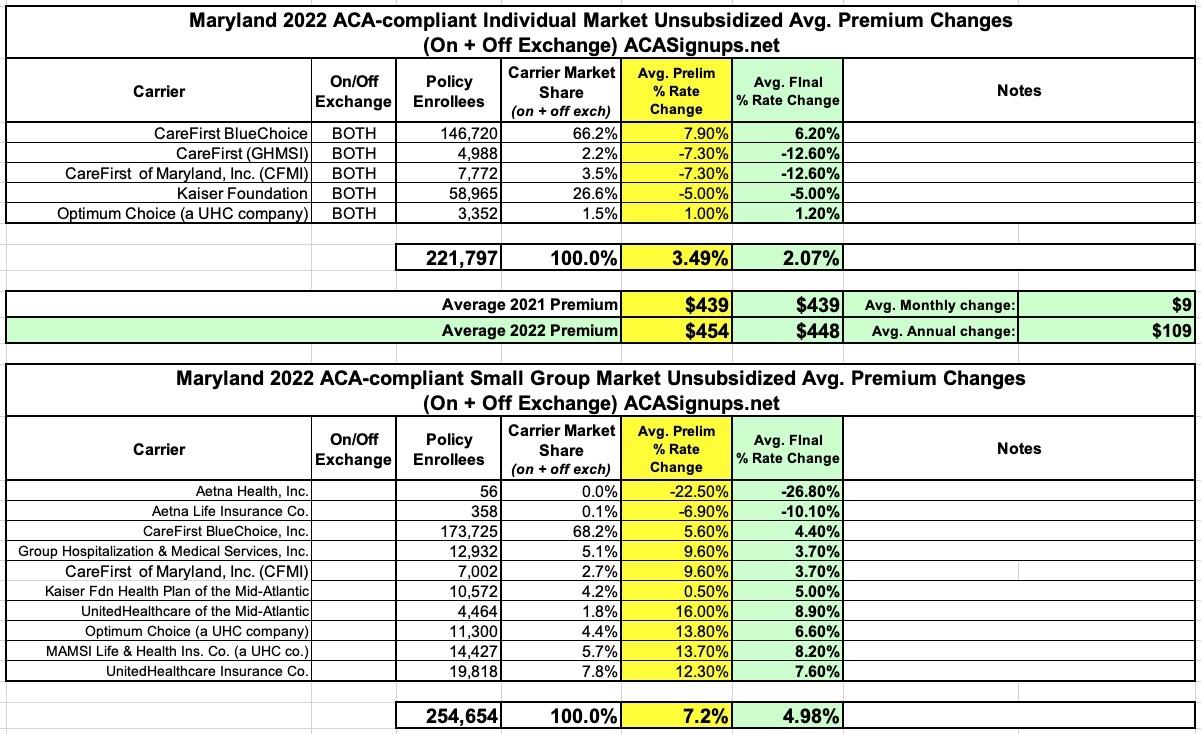

Maryland: Approved avg. 2022 #ACA rate changes: +2.1% individual market; +5.0% small group market

Back in June (yeah, I'm way behind as I've said before), the Maryland Insurance Commissioner published the preliminary 2022 rate filings for the state's individual and small group markets:

Health Carriers Propose Affordable Care Act (ACA) Premium Rates for 2022 Public Invited to Submit Comments

BALTIMORE – The Maryland Insurance Administration has received the 2022 proposed premium rates for Affordable Care Act products from health carriers. Health carriers are seeking a range of changes to the 2021 premium rates for plans sold in Maryland’s Individual Non-Medigap (INM) and Small Group (SG) markets in 2021.

In the INM market, carriers have requested an overall average rate increase of +3.5%, with averages by carrier and product ranging from -7.3% to +7.9%. In the SG market, carriers have requested an overall average rate increase of +7.2%, with averages by carrier and product ranging from -22.5% to +16.0%. In the INM, stand-alone dental market, carriers have requested an overall average rate increase of +0.3%, with averages by carrier and product ranging from 0.0% to +3.8%.

“It is clear from our preliminary review of the rate filings that projections regarding the financial impact of COVID-19 on claim trends is a key factor in this year’s rate requests. It is also clear that there is a significant difference in those projections among carriers and across products,” noted Insurance Commissioner Kathleen A. Birrane. “We have already reached out to the carriers with our first set of questions, and understanding how carriers are accounting for COVID-19 is an important first focus for our actuarial team.”

Across all markets, rate adjustments by carriers to account for COVID-19 ranged from zero to 14.1%. These adjustments account for the fact that claims utilization was depressed during some months of the 2020 experience period and are expected to increase to a more normal level in 2022, and for potential future claims related to COVID-19.

The rates submitted for the INM market include the estimated impacts from the Hogan Administration’s innovative, state-based reinsurance program established in 2019. The reinsurance program was designed to reduce and stabilize INM rates, following several years of annual double-digit increases tied to increasing morbidity and decreasing enrollment after the initial implementation of the Affordable Care Act. The expectation was that the reinsurance program would result in an overall average reduction of 30% for INM rates after three years, with future rate increases tied primarily to increases in the cost of care. “Governor Hogan delivered on that objective sooner and better than anticipated,” noted Commissioner Birrane. “The reinsurance program went into effect in 2019 and the 2021 rates reflected an overall 32.8% decrease from those charged in 2018.”

About a week ago, the MD Insurance Administration issued their approved rate changes for the 2022 ACA individual & small group markets:

State Insurance Commissioner Kathleen A. Birrane today announced the premium rates approved by the Maryland Insurance Administration (MIA) for individual and small group health insurance plans to be offered in the state for coverage beginning Jan. 1, 2022.

Thanks to the innovative reinsurance program developed by the Hogan administration in 2018 to reduce and stabilize rates in the individual market, the rates for individual health insurance plans under the Affordable Care Act (ACA) will increase by an average of only 2.1% this year, despite an increase in the average claims trend of 4.4%. The approved rates are 1.4% lower on average than insurance carriers officially requested – a difference of more than $15 million in total annual premium savings for Maryland consumers.

Maryland’s 1332 State Innovation Waiver was the result of a bipartisan legislative effort led by the Hogan administration and the presiding officers of the Maryland General Assembly in 2018. The waiver was approved by the Centers for Medicare and Medicaid Services on August 22, 2018, clearing the way for the implementation of the Reinsurance Program in 2019. The Reinsurance Program was projected to decrease then spiraling rates for individual insurance by 30% over three years, with future changes tied to claim trends.

Since the implementation of the State Reinsurance Program in 2019, premium rates in that market have decreased by an average of nearly 32%.

“I am very pleased that we were able to hold the average rate changes below the average claim trend. Governor Hogan’s foresight and leadership has saved individual Marylanders hundreds of millions of dollars in health insurance premiums. And, by making health insurance more affordable, we are continuing to drive down the rate of uninsured individuals in the state.” Commissioner Birrane said.

About 222,000 Marylanders are impacted by the approved rates. The actual percentage by which the rates for a specific plan will change depends on the plan. There are 34 plans in the Maryland individual market. Of these, rate increases have been approved for nine; the remaining 25 plans are reducing rates.

Here's what this all boils down to: Roughly a 2.1% average unsubsidized premium increase on the individual market and around 5.0% on average for the small groiup market:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.