CMS releases Early 2020 Effectuated Enrollment Report!

This actually came out last week but I didn't have a chance to do a write-up on it until now:

July 23, 2020 - Early 2020 Effectuated Enrollment Snapshot

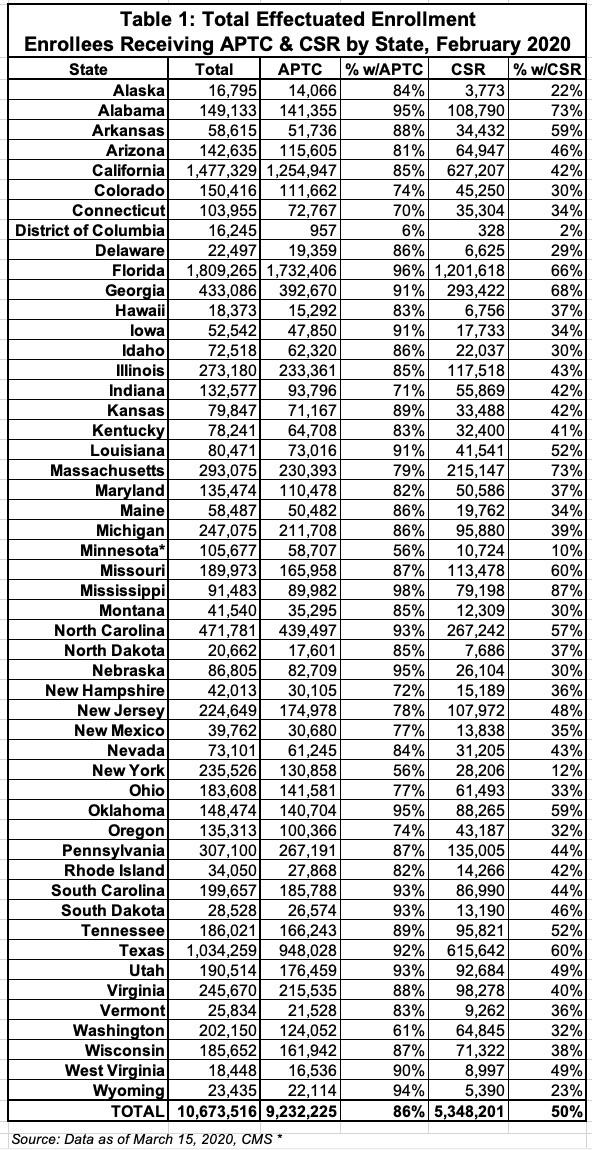

This report provides effectuated enrollment, premium, and advance payments of the premium tax credit (APTC) data for the Federally-facilitated and State-based Exchanges (“the Exchanges”) for February 2020 and for the 2019 plan year.

February 2020 Effectuated Enrollment Snapshot Key Findings

As of March 15, 2020, 10.7 million consumers had effectuated coverage through the Exchanges for February 2020, meaning that they selected a plan, paid their first month’s premium, if applicable, and had coverage in February 2020. This number represents approximately 94 percent of consumers who made plan selections during the 2020 Open Enrollment Period (11.4 million). Although the number of plan selections through the Exchanges were approximately equal in the 2019 and 2020 Open Enrollment Periods (OEPs), a greater number of consumers had effectuated coverage in February 2020 compared to February 2019, as of March 15 of both years. Total effectuated enrollment for February 2020 increased by approximately one percent from total effectuated enrollment for February 2019.

The average total monthly premium for Exchange enrollees in February 2020 was $576.16, a decrease of three percent from the February 2019 average premium of $594.17. Approximately 9.2 million, or 86 percent, of Exchange enrollees in February 2020 received APTC, which represents a decrease of approximately 1 percentage point from the share of Exchange enrollees who received APTC in February 2019. The average monthly amount of APTC per enrollee receiving APTC fell by approximately four percent from February 2019, to $491.53. The numbers reported today may be revised in future months as additional data on new effectuations, terminations, and cancellations become available. Later this year, CMS plans to publish effectuated enrollment data for the first six months of 2020, which will include updated February 2020 enrollment data.

As you can see, the main numbers are almost identical year over year. The most noteworthy change is that average premiums dropped by 3% but average ACA subsidies dropped by 4%...this is the net effect of "Reverse Silver Loading", which I've discussed several times before but am not going to bother delving into today. Suffice it to say that some people who benefitted from Silver Loading in 2018 & 2019 saw their fortunes reversed in 2020. This is the downside of the wacky premium pricing caused by the cut-off of CSR reimbursement payments by Donald Trump in the fall of 2017.

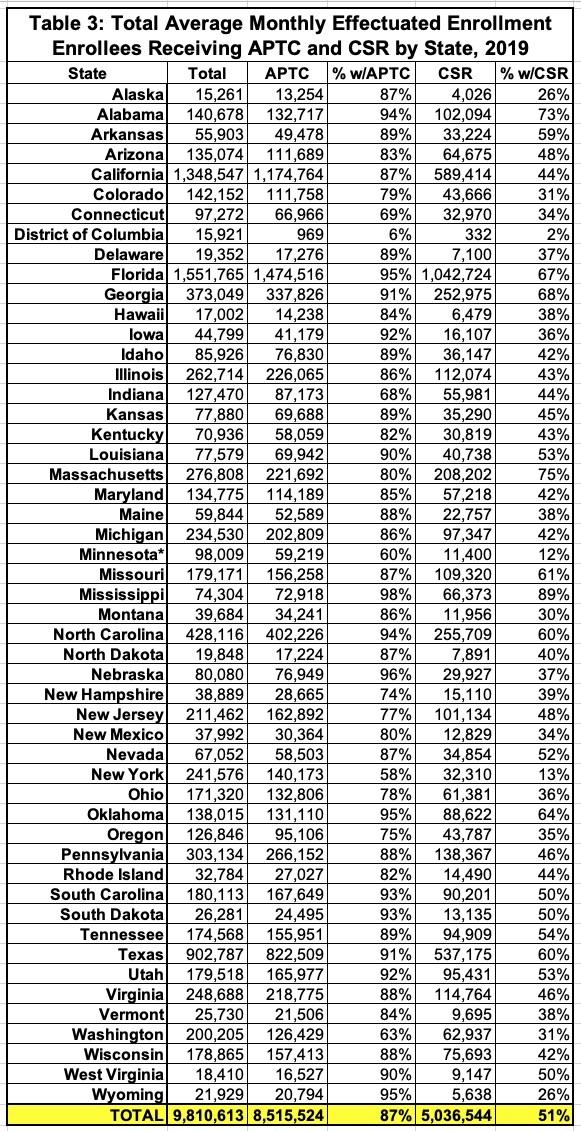

2019 Average Monthly Effectuated Enrollment Snapshot Key Findings

On a monthly average basis, 9.8 million consumers had effectuated coverage through the Exchanges in the 2019 plan year. This is a decrease of slightly less than one percent from the average monthly effectuated enrollment of 9.9 million in the 2018 plan year.

The average total monthly premium for Exchange enrollees in 2019 was $591.26, consistent with the 2018 average total monthly premium of $594.11. Approximately 87 percent of Exchange enrollees received APTC in 2019, consistent with the percentage of enrollees who received APTC in 2018. In 2019, the average monthly amount of APTC per enrollee receiving APTC fell by approximately one percent from 2018, to $512.11.

In 2019, monthly effectuated enrollment peaked in January at approximately 10.5 million consumers and fell to approximately 9.1 million by December, meaning that monthly effectuations and disenrollments followed a similar pattern as in 2018, when monthly effectuated enrollment fell from a high of approximately 10.5 million consumers in February to approximately 9.2 million at the end of the year.

Background Information

The primary sources for both the February 2020 effectuated enrollment snapshot and the 2019 average monthly effectuated enrollment data are payment and enrollment data, which include data from both the Federallyfacilitated and State-based Exchanges. Effectuated enrollment for February 2020 is the total number of consumers who paid their premiums (if applicable)—thus effectuating their coverages—and who had active policies in February 2020 as of March 15, 2020. The 2019 average monthly effectuated enrollment is the average monthly number of consumers who paid their premiums (if applicable)—thus effectuating their coverages—and who had active policies in 2019 as of March 15, 2020. The average monthly effectuated enrollment number was calculated by adding total member months for 2019 and dividing by 12.

APTC enrollment for the February 2020 effectuated enrollment snapshot is the total number of consumers who paid their premiums (if applicable)—thus effectuating their coverages—and who received APTC in association with their active policies in February 2020. The 2019 average monthly APTC enrollment is the average number of consumers who paid their premiums (if applicable)—thus effectuating their coverages— and who received APTC in association with their active policies in 2019. APTC is generally available if a consumer's household income is between 100 percent and 400 percent of the federal poverty level. (Certain other criteria apply to APTC eligibility and must be met in order to receive APTC.) Consumers were defined as receiving APTC if the APTC amounts applied to their premiums were greater than $0; otherwise, consumers were classified as not receiving APTC.

Cost-sharing reduction (CSR) enrollment for the February 2020 effectuated enrollment snapshot is the total number of consumers who paid their premiums (if applicable)—thus effectuating their coverages—and who received CSRs in association with their active policies in February 2020. The 2019 average monthly CSR enrollment is the average number of consumers who paid their premiums (if applicable)—thus effectuating their coverages—and who received CSRs in association with their active policies in 2019. A consumer is generally eligible for a CSR if the consumer is eligible for APTC, has a household income between 100 percent and 250 percent of the federal poverty level, and is enrolled in a qualified health plan from the silver plan category. (American Indians and Alaskan Natives are eligible for CSRs under different criteria.)