BidenCare Revisited: Let's take another look at what Uncle Joe has in mind for healthcare!

It's been a solid year since Joe Biden rolled out his own official healthcare policy proposal. I did a fairly in-depth writeup on it last summer, but it's the understatement of the year to say that "a lot has changed since then".

The two most obvious developments on this front are 1. Biden has gone from one candidate of two dozen to being the presumptive Democratic Nominee; and 2. The COVID-19 pandemic has completely upended not only the Presidential race but the economy and the entire U.S. healthcare system. A third important (if less consequential) development is that the House has actually passed their own "ACA 2.0" bill in the form of H.R. 1425, the Affordable Care Enhancement Act, which partially overlaps Biden's healthcare plan.

With all of this in mind, I figured this would be a good point to revisit Biden's proposal. Most of it remains the same as it did a year ago, but there's been some enhancements since then, and again, the COVID-19 pandemic has changed both the economics and politics of healthcare as well...including, I'm guessing, improving the odds of his plan (or something close to it) making it through the Senate next year, assuming Democrats retake both the White House and the Senate, that is.

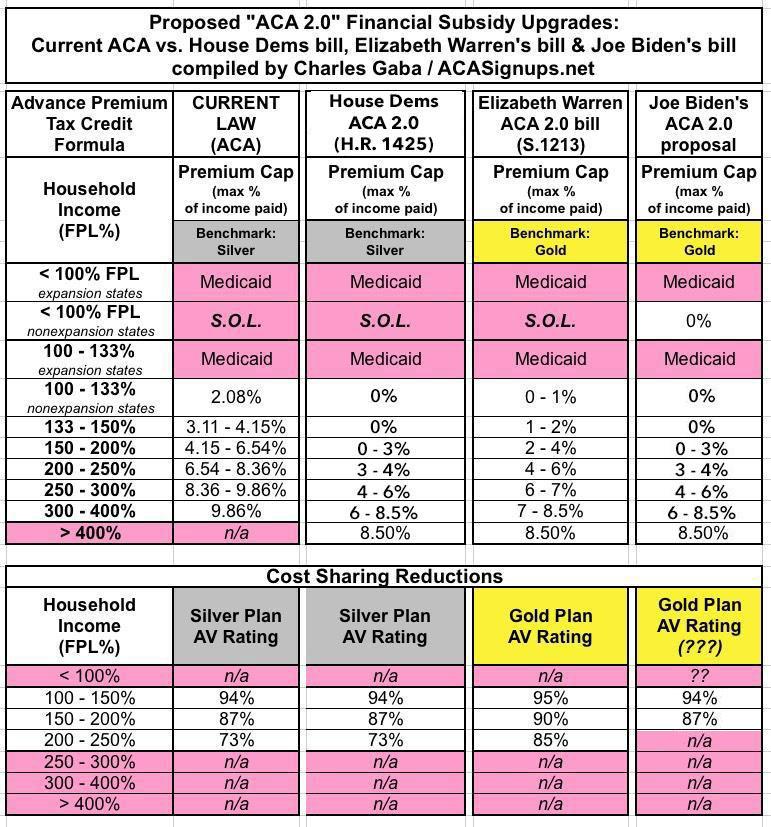

As I noted last summer, Biden's plan basically takes the Senate "ACA 2.0" bill introduced by Elizabeth Warren a few years ago and reintroduced last year (S.1213, the Consumer Health Insurance Protection act), combines it with the Public Option portion of Jeff Merkley & Chris Murphy's "Choose Medicare" bill, and adds on a major chunk of H.R. 3 (the Lower Drug Costs Now Act, which was passed by the House last year).

There's a lot more to it than this, of course, but I think mashing those three bills together covers about 80% of of his plan as it stood last summer...and I don't mean that as an insult. Good legislation is a collaborative effort; the idea is to build upon the work of others, whether in small or large ways...and Biden's plan would definitely a massive improvement over the status quo:

THE BIDEN PLAN TO PROTECT & BUILD ON THE AFFORDABLE CARE ACT

I. GIVE EVERY AMERICAN ACCESS TO AFFORDABLE HEALTH INSURANCE

From the time right before the Affordable Care Act’s key coverage-related policies went into effect to the last full year of the Obama-Biden Administration, 2016, the number of Americans lacking health insurance fell from 44 million to 27 million – an almost 40% drop. But President Trump’s persistent efforts to sabotage Obamacare through executive action, after failing in his efforts to repeal it through Congress, have started to reverse this progress. Since 2016, the number of uninsured Americans has increased by roughly 1.4 million.

As president, Biden will stop this reversal of the progress made by Obamacare. And he won’t stop there. He’ll also build on the Affordable Care Act with a plan to insure more than an estimated 97% of Americans. Here’s how:

- Giving Americans a new choice, a public health insurance option like Medicare. If your insurance company isn’t doing right by you, you should have another, better choice. Whether you’re covered through your employer, buying your insurance on your own, or going without coverage altogether, the Biden Plan will give you the choice to purchase a public health insurance option like Medicare. As in Medicare, the Biden public option will reduce costs for patients by negotiating lower prices from hospitals and other health care providers. It also will better coordinateamong all of a patient’s doctors to improve the efficacy and quality of their care, and cover primary care without any co-payments. And it will bring relief to small businesses struggling to afford coverage for their employees.

OK, this is of course the much-ballyhooed (in the past) "Public Option". It sounds an awful lot like the PO portion of Senators Merkley & Murphy's "Choose Medicare" bill. It's important to keep in mind that there's no mention of what reimbursement rates to healthcare providers would be under this bill.

Washington State is the example to watch here: Their recently-passed "Public Option" (which isn't entirely public, depending on your definition of the term since it involves the state contracting out to a private carrier) was originally supposed to pay healthcare providers Medicare rates...but eventually ended up agreeing to pay 60% more than that when they weren't able to get enough doctors/hospitals onboard at 100% Medicare.

Provider reimbursement rates are gonna be one of the toughest battles any major expansion of government-controlled healthcare will face, and is the main reason why the entire industry is dead set on preventing any "public option" whatsoever.

- Increasing the value of tax credits to lower premiums and extend coverage to more working Americans. Today, families that make between 100% and 400% of the federal poverty level may receive a tax credit to reduce how much they have to pay for health insurance on the individual marketplace. The dollar amount of the financial assistance is calculated to ensure each family does not have to pay more than a certain percentage of their income on a silver (medium generosity) plan. But, these shares of income are too high and silver plans’ deductibles are too high. Additionally, many families making more than 400% of the federal poverty level (about $50,000 for a single person and $100,000 for a family of four), and thus not qualifying for financial assistance, still struggle to afford health insurance. The Biden Plan will help middle class families by eliminating the 400% income cap on tax credit eligibility and lowering the limit on the cost of coverage from 9.86% of income to 8.5%. This means that no family buying insurance on the individual marketplace, regardless of income, will have to spend more than 8.5% of their income on health insurance. Additionally, the Biden Plan will increase the size of tax credits by calculating them based on the cost of a more generous gold plan, rather than a silver plan. This will give more families the ability to afford more generous coverage, with lower deductibles and out-of-pocket costs.

This is taken directly from the "Healthy America" proposal by Linda Blumberg, John Holahan and Stephen Zuckerman of the Urban Institute...as is Elizabeth Warren's ACA 2.0 bill...and, in fact, as was Hillary Clinton's 2016 proposal. A similar formula was also used in the House Democrats' ACA 2.0 bill, although their version sticks with Silver as the benchmark instead of upgrading to Gold.

I don't just mean all of these are kind of taken from the Urban Institute...I mean the exact subsidy formula is identical in all three cases. The House stuck with it for a few years as well, though H.R. 1425 made it a bit more generous at the bottom end.

Here's where Biden's proposal differs from Warren's bill, however:

- Expanding coverage to low-income Americans. Access to affordable health insurance shouldn’t depend on your state’s politics. But today, state politics is getting in the way of coverage for millions of low-income Americans. Governors and state legislatures in 14 states have refused to take up the Affordable Care Act’s expansion of Medicaid eligibility, denying access to Medicaid for an estimated 4.9 million adults. Biden’s plan will ensure these individuals get covered by offering premium-free access to the public option for those 4.9 million individuals who would be eligible for Medicaid but for their state’s inaction, and making sure their public option covers the full scope of Medicaid benefits. States that have already expanded Medicaid will have the choice of moving the expansion population to the premium-free public option as long as the states continue to pay their current share of the cost of covering those individuals. Additionally, Biden will ensure people making below 138% of the federal poverty level get covered. He’ll do this by automatically enrolling these individuals when they interact with certain institutions (such as public schools) or other programs for low-income populations (such as SNAP).

Back in April 2017, I proposed modifying the ACA's subsidy formula to range from 0% - 10% of income regardless of income (that is, I removed the 400% FPL income eligibility cap), but I also originally proposed removing the lower-bound 100% FPL cut-off as well. HOWEVER, I later scrapped the lower-bound proposal for the following reason:

The original version of this formula restructure included removing the lower cut-off point (<100% FPL) for tax credits as well. My rationale was that if some states are dead-set on not expanding Medicaid no matter what, folks caught in the Medicaid gap should at least be allowed to enroll in ACA exchange policies with full APTC/CSR assistance. Unfortunately, as several people have pointed out, APTC/CSR assistance is 100% federally funded, whereas the states have to pony up a portion of Medicaid expansion funds...only 5-10% of it, but that can still add up. That means that once you allow those below the 100% threshold to receive tax credits via the individual market, that pretty much guarantees that none of those 19 remaining holdout states will budge...and also means that at least a few of the states which have expanded the program would likely drop it, meaning a complete backfire on the goal of this measure. Therefore, sadly, I had to scratch the "APTC under 100% FPL" part of this idea.

Biden is proposing to "solve" this problem by basically punishing the expansion states by requiring them to continue paying 10% of the cost of Medicaid for expansion enrollees (around $10.3 billion/year collectively, I believe)...while letting the non-expansion states completely off the hook.

This may or may not prove to be good politics, but it's pretty rude since it's literally rewarding non-expansion states for being jackasses the past seven years. It would, however, "solve" the Medicaid Gap problem for millions of people in those non-expansion states.

The last sentence in the above is also far more important than it may appear at first: He's proposing to automatically enroll low-income residents (below 138% FPL) into the Public Option...without any premiums required. This would be massive. According to the Kaiser Family Foundation, as of 2018, a good 6.7 million uninsured Americans were already eligible for either Medicaid or CHIP at either zero or almost zero cost...but aren't enrolled either due to not knowing they're eligible or finding it too difficult to jump through the various red tape, paperwork and other hurdles needed to sign up for these programs. Auto-enrollment of the non-expansion state population into this program would immediately reduce the number of uninsured Americans by a good 4.9 million people in one shot.

II. PROVIDE THE PEACE OF MIND OF AFFORDABLE, QUALITY HEALTH CARE AND A LESS COMPLEX HEALTH CARE SYSTEM

Today, even for people with health insurance, our health care system is too expensive and too hard to navigate. The Biden Plan will not only provide coverage for uninsured Americans, it will also make health care more affordable and less complex for all.

The plan’s elements described above will help reduce the cost of health insurance and health care for those already insured in the following ways:

- All Americans will have a new, more affordable option. The public option, like Medicare, will negotiate prices with providers, providing a more affordable option for many Americans who today find their health insurance too expensive.

- Middle class families will get a premium tax credit to help them pay for coverage. For example, take a family of four with an income of $110,000 per year. If they currently get insurance on the individual marketplace, because their premium will now be capped at 8.5% of their income, under the Biden Plan they will save an estimated $750 per month on insurance alone. That’s cutting their premiums almost in half. If a family is covered by their employer but can get a better deal with the 8.5% premium cap, they can switch to a plan on the individual marketplace, too.

- Premium tax credits will be calculated to help more families afford better coverage with lower deductibles. Because the premium tax credits will now be calculated based on the price of a more generous gold plan, families will be able to purchase a plan with a lower deductible and lower out-of-pocket spending. That means many families will see their overall annual health care spending go down.

The bullets above are just rehashes of the PO/subsidy expansions. As far as I can tell, this is what Biden's plan looks like compared to the ACA 2.0 bill just passed by the House Democrats and the version introduced by Warren:

I could be wrong about Biden's plan in the CSR portion of the table, since he doesn't specify whether or not he intends on keeping CSR in place at all, although the upgrade from Silver to Gold would accomplish most of that anyway...in fact, the 73% AV threshold would become moot since the Gold benchmark plan itself would be set at 80% AV to begin with.

I've spent a LOT of time running analyses of how much different households would save under the House ACA 2.0 bill...but I have to modify those numbers for Biden's plan, since he's also proposing upgrading the benchmark plan from Silver to Gold (plus, the version of the House bill which actually passed had a different formula than their prior version anyway).

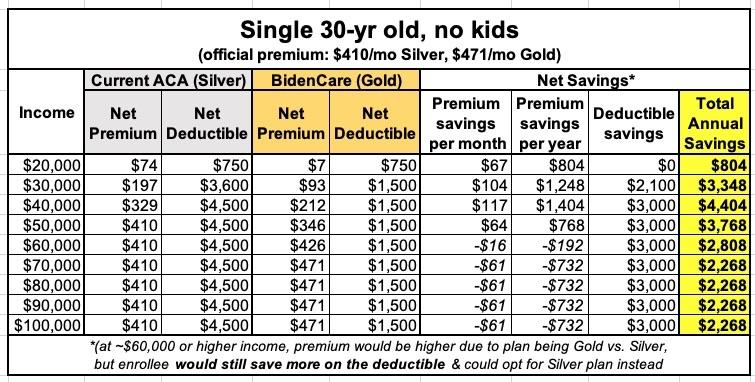

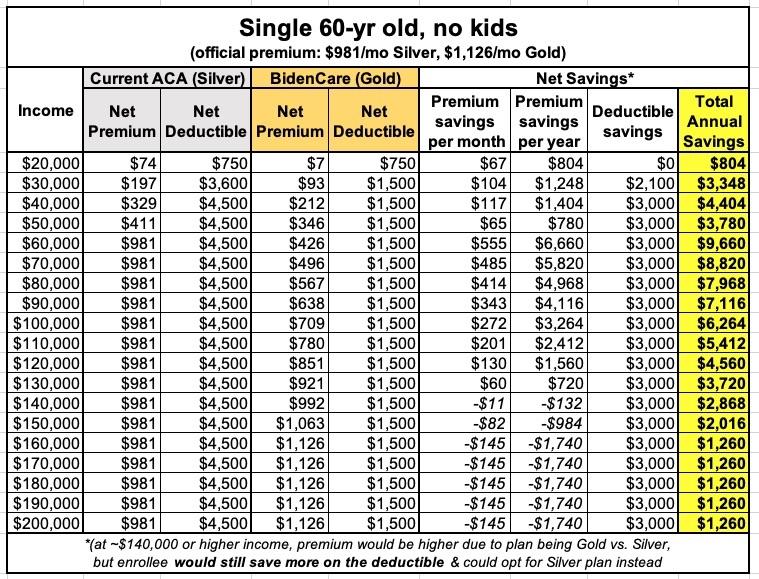

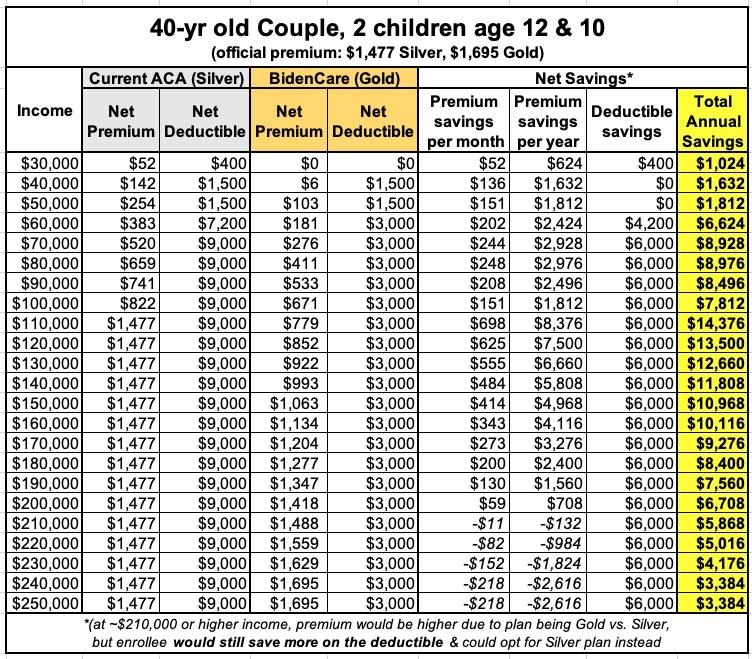

Below I've listed four examples. These are all based on the following assumptions:

- First, I'm assuming that it would utilize the revised APTC formula included in the H.R. 1425 bill just passed by the House (which is a bit more generous than the prior version had been).

- I'm using 2020 Federal Poverty Level thresholds; these will actually be somewhat higher by 2022 (when the bill would be implemented), which means even greater savings. I'm also using 2020 premium and deductible averages; these will differ in 2022.

- According to the Kaiser Family Foundation, the average benchmark Silver plan for a single 40-year old adult in 2020 is $462/month, and the average lowest-priced Gold plan is $501/month.

- KFF says the average gap between the lowest-cost Silver and the benchmark Silver in 2020 is $20 ($442 vs. $462), so I'm assuming the average benchmark Gold plan would be $530/month.

- I'm then using the standard 3:1 ACA Age Band table to adjust the premium up or down depending on the ages of the enrollees.

- Also according to KFF, the average deductible for a Silver plan in 2020 is around $4,500/person, while the average for a Gold plan is around $1,500.

- KFF also says the average deductible for a Silver plan for an enrollee earning 100 - 150% FPL (CSR 94) is around $200; from 150 - 200% FPL (CSR 87) it's around $750; and from 200 - 250% FPL (CSR 73) it's around $3,300.

- KFF says the average Maximum Out of Pocket (MOOP) caps for Silver enrollees in 2020 are $1,200 at CSR 94, $2,400 at CSR 87 and $6,200 at CSR 73.

- Finally, according to Health Pocket, the average MOOP cap for Gold plan enrollees in 2019 was around $1,000/year lower than for Silver enrollees. I'm assuming that would be around $6,800 in 2020.

With all of this in mind, here's the four examples (click on the images for a higher resolution version):

- A single 30-year old, no kids

- A single 60-year old, no kids

- A 40-year old couple with 2 children age 12 & 10

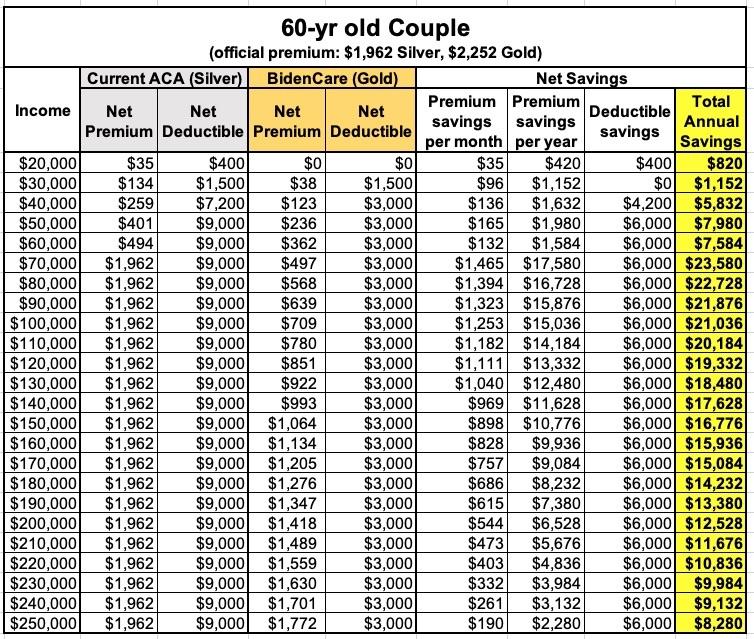

- A 60-year old couple, no kids

Assuming it utilizes the revised H.R. 1425 APTC formula, Biden's plan would save a the average single 30-year old without any children a minimum of $800/year and for some enrollees over $4,400/year depending on their income. At higher income levels they'd lose the premium savings if they enrolled in the Gold plan vs. Silver, but would still have a deductible that's $3,000 lower, for a net savings of over $2,200/year. Of course they'd also still have the option of enrolling in the Silver plan after all, which would reduce their premiums by $732/year but increase the deductible instead.

At 60 years old, the savings at lower incomes would remain the same (between $800 - $4,400/year), but middle class enrollees would save up to $9,600/year: As much as $6,600 in premiums (mostly due to the subsidy cliff being eliminated), plus the deductible being lopped down to 1/3 of the prior level.

Next we look at actual family households. First, a family of four. This gets a little tricky at the lower income levels for two reasons: First, it depends on whether they live in a Medicaid expansion or non-expansion state; secondly, because some states have higher CHIP eligibility thresholds for the children than others. For purposes of this example, I'm going to assume that the family lives in a non-expansion state which doesn't offer CHIP for children in families over the 100% FPL income threshold. I think it would look something like this under Biden's proposal:

This family would save up to $8,900/year beyond any existing ACA subsidies ($6,000 on the family deductible and up to another $2,900 in premium tax credits), while if they earn just over the 400% FPL threshold, they'd save up to $14,300/year.

Finally, here's what the savings would look like for a 60-year old couple. As with the nuclear family, this gets a bit awkward at the lower income thresholds, since it depends on whether they live in an expansion or non-expansion state, as well as the question of whether they would be enrolled in the Public Option, the subsidized private ACA exchange policy or Biden's newly-proposed Medicare buy-in option (see below), but I've done the best I can to figure it out:

They'd save at least $800/year at the lower income thresholds...and if they earn more than 400% FPL, this couple could potentially save up to a whopping $23,000/year or more!

Again, I need to stress that all four tables above are for illustrative purposes only; the actual impact will vary greatly from state to state, county to county and family to family. These should be pretty close to the mark, however.

Speaking of 60-year olds, the biggest addition to Biden's healthcare plan since he introduced it last summer is that he's also calling for the Medicare eligibility age to be lowered from 65 to 60:

I have directed my team to develop a plan to lower the Medicare eligibility age to 60.

Under this concept, Americans would have access, if they choose, to Medicare when they turn 60, instead of when they turn 65. Medicare benefits would be provided to them as they are to current Medicare recipients. This would make Medicare available to a set of Americans who work hard and retire before they turn 65, or who would prefer to leave their employer plans, the public option, or other plans they access through the Affordable Care Act before they retire. It reflects the reality that, even after the current crisis ends, older Americans are likely to find it difficult to secure jobs.

Of course, those who prefer to remain on their employer plans would be permitted to do so, and employers would have to comply with non-discrimination laws and would be prohibited from excluding older workers from coverage or otherwise try to push them out of their plans. And the Biden Medicare-like public option — as well as other subsidized private plans available to individuals through the Affordable Care Act — would remain available.

Any new Federal cost associated with this option would be financed out of general revenues to protect the Medicare Trust Fund.

This is an unusual additional piece to add to his plan, especially given that it would be separate from the new Public Option. It's important to understand that as described by Biden himself, this would be the current Medicare program (with the same premiums, co-pays, deductibles and coverage limits that the program currently has), not Bernie Sanders' "everything under the sun" Medicare. I'm not entirely sure why this would be necessary alongside the "Medicare-like Public Option", unless the idea is to use it as a backstop in the event that the larger-in-scope PO doesn't make it through the legislative sausage grinder.

By itself, this is a smaller version of Sen. Debbie Stabenow's "Medicare 50+" bill, which would do the same thing but starting at age 50 or up vs. 60. The idea is that the 60-64 year old age bracket is the most expensive part of the non-Medicare market, so shifting them over to Medicare would instantly improve the risk pool and lower costs for everyone on either private or public coverage under 60...but I'm not sure how that would play out in practice. Here's a summary of the pros and cons from Healthcare Dive:

Though the presidential candidate hasn't released many specifics of this proposal, Biden would lower the age to opt into Medicare, which would make roughly 20 million more Americans eligible for the health insurance program.

...Proponents of lowering the Medicare eligibility age argue it would reduce hospital costs and help both the Medicare and private insurance risk pools, as those age 60-64 are likely to be the unhealthiest population in commercial risk pools. If they're moved into Medicare's instead, they would statistically be among the healthiest, which could lower costs for beneficiaries across the board.

However, research is mixed on whether allowing younger beneficiaries to join Medicare would translate to overall savings. And Biden's plan could result in dramatically lowered reimbursements for hospitals, as Medicare generally pays significantly less than commercial insurance. The loss of commercial payments for adults aged 60 to 64 could decimate a significant revenue stream for providers and prove disastrous for cash-strapped facilities.

Getting back to Biden's main plan, here's the other major provisions he lays out:

- Stop “surprise billing.” Consumers trying to lower their health care spending often try to choose an in-network provider. But sometimes patients are unaware they are receiving care from an out-of-network provider and a big, surprise bill. “Surprise medical billing” could occur, for example, if you go to an in-network hospital but don’t realize a specialist at that hospital is not part of your health plan. The Biden Plan will bar health care providers from charging patients out-of-network rates when the patient doesn’t have control over which provider the patient sees (for example, during a hospitalization).

Surprise Billing, of course, has been very much in the news of late. Eliminating it has been included in Elizabeth Warren's bill for over a year, and it's part of several other proposals.

- Tackle market concentration across our health care system. The concentration of market power in the hands of a few corporations is occurring throughout our health care system, and this lack of competition is driving up prices for consumers. The Biden Administration will aggressively use its existing antitrust authority to address this problem.

- Lower costs and improve health outcomes by partnering with the health care workforce. The Biden Administration will partner with health care workers and accelerate the testing and deployment of innovative solutions that improve quality of care and increase wages for low-wage health care workers, like home care workers.

- Repeal the outrageous exception allowing drug corporations to avoid negotiating with Medicare over drug prices. Because Medicare covers so many Americans, it has significant leverage to negotiate lower prices for its beneficiaries. And it does so for hospitals and other providers participating in the program, but not drug manufacturers. Drug manufacturers not facing any competition, therefore, can charge whatever price they choose to set. There’s no justification for this except the power of prescription drug lobbying. The Biden Plan will repeal the existing law explicitly barring Medicare from negotiating lower prices with drug corporations.

...which is exactly what H.R. 3, the Lower Drug Costs Now Act of 2019 would do, among other things.

- Limit launch prices for drugs that face no competition and are being abusively priced by manufacturers. Through his work on the Cancer Moonshot, Biden understands that the future of pharmacological interventions is not traditional chemical drugs but specialized biotech drugs that will have little to no competition to keep prices in check. Without competition, we need a new approach for keeping the prices of these drugs down. For these cases where new specialty drugs without competition are being launched, under the Biden Plan the Secretary of Health and Human Services will establish an independent review board to assess their value. The board will recommend a reasonable price, based on the average price in other countries (a process called external reference pricing) or, if the drug is entering the U.S. market first, based on an evaluation by the independent board members. This reasonable price will be the rate Medicare and the public option will pay. In addition, the Biden Plan will allow private plans participating in the individual marketplace to access a similar rate.

Again, this has been in the news a lot lately, and even the Trump Administration has at times been open to letting other countries determine what we pay for prescription drugs. The irony of that coming from a xenophobic nationalist bigot like Trump is staggering, of course.

- Limiting price increases for all brand, biotech, and abusively priced generic drugs to inflation. As a condition of participation in the Medicare program and public option, all brand, biotech, and abusively priced generic drugs will be prohibited from increasing their prices more than the general inflation rate. The Biden Plan will also impose a tax penalty on drug manufacturers that increase the costs of their brand, biotech, or abusively priced generic over the general inflation rate.

If you're wondering why the healthcare lobby is opposed to even a plan from a supposedly "market-friendly", "corporate" type of Democrat like Biden, here's part of your answer. Price controls don't go over well with that group no matter who proposes them.

- Allowing consumers to buy prescription drugs from other countries. To create more competition for U.S. drug corporations, the Biden Plan will allow consumers to import prescription drugs from other countries, as long as the U.S. Department of Health and Human Services has certified that those drugs are safe.

Again: A great idea but hardly a new one.

- Terminating pharmaceutical corporations’ tax break for advertisement spending. Drug corporations spent an estimated $6 billion in 2016 alone on prescription drug advertisements to increase their sales, a more than four-fold increase from just $1.3 billion in 1997. The American Medical Association has even expressed “concerns among physicians about the negative impact of commercially driven promotions, and the role that marketing costs play in fueling escalating drug prices.” Currently, drug corporations may count spending on these ads as a deduction to reduce the amount of taxes they owe. But taxpayers should not have to foot the bill for these ads. As president, Biden will end this tax deduction for all prescription drug ads, as proposed by Senator Jeanne Shaheen.

- Improving the supply of quality generics. Generics help reduce health care spending, but brand drug corporations have succeeded in preserving a number of strategies to help them delay the entrance of a generic into the market even after the patent has expired. The Biden Plan supports numerous proposals to accelerate the development of safe generics, such as Senator Patrick Leahy’s proposal to make sure generic manufacturers have access to a sample.

These make sense, of course. Not huge but still important.

- Expanding access to contraception and protect the constitutional right to an abortion. The Affordable Care Act made historic progress by ensuring access to free preventive care, including contraception. The Biden Plan will build on that progress. Vice President Biden supports repealing the Hyde Amendment because health care is a right that should not be dependent on one’s zip code or income. And, the public option will cover contraception and a woman’s constitutional right to choose. In addition, the Biden Plan will:

Well, now. This makes it official: Pretty much the entire Democratic Party, including Biden, now agree that #HydeMustGo.

- Reverse the Trump Administration and states’ all-out assault on women’s right to choose. As president, Biden will work to codify Roe v. Wade, and his Justice Department will do everything in its power to stop the rash of state laws that so blatantly violate the constitutional right to an abortion, such as so-called TRAP laws, parental notification requirements, mandatory waiting periods, and ultrasound requirements.

- Restore federal funding for Planned Parenthood. The Obama-Biden administration fought Republican attacks on funding for Planned Parenthood again and again. As president, Biden will reissue guidance specifying that states cannot refuse Medicaid funding for Planned Parenthood and other providers that refer for abortions or provide related information and reverse the Trump Administration’s rule preventing Planned Parenthood and certain other family planning programs from obtaining Title X funds.

- Just as the Obama-Biden Administration did,President Biden will rescind the Mexico City Policy (also referred to as the global gag rule) that President Trump reinstated and expanded. This rule currently bars the U.S. federal government from supporting important global health efforts – including for malaria and HIV/AIDS – in developing countries simply because the organizations providing that aid also offer information on abortion services.

- Reducing our unacceptably high maternal mortality rate, which especially impacts people of color. Compared to other developed nations, the U.S. has the highest rate of deaths related to pregnancy and childbirth, and we are the only country experiencing an increase in this death rate. This problem is especially prevalent among black women, who experience a death rate from complications related to pregnancy that is more than three times higher than the rate for non-Hispanic white women. California came up with a strategy that halved the state’s maternal death rate. As president, Biden will take this strategy nationwide.

- Defending health care protections for all, regardless of gender, gender identity, or sexual orientation. Before the Affordable Care Act, insurance companies could increase premiums merely due to someone’s gender, sexual orientation, or gender identity. Further, insurance companies could increase premiums or deny coverage altogether due to someone’s HIV status. Yet, President Trump is trying to walk back this progress. For example, he has proposed to once again allow health care providers and insurance companies to discriminate based on a patient’s gender identity or abortion history. President Biden will defend the rights of all people – regardless of gender, sexual orientation, gender identity – to have access to quality, affordable health care free from discrimination.

- Doubling America’s investment in community health centers. Community health centers provide primary, prenatal, and other important care to underserved populations. The Biden Plan will double the federal investment in these centers, expanding access to high quality health care for the populations that need it most.

I rip on Bernie Sanders a lot, but I do owe him a shout-out for ensuring this funding was included in the ACA back in 2009.

- Achieving mental health parity and expanding access to mental health care. As Vice President, Biden was a champion for efforts to implement the federal mental health parity law, improve access to mental health care, and eliminate the stigma around mental health. As President, he will redouble these efforts to ensure enforcement of mental health parity laws and expand funding for mental health services.

When I first gave Biden's plan a once-over, I quipped that it looks like Elizabeth Warren's ACA 2.0 bill with a "Choose Medicare"-style Public Option added to it, and I still stand by that, although it's obviously more complicated than that. Over at Xpostfactoid, Andrew Sprung describes it as more like a cross between ACA 2.0 & Medicare for America, which seems like a pretty good summary as well...although Med4America guarantees 100% coverage, while the Biden plan (as with Choose Medicare) does not appear to include mandatory enrollment (except for the auto-enrollment of low-income Americans in non-expansion states).

This last point is interesting to me since Biden has specifically stated that he supports bringing back the ACA's individual mandate penalty...yet I don't see it mentioned in his own proposal. Huh.

To his credit, Biden also makes sure to include how to pay for his plan (not that this makes his pay-for any easier to achieve, but it's good to at least spell out what he has in mind):

The Biden Plan will make health care a right by getting rid of capital gains tax loopholes for the super wealthy. Today, the very wealthy pay a tax rate of just 20% on long-term capital gains. According to the Joint Committee on Taxation, the capital gains and dividends exclusion is the second largest tax expenditure in the entire tax code: $127 billion in fiscal year 2019 alone. As President, Biden will roll back the Trump rate cut for the very wealthy and restore the 39.6% top rate he helped restore when he negotiated an end to the Bush tax cuts for the wealthy in 2012. Biden’s capital gains reform will close the loopholes that allow the super wealthy to avoid taxes on capital gains altogether. The Biden plan will assure those making over $1 million will pay the top rate on capital gains, doubling the capital gains tax rate on the super wealthy.

I'm all for doing this, of course. Note that everything in Biden's funding proposal hits those at the very top of the income mountain. Getting that done, of course, is a whole different discussion...and that's where the COVID-19 pandemic really changes the equation.

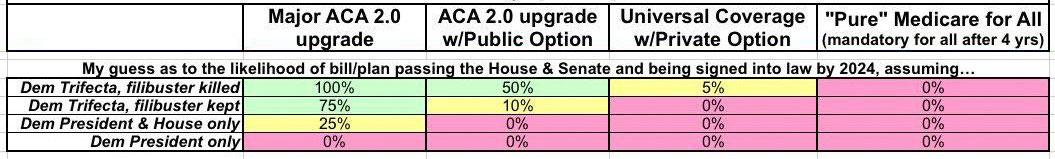

Regular readers may recall that throughout the Democratic Presidential primary season last year and early this year, I posted a table which boiled down the various candidates' healthcare proposals into four different general categories: "Major ACA 2.0 upgrade"; "ACA 2.0 w/Public Option"; "Universal Coverage w/Private Option" and "Pure Medicare for All". I started out with over a dozen candidates listed, and updated it to strip them out as they dropped out of the race. Joe Biden's plan falls squarely in the 2nd category.

At the bottom of the table, however, I also included a second little table which looked something like this:

In other words, before the COVID-19 pandemic, I was fairly pessimistic about Biden's full proposal making it through the sausage grinder of Congress even if the Dems end up with a trifecta. At the time, I put the odds at perhaps 50/50 even if the Dems eliminate the filibuster in the Senate, and only gave it a 10% chance if they don't.

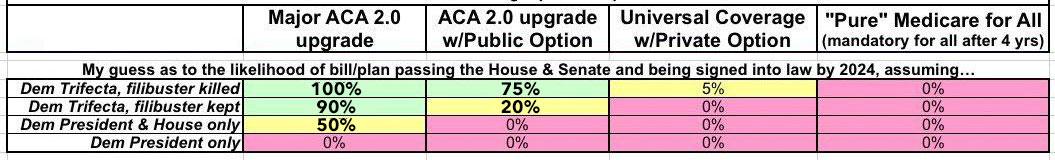

That was then; this is now. In January 2021, the U.S. will either still be in the middle of the pandemic (I hope not) or, at best, will be in the midst of recovering from it. EIther way, if the Democrats have a full trifecta (control of the White House, U.S. House of Representatives and U.S. Senate), I'd put the odds of each of these at more like this:

In other words, I'm a lot more optimistic now about the odds of getting some sort of major healthcare policy upgrade actually passed through both the House and Senate and signed into law by a President Biden today than I was six months ago. The House, of course, recently passed their own "Major ACA 2.0 upgrade" in the form of H.R. 1425, so that's not even in question--the only issue here is the Senate. But I have to imagine that even the most conservative Democratic Senators like Joe Manchin and Krysten Sinema would be a lot more open to a significant upgrade now than they were before the COVID pandemic hit (Sinema in particular, seeing how she represents Arizona, which is currently being ravaged horribly by the virus).

This doesn't mean that the bill which passes would be exactly as Biden's proposal describes--there will obviously be a lot of tinkering with it, and some elements might not make the cut--but the odds are pretty good that something resembling it will make it through the process and become the law of the land...again, if the Democrats win back the White House and retake the Senate and eliminate the filibuster. If one or more of those things don't happen, well...