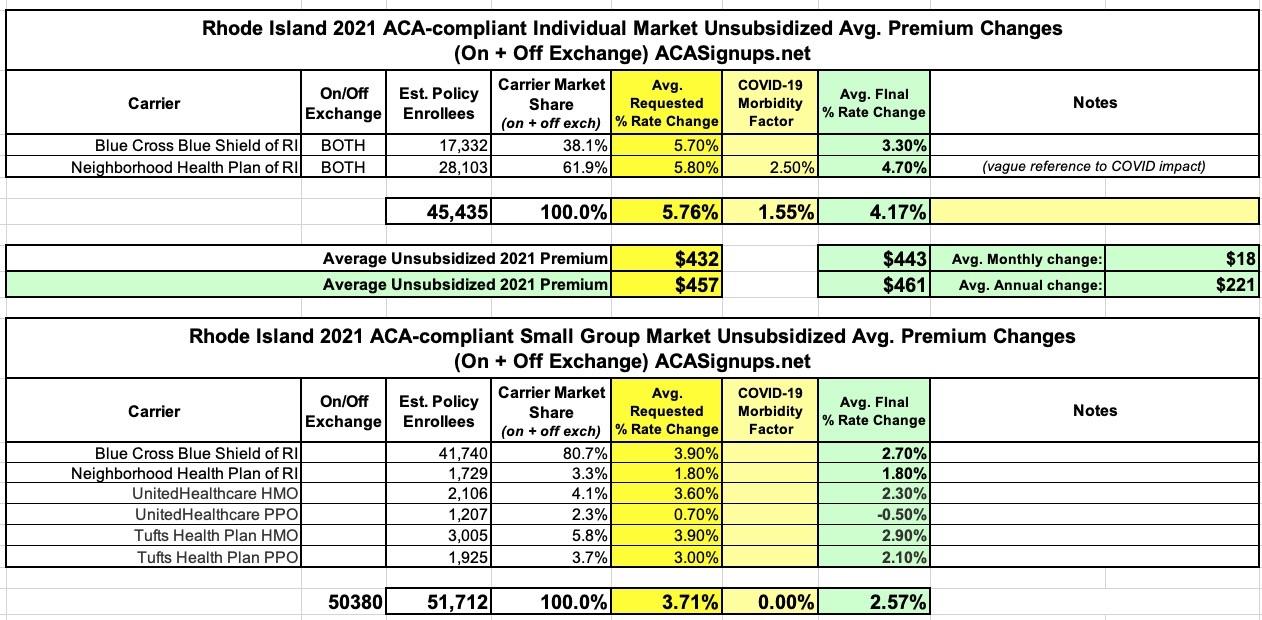

Rhode Island: *Approved* avg. 2021 #ACA premium rates: +4.2% indy, +2.6% sm. group

Back in late July, the Rhode Island insurance dept. issued a press release with the preliminary 2021 rate filings for the state's individual and small group markets. At the time, the weighted statewide average increases being requested were around +5.0% and +2.2% respectively.

A month later, the RI DOI issued their approved 2021 rate decisions, and made some small tweaks to each. In fact, it looks like there was at least one revision in between, as the new press release lists slightly different numbers for the "preliminary" requests.

In any event, Rhode Island indy & sm. group enrollees will be looking at roughly 4.2% increases on the individual market and 2.6% increases for small group plans:

CRANSTON, R.I. – Health insurance premium rates for 2021 have been approved by Rhode Island’s Office of the Health Insurance Commissioner (OHIC). Overall, this year, OHIC has saved Rhode Islanders $12,870,000 by cutting the insurers’ proposed 2021 rate increases. As Rhode Islanders continue to face the economic hardships brought on by the spread of COVID-19, OHIC is committed to keeping the cost of insurance affordable. The newly approved rates are listed in the charts at the end of this release.

In addition to lowering the 2021 rates through the rate review process, earlier this year OHIC approved premium reductions for Rhode Island businesses associated with the termination of the federal health insurance tax in 2021. A $7.5 million savings is associated with reductions to fully insured Rhode Island businesses through the elimination of the tax. While not all states effectively enabled the full termination of this health insurance tax, Rhode Island allowed the tax to sunset. For those businesses whose contracts began late in 2020, extending into part of 2021, OHIC required the insurers to reduce rates associated with the tax in their 2020 existing contracts.

Additionally, during the COVID-19 pandemic, OHIC approved insurer-proposed premium credits for consumers of some dental and medical plans. Such reductions to consumer costs are associated with the reduced claims expenses due to lower use of health care services during the COVID-19 pandemic. These premium credits amounted to over $20 million and were provided to approximately 220,000 subscribers, including groups and individuals who pay for their own insurance without any assistance from an employer or a government subsidy.

Ensuring that consumers continue to receive the important care they rely on, while also working to limit the spread of COVID-19, OHIC has fostered innovative solutions to health care delivery. Amongst the actions taken were numerous bulletins and insurance guidance to remove and reduce barriers to care and make it easier for consumers to continue to receive the health care services they rely on. Together with Governor Raimondo and our state and community partners, OHIC has set in place policies to ensure continuity of care, affordable access to COVID-19 screening, testing and treatment, and telemedicine coverage policies that make receiving care safer for Rhode Island families.

OHIC has ensured that consumers will not be charged added, direct fees by their dental or other health care providers to offset the costs of provider personal protective equipment needed to safely deliver care during this pandemic. Strengthening consumer protections and removing barriers to care has always been at the core of OHIC’s work, and amid the public health crisis brought on by COVID19 it is more important now than ever before.

In addition to creating policies that maintain safe access to health care and lowering premium increases, OHIC is dedicated to improving the health care system in our state to meet the needs of those who have been impacted by the social and economic stresses caused by the pandemic. OHIC worked to establish a COVID-19 Behavioral Health Grant Fund at the Rhode Island Foundation with more than $5 million designated to fund nonprofits working to address Rhode Islanders’ behavioral health needs during the pandemic. This funding was made available by the state’s four major insurers, as a result of a behavioral health coverage compliance review conducted by OHIC.

“Consumer protection remains at the forefront of all of OHIC’s work. Affordable access to health care services is more important now than ever before.” said Health Insurance Commissioner Marie Ganim, “We know that Rhode Islanders are facing increasingly difficult hardships due to the spread of COVID-19, and our office is working hard to make accessing the health care services they need easier, and more affordable.”

Rhode Island remains the only state with an insurance commissioner who focuses specifically on health care, giving OHIC the unique legal charge to view the state’s health care system as a comprehensive entity and encourage the state’s insurers towards policies that improve the quality and efficiency of the health care delivery system in our state. OHIC is dedicated to protecting consumers; guarding the solvency of health insurers; encouraging the fair treatment of health care providers; and improving the health care system.

OHIC’s rate review process is a part of the office’s efforts to control employer and consumer premium growth in Rhode Island. Consumer protection and affordability continue to be core tenets of OHIC’s mission.