Illinois: APPROVED 2019 #ACA rate changes: FLAT, but would likely have DROPPED ~13% w/out #ACASabotage

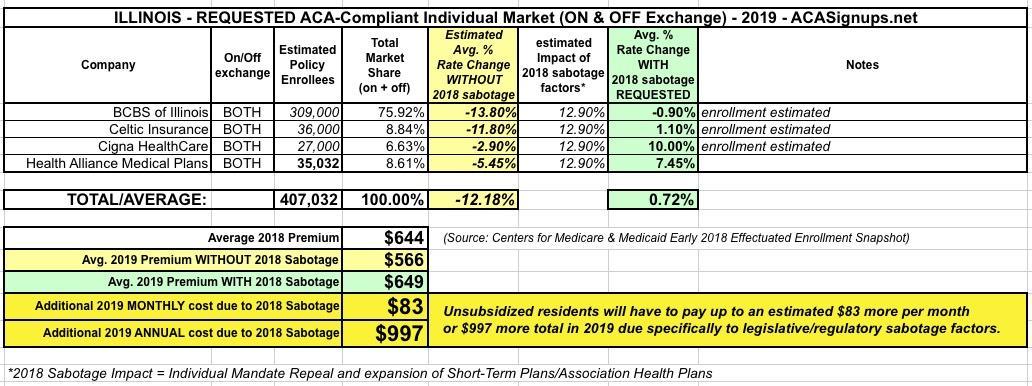

I ran the numbers for Illinois' requested 2019 ACA individual market rate changes back in August. At the time, the weighted year-over-year average was a mere 0.7% increase, with Cigna and Health Alliance's 10% and 7.5% being mostly cancelled out by Celtic's 1.1% and especially Blue Cross Blue Shield's slight drop of 0.9%. Since BCBSIL holds something like 3/4 of the state's individual market share, that alone mostly wiped out the other increases.

Unfortunately, I don't have access to the hard enrollment numbers, so this was a rough estimate based on 2017's breakout. Here's what it looked like at the time:

Yesterday, the Illinois Department of Insurance issued a press release with the final/approved 2019 ACA premium changes, but it's a bit vague about the hard numbers:

Illinois Department of Insurance releases ACA Exchange health care insurance rates for 2019

Some plan rates decrease for first time since 2015SPRINGFIELD – Today, the Illinois Department of Insurance (DOI) released its on-Exchange health care rate and plan analysis for Plan Year 2019, showing that rates have stabilized for the first time in recent years.

Average rates for the 2019 lowest cost silver plans decreased four percent and the lowest cost gold plans decreased by six percent from last year.

Overall, rates for the lowest cost bronze plans modestly increased approximately six percent, far less than the 20 percent increase reported for 2018 rates.

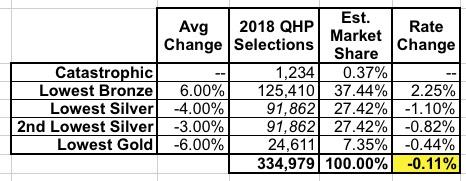

The full rate analysis report from the IL DOI isn't much better, I'm afraid; while it includes all sorts of geographic information (which carriers are offering which plans in which rating areas, etc), there's no hard numbers about individual carrier rates or enrollment numbers. Instead, the rate changes are broken out by metal level, as noted above:

- Lowest-priced Bronze plans are increasing by 6%

- Lowest-priced Silver plans are dropping by 4%

- 2nd-Lowest-priced Silver plans are dropping by 3% (these are the benchmark policies which determine ACA subsidies for those eligible)

- Lowest-priced Gold plans are dropping by 6%

Unfortunately, since there are literally dozens of plans available (some counties have up to 30 plans available, which is a good thing), this means the "lowest/2nd-lowest" averages don't paint anything close to the whole picture...but it's the best I can do.

The good news is that I do have the metal level breakout of the 2018 ACA exchange enrollees from the CMS Public Use File report: 37% of enrollees chose Bronze, 55% chose Silver and just 7.4% chose Gold plans, with nominal numbers choosing Catastrophic policies (and I don't think there are any Platinum plans available in Illinois at all).

If I use that as a guideline and split the Silver plans between the 1st and 2nd-lowest priced policies, I get the following:

Again, I realize that this is a very rough way of doing this, but it seems to be reasonably close. If the state Dept. of Insurance modified any of the requested rates, they don't appear to have changed them by very much. As far as I can tell, Illinois rates are barely changing one way or the other on average.

HOWEVER, there's still that 13-point estimated #ACASabotage factor caused by Congressional Republicans repealing the Individual Mandate and the Trump Administration removing the restraints on #ShortAssPlans. Illinois had a chance at mitigating the #ShortAssPlans damage. Unfortunately, GOP Gov. Bruce Rauner blew that by vetoing a bill which would've put restrictions back on them. That is, IL premiums would have likely dropped by around 13% if the mandate hadn't been repealed and #ShortAssPlans weren't being expanded all over the place.

As a result, unsubsidized enrollees are likely looking at paying nearly $1,000 more than they would otherwise next year as a result of those factors.

“Illinois consumers will finally have some relief after facing years of on average double-digit increases in health insurance premium rates,” DOI Director Jennifer Hammer said. “We are starting to see signs that the Exchange is stabilizing given this year’s rates, a new insurer entering the on-Exchange market in 2019, and no insurers from last year exiting.”

Illinois consumers in all counties will have options to purchase health insurance coverage on the Exchange.

Get Covered Illinois (GCI) is the official health marketplace or “exchange” for health insurance for all Illinoisans. Individuals and small businesses can purchase their health insurance on the GCI website. Because GCI facilitates the federal subsidies, consumers are able to see their monthly premium at the discounted price.

“As steadfast supporters and opponents of the Affordable Care Act continue to drive division, I am proud of our Administration’s efforts,” Gov. Rauner said. “Director Hammer and DOI have united their resources to bring stability and rate decreases to the market for Illinois consumers. We are working hard to lower rates and stay ahead of trends to help consumers get the coverage they need.”

DOI is advising consumers enrolling or re-enrolling in coverage to start shopping early, due to the six week enrollment period set by the federal government, and to look at all options available to them on and off the Exchange, from November 1, 2018 to December 15, 2018.

“We continue to focus on our core mission – to protect and educate consumers,” Hammer said. “We recognize some families may have to face difficult decisions this fall, and we will be visiting all 102 counties for the second year in a row to discuss coverage and answer questions about mental health and substance use disorder treatment. We want to make sure consumers are aware of all their options.”

Consumers are encouraged to visit DOI’s GCI website for further information and assistance, or to contact their trusted licensed insurance agent. The Get Covered Connector on the website allows consumers to search for options by zip code to find local, free application help in English or Spanish. Consumers can also use this tool to schedule in-person assistance appointments with navigators and certified application counselors. Anyone may call DOI at 866-311-1119 for additional resources and information regarding health insurance.

The full analysis can be found on DOI’s website under the “latest news” tab.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.