CBO releases estimated 10-yr cost of House Ways & Means #COVID19 bill, including #KillTheCliff / #UpTheSubs

This afternoon, the Congressional Budget Office released their 10-year "score" report of the largest single chunk of the House Democrats version of the American Rescue Plan from the Ways & Means Committee:

Legislation Summary

S. Con. Res. 5, the Concurrent Resolution on the Budget for Fiscal Year 2021, instructed several committees of the House of Representatives to recommend legislative changes that would increase deficits up to a specified amount over the 2021-2030 period. As part of this reconciliation process, the House Committee on Ways and Means approved legislation on February 10 and 11, 2021, with a number of provisions that would increase deficits. The legislation would extend unemployment benefits, establish a pandemic emergency fund, increase subsidies for health insurance, provide cash payments to eligible people, expand several tax credits, and modify rules for pensions, among other provisions designed to mitigate the impact of the COVID-19 pandemic caused by the coronavirus.

Estimated Federal Cost

CBO and the staff of the Joint Committee on Taxation (JCT) estimate that the reconciliation recommendations of the Committee on Ways and Means would increase deficits by $927 billion over the 2021-2030 period. The estimated budgetary effects of the legislation are shown in Table 1. The changes in outlays from the legislation fall within budget functions 500 (education, training, employment, and social services), 550 (health), 570 (Medicare), 600 (income security), 800 (general government), and 900 (net interest).

The whole thing is 27 pages long, and obviously the key provisions which are of most interest to this website only make up a small portion of the total. Furthermore, the entire W&M Committee bill only makes up about half of the full American Rescue Plan; other portions are currently being worked on by the House Energy & Commerce and Education & Labor Committees, along with several others.

However, it's the increased/expanded ACA individual market subsidies which are indeed very much of interest to me, so let's take a look:

Premium tax credit.

Under current law, subsidies for health insurance through the marketplaces established under the Affordable Care Act are primarily provided through premium tax credits, which are available to people with modified adjusted gross income between 100 percent and 400 percent of the federal poverty level (FPL) who are lawfully present in the United States, are not eligible for public coverage (such as Medicaid or the Children’s Health Insurance Program (CHIP)), and do not have an affordable offer of employment-based coverage. Eligible people can use those tax credits to lower the out-ofpocket cost of their monthly premiums. The amount of a person’s premium tax credit is calculated as the difference between the benchmark premium (that is, the premium for the second-lowest-cost silver plan available in the marketplace in the area of residence) and a specified maximum contribution expressed as a percentage of income. That specified percentage of income varies according to household income.

Expanding premium assistance for consumers.

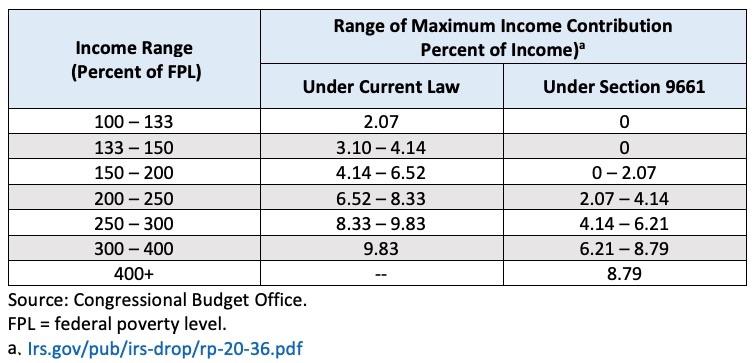

Section 9661 would increase premium tax credits for most currently eligible people and expand eligibility to people with incomes greater than 400 percent of the FPL through the end of 2022. For 2021, the legislation would modify the subsidy structure under current law, as detailed in Exhibit 1.

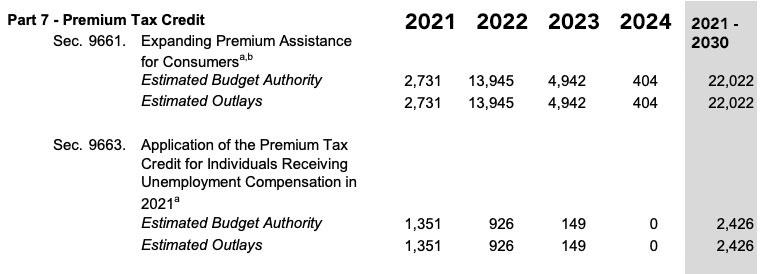

CBO and JCT estimate that section 9661 would increase federal deficits by $34.2 billion over the 2021-2030 period: an increase in direct spending of $22.0 billion and a reduction in revenues of $12.2 billion. Those effects reflect a $35.5 billion increase in premium tax credits for health insurance purchased through the marketplaces established under the Affordable Care Act, partially offset by other small effects.

It's important to note that only the $22 billion portion of this could be reasonably used to get an idea of how much eliminating the Subsidy Cliff & beefing up the APTC levels would actually cost on a regular basis; the "reduction in revenues" portion mostly refers to COVID-era provisions like waiving federal clawback of excessive APTC subsidies from 2020 and treating exchange enrollees who filed for unemployment this year as only earning 133% FPL even if they actually earned more than that.

Section 9661 would have a twofold effect on people with health insurance coverage through the marketplaces. First, most marketplace enrollees with subsidies under current law would gain access to enhanced subsidies, lowering their out-of-pocket premium costs. Second, marketplace enrollees who are currently ineligible for subsidies because their income is greater than 400 percent of the FPL could gain eligibility for subsidies under the enhanced subsidy structure. In addition to reducing the costs of marketplace coverage for those currently enrolled, CBO and JCT project that the enhanced subsidies would also attract enrollees who are new to the marketplaces, particularly people who are uninsured under current law. CBO and JCT estimate that new marketplace enrollees would account for $13.0 billion of the estimated increase in premium tax credits and existing marketplace enrollees would account for the remaining $22.5 billion.

Exhibit 1. Maximum Income Contribution Percentage by Household Income for Premium Tax Credits in 2021

Hmmm...the official table is set to: 0%, 0%, 0 - 2.0%, 2.0 - 4.0%, 4.0 - 6.0%, 6.0 - 8.5% and 8.5%. The reason the exact percents are slightly higher is due to the Premium Adjustment Pricing Index, which basically modifies these percentages by a formula based on the difference in average premiums from 2013 to the current year. Some years this inches up, some years it inches down. Personally I think they should just scrap the PAPI and keep it locked in at the original percentages, but I guess that's not happening.

In general, the enhanced tax credits under the legislation would be larger than the premium tax credits under current law. In an illustrative example, CBO and JCT estimate that a 21- year-old with income at 150 percent of the FPL in 2021 would be eligible for a premium tax credit of about $3,500 under current law; the tax credit would increase to about $4,300 under the legislation (see Exhibit 2). CBO and JCT expect that people with incomes just over 400 percent of the FPL who are older or enrolled in family policies or in insurance rating areas with especially high premiums would experience the greatest reduction in net premiums.

...In 2022, the year for which the provision would be in effect for the entire calendar year, CBO and JCT estimate that enacting the provision would increase the number of people with coverage through the marketplaces by 1.7 million. The agencies project that roughly 40 percent of the additional marketplace enrollees would be people ineligible for premium tax credits under current law because their income exceeds 400 percent of the FPL.

In other words, they're projecting that total ACA exchange enrollment would increase from around 10.5 million people per month on average to around 12.2 million/month on average, including ~1.0 million additional enrollees earning less than 400% FPL and ~700K earning more than 400% FPL.

For 2021, the 85% COBRA subsidy provision will likely keep the numbers down, but for 2022 I suspect this is significantly underestimating the actual numbers in 2022 (especially the > 400% crowd), but who knows?

The estimated increase in marketplace enrollment would consist of 1.3 million fewer uninsured people, 300,000 fewer people with nongroup coverage purchased outside of the marketplaces, and 100,000 fewer people with employment-based coverage. The estimated effect on the number of people with employment-based coverage is limited because CBO and JCT do not anticipate that many employers would change their decision to offer health insurance given the temporary nature of the enhanced subsidy.

Again, for 2021 specifically this may not be far off, since a) it'll likely be April at the earliest before the bill is signed & put into effect; b) it'll take some time to get the word out to middle-income enrollees; and c) the subsidized COBRA extension will prevent a lot of people from needing to make the move...but for 2022 this sounds like a pretty low estimate. The CBO thinks that only 300,000 of those currently paying full price for basically identical, ACA-compliant policies off-exchange would shift to the on-exchange equivalent in order to save potentially thousands or even tens of thousands of dollars? I don't know how many off-exchange ACA enrollees there are today, but my best estimate from my annual Rate Hike project is that it's likely around 2.8 million people, give or take. The CBO thinks only ~11% of those folks would make the move. Huh.

CBO and JCT estimate that enacting section 9661 would affect health insurance coverage to a much more limited extent in 2021 and 2023. The effect on health insurance coverage in 2021 would be constrained because the enhanced subsidy structure would take effect midway through the plan year. For 2023, CBO and JCT anticipate that some of the estimated increase in enrollment would persist beyond 2022, when the enhanced subsidy structure prescribed by this legislation would expire, and would gradually return to current law levels by 2024.

This is pretty much what I just said, and yes, some of those receiving expanded subsidies would likely stick around for another year or two (since most would still receive some APTC assistance, just not as much). I'm pretty sure the vast bulk of those earning more than 400% FPL would either downgrade their coverage or drop it completely after 2022, however...unless, that is, H.R 369 makes the enhanced/expanded subsidies permanent...

Modification of limits on reconciliation of tax credits.

Under current law, people are entitled to advance payments of their subsidies, which are based on income estimated from tax returns for prior years. If people’s circumstances change to the extent that their advanced subsidies exceed the actual subsidies to which they are entitled, they may be required to repay some or all of the credits. Section 9662 would remove this requirement for purposes of plan year 2020.

Section 9662 also would eliminate the requirement that people must repay any overpayments of health insurance subsidies received for plan year 2020. JCT estimates that section 9662 would increase the federal deficit by $6.3 billion over the 2021-2030 period after accounting for interactions with sections 9661 and 9663 as well as section 9501 in subtitle F. This increase would come from a decrease in revenues.

Application of premium tax credit for people receiving unemployment compensation in 2021.

Under current law, eligible people may receive a premium tax credit for health insurance through the marketplaces that equals the difference between the benchmark premium and a maximum contribution specified as a percentage of household income. Exhibit 1 shows the maximum income contribution percentages for 2021 under section 9661. (CBO and JCT estimated the effects of section 9663 relative to section 9661, which would increase premium tax credits for all currently eligible income levels and expand eligibility to people with incomes greater than 400 percent of the FPL through the end of 2022.)

Section 9663 would increase the amount of the premium tax credit for people receiving unemployment benefits for any length of time in 2021. People with household incomes greater than 100 percent of the FPL after excluding unemployment benefits—who are otherwise eligible for premium tax credits—would receive a premium tax credit as if their income were 133 percent of the FPL in 2021.

After accounting for the effects of section 9661, CBO and JCT estimate that section 9663 would increase federal deficits by $4.5 billion over the 2021-2030 period, which would consist of an increase in outlays of $2.4 billion and a decrease in revenues of $2.1 billion. Those effects would stem primarily from an increase in premium tax credits for health insurance purchased through the marketplaces.

In 2021, CBO and JCT estimate that about 900,000 people enrolled in subsidized coverage through the marketplaces under current law and after incorporating the effects of section 9661 would receive unemployment benefits and an increased subsidy under section 9663. The average incremental subsidy people would receive is estimated to be $1,040. An additional 500,000 people, who would otherwise obtain health insurance through COBRA or be uninsured, would newly enroll in coverage through the health insurance marketplaces and newly receive on average a premium tax credit of $7,040.

Overall, the agencies estimate a total of about 1.4 million people receiving unemployment benefits would be enrolled in subsidized coverage through the marketplaces and receive a premium tax credit. The mid-year enactment of the policy would limit the provision’s effect on health insurance coverage. CBO and JCT expect that most of the people newly enrolling in coverage through the marketplaces because of the increased premium tax credit are those who would begin receiving unemployment benefits following enactment of the legislation and would have otherwise enrolled in another form of coverage, such as a spouse’s employment-based insurance plan or COBRA continuation coverage. The provision would not affect the incentives of most recipients to take a new job because they would be considering job offers from employers that would not provide them with an offer of health insurance coverage that would disqualify them from receiving the subsidy in 2021. For recipients considering job offers that would disqualify them from receiving the subsidy because the job included an affordable offer of employment-based health insurance, the effect of the provision on the disincentive to take the job would depend on the extent of the subsidy for health insurance provided by the employer.

For 2022, CBO and JCT anticipate that some of the estimated increase in enrollment would persist beyond 2021, when the increase in premium tax credits in this provision would expire, and would return to current law levels by 2023.

Remember when I said that only around $22 billion of the $34.2 billion total cost would apply to a "normal" permanent, non-COVID Kill the Cliff/Up the Subs bill like H.R. 369? It's actually less than that on an annual basis; remember, that $22 billion includes the total cost for a 2-year program over a 10-year period, during which it would only be fully in effect for one full year (2022). Here's the actual additional outlays from the CBO report:

It's really the ~$14 billion in 2022 which is what we're talking about here. That's the amount in additional subsidies which would be spent on:

- Currently-subsidized on-exchange enrollees: Around 9.1 million

- (Last year these ~9.1M people received appx. $490/mo apiece in APTC, or ~$5,900/year)

- (That's around $53.7 billion/year in current APTC)

- New enrollees under 400% FPL: Around 1.0 million

- New enrollees over 400% FPL: Around 700K (~300K of whom CBO says would come from off-exchange ACA enrollment; ~100K would come from ESI enrollment (?))

- I don't see the ~1.4 million existing on-exchange enrollees who don't currently receive subsidies mentioned in the mix above...I'm pretty sure most of them would be newly-subsidized as well. Perhaps 1.2 million or so?

In short, if the CBO is accurate in its projections, we'd go from spending around $54 billion/year to subsidize 9.1 million people ($5,900/yr apiece) to spending around $68 billion/year to subsidize either 10.8 million people if you don't include the current unsubsidized exchange enrollees ($6,300/yr apiece) or 12.0 million people if you do include them ($5,700/yr apiece).

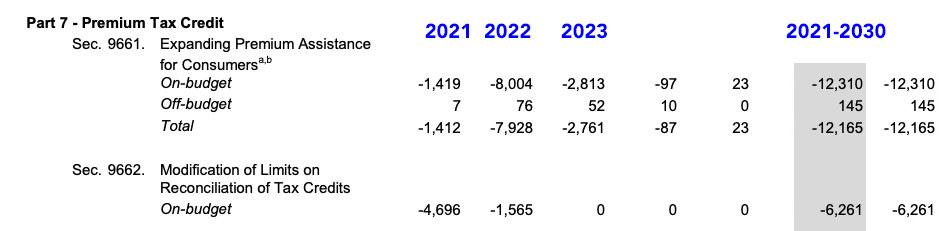

UPDATE: OK, I made my own big mistake here...I forgot to include the reduction in revenue side of the equation, which the CBO lists as:

...which, when you add the $12.2B to the $22.0B does indeed come to around $34.2 billion.

However, again, only $7.9 billion of that would be in 2022 specifically; add that to the $14 billion and you get $21.9 billion in "clean" non-COVID specific additional ACA subsidies...for at least 10.8 million people. That's $2,027 apiece at most. Even if you include existing ACA subsidy spending, the total is sstill just $75.9 billion / 10.8 million or around $7,000 apiece for a full year on average.

But again, I personally suspect that the CBO has lowballed the amount of additional on-exchange enrollment this will cause for 2022 specifically (2021 is harder to estimate for the factors already mentioned, and 2023 - 2024 assume that the subsidy expansion is limited to 2 years, which I sure as hell hope isn't the case).

Personally, I suspect the total net on-exchange enrollment gain (for 2022 at least) would be more like 2.5 - 3.0 million vs. the 1.7 million the CBO is projecting, but who knows? Anyway, it's a start.

UPDATE: Good lord. I wrote this post last night in response to a kneejerk tweet by Brian Blase, a conservative healthcare wonk who worked for the Trump Admin for a few years:

$34 billion to decrease the number of uninsured by 1.3 million. That's $26,000 for every one person reduction in the uninsured. If the overriding goal is to reduce the number of uninsured, this is a really, really inefficient way to do so. https://t.co/QZGeuHqml4

— Brian Blase (@brian_blase) February 16, 2021

In response to being blasted by folks like Cynthia Cox of the Kaiser Family Foundation and myself, Blase has already "clarified" his estimate from $26K apiece down to $17K apiece (though he still hasn't deleted the original garbage tweet):

#ACA subsidy expansion has largest effect in 2022. Projected to increase exchange enrollment by 1.7m, reduce nonexchange ind market by 0.3m, ESI by 0.1m. So, reduce uninsured by 1.3m at a cost in 2022 of $22b. This works out to $17,000 for every additional insured in 2022. (2/4)

— Brian Blase (@brian_blase) February 17, 2021

Note that Blase still assumes all $22 billion would go to those additonal 1.3 million people, which, again, is nonsense; it would be spread out across between 10.8 - 12.0 million people depending on whether the CBO report accounts for the currently-unsubsidized on-exchange enrollees or not. If you split the difference (11.4 million) that would average out to around $1,930 apiece. Even at the low end (10.8M) it'd still only be a little over $2,000 apiece.

And again, it's not $22 billion in new subsidies being paid out anyway, even in 2022 alone; it'd be around $14 billion. The other $8 billion is a combination of waiving clawbacks for those enrolled in 2020 and providing full subsidies for those on unemployment in 2021. For 2022 specifically, it'd be $14 billion / at least 10.8 million people, or $1,300 apiece.

It's not surprising that a Trump Admin guy like Blase would deliberately misstate the facts by a factor of 13x. What is surprising is that professional healthcare reporters like Sam Baker and Caitlin Owens would fall for it as well. I was a bit shocked at this post out of Axios this morning, in which Baker claimed (and Catilin reposted) the following:

1 big thing: Democrats' very pricey, very small coverage expansion

The Congressional Budget Office doesn't expect much from House Democrats' plan to temporarily expand health care coverage through the Affordable Care Act, Axios' Sam Baker writes.

This part is fair--as I note above, the CBO's projection of a net gain of 1.7 million on-exchange enrollees (and more to the point, the net reduction in the uninsured of just 1.3 million) does seem considerably lower than I'm expecting it to be. HOWEVER, after that it goes off the rails:

The big picture: According to CBO's estimates, Democrats' proposals would cover fewer than 2 million uninsured Americans — at a cumulative cost of over $50 billion.

Right off the bat, the average reader's takeaway from this would be that Democrats are "spending $25,000 per person!!"

Details: Democrats on the House Ways and Means Committee want to make more people eligible for the ACA's premium subsidies and increase the value of those subsidies for people who already get them. Both changes would be temporary.

Those changes would cover about 1.3 million uninsured people next year, CBO projects, and would end up costing the federal government about $34 billion.

Offering full subsidies to people receiving unemployment benefits would cost another $4.5 billion. And people wouldn't have to pay back excess subsidies from last year, adding another $6.3 billion.

Good Lord. AGAIN, the bulk of the $34 billion isn't intended to cover those currently uninsured but to provide additional financial relief to those who ARE already insured.

Hell, the last item (waiving clawback of excess subsidies from 2020) can't possibly go to lower the uninsured rate in 2021 since it specifically applies to LAST year's enrollees. I mean, it could certainly help a few of those folks stay enrolled in 2021, but that would be incidental.

Baker makes the same mistake in the second part of his piece about COBRA (which I didn't even get into above):

Separately, Democrats' plan to subsidize COBRA benefits would cover about 600,000 otherwise uninsured Americans, along with over 1.6 million more who would have otherwise had some other form of coverage, at a cost of $7.8 billion.

By the numbers: That comes out to nearly $53 billion, for a set of policies that would, per CBO's estimates, cover 800,000 uninsured Americans this year, 1.3 million in 2022 and 400,000 in 2023, before phasing out.

Again, he makes it sound like the full $7.8 billion in COBRA subsidies would go only to the 600K newly insured people ($13,000 apiece!) instead of the 2.2 million total ($3,550 apiece). It's even possible that you'd have to divide that $7.8 billion into the larger pool of ~3.0 million total COBRA enrollees...

In response to the availability of those subsidies, CBO and JCT estimate that an additional 2.2 million people, on a FYE basis, would enroll in COBRA coverage, resulting in a total of about 3 million FYE COBRA enrollees in 2021. In total, the agencies estimate that subsidies for COBRA—for existing and new enrollees—would increase deficits by $14.8 billion over the 2021-2030 period.

...which would reduce the per-enrollee amount further to perhaps $2,600 apiece, but I could be wrong about that.

Sam's thought bubble: This does not seem like a particularly efficient, or even effective, way to achieve Democrats' primary goal: Offering a bridge to the millions of people who lost their health insurance when they or their family members lost their jobs amid the pandemic.

...except that this is only one of TWO primary goals, Sam. ONE of those goals is to reduce the total number of uninsured. The OTHER goal is to provide financial relief/savings to those currently insured.