Exclusive! Michigan: 2018 MLR Rebate Payments (& potential 2019 rebates)

A few weeks ago, I posted a lengthy, in-the-weeds explainer about how the ACA's Medical Loss Ratio (MLR) provision works. The short version is that ever since the ACA went into effect in 2011 (3 years before newly-sold policies had to be ACA compliant), to help reduce price gouging, insurance carriers have been required to spend a minimum of 80% of their premium revenue (85% for the large group market) on actual medical claims.

Put another way, their gross margins are limited to no more than 20% (or 15% in the large group market). Remember, that's their gross margin, not net; all operational expenses must come out of that 20% (15%). The idea is that they should be spending as much of your premium dollars as possible on actual healthcare, as opposed to junkets to Tahiti or marble staircases in the corporate offices, etc. Anything over that 20% (15%) gross margin has to be rebated to the policyholder.

As I noted in my explainer, in practice it gets quite a bit more complicated than that. For one thing, like everything else in health insurance, there's three different markets: Large Group (companies with more than 100 employees); Small Group (companies with 2-100 employees) and Individual (people without employer-sponsored coverage who buy policies for themselves and their families).

Secondly, the MLR percentage is calculated based on a 3-year rolling average, which means that one awful year for a carrier can cancel out two pretty good years.

There's also some additional adjustments and caveats which tweak the formula up or down based on various factors (risk adjustment, taxes, etc), and in some cases how many enrollees the carrier actually has. For instance, if a carrier has fewer than 1,000 total enrollees over the 3-year period, they're exempt from the MLR rule; if they have between 1,000 - 75,000 total enrollees over that period, there's an upward adjustment to smooth out the formula.

Even with all of this, since 2011, nearly $4 billion in excessive premiums has been returned to policyholders thanks specifically to the ACA's MLR rule, averaging around $560 million per year.

As I also noted, the amount of the rebate can vary widely from year to year, from carrier to carrier, and between the three markets. Some carriers don't end up having to pay anything back to anyone; others may have to shell out a ton of money. The number of recipients also varies widely depending on carrier, year and market, which in turn means a wide variance in the average amount each policyholder actually receives. It could be nothing, a few bucks or several hundred dollars.

MLR rebate payments for 2018 are being sent out to enrollees even as I type this. The data for 2018 MLR rebates won't be officially posted for another month or so, but I've managed to acquire it early, and after a lot of number-crunching the data, I've recompiled it into an easy-to-read format.

But that's not all! In addition to the actual 2018 MLR rebates, I've gone one step further and have taken an early crack at trying to figure out what 2019 MLR rebates might end up looking like next year (for the Individual Market only). In order to do this, I had to make several very large assumptions:

- First, I've assumed that total enrollment for each carrier remains exactly the same year over year.

- Second, I've assumed that the average 2019 rate changes I recorded for each carrier last fall are accurate.

- Third, I'm assuming that 2019 is seeing a 5% medical trendline on average...that is, that total 2019 claims per enrollee will be 5% higher than 2018's.

All three of these are very questionable, of course, but they at least provide a baseline.

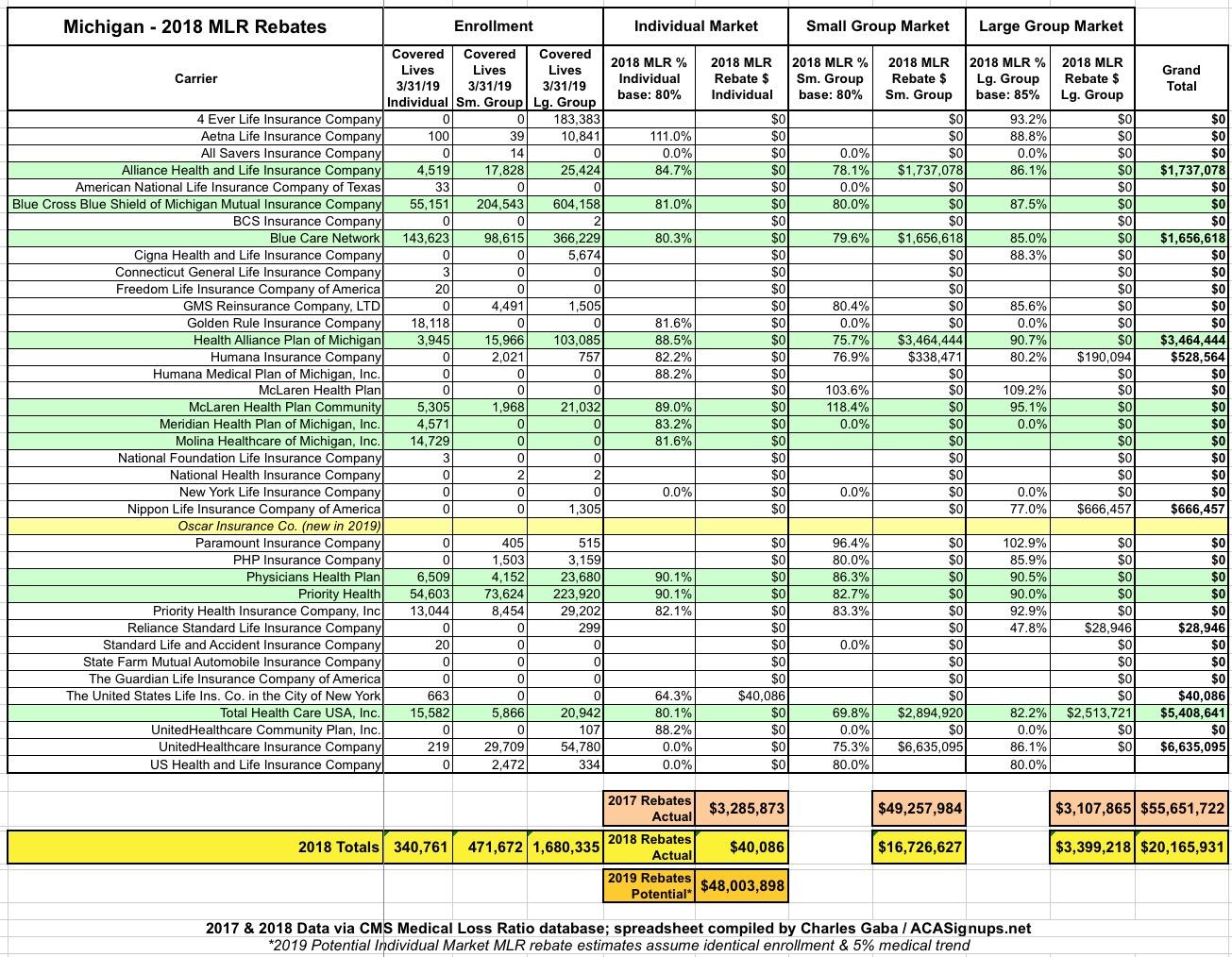

All that being said, here's what things look like here in Michigan for 2018:

Rebates went up slightly in the Large Group market, from $3.1 million to $3.4 million. In the Small Group market they dropped dramatically, from over $49 million to just $16.5 million. It's the Individual Market which is the most surprising, however: Last year nearly $3.3 million was paid back to policyholders; this year it's a mere $40,000 from a single carrier (and not even one I'm familiar with...I've never heard of "The United States Life Insurance Co. in the City of New York", as awkward as the company's name may be.

NEXT year, however, as I noted in my MLR explainer, there's the potential for a massive increase in Individual Market MLR rebate payments, mainly due to 2016 dropping off of the 3-year rolling average calculation. Here's why:

- In 2016, Michigan Indy Market carriers averaged an atrocious 90.1% average MLR.

- In 2017, that dropped to a more reasonable (but still high) 84.5%

- In 2018, it plummeted to just 75.2% on average.

This means that for 2018, the 3-year rolling average was 82.9%; this is why only a single carrier falling below the 80% mark (a few technically did but were nudged back over the 80% line due to the adjustments I mentioned above).

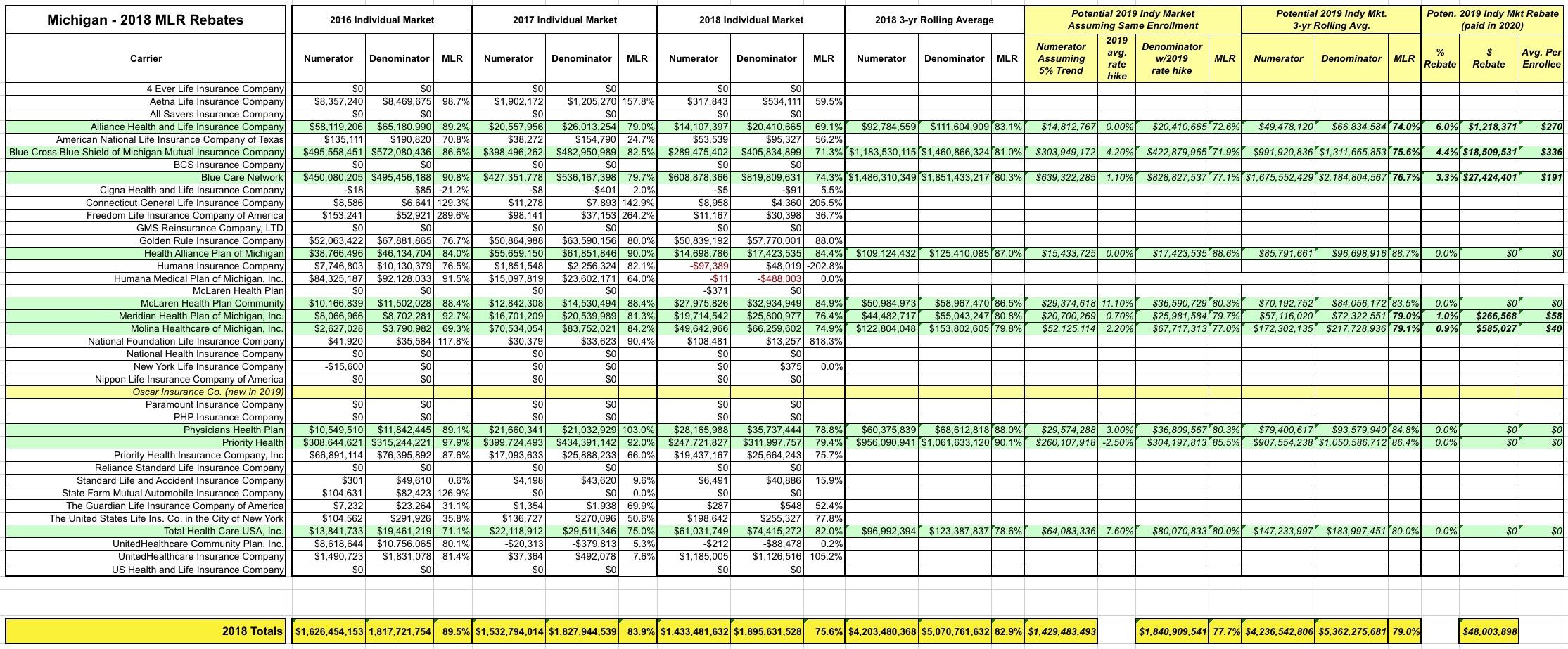

However, it also means that for 2019, that 90.1% from 2016 will drop off the map. The 3-year average will include 2017's 84.5%, 2018's 75.2% and whatever the MLR is for 2019...which I'm pegging at perhaps 77.7% using my "5% medical trend" assumption. Here's what that could look like (click image for high-res version):

This would give a weighted average of around 79% even, which could potentially mean as much as $48 million in MLR rebates having to be paid out on the Individual Market alone from up to 5 of the carriers on the ACA individual market (Alliance, Blue Cross Blue Shield of Michigan, Blue Care Network, Meridian Health Plan and Molina Healthcare), or an average of around $215 per eligible enrollee.

AGAIN: There's absolutely no guarantee that things will play out this way. It's possible that none of these carriers will make MLR payments next year, or only some of them will, or the amounts will be smaller. These 2019 projections are pure speculation on my part based on a number of big assumptions.