MAJOR UPDATES: Senate Democrats introduce their own ACA 2.0 bill...and look who's on board with it!

A couple of weeks ago, several Democratic members of the House of Representatives introduced a new bill designed to significantly improve, strengthen and expand the Affordable Care Act. It's officially titled "H.R. 5155: Undo Sabotage and Expand Affordability of Health Insurance Act of 2018", but I shortened this to simply "ACA 2.0", because that's pretty much what it is.

The House ACA 2.0 bill would check off a half-dozen or so of the 20 items on my (now outdated) wish list of ACA fixes/improvements...but also includes another half-dozen provisions on top of that (many of the additional items would cancel out Trump/GOP sabotage efforts which hadn't even happened when I wrote my "If I Ran the Zoo" wish list a year ago).

As I noted several times in my analysis of the House ACA 2.0 bill, these ACA fixes are almost certainly intended to tide things over until a more comprehensive/robust universal healthcare bill can be passed, presumably sometime in 2021-2022 or so. As I stressed repeatedly, even if there's massive blue waves in 2018 and 2020, no universal coverage bill--whether CAP's Medicare Extra, Bernie's "Medicare for All" or any other such bill--is going to become law and actually be implemented until 2022 at the earliest, so we need a singnificant ACA boost in the meantime.

Anyway, today, it looks like the Senate Democrats are following suit (via Daniel Marans at Huffington Post):

Sen. Elizabeth Warren (D-Mass.) introduced a bill Wednesday aimed at dramatically increasing the affordability and reliability of health insurance plans available on the Affordable Care Act marketplaces.

The legislation, called the Consumer Health Insurance Protection Act, would offer people buying health insurance on their own more financial assistance ― and allow more people to qualify for that assistance. Nobody would have to pay more than 8.5 percent of income on premiums.

Hmmm...the acronym for Warren's bill is CHIPA, which admittedly is gonna confuse the hell out of people who will mix it up with CHIP, but whatever. I'll stick with "Senate ACA 2.0".

As Andrew Sprung just reminded me, the "no more than 8.5% income cap for everyone" threshold was first proposed by analysts Linda Blumberg and John Holahan of the Urban Institute in 2015, and was adopted by Hillary Clinton during her Presidential campaign, not that many people seemed to care at the time.

Warren does not envision this new plan as an alternative to more ambitious proposals. She remains a co-sponsor of the single-payer legislation introduced by Sen. Bernie Sanders (I-Vt.).

But as Warren made clear in a January speech before the consumer group Families USA, she understands that enacting a single-payer plan would be difficult ― and that, as a result, private insurance probably won’t disappear overnight. And so she also wants to focus on what can be done right away to subject the industry to the type of stringent consumer protections she has already successfully championed in the financial sector.

...Sanders is actually a co-sponsor of the Warren bill, as are Democratic Sens. Kamala Harris (Calif.), Maggie Hassan (N.H.), Kirsten Gillibrand (N.Y.) and Tammy Baldwin (Wis.).

I need to take a moment here to call out progressives who badmouthed and scolded me last week for promoting the House ACA 2.0 bill by insisting that ONLY Bernie's M4A bill will do, and ANYTHING short of that--even in the short term--is unacceptable:

- "Or we could, I don’t know. Just support Medicare4All. Make sure the Insurance companies don’t make profit off of health. I mean, isn’t that something all Democrats should stand behind. Why are we pussyfooting around?"

- "I take issue with the term “pragmatic” you use to describe the corrupted and compromised wing of the party. It implies that these people have the best interest of the country at heart and are navigating a difficult path to a better program. “Pragmatism” has been a time-worn euphemism for betrayal. We should not use it to describe the people who have been bought by the corporate interests."

- "If you don’t think that healthcare is a right and that it’s way past time for Americans to not be price-gouged whenever they get sick, by all means join in on creating divisive efforts like “ACA 2.0.” Otherwise your time would be better used helping to make Medicare for All a reality, instead of working to defeat it “out of principle”."

- "In truth, I have attacked the idea of Democrats creating alternate bills such as MEFA or “ACA 2.0” instead of trying to work with those who have SUCCESSFULLY moved the Overton window over so far to the left. "

I wonder how these folks are gonna respond to today's news that Bernie Sanders himself is on board with Senator Warren's "ACA 2.0" bill? Will I receive an apology for being referred to as part of the "corrupted and compromised wing of the party?" Will Bernie be accused of "betrayal" for "creating divisive efforts like ACA 2.0"? I'm not holding my breath.

But I digress:

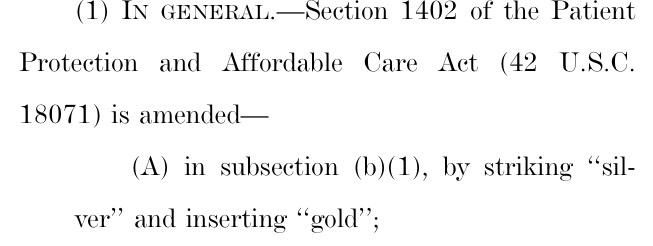

...By switching to a system where premiums are capped as a percentage of income, Warren would insure that no household is without protection from premium increases. Basing the subsidies on the cost of the more expensive “gold” plans would also allow families to buy more generous coverage at the same cost or stick with a less generous plan and pocket the savings.

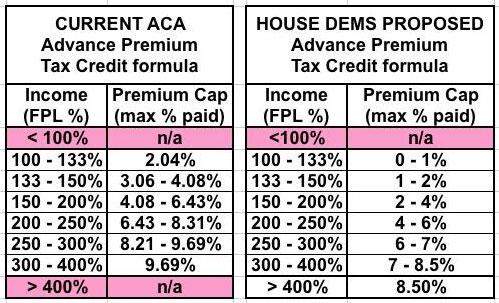

This sounds almost identical to the House bill, which also caps premiums at no more than 8.5% of income. The HuffPo story doesn't include the exact tax credit formula, but it sounds like it'd be very similar to this:

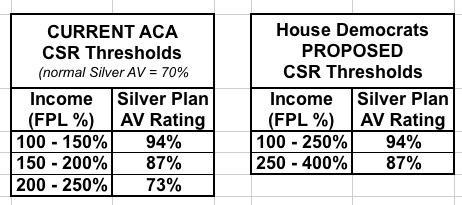

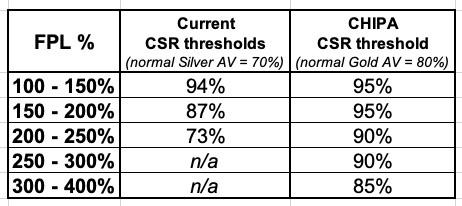

The biggest difference between the House and Senate bills on the tax credit front is that the House bill sticks with Silver as the benchmark plan while the Senate bill upgrades to Gold. HOWEVER, the House bill also significantly beefs up and expands the CSR formula as well, which amounts to pretty much the same thing in practice:

Under the House bill, enrollees up to 400% FPL would be guaranteed a Platinum or near-Platinum policy for no more than 8.5% of their income, while those over 400% would be guaranteed a Silver plan for 8.5%. Under the Senate bill, CSRs would be officially appropriated (see below), presumably at the same threshold as now, which means those earning up to 200% FPL would be guaranteed Platinum/near-Platinum, while everyone over 200% FPL would be guaranteed Gold for 8.5%.

The House bill is better for those under 400% FPL, while the Senate version is better for those over 400% FPL, but both would be a vast improvement over the current situation.

Another feature of Warren’s bill aimed at enhancing affordability is a provision capping out-of-pocket costs on prescription drugs at $250 per month that would apply to all private plans...the number of people who would save money from the provision is likely minor but still significant.

This is a nice touch which the House bill doesn't include.

The legislation would also introduce new rules designed to protect consumers from insurance plans that prove unreliable and inadequate. All private insurance plans would be required to spend 85 percent of their premium dollars on paying out insurance claims ― subjecting them to a tighter standard than the one that already applies to ACA plans. They would also be barred from changing the kinds of drugs that they cover in the middle of the year, as well as how much of those drugs’ costs are born by consumers.

Right now, large group plans (for businesses with more than 100 employees) already have to spend at least 85% of premiums on claims, but small group and individual market plans only have to spend 80%. Truth be told, the 80% threshold was kind of a moot point the first few years of the ACA, since most indy market carriers were paying 90% or even 100% of their premium income on claims and losing money anyway. Now that they've finally figured out how to properly price for the ACA exchange markets, however, bumping it up to 85% might have some impact (not that they'd like it, of course).

Consumers would also be shielded from the effects of an insurer dropping a plan during their course of treatment. And insurers would have to notify consumers if a plan no longer covered a particular doctor.

These are both good things.

The bill’s provisions protecting the ACA from Trump administration sabotage include increased funding for outreach and education about enrollment in ACA plans, and tightening rules requiring coverage of “essential” health benefits, which the administration is trying to water down. Like other bipartisan legislation under serious consideration in Congress, Warren’s bill would also reinstate the federal government’s cost-sharing reduction payments to insurers, which subsidize limitations on out-of-pocket costs for low- and middle-income consumers.

All three of these items are on the House bill's checklist.

Finally, Warren would “call [the insurers’] bluff” by requiring insurance companies that bid on Medicare Advantage and Medicaid contracts to offer plans on the ACA marketplaces in parts of the country with limited insurance industry competition. New York already has a similar regulation in place.

Hey, look at that! #12 on my "If I Ran the Zoo" wish list!

I'd have to see the actual text of Warren's bill to know for sure if there's anything else missing, but it appears to cover the following items on my wish list:

- 1. Lock in CSR reimbursements

- 7a. Raise or remove the 400% FPL subsidy cap...

- 7b. ...and beef up the formula below 400%

- 8. Raise the cap on CSR eligibility (sort of...Warren's bill would simply upgrade the benchmark from Silver to Gold instead)

- 12. Tie Medicare Advantage/MCO contracts to exchange participation

- 14. Institute an 80/20 MLR policy for pharmaceuticals (no, but Warren's bill would cap prescription drug costs to $250/mo, which is sort of in the same realm)

It would also include several items not on my wish list, including the bump from 80% to 85% MLR, the shielding/notification requirements and the increased outreach funding.

In other words, there's a lot of overlap with the House ACA 2.0 bill here, and both of them overlap with many of my own wish list items. Good to hear.

Just keep in mind that again, neither the House nor Senate bills has a chance in hell of actually being passed or signed into law until January 2019.

So why are Senators Warren, Harris, Gillibrand and yes, SANDERS (all 4 of whom are widely expected to run in 2020, I should note) all co-sponsoring this bill, along with Baldwin (expected to be in a tight re-election campaign this year) and Hassan all sponsoring it anyway? Because the Dems need a solid healthcare bill with teeth in the short term REGARDLESS of what long-term overhaul they end up with after 2020...which is EXACTLY what I was saying last week.

UPDATE: Daniel Marans has updated his HuffPo story with links to Warren's one-page summary as well as to the legislative text itself:

The Consumer Health Insurance Protection Act – Senator Elizabeth Warren

The Affordable Care Act put an end to some of the most egregious practices that insurance companies used to shift costs onto patients, including annual and lifetime coverage limits and discrimination against people with pre-existing conditions. But today, too many patients still have to battle with their insurance companies just to see a doctor or get a prescription filled. Insurance companies draw networks so narrow that patients struggle to find a doctor or get an appointment.1 Patients find out when they get a bill in the mail that they unwittingly relied on an outdated provider directory and now owe hundreds of dollars in unexpected costs for out-of-network care. 2 Insurance companies can drop doctors from their network in the middle of the plan year with no notice, suddenly jack up out-of-pocket costs for a cancer or MS drug,3 or rip up a plan at the end of the year and leave new mothers or patients dealing with a serious health condition scrambling to maintain access to their doctor.

Also thanks to the Affordable Care Act, an historic number of Americans now have affordable health insurance coverage. But the more than 216 million individuals who rely on private insurance are facing rising out-of-pocket costs. Between 2005 and 2015, out-of-pocket costs for workers with employer coverage rose twice as fast as wages.5 Today, three out of every ten American adults with health insurance say they’re having a hard time paying their medical bills.6 Meanwhile, thanks to revenue from taxpayer-funded programs, insurance company profits are booming. The top insurers in the U.S. pull in nearly 60% of their revenue – more than $200 billion in 2016 – from Medicare and Medicaid, even as some of these same insurers claim they can’t afford to participate in the ACA exchanges.

The Consumer Health Insurance Protection Act

We must do more to hold insurance companies accountable by requiring them to providing coverage that is just as affordable and high-quality as coverage in public programs like Medicare and Medicaid. The Consumer Health Insurance Protection Act calls insurance companies’ bluff by putting an end to abuses that hurt patients and by requiring insurers making money off Medicare and Medicaid to step up to the plate in the ACA markets. The Act’s provisions include:

- Setting limits on insurance company profits to match those private insurers can earn in Medicare and Medicaid

- Instituting new protections to ensure all patients are notified when doctors are dropped from the network and are protected if they rely on an inaccurate provider directory or have a plan discontinued while in an active course of treatment

- Prohibiting surprise bills for emergency room care

- Requiring insurers generating revenues from Medicare Advantage or Medicaid managed care plans to offer coverage on the exchanges in areas with limited insurer competition.

- Guaranteeing that every individual on the ACA exchanges has access to a plan that covers 80% of out-of-pocket costs and costs no more than 8.5% of income in premiums.

- Protecting against unreasonable premium increases with stronger rate review standards

- Requiring the tracking and analysis of consumer complaint data

- Strengthening enrollment and outreach programs

Hmmm...the one-pager doesn't really include anything which wasn't in the HuffPo story, aside from the "tracking of consumer complaints" and such.

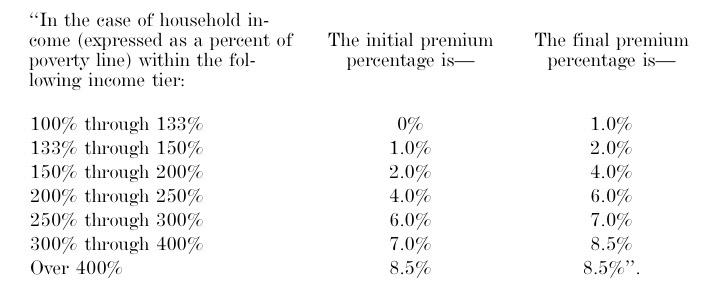

The legislative text does indeed inlcude the revised APTC table:

...and sure enough, it's identical to the House version except that it would be based on a benchmark GOLD plan (80% Actuarial Value) instead of SILVER (70% AV).

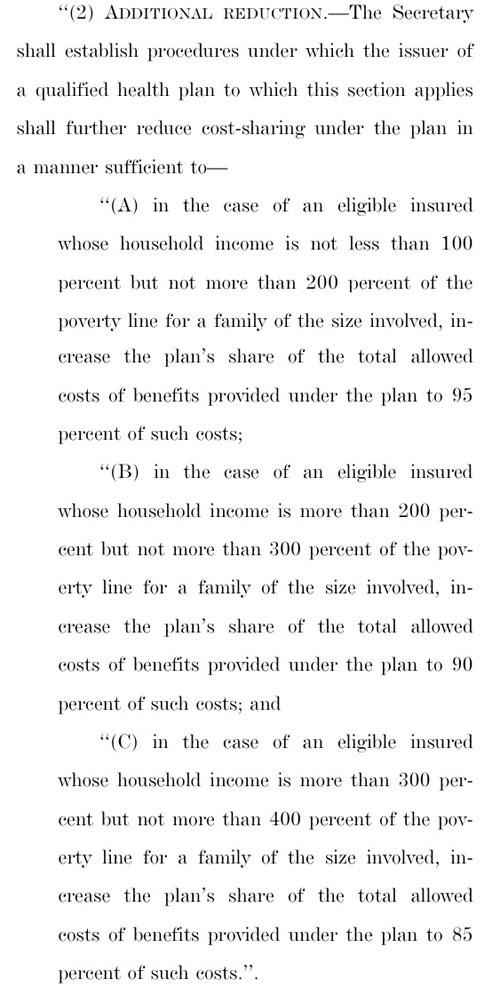

However, it appears that Cost Sharing Reductions would also be beefed up similarly to how the House bill does it...instead of 94% AV up to 200% FPL and 87% up to 400% FPL, Warren's version would stick with three tiers:

- 95% up to 200% FPL

- 90% up to 300% FPL

- 85% up to 400% FPL

Here's a comparison:

I'll read through more of it later today to see if there are any additional items I missed.

UPDATE x2: OK, here's some more odds and ends whch either clarify some of the above bullets or add to them:

- On pages 3-7, it gives the HHS Secretary the authority to veto "unreasonable" rate increases. Right now, the states have the ability to review rate increase requests, and most of them have the ability to veto them if they're deemed excessive...but in some states, the insurance commissioner can't actually do anything about excessive rate hikes beyond publicly scolding the carrier. This appears to give HHS the authority to chop 'em down to size in states where the insurance commissioner either can't or refuses to do so.

- The effective date on at least some of the provisions is January 1, 2020, which is a depressing admission that there's no way in hell this bill will become law before January, at which point it'll be too late to do much for 2019.

- On page 11-12, Cost Sharing Reduction reimbursement payments are, indeed, formally appropriated. THIS IS VERY DIFFERENT from how it would be done under the Alexander-Collins bill, however, because this bill also beefs up the APTC/CSR formula and removes the 400% FPL cap, which makes all the difference in the world.

- The prescription drug cost cap shows up on page 12. It limits out of pocket drug costs to $250/month for individuals and $500 for families, with annual increases chained to the CPI. Note that this isn't that generous--that amounts to an annual drug deductible of $3,000 per person or $6,000 for families, although these are still bundled in with the larger deductible as well, I believe.

- It looks like the prescription drug cap would also apply to group policies (page 13)?

- On pages 14 - 16, this bill appears to require standardized metal level plans ONLY! This is excellent:

‘‘(iv)(I) agrees to offer the standardized option established for the State under paragraph (5) for each level of coverage offered by the issuer that is the bronze, silver, or gold level of coverage; and ‘‘(II) with respect to offering coverage that is the bronze, silver, or gold level of coverage on an Exchange that is operated by the Secretary, agrees to offer only standardized options established for the State under paragraph (5) and not any other plan for such levels of coverage;

It goes on to define what those "standard" requirements at each metal level actually are, but the larger point is that this would prevent the exchanges from getting cluttered up with dozens of virtually-identical policies which a) confuse the hell out of enrollees and b) create the "Silver Spamming" problem (fix #16 on my wish list), as Dave Anderson describes it:

This is a way to exploit the subsidy formula to build a bigger and healthier subsidized enrollment pool. The key assumption is the last person to buy is extremely price sensitive and also very healthy/low cost. Lower post-subsidy plans will attract more people who think that they won’t actually use then plan than if the least expensive option is priced high.

The subsidy is based on the 2nd least expensive Silver plan. Everyone who gets a subsidy for a given income level pays the same out of pocket premium for that 2nd least expensive Silver no matter where they are in the country. The APTC fills the gap between the individual payment and the actual premium. The APTC is constant. If the buyer chooses a less expensive plan (Bronze or #1 Silver) their out of pocket premium decreases. If they choose a more expensive plan #3 Silver or Gold or Platinum, they pay the incremental increase in premium.

SO Silver Gapping is when there is a big spread between #1 and #2 Silver. This means the #1 Silver might only cost someone making $20,000 $10 a month out of pocket while the #2 Silver costs $65/month. And the Bronze plans might be either free or $1 a month.

This is a hack that works in minimally competitive markets. In perfectly competitive markets, two or more carriers are tightly clustered at the Silver benchmark point.

- On pages 17-19, I think the "Family Glitch" is fixed! (#3 on my wish list!):

‘‘(III) REQUIRED CONTRIBUTION 4 WITH RESPECT TO FAMILY MEMBERS.—In the case of an individual who is eligible to enroll in the plan by reason of a relationship the individual bears to the employee, the required contribution for purposes of subclause (I) is the employee’s required contribution (within the meaning of sec12 tion 5000A(e)(1)(B)(i), determined by substituting ‘family’ for ‘self-only’) with respect to the plan.’’.

- On pages 19 - 24, Warren's bill strongly beefs up/tightens up on the Network Adequacy requirements of ACA policies. This one isn't on my wish list but is an important improvement.

- Pages 24-29 refer to tying Medicare Advantage and Managed Care Organization (MCO) contracts for Medicaid to ACA exchange participation. HOWEVER, the language makes clear that this requirement only refers to coverage areas/states which have 1-2 carriers on the exchange already. In a state like Michigan or Wisconsin, where there's already a dozen or so carriers, this requirement wouldn't be in place.

- Interesting...on page 29-30, this bill would require the annual Open Enrollment Period to last at least 8 weeks (56 days). This is shorter than it was in 2014-2016 (3 months) but still longer than it was last year (45 days).

- Page 30 is where it makes sure that you qualify for a Special Enrollment Period (SEP) if your carrier drops your doctor/hospital mid-year (bait & switch!). You'd still have to switch plans, mind you, but at least you'd be allowed to do so.

- Page 30 also adds an interesting item:

The Secretary shall establish a process to allow an individual, who is enrolling in a qualified health plan through an Exchange and whom the Exchange estimates is eligible to receive a premium tax credit under section 36B of the Internal Revenue Code of 1986, to provide consent to the Exchange to not automatically re-enroll the individual in such qualified health plan (or a comparable qualified health plan in a case described in subsection (b)) for the following plan year if during the plan year the Exchange estimates that the individual has become no longer eligible to receive such credit.

I'm not quite sure why this would be a problem--even if you're auto-renewed into a policy which you can no longer afford, you can still simply cancel that policy before January 1st anyway. I guess this just means HealthCare.Gov would have to add a checkbox to the application form on the website saying "I don't want to be auto-renewed if I no longer qualify for tax credits next year" or something like that.

- There's some related language on pages 30 - 32 about clearly notifying enrollees about auto-renewals and their policys being discontinued. I kind of thought this was already required anyway, but perhaps this cleans up the language on those notices or whatever.

- Pages 32 - 33 legally appropriate and require the HHS Secretary to spend...holy crap...$480 MILLION on ACA enrollment outreach/education/marketing for 2019, to be increased by 4% per year after that. WOW. That's a lot of money to be sure...more than 4x as much as the House version would require for advertising/marketing. However, this would also include the outreach program budget, which I assume means all the ACA navigator grants and so forth, so it migh only be around twice as much as usual. I'm not sure about the breakout.

While this may sound excessive, for comparison, it's worth noting that Covered California spent $45 million on ads for the 2018 Open Enrollment Period this season. Considering the state holds 12% of the population, extrapolated nationally that would be roughly...$375 million. Is that too much? I have no idea.

- Page 36: Huh. If I'm reading this correctly, #SenateACA2 would eliminate the 50% premium surcharge currently allowed for smokers. This is the only "medical history" or "personal behavior" underwriting currently allowed for under the ACA, and it looks like Sen. Warren wants to scratch this one off the list as well. Unexpected.

- Pages 36-37 appear to be all about beefing up the public posting of health insurance information

- Pages 37-44 appear to be all about outlawing "surprise billing" and the like from out-of-network doctors/hospitals/etc.

- Pages 44-45 are about protecion from costs of prescription drugs being yanked mid-year.

- Paes 45-46 deal with "balance billing"

- Page 47 deals with mandatory notifications about doctors/hospitals being dropped from a network

- Page 48 is interesting:

"SEC. 406. SHORT-TERM LIMITED DURATION HEALTH INSURANCE COVERAGE. (a) IN GENERAL.—Section 2791(b)(5) of the Public Health Service Act (42 U.S.C. 300gg–91(b)(5)) is amended by striking ‘‘but does not include’’ and inserting ‘‘including’’.

If I'm understanding this correctly, it would basically be the same as Senator Baldwin's earlier standalone bill, which subjects Short-Term Plans to the same requirements as ACA-compliant policies. I could be wrong about this, but if I have it right, it completely wipes out the whole point of Donald Trump's #ShortAssPlan executive order. The only reason why most people would want to enroll in a Short-Term Plan is because they're far less expensive than ACA plans...but the reason they're so inexpensive is because they tend to have pretty poor coverage (this varies, of course). If they're required to hold to ACA regulations, there goes that price advantage.

- Pages 48-49 tighten up the rules about Essential Health Benefits

- Pages 49-52 heads off the "Association" (Ass) part of Trump's #ShortAssPlan executive order, similarly to how page 48 nips Short-Term Plans in the bud.

Now, to be honest, a few of the items above may be pushing the point even under a full Democratic House and Senate (the 85% MLR for indy plans, for instance, and the $480 million per year for marketing/outreach come to mind), but for the most part I love this bill for the same reasons I love the House version.

There’s one major exception in both, however:

Neither one includes restoring the individual mandate (although the House version does include funding for “state innovation” programs which it notes could include restoring a mandate penalty).

As far as I can tell, at the federal level, at least, Democrats have decided that after losing the House and possibly the Senate over the ACA individual mandate, the horse has escaped from the barn and it wouldn’t be worth the headaches they’d get from trying to bring it back (much less increase it, which is really what should be done).

Since the Republican Party has clearly proven that they no longer give a rat’s ass about running up the deficit anyway, the Dems have apparently decided to say “to hell with it” and rely on beefing up federal spending on subsidies dramatically. That’s not so different from how the Alexander-Collins bill would handle it, after all (cancelling out the mandate repeal rate hikes with $30 billion in reinsurance funds).

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.