Admin releases latest #BuildBackBetter framework; here's what the healthcare section looks like

A couple of hours ago, the Biden White House posted a completely updated version of what's being described as a "framework" for his Build Back Better policy agenda, which has been significantly pared down from the more ambitious version last spring. There are three main reasons for this: Congressional/Senate Republicans as a whole; Senator Joe Manchin of West Virginia; and Senator Kyrsten Sinema of Arizona.

There's still no way of knowing whether or not this version of Biden's #BBB agenda will pass either, but assuming it does, here's what will make the final cut:

- Universal Preschool for all 3- and 4-year Olds: Expand access to free high-quality preschool for more than 6 million children. This is a long-term program, with funding for six years.

- Affordable High Quality Child Care: Limit child care costs for families to no more than 7% of income, for families earning up to 250% of state median income. It enables states to expand access to about 20 million children. Parents must be working, seeking work, in training or taking care of a serious health issue. This is a long-term program, with funding for six years.

- Affordable, High-Quality Care for Hundreds of Thousands of Older Americans and People with Disabilities in Their Homes and Communities: Strengthening an existing program through Medicaid and ending the existing backlog and improving working conditions for home care workers

- Expanded Child Tax Credit: Extend for one year the current expanded Child Tax Credit for more than 35 million American households, with monthly payments for households earning up to $150,000 per year. Make refundability of the Child Tax Credit permanent.

- Clean Energy Tax Credits ($320 billion): Ten-year expanded tax credits for utility-scale and residential clean energy, transmission and storage, clean passenger and commercial vehicles, and clean energy manufacturing.

- Resilience Investments ($105 billion): Investments and incentives to address extreme weather (wildfires, droughts, and hurricanes, including in forestry, wetlands, and agriculture), legacy pollution in communities, and a Civilian Climate Corps.

- Investments and Incentives for Clean Energy Technology, Manufacturing, and Supply Chains ($110 billion): Targeted incentives to spur new domestic supply chains and technologies, like solar, batteries, and advanced materials, while boosting the competitiveness of existing industries, like steel, cement, and aluminum.

- Clean Energy procurement ($20 billion): Provide incentives for government to be purchaser of next gen technologies, including long-duration storage, small modular reactors, and clean construction materials.

- Affordable Care Act Premium Tax Credits: Extend the expanded Affordable Care Act premium tax credits through 2025. Experts predict that more than 3 million people who would otherwise be uninsured will gain health insurance.

- Also make Affordable Care Act premium tax credits available through 2025 to 4 million uninsured people in uncovered states.

- Allow Medicare to cover the cost of hearing. Establish a hearing benefit in Medicare, a crucial benefit to our seniors for a reasonable cost.

- Housing: $150 billion investment in housing affordability and reducing price pressures, including in rural areas. Funds go towards building, preserving, and improving more than 1 million affordable rental and single-family homes, including public housing, plus rental and down payment assistance.

- Education Beyond High School and Workforce Development: Reduce costs and expand access to education beyond high school by raising the maximum Pell grant, providing support to Historically Black Colleges & Universities (“HBCUs”), Hispanic Serving Institutions (HSIs), Minority Serving Institutions (“MSIs”), and Tribal Colleges and Universities (“TCUs”), and investing in workforce development, including community college workforce programs, sector-based training, and apprenticeships.

- Earned Income Tax Credit for 17 Million Low-Wage Workers: Extend for one year the current expanded Earned Income Tax Credit for childless workers.

- Equity and Other Investments: Other targeted investments including maternal health, community violence initiatives, Native communities, disadvantaged farmers, nutrition, pandemic preparedness, supply chain resilience, and other areas.

- Improve Our Immigration System Consistent with the Senate’s Reconciliation Rules.

As for the pay-fors, it looks like allowing Medicare to negotiate prescription drug prices--which was once one of the cornerstones of how the BBB would be paid for, and which has been a long-term goal by Democrats--is out. In fact, the only prescription drug provision listed at all is this:

- Repeal of Trump Administration Rebate Rule, Which Would Have Increased Seniors’ Drug Premiums

Here's some background on Trump's Medicare Part D rebate rule, which (if implemented) would increase drug prices for Medicare enrollees to the tune of $145 Billion over the next decade, according to the Biden Administration. So far it's been delayed; the idea here is that repealing it entirely would save the federal government that much, thus paying for a chunk of the rest of the BBB bill.

All of these things are important, of course, and some of them would be truly transformational in a positive way.

However, this site is about healthcare/health policy in general, and the ACA in particular, so it behooves me to focus on the highlighted bullets only:

- Affordable Care Act Premium Tax Credits: Extend the expanded Affordable Care Act premium tax credits through 2025. Experts predict that more than 3 million people who would otherwise be uninsured will gain health insurance.

This presumably means simply extending the dramatically upgraded ACA subsidies under the American Rescue Plan (ARP), currently set to only last for one more year (2022), for another 3 years. Obviously I wish this was made permanent, but 3 years seems to be the best we're gonna get for the moment.

As an aside: The wording about the ACA subsidy provision in the more detailed version on the White House website gave me a bit of a shock this morning:

Strengthen the Affordable Care Act and reduce premiums for 9 million Americans. The framework will reduce premiums for more than 9 million Americans who buy insurance through the Affordable Care Act Marketplace by an average of $600 per person per year. For example, a family of four earning $80,000 per year would save nearly $3,000 per year (or $246 per month) on health insurance premiums. Experts predict that more than 3 million people who would otherwise be uninsured will gain health insurance.

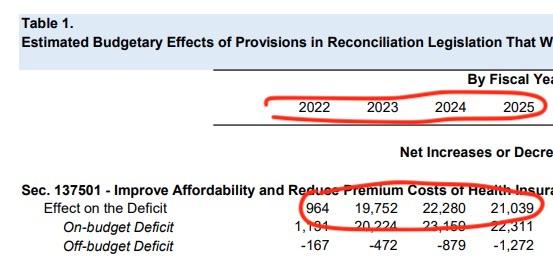

The problem with this is that if you take it literally, it adds up to 9 million x $600 x 3 years = just $16.2 billion for this section of the bill. This makes no sense when you consider that the CBO score of extending ARP subsidies out to 2025 would cost around $64 billion:

At first I freaked out a bit because I assumed they were seriously slashing the subsidy expansion down to the bone...until I realized that the "9 million" only refers to those who were already receiving ACA subsidies without the ARP. The bulk of the extra subsidies would be going to the newly-subsidy eligible enrollees.

This is borne out by the WH framework's cost summary, which puts it at $130 billion for the expanded subsidies thru 2025 (the other half would go towards the Medicaid Gap population; see below):

- Also make Affordable Care Act premium tax credits available through 2025 to 4 million uninsured people in uncovered states.

The original idea to close the Medicaid gap was a 2-stage process: For the short term (3 years), allow those caught in the Medicaid Gap fully-subsidized ACA exchange plans by temporarily eliminating the lower-end 100% FPL subsidy cliff; this would provide the time needed for the second phase: Establishing a federal version of the Medicaid program (call it "Fedicaid?") which the Gap population would then be transferred into.

It looks like the revised plan would keep the first phase but eliminate the second one: The Medicaid Gap population would be eligible for fully-subsidized ACA exchange plans from 2022 - 2025. After that, hopefully it would either be extended out again or the Fedicaid program would be implemented (or, who knows, a few of the non-expansion states might actually expand Medicaid under the ACA the way they were supposed to nearly a decade ago...)

- Allow Medicare to cover the cost of hearing. Establish a hearing benefit in Medicare, a crucial benefit to our seniors for a reasonable cost.

The original hope was that hearing aids, vision care and dental care would all be added to traditional Medicare coverage, along with a cap on prescription drug expenses. It sounds like hearing aid coverage is the only one which will make the final cut.

The thing is, each of these items (along with the other dozen or so in the larger BBB framework) would normally be considered a pretty big deal if they passed by themselves...but that assumes that we had a normal, functional government which wasn't facing an existential threat by White Supremacists, Dominionists and other Authoritarianists...while simultaneously facing an existential threat due to Climate Change.

Anyway, stay tuned...

UPDATE: I've decided to list the detailed look at what's in the BBB language over to a separate blog entry.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.