Idaho: *Preliminary* avg. 2020 ACA rate changes: 7.0% increase

This just in from the Idaho Insurance Dept:

Individual Medical Plans

The Department of Insurance received preliminary 2020 health plan information from insurance carriers on June 1 and began reviewing the proposed plan documents and rates for compliance with Idaho and federal regulations. The Department of Insurance does not have the authority to set or establish insurance rates, but it does have the authority to deem rate increases submitted by insurance companies as reasonable or unreasonable. After the review and negotiation process, the carriers submit their final rate 2020 increase information. The public is invited to provide comments on the rate changes. Please send any comments to Idaho Department of Insurance.

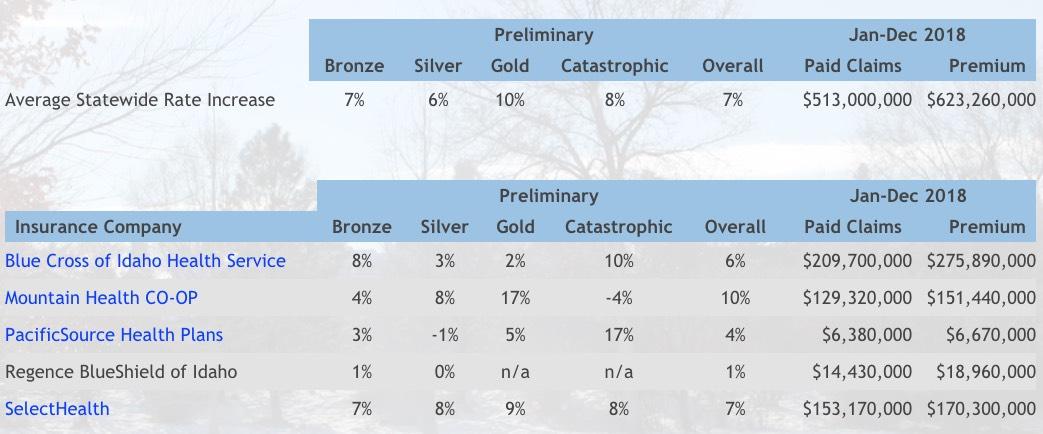

A key driver of increases is generally the level of health claims paid compared to the premium collected. The table below shows the level of claims paid and premium collected by each insurance company for ACA-compliant health benefit plans during 2018. In addition to claims paid, the premium needs to cover the company’s administrative costs, insurance fees, and taxes. Those costs generally consume around 20% of the premium. Larger rate increases may be needed when the prior year’s premium is not sufficient to pay for health claims and administrative costs and fees. With its rate increase submission, each insurance company submits a consumer-oriented explanation of the increase, which is available by clicking on the name of the insurance company in the table below.

Each health benefit plan has an associated “metal level” of Bronze, Silver, Gold, or Catastrophic and offers, at a minimum, Idaho's Essential Health Benefits package. The metal level is assigned based on the policyholder's "cost-sharing," which includes any deductibles, coinsurances, copays, and out-of-pocket maximums. A Silver plan usually will have lower cost-sharing than a Bronze plan, and a Gold plan will usually have lower cost-sharing than a Silver plan. However a Gold plan usually has a higher monthly premium than a Silver plan, and a Silver plan usually has a higher monthly premium than a Bronze plan. Policyholders are able to choose which metal level and which plan within that metal level best works for them.

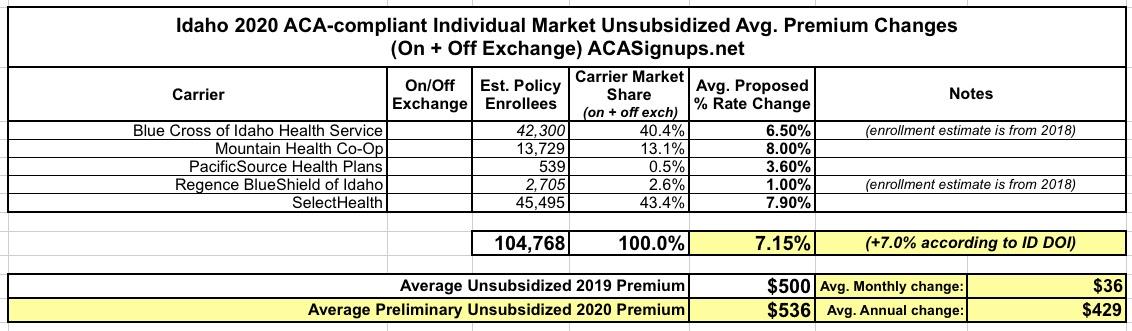

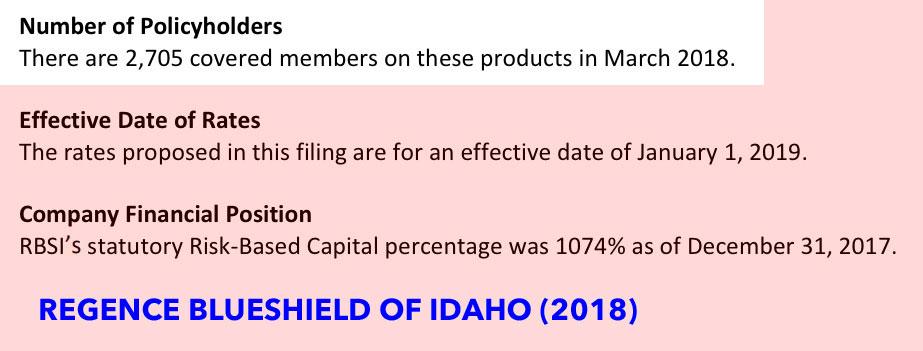

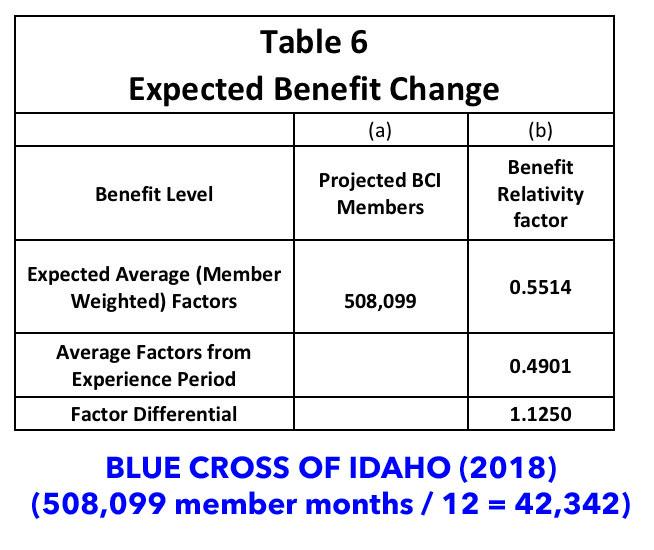

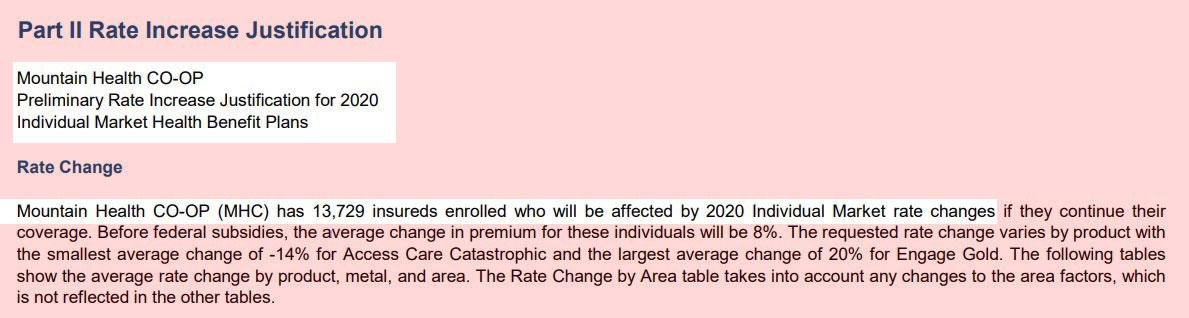

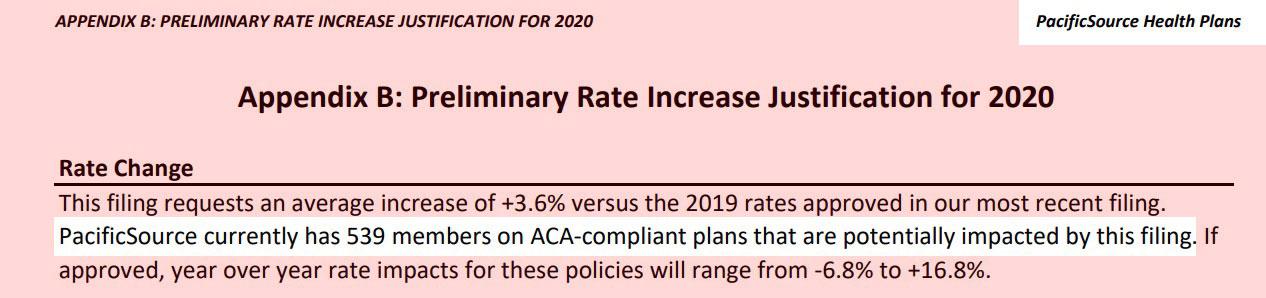

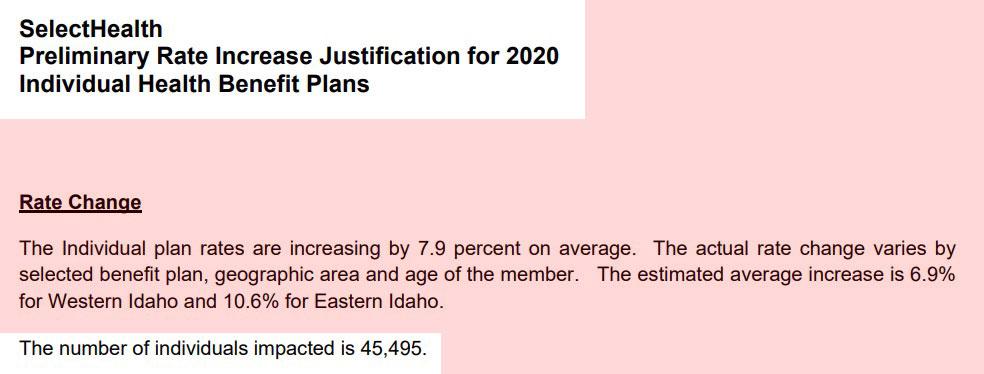

Idaho's DOI does a nice job of breaking out the rate h ikes by metal level, and the addition of the prior years' premiums/claims is a nice touch. Unfortunately, while they do include links to the filing summaries, one of them is missing (Regence BlueShield), and the one for Blue Cross doesn't give a hard enrollment number, making it difficult to plug in the relative market share for each carrier. For now I'm using the 2018 enrollment numbers for these two in the hope that their enrollment numbers stayed relatively stable (Idaho's exchange enrollment was virtually unchanged year over year, for instance).

Doing it this way I come up with a weighted average increase of 7.15%, which is pretty close to the 7.0% claimed by the Idaho Insurance Dept., so I'm comfortable with my estimates:

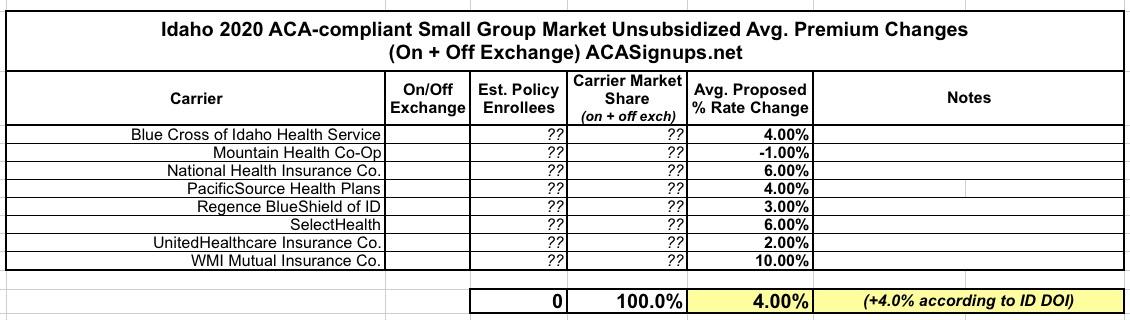

Here's the Small Group market...I'm not bothering trying to break that by carrier market share:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.