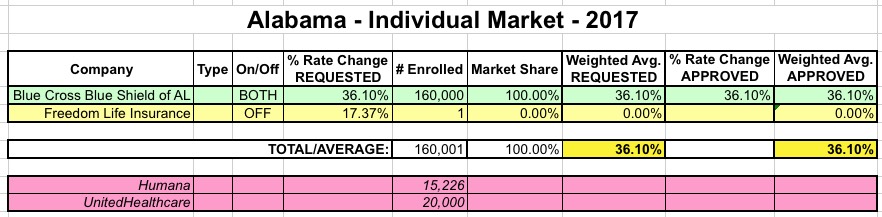

Alabama: Approved *unsubsidized* 2017 indy mkt rate hikes: 36%

I noted about a month ago that Blue Cross Blue Shield of Alabama had lowered their original 39% rate hike request a bit to 36.1%. As has been the norm this year, the state regulators went ahead and approved the final request. Kudos again to Louise Norris:

For 2017, only Blue Cross Blue Shield of Alabama will participate in the exchange. In August 2016, the carrier filed rate increases for 2017 that average 36.1 percent (with a range from 20.6 percent to 38.3 percent). This was a revised rate filing, and was slightly lower than the average rate increase proposal of 39.3 percent that the carrier initially filed in June.

The Alabama Department of Insurance approved the 36.1 percent average rate increase in October 2016, and the new rates will take effect in January 2017. AL.com reports that pre-subsidy rates for Bronze plans will increase between 20 percent and 23 percent, while Silver and Gold plans will increase in price between 32 percent and 38 percent.

This is the first year that the state has taken part in the rate review process for ACA-compliant plans; in previous years, the federal government handled the review process, as Alabama did not have an effective rate review process.

That changed in the spring of 2016 however, and the state collaborated with HHS to ensure that the rates and plans filed for 2017 are in compliance with ACA requirements. Although, like many other states, Alabama regulators do not have the power to reject rate increases or prevent them from taking effect.

BCBS appears to also be the only carrier participating in the individual market off the exchange in Alabama as well (other than the mysterious "Freedom Life" which appears to be using their indy market filing as more of a placeholder), so that's pretty much that...36.1% average rate hikes for unsubsidized enrollees: