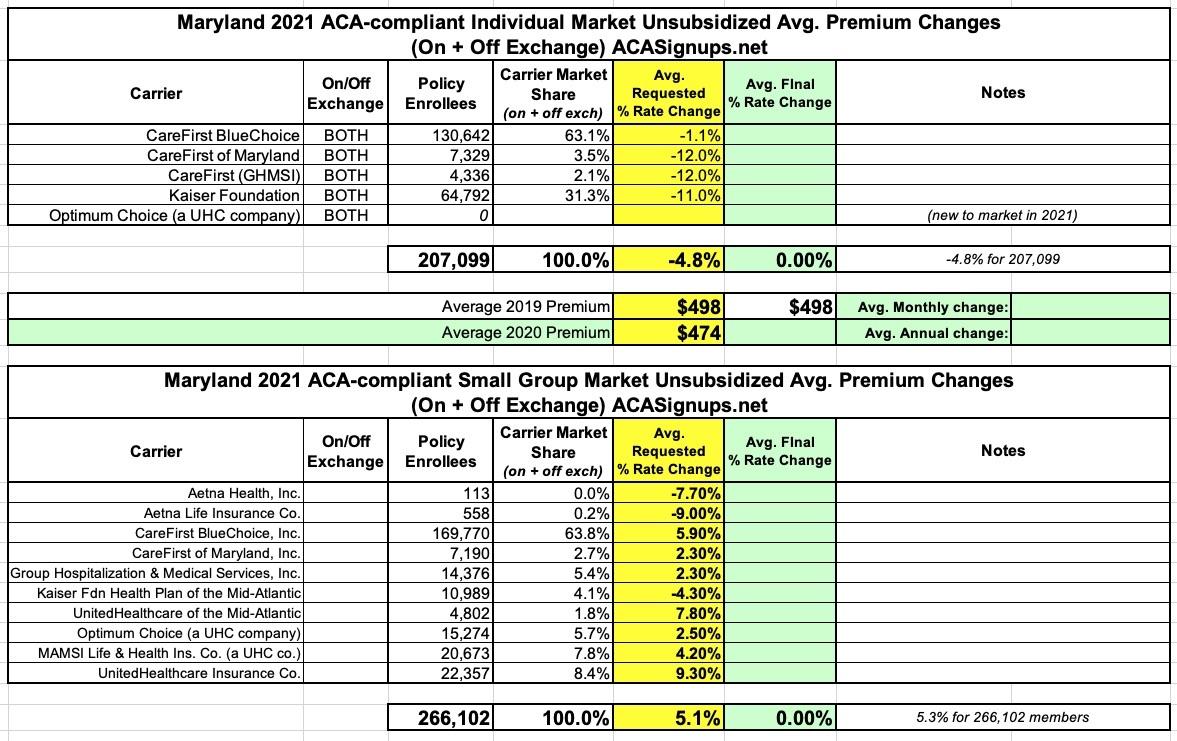

Maryland: Preliminary avg. 2021 #ACA premiums: 4.8% decrease for indy market, 5.3% increase for sm. group

via the Maryland Insurance Administration:

Health Carriers Propose Affordable Care Act (ACA) Premium Rates for 2021

BALTIMORE – Health carriers are seeking a range of changes to the premium rates they will charge consumers for plans sold in Maryland’s Individual Non-Medigap (INM) and Small Group (SG) markets in 2021.

The rates submitted for the INM market include the estimated impacts from the state-based reinsurance program (SBRP) enacted in 2019 via a 1332 State Innovation Waiver, approved by the federal Centers for Medicare & Medicaid Services.

“We are pleased with the continued downward trend that we see in the proposed rates. It is clear that the federal waiver and reinsurance plan crafted by Governor Larry Hogan and the legislature have provided the relief intended,” said Maryland Insurance Commissioner Kathleen A. Birrane. “It is important to remember that these are the rates requested by insurers and not necessarily the rates that will be approved. The Administration will conduct a thorough review of the requested rates and the justification provided and will consider information and comments from consumers. As in years past, we may approve amounts less than those requested.”

In Maryland, only those rates approved by the Insurance Commissioner may be charged to policyholders. Before approval, all filings undergo a comprehensive review of the carriers’ analyses and assumptions. Public comments are considered as part of the review process. By law, the Commissioner must disapprove or modify any proposed premium rates that appear to be excessive or inadequate in relationship to the benefits offered, or are unfairly discriminatory. The Maryland Insurance Administration (MIA) expects to issue decisions about rates and products no later than mid-September.

SUMMARY OF PROPOSED RATES FOR 2021

- For the INM market, the filed average annual rate change is a decrease of -4.8% affecting 207,099 members as detailed below.

- CareFirst BlueChoice Inc. HMO – a -1.1% decrease;

- CareFirst of Maryland Inc. and Group Hospitalization and Medical Services Inc. (GHMSI) (both CareFirst companies) PPO – a -12.0% decrease;

- Kaiser Foundation Health Plan of the Mid-Atlantic States HMO – a -11.0% decrease.

...Per Governor Hogan’s press release of May 11, 2020, after a four-year hiatus from the INM market that began in 2017, UnitedHealthcare (UHC) will reenter in 2021 under the name “Optimum Choice.” UHC intends to offer coverage in 14 of Maryland’s 24 counties, namely, 1) Anne Arundel, 2) Baltimore city, 3) Baltimore, 4) Carroll, 5) Charles, 6) Frederick, 7) Howard, 8) Kent, 9) Montgomery, 10) Prince George’s, 11) St. Mary’s, 12) Talbot, 13) Washington, and 14) Wicomico. The number of counties where consumers have only one choice of carrier will decrease from thirteen to eight. UHC will offer two Bronze plans, four primary Silver plans, and one Gold plan. While unsubsidized premiums are decreasing for all carriers, there is also going to be a general decline of "Advance Premium Tax Credit" (APTC) subsidy amounts due to both the rate reductions for existing carriers and the entrance of a new carrier. Depending on a person's age, Federal Poverty Level (FPL), and selected benefit, some members could see significant increases in their post-APTC premiums.

I'm actually rather impressed that the MD DOI was honest and transparent enough to come right out and state that lower unsubsidized premiums and increased competition in the marketplace could, ironically, lead to higher subsidized premiums for many people due to how the ACA subsidy formula is structured.

For the SG (50 or less contracts) market, the filed average rate change is an increase of +5.3% affecting 266,102 members over all four quarters of the year. Rates can change on a quarterly basis and some employers contribute toward their employees’ premiums. The proposed average rate changes below are for plans that begin in the first quarter of 2021.

- Aetna Health Insurance Inc. HMO – a -7.7% decrease;

- Aetna Life Insurance Inc. PPO – a -9.0% decrease;

- CareFirst BlueChoice Inc. HMO – a +5.9% increase;

- CareFirst of Maryland Inc. and GHMSI PPO – a +2.3% increase;

- Kaiser Foundation Health Plan of the Mid-Atlantic States Inc. HMO – a -4.3% decrease;

- UnitedHealthcare of the Mid-Atlantic HMO – a +7.8% increase; and

- Optimum Choice (a UnitedHealthCare company) HMO – a +2.5% increase.

- MAMSI Life and Health Insurance Co. (a UnitedHealthCare company) EPO – a +4.2% increase;

- United Healthcare Insurance Co. PPO – a +9.3% increase.

...For the stand-alone dental market, four carriers submitted premiums for the INM market affecting 60,276 members. Requested rate increases range from -1.3% to +1.9%. The latest enrollment data indicates that roughly 30% of INM ACA members have enhanced their coverage to include stand-alone dental. Exhibit 3 provides further detail and context.

I also appreciate the MD DOI doing the work of answering this burning question:

Only one of the carriers in one market elected to adjust 2021 costs due to the COVID-19 pandemic in their initial filings for any market citing uncertainty. UnitedHealthcare filed a 2.0% factor for COVID-19 for their INM market. All carriers reserved the right to revisit the impact of COVID-19 as more data emerges. Some of the potential factors, with upward and downward impacts to cost, include 1) deferred care / pent-up demand, 2) a potential COVID 19 resurgence in the fall of 2020, 3) economic impacts to individuals and employers, 4) the COVID-19 special open enrollment and “easy enrollment” periods, 5) lasting utilization changes due to telemedicine, 6) postponement of chronic care management and preventive care, 7) enrollment shifts between markets such as group to individual to Medicaid, 8) the removal of insured cost shares for diagnosis and treatment of COVID-19, 9) mental and behavioral health care pattern changes, and 10) a vaccine.

This is pretty much in line with the other state carriers which have submitted preliminary 2021 rate filings so far in Vermont, Oregon, DC, Washington State and New York: A handful are tacking on a few percentage points to cover potential COVID-19 expenses, but for the most part they're either shrugging it off or taking a "wait and see" approach.

Rates being reviewed by the MIA do not affect health insurance plans offered by large employers or employees who self-insure, “grandfathered” plans purchased before March 2010, or federal plans such as Medicare, Tricare and federal employee plans.

Here's what both the Individual and Small Group markets look like. My weighted average for the sm. group market is slightly lower than the MD Insurance Dept. claims (5.1% vs. 5.3%):