New Hampshire: *Preliminary* avg. 2020 ACA premium changes: 1.1% increase

This Just In from the New Hampshire Insurance Dept:

Federal Government Announces 2020 Premium Rates

Website details proposed decreases for health plans to be sold in NHCONCORD, NH – The federal government has published information on proposed rates for New Hampshire’s health insurance exchange (HealthCare.gov) in 2020.

The New Hampshire Insurance Department looks at premiums each year from a market-wide perspective, comparing the median premium for an on-exchange silver-level plan covering a 40-year-old non-tobacco-user. For 2019, the median premium at this level was $440; the median premium at this level for 2020 would be $429, based on the carriers’ proposed rates. If these rates are ultimately approved, this would represent a 2.5% decrease between next year’s and this year’s median premium in the individual market.

It's very important to note that the 2.5% reduction does not refer to the statewide, overall weighted average premium change; it applies to the median premium for a single, 40-year old non-smoking on-exchange Silver plan, which is a hell of a lot of descriptors.

“New Hampshire has had two consecutive years of modest premium rate decreases,” said Insurance Commissioner John Elias. “Rates are still high, particularly for NH residents who do not qualify for premium assistance, and we are continuing to work collaboratively with insurance companies and policymakers to pursue other efforts to improve health insurance markets in New Hampshire.”

The 2020 rate information released by the federal government details proposed annual rate changes for benefit plans that are submitted by insurance companies operating on HealthCare.gov. The New Hampshire Insurance Department is prohibited by law from releasing rate information until Nov. 1, the first day of open enrollment. A benefit plan is a specific plan that a New Hampshire resident would select for enrollment, such as a bronze, silver, or gold level metal plan.

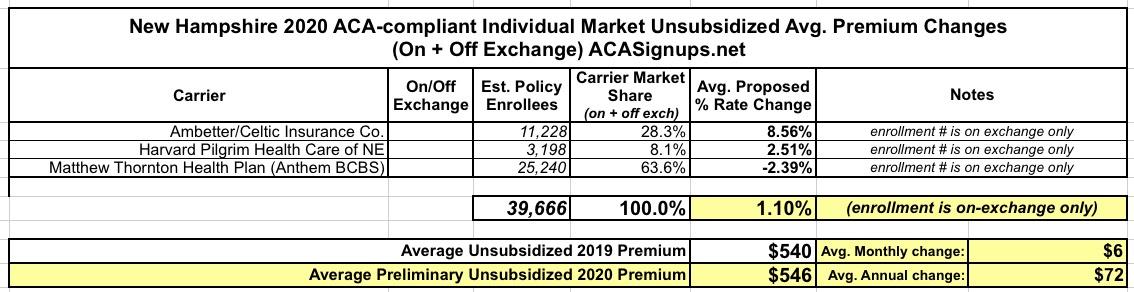

In other words, New Hampshire itself can't publicly post any details until 11/01/19, but RateReview.HealthCare.Gov can...and did, starting today. Unfortunately, most of the filing information is still redacted there as well. They post the requested rate changes for each carrier, of course, but the enrollment data for each is blotted out. Ironically, New Hampshire does post a monthly report with the on-exchange enrollment numbers, but not the off-exchange portion, so the table below is probably missing about 30% of enrollees, give or take:

“I am pleased to see that New Hampshire insurance companies are anticipating a decrease in the cost of premiums for the second year in a row,” stated Governor Chris Sununu. “This is a stark contrast to previous year’s premium increases and is due to our commitment to working with the insurance companies to decrease premiums and deliver real savings for the people of our state."

Three companies have filed rates with the intention to offer products the exchange in 2020 for New Hampshire: Ambetter, Anthem, and Harvard Pilgrim. The companies have until Sept. 24 to commit to selling plans on HealthCare.govfor the 2020 plan year.

The Department advises consumers that the only way to receive an accurate premium rate amount is to update your application on HealthCare.gov each year. The amount of premium assistance you may qualify for changes each year depending on your age, financial status, and household size. An insurance agent or enrollment assister can help you update your application.

The New Hampshire Insurance Department Can Help

The New Hampshire Insurance Department can help you with questions or concerns about your existing coverage. To speak to a member of the Consumer Services Department, call (800) 852-3416, (603) 271- 2261 or email consumerservices@ins.nh.gov.

The New Hampshire Insurance Department’s mission is to promote and protect the public good by ensuring the existence of a safe and competitive insurance marketplace through the development and enforcement of the insurance laws of the State of New Hampshire. For more information, visit www.nh.gov/insurance.

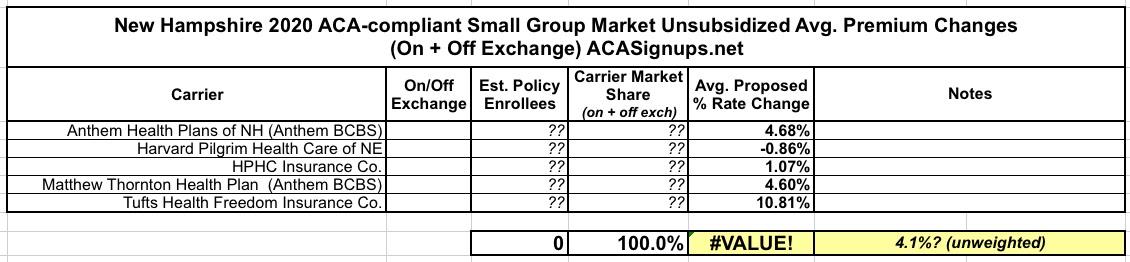

For the Small Group market, I don't even have access to the enrollment numbers, so the best I can do is an unweighted average (a 4.1% increase), which of course is likely not accurate since one of the carriers could easily hold 80% of the total market or whatever, but here's the individual rate change requests, anyway:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.