North Dakota: *Approved* avg. 2020 premiums: 5.8% *lower* thanks to ACA reinsurance program

Last month I noted that North Dakota had posted their requested 2020 premium rate change requests, including two different filings: One assuming the states' ACA Section 1332 Reinsurance Waiver didn't get approved, the other assuming it did. It was pretty unlikely that their waiver would be denied, however, so the general assumption was that they'd be looking at a significant rate reduction, especially compared with the rate increase if the waiver didn't go through.

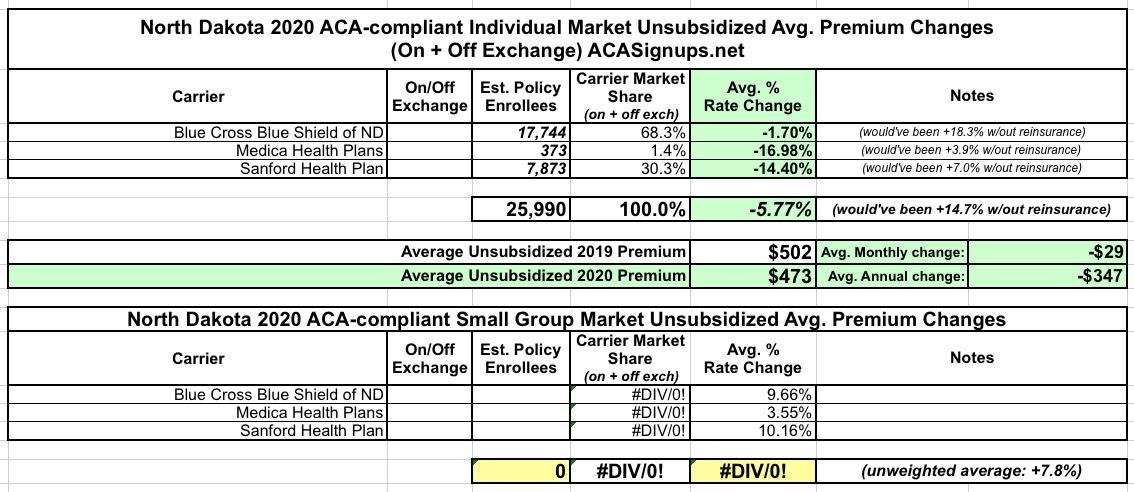

At the time, I didn't have access to the actual enrollment figures for the three carriers on North Dakota's individual market, so I had to go with an unweighted average rate change, and came up with a drop of 7.9%.

Since then, however, the state regulators have reviewed and approved the 2020 premium changes, and thanks to Louise Norris, I don't even have to dig up the enrollment data:

Average rates dropping by nearly 6% in 2020 (without reinsurance, they’d have increased by nearly 15%)

Since rate filings were due well before the state’s reinsurance proposal had gained federal approval, North Dakota’s insurance commissioner directed the state’s insurers to file two sets of rates for 2020: One based on reinsurance being enacted and the other based on the status quo. Once the federal government granted approval for the 1332 waiver, the North Dakota Insurance Department used the rate filings based on the reinsurance program being in place. The following average rate changes were approved for 2020 (all data is from North Dakota SERFF):

- Medica: 17 percent decrease (Medica’s alternate filing was for a 3.9 percent rate increase if reinsurance hadn’t been approved; they have 373 members)

- Blue Cross Blue Shield of North Dakota/Noridian: 1.7 percent decrease (Noridian’s alternate filing was for an 18.3 percent increase; they have 17,744 members)

- Sanford: 14.4 percent decrease (Sanford’s alternate filing was for a 7 percent increase; they have 7,873 members)

With the reinsurance program in place, North Dakota estimated that premiums in the individual market would be up to 20 percent lower than they would otherwise have been, which was very accurate: Overall, there’s a weighted average rate decrease of 5.72 percent for 2020; without reinsurance, there would have been an average rate increase of about 14.65 percent.

State officials also projected that with reinsurance in place, individual market enrollment will be 1 percent higher in 2020 than it would otherwise have been (this is because coverage will be more affordable for people who don’t receive premium subsidies, since full-price premiums will be lower).

With the actual enrollment data in place, I can now run a properly weighted average. I get a sligthly higher reduction than Norris, however: -5.8%. I'm not sure what the final small group rates are, however; I might update those later on: