2017 Rate Request Early Look: Wyoming

With only 584,000 residents, Wyoming is the smallest state, with a population over 10% smaller than even the District of Columbia or Vermont. Last year there were only 2 insurance carriers offering individual policies on the ACA exchange, Blue Cross and WINhealth. The average rate increase for 2016 was right around 10% even.

Unfortunately, WINhealth, a not-for-profit organization which had been around for 20 years, ended up as one of the few NON-Co-ops to go belly up last fall due specifically to Marco Rubio's Risk Corridor Massacre:

WINhealth sent along this release saying: As of October 8, 2015, WINhealth has chosen not to participate in the individual market, to include the federal exchange, for the 2016 plan year. The decision not to participate stems from a recent announcement from the federal government regarding the risk corridor program .

...This recent development from CMS came as a surprise to WINhealth. The financial impact of the federal government’s decision on WINhealth amounts to approximately $4.4M. The ambiguity of federal government repayments, both in timeline and amount, have created an environment of uncertainty and increased risk in the individual environment. For this reason, WINhealth has chosen not to participate in the individual market for 2016.

WINhealth’s President & Chief Executive Officer , Stephen Goldstone, stated “The federal government’s decision to significantly reduce the reimbursement we would receive under the risk corridor program came as a complete surprise to WINhealth. This combined with the continuous delays in repayment has caught WINhealth flat-footed with no choice but to turn down participating in the exchange for 2016.”

WINhealth went into receivership shortly thereafter.

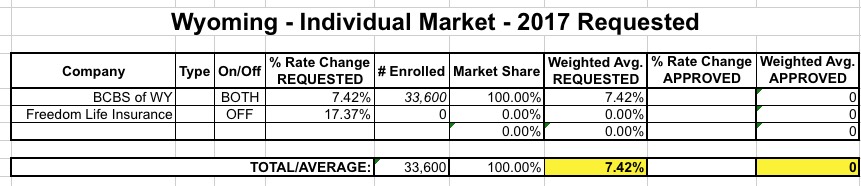

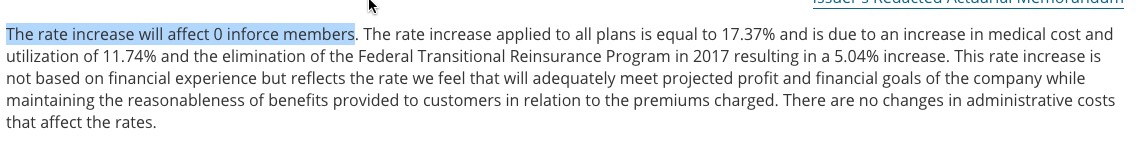

That left Blue Cross Blue Shield of Wyoming as the sole carrier providing individual policies in the states other than Freedom Life Insurance, which only sells off-exchange policies and (from their filing for 2017 below) doesn't appear to have anyone enrolled in them at the moment anyway. You would think that this would mean BCBS would take advantage of their monopoly to jack up prices dramatically...but it appears that a combination of the ACA's 80/20 Medical Loss Ratio rule, along with state insurance regulators who are presumably taking their jobs seriously, have resulted in a surprisingly low (for this year) requested rate increase:

Blue Cross has 4 separate filings, none of which include their actual membership numbers (the actual filings are all redacted), so there's no way of knowing the breakout between the 4. However, they have a very narrow range of 6.74 - 8.18%, and when you average them together it comes in at just 7.4%:

Not having actual enrollment numbers would normally be a problem for weighted averages, but in this case it's easy: There's only one other carrier (Freedom Life), and they don't have any enrollees, so there's no weighting needed. Just for completeness, I've estimated around 33,600 people anyway, based on an assumption of a 25% increase over 2014's 26.9K enrollees in the Wyoming indy market.

In any event, the bottom line is that BCBS of Wyoming is only requesting a 7.4% rate hike on average, which is the second lowest average so far (behind Rhode Island's 3.6%).

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.