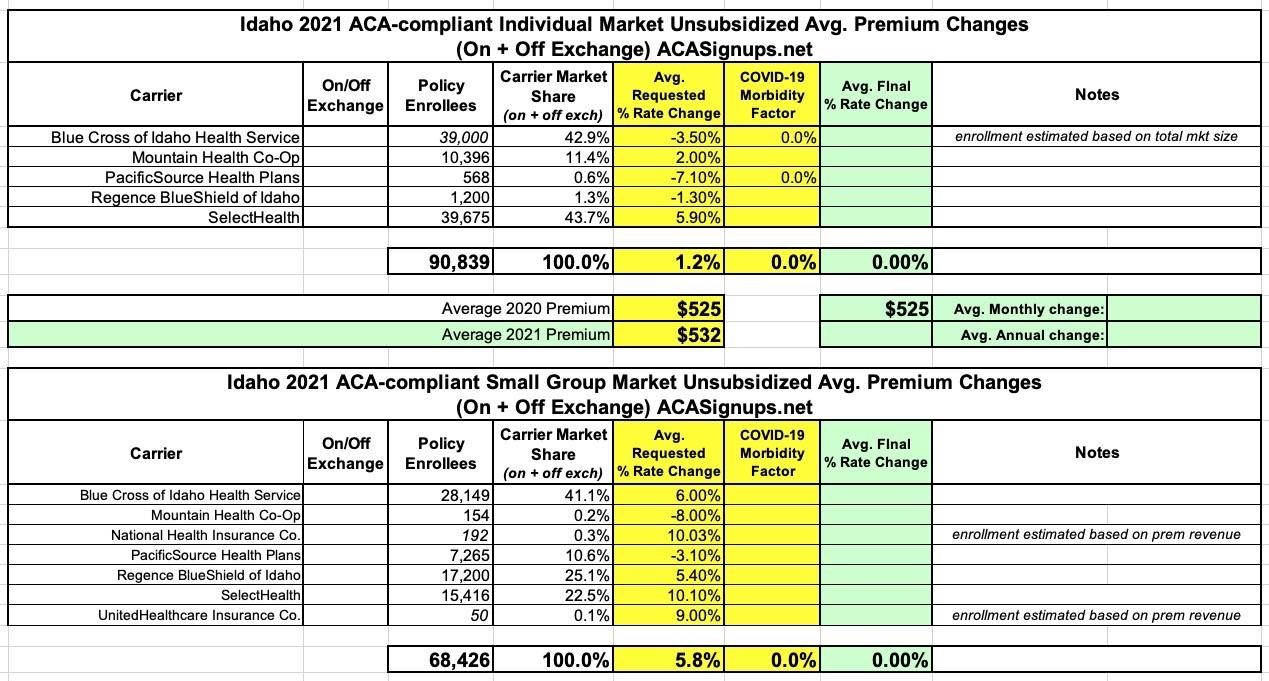

Idaho: Preliminary avg. 2021 #ACA premiums: +1.2% indy market, +5.8% sm. group

The Idaho Insurance Dept. has posted the preliminary rate filings for the 2021 Individual and Small Group markets:

The Department of Insurance receives preliminary health plan information for the following year from insurance carriers by June 1 and reviews the proposed plan documents and rates for compliance with Idaho and federal regulations. The Department of Insurance does not have the authority to set or establish insurance rates, but it does have the authority to deem rate increases submitted by insurance companies as reasonable or unreasonable. After the review and negotiation process, the carriers submit their final rate increase information. The public is invited to provide comments on the rate changes. Please send any comments to Idaho Department of Insurance.

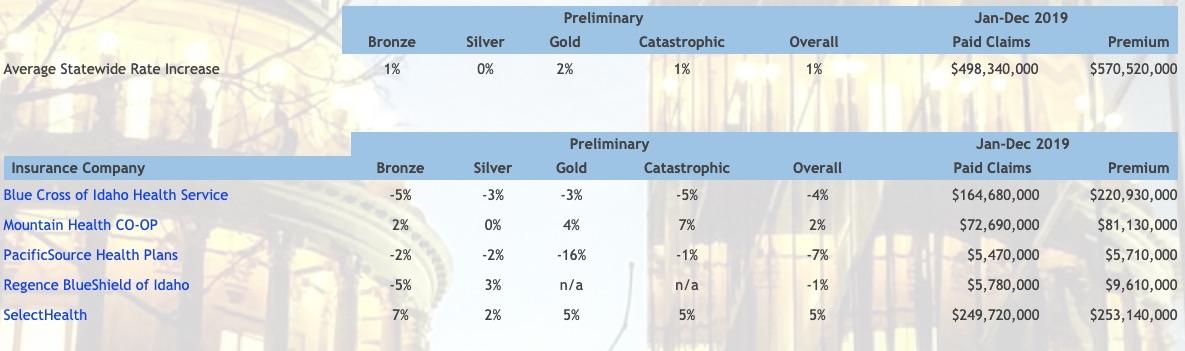

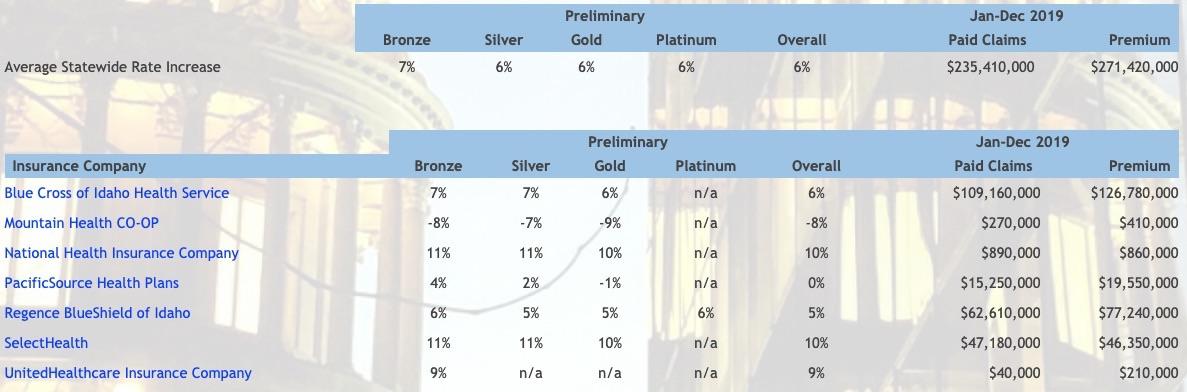

A key driver of increases is generally the level of health claims paid compared to the premium collected. The table below shows the level of claims paid and premium collected by each insurance company for ACA-compliant health benefit plans during 2019. In addition to claims paid, the premium needs to cover the company’s administrative costs, insurance fees, and taxes. Those costs generally consume around 20 percent of the premium. Larger rate increases may be needed when the prior year’s premium is not sufficient to pay for health claims and administrative costs and fees. With its rate increase submission, each insurance company submits a consumer-oriented explanation of the increase, which is available by clicking on the name of the insurance company in the table below.

Each health benefit plan has an associated “metal level” of Bronze, Silver, Gold, or Catastrophic and offers, at a minimum, Idaho's Essential Health Benefits package. The metal level is assigned based on the policyholder's "cost-sharing," which includes any deductibles, coinsurances, copays, and out-of-pocket maximums. A Silver plan usually will have lower cost-sharing than a Bronze plan, and a Gold plan will usually have lower cost-sharing than a Silver plan. However a Gold plan usually has a higher monthly premium than a Silver plan, and a Silver plan usually has a higher monthly premium than a Bronze plan. Policyholders are able to choose which metal level and which plan within that metal level best works for them.

Idaho's formatting has some positive and negatives. On the upside, they break out the filings for every carrier by metal level as well as the overall weighted average, and they even provide a summary of the total premium revenue and claims paid out for the prior year. They also link to an actuarial summary page with some additional details.

On the downside, they round off all of the rate changes to the nearest percentage point, and they don't link to the full actuarial memo which usually includes more detailed information. The summary pages include the critical effectuated enrollment numbers in some cases but not others, so I've had to plug in a rough estimate in a few cases, especially for Blue Cross of Idaho's individual market:

In the tables below I've tweaked the rate change requests to the specific percents noted in the summary pages, and have plugged in the enrollment numbers where known. Only a couple of carriers mentioned COVID-19 at all, and only then to say they aren't counting any COVID factor in their filings (at least for now).

It's also worth noting that Idaho's total ACA-compliant individual market is around 14,000 smaller than last year...but there's a key reason for that which I warned about: Roughly 15,000 ACA exchange enrollees in Idaho last year earn between 100 - 138% FPL, which means they've been shifted over from subsidized ACA policies over to the newly-enacted Medicaid expansion program.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.