Connecticut: Preliminary 2019 #ACA rate hikes: 12.3% WITH sabotage, 7.4% WITHOUT sabotage

This just in from the Connecticut Insurance Dept...

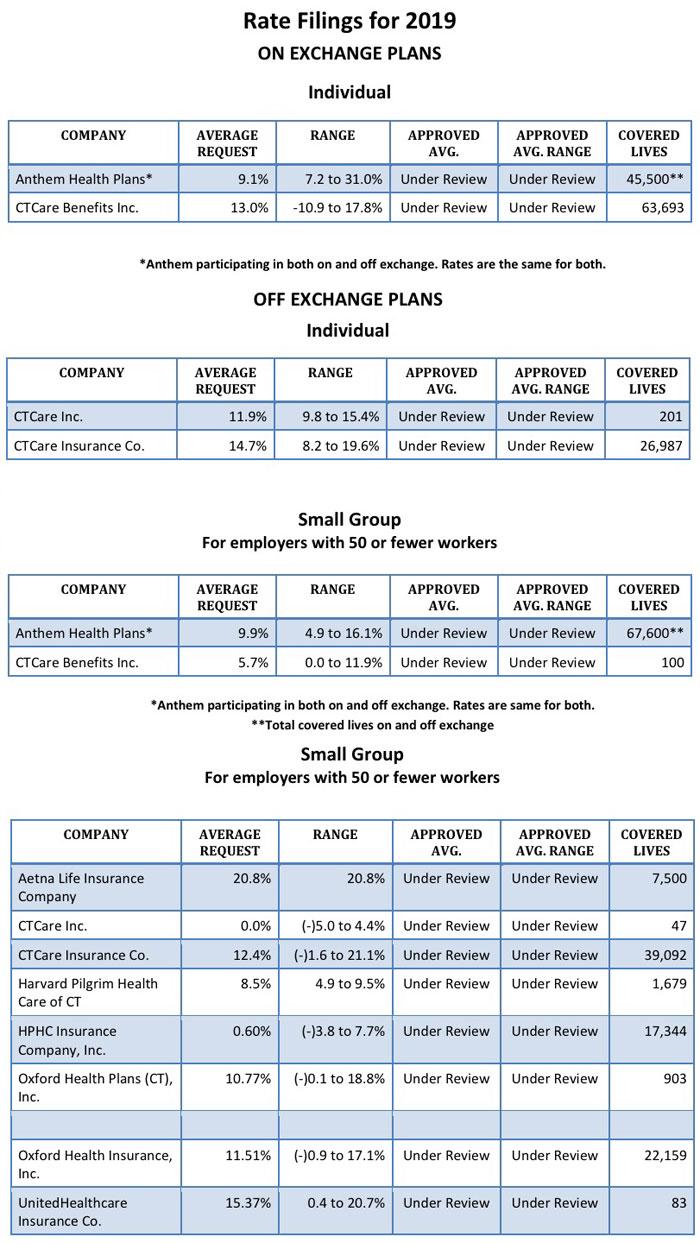

The Connecticut Insurance Department is reviewing 14 health insurance rate filings for the 2019 individual and small group markets. The filings were made by 10 health insurers for plans that currently cover about 293,000 people.

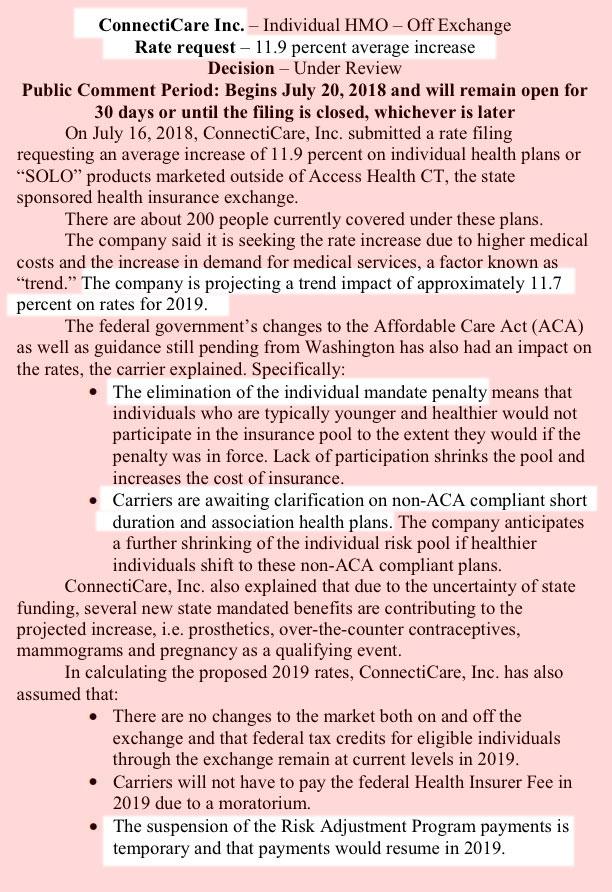

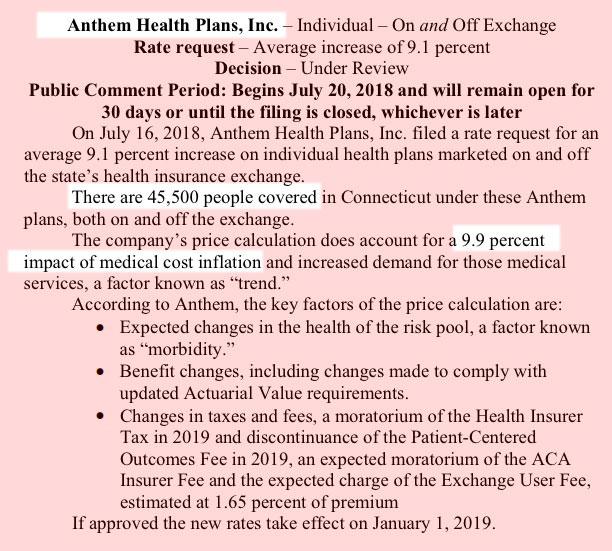

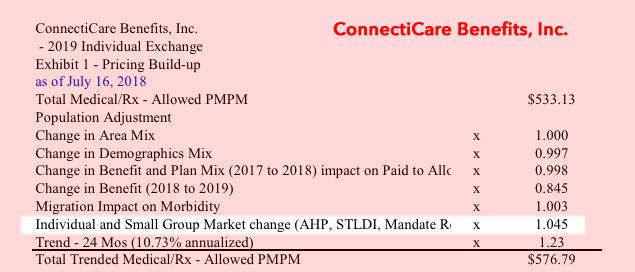

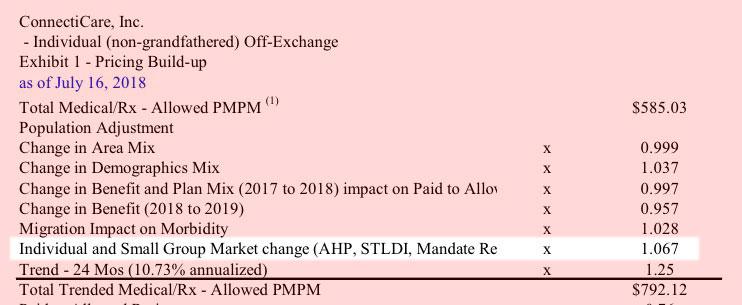

Two carriers – Anthem and ConnectiCare Benefits Inc. (CBI) – have filed rates for both individual and small group plans that will be marketed through Access Health CT, the state-sponsored health insurance exchange.

The 2019 proposed rate increases for both the individual and small group market are, on average lower, than last year:

- The proposed average individual rate increase request is 12.3 percent and ranges from -10.9 percent to 31.0 percent. This compares to the average increase request of 25.51 percent requested last year.

- The proposed average small group rate increase request is a 10.22 percent and ranges from -5.0 percent to 21.1 percent. This compares to the average increase request of 18.06 percent requested last year.

In their rate filings, carriers have attributed the increases to:

- Trend: Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs, and the increased demand for medical services.

- Uncertainty in Washington:

- Removal of penalty for individual mandate: The elimination of the penalty means that individuals who are typically younger and healthier would have no inducement to participate in the insurance pool, which could further destabilize the market. Lack of participation shrinks the pool and increases the cost of insurance to the remaining members.

- Short-duration health plans and Association Health Plans: Still pending are final federal regulations on non-ACA compliant short-duration plans, which may have implications for the ACA risk pool. Also, Connecticut along with other state insurance regulators, are awaiting clarification from the federal government on new federal regulations allowing association health plans, which could further shrink the ACA risk pool.

What’s Next

- The Insurance Department will conduct actuarial reviews on each filing to determine if they are justified and will either approve, reject or modify the request.

- The 30-day public comment period on all filings begins today (July 20) and comments can be filed online through the link that accompanies every filing or can be delivered to the Connecticut Insurance Department at P.O. 816, Hartford, CT 06142-0816.

- An informational hearing on the filings will be held September 5 at 10 a.m. at the Insurance Department.

- The Department expects to make final rulings on the proposals in September. Open enrollment for the 2019 coverage year begins November 1, 2018.

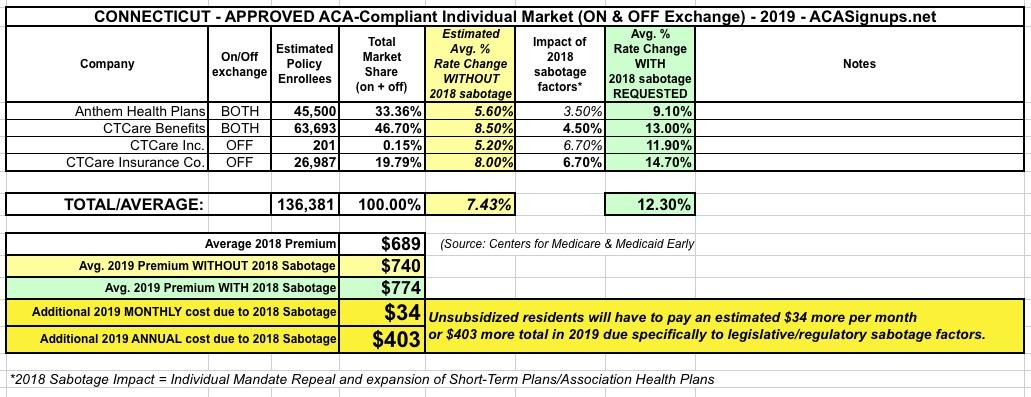

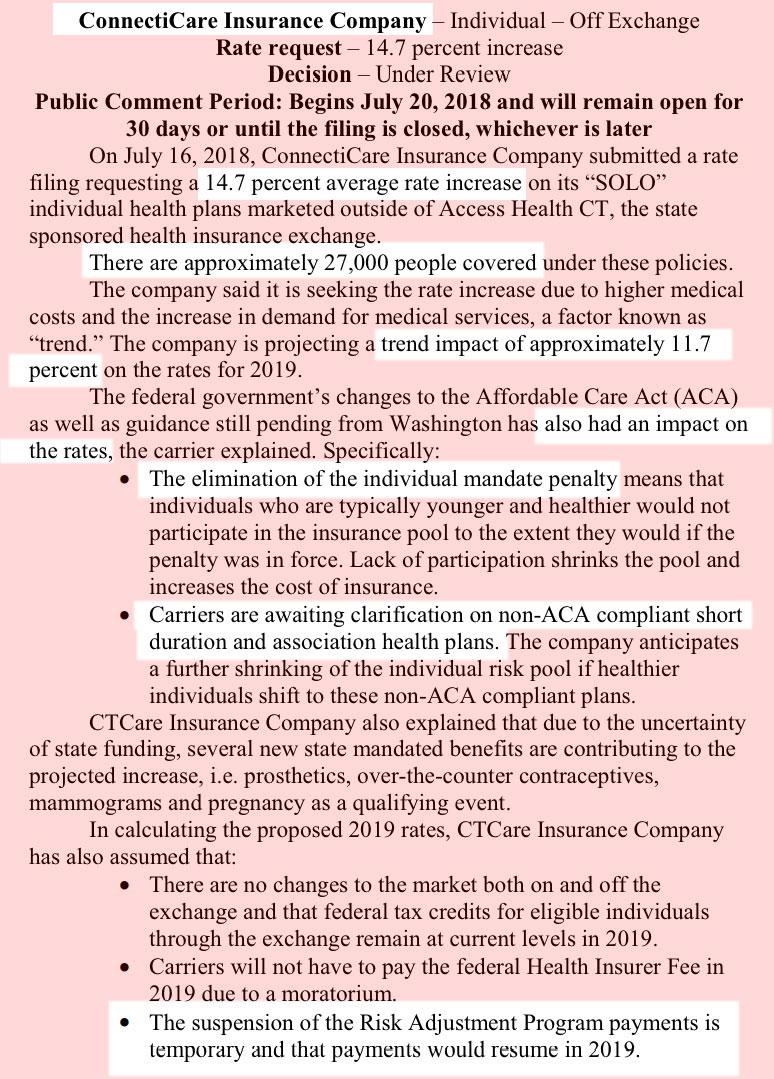

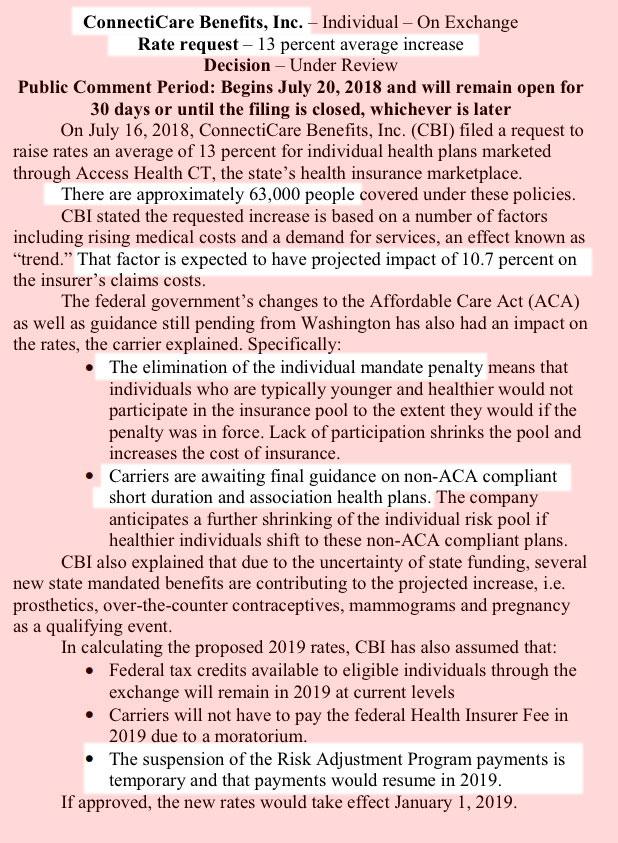

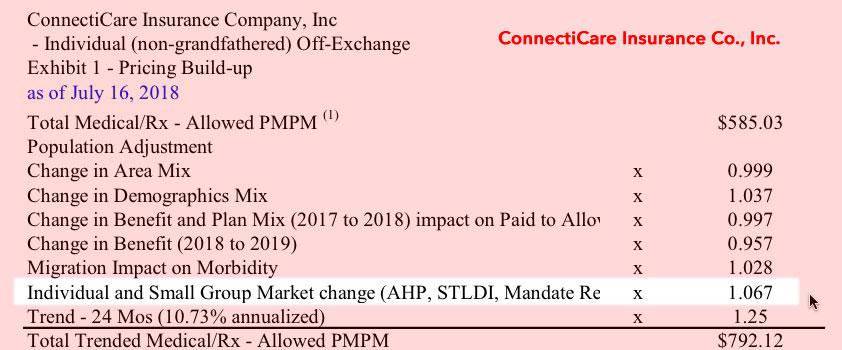

All three of the ConnectiCare filings make it pretty clear that in the case of Connecticut, the carriers are only anticipating a fairly small impact from the GOP's mandate repeal and #ShortAssPlans expansion, tacking on around 2-5% to premiums in 2019.

Anthem, on the other hand, says that they're medical trend (9.9%) was higher than their actual rate hike request (9.1%), which means they definitely overshot the mark a bit this year and are backing off a bit next year to stick to the ACA's 80/20 MLR rule. At the same time, they don't mention anything at all about mandate repeal or #ShortAssPlans, so either they decided to leave that out or they're confident that it will have a nominal impact on their risk pool.

It's important to note that the sabotage factors will always be about 2 points higher than they may appear because this is partly cancelled out by the health insurance fee moratorium. So for example, in the case of CTCare Insurance, medical trend was 11.7% but they're raising rates 14.7%. That makes it look like the sabotage factors only add 3 points...but the tax moratorium also knocks 2 more points off the total, so it's actually a 5 point increase from mandate repeal/shortassplans.

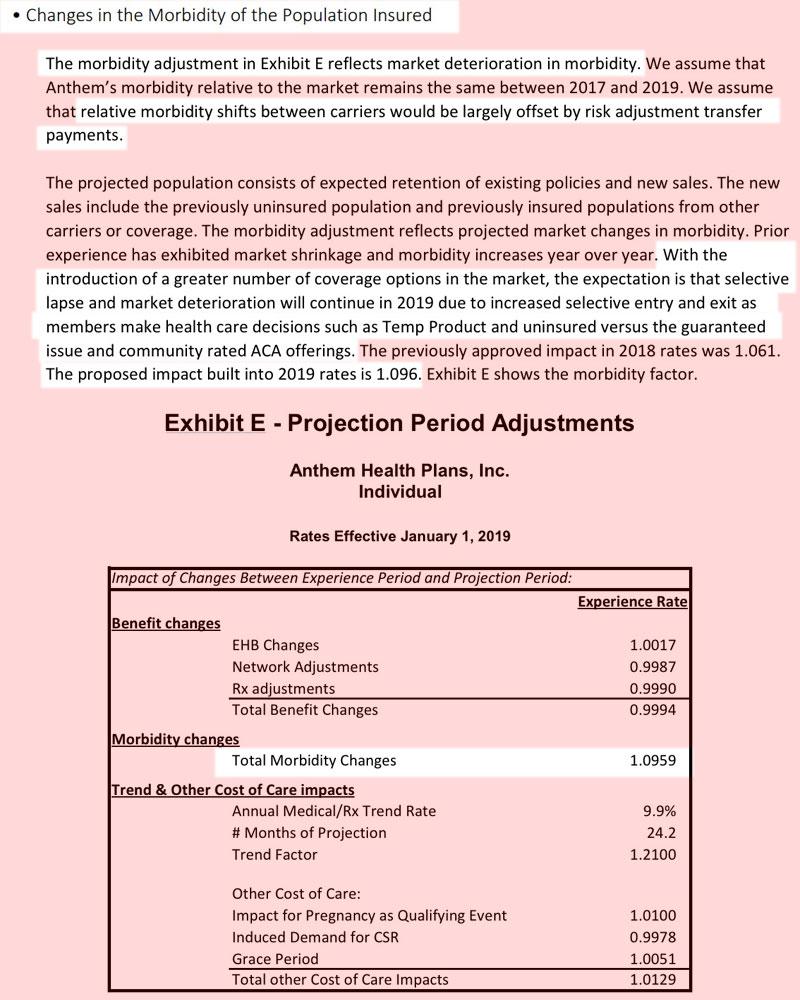

UPDATE: OK, I dug deeper into the filings (scroll down to the last 4 screen shots) and found the hard morbidity impact specifically due to mandate repeal, short-term plan expansion and association plan expansion, and it's a couple of points higher than I thought after all, including roughly a 3.5% hit to Anthem plans after all. The table below has been updated to reflect this: 12.3% with sabotage, 7.4% without.

Anthem's filing was confusing to me until Dave Anderson explained: +9.9% medical trend, -2.5% due to the carrier tax holiday, +9.6% morbidity, however that's a two-year morbidity factor. The first 6.1 points were for this year (uncertainty about mandate repeal), leaving about 3.5% due to this year's surprise (#ShortAssPlans).

Also, while my math adds up to a weighted average increase of 12.0%, the CT insurance dept. insists that it's actually 12.3%, so I'm bowing to their statement:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.