Florida: *Approved* avg. 2021 #ACA premiums: +3.1% individual market; +3.4% sm. group

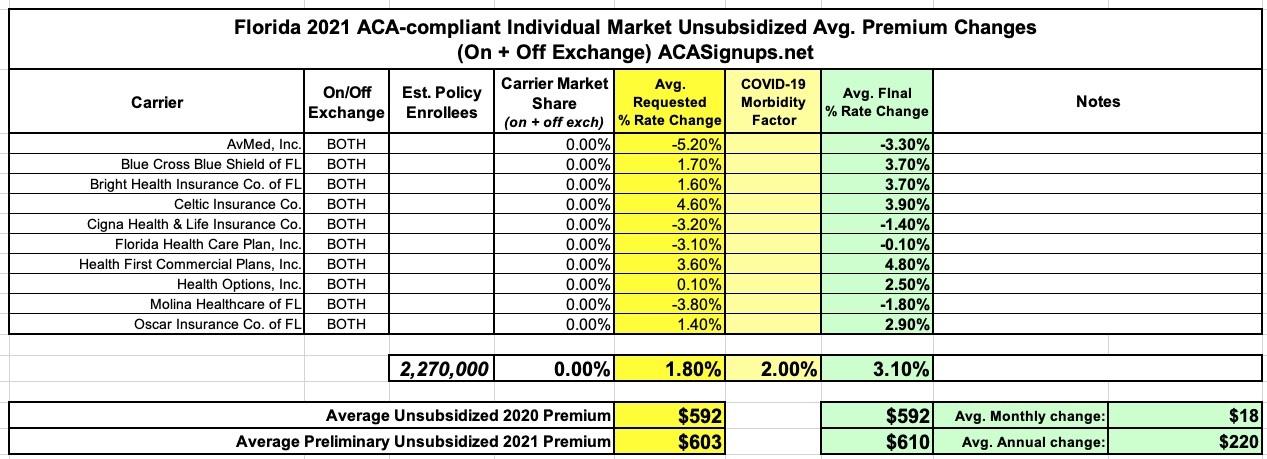

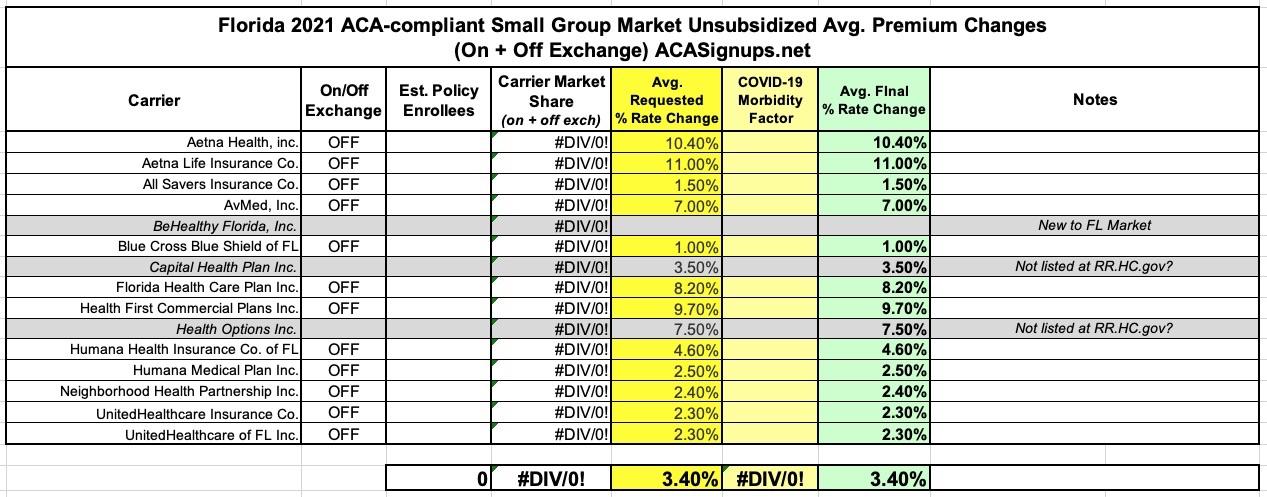

Back in late August, the Florida Office of Insurance Regulation posted preliminary 2021 individual & small group market rate filings. At the time, the weighted average increases were around 1.8% on the individual market and 3.3% for small group plans. Unfortunately, the actual enrollment data for each carrier is protected as a trade secret in Florida, but the FLOIR did post those weighted statewide averages.

Last month (I'm a bit behind) they posted the approved, final rate filings. The average individual market increases actually went up a bit, which is unusual (usually they're whittled down a few points), while the small group market average is exactly the same (oddly, they had it as 3.3% in August but say that the preliminary average was 3.4% now):

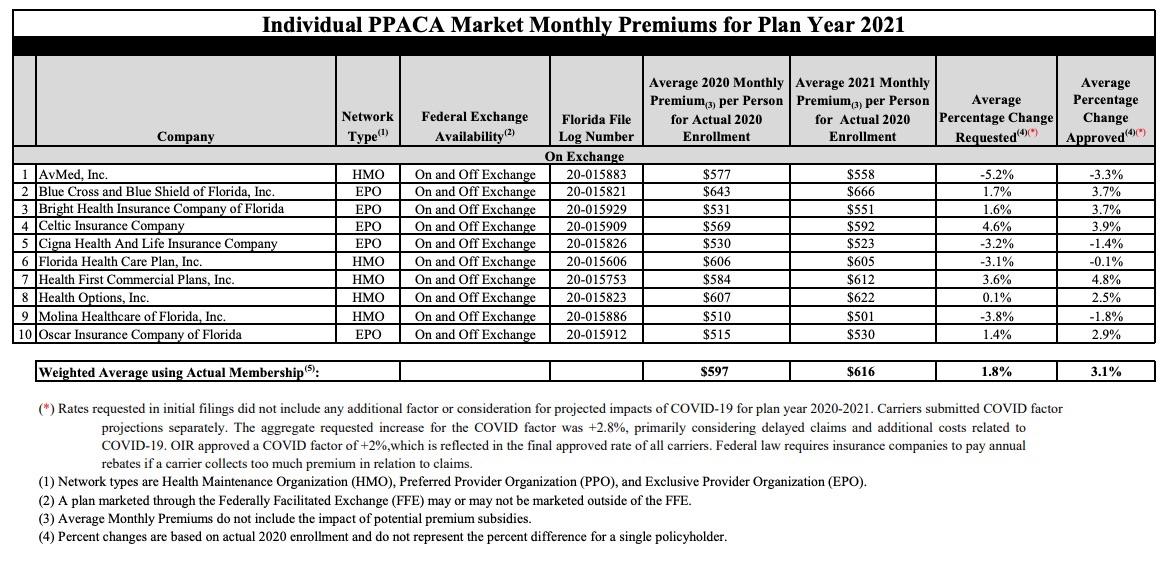

The Florida Office of Insurance Regulation (OIR) announced today that premiums for Florida individual major medical plans in compliance with the federal Patient Protection and Affordable Care Act (PPACA) have been approved for the 2020-2021 plan year. Following OIR’s rate filing review, the average statewide approved rate change on the Exchange is +3.1 percent, beginning January 1, 2021.

Ten health insurance companies submitted rate filings for OIR’s review in July with final rate determinations due by August 26, 2020, per federal guidelines. Rate filing information is available in the Individual PPACA Market Monthly Premiums for Plan Year 2021 documents here.

Rates requested in initial filings did not include any additional factor or consideration for projected impacts of COVID-19 for plan year 2020-2021. Carriers submitted COVID factor projections separately with an aggregate request of +2.8 percent. OIR approved a COVID factor of +2 percent, considering delayed claims and additional costs related to COVID-19. The COVID factor is reflected in the final approved rate for all carriers. Federal law requires insurance companies to pay annual rebates if a carrier collects too much premium in relation to claims.

During the 2021 open enrollment period, consumers are encouraged to review their coverage options on HealthCare.gov to find a plan which best suits their needs.

Federal review of the rate filing information has not been finalized by the Department of Health and Human Services and is subject to change. Further information can be obtained on OIR’s Federal Health Care Insurance webpage.Information on individual filings can be found using OIR’s IRFS Filing Search System.

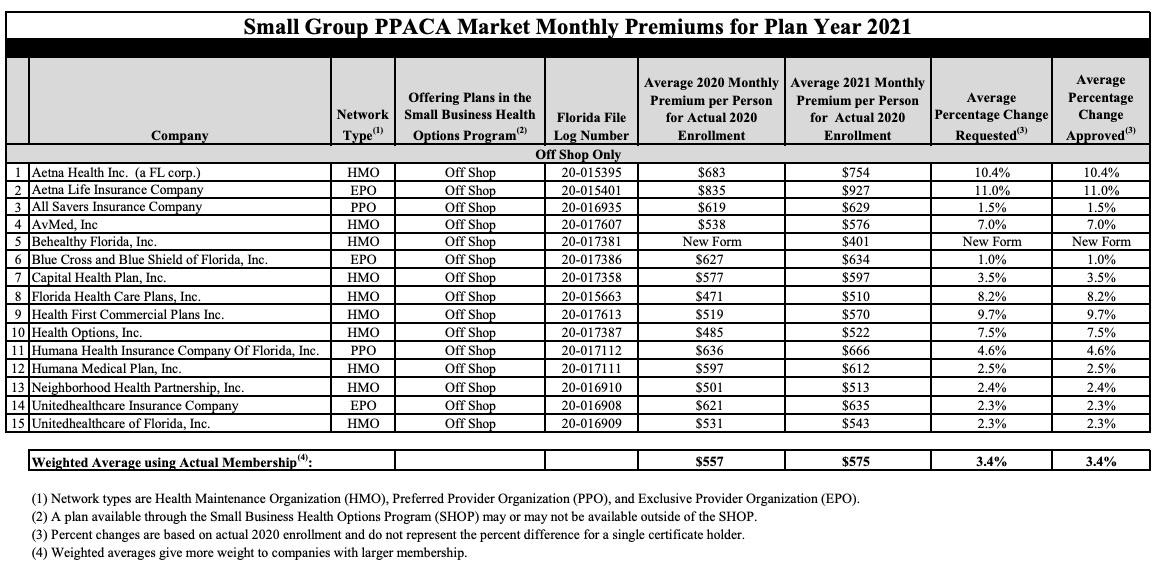

There's no press release for the small group market approvals, but the documentation is available here as well.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.