How would middle-class families fare under ACA 2.0 vs. today's ACA/Trumpcare hybrid?

A note about the headline: I originally referred to "ACA 2.0 vs. Trumpcare", but the more I thought about it, the more I realized that as of this moment, Donald Trump and the GOP have only partially mutated the Affordable Care Act into their own warped vision. They've managed to scare off carriers, confuse enrollees, cause unsubsidized premiums to shoot up an extra 18%, and with the repeal of the individual mandate (and potentially the massive expansion of #ShortAssPlans via #RegulatorySabotage) starting next year are about to cause those same premiums to jump another 16% or so on average. They've also started eroding ACA Medicaid expansion by starting to add work requirements and may possibly even add something as draconian as lifetime limits.

On the other hand, the ACA exchanges are still around, the tax credit structure is still intact, Trump's cut-off of CSR reimbursement payments was neatly cancelled out for most people by Silver Loading and the Silver Switcharoo, and Medicaid expansion is still pretty much the same in most states (for now, anyway). As a result, the ACA finds itself in an extremely awkward and fragile state--beaten and bloodied but still standing its ground.

There are two main populations caught in the crossfire of the current situation: The ~2.4 million people still caught in the Medicaid Gap across the 18 states which haven't expanded the program yet (19 until Maine actually enacts their recently-passed referendum to do so)...and the 5-6 million middle-class people who are on the individual market but earn more than 400% of the Federal Poverty Line (around $48,000 for a single adult or $98,000 for a family of 4).

The Medicaid Gap problem is being chipped away at gradually; in addition to Maine's 80,000 residents who are about to become Medicaid-eligible, Virginia is on the verge of passing Medicaid expansion for 400,000 residents. If so, that would lop the number caught in The Gap down to less than 2 million, with ballot initiative drives ramping up in states like Nebraska, Idaho, Missouri and Utah (a legislative attempt to expand the program to 150,000 in Kansas fell apart a second time a couple of weeks ago).

As for the Unsubsidized Middle-Class problem, things are looking grim for 2019. As noted above, not only did unsubsidized rates go up around 30% this year alone (with 3/5ths of that due specifically to Trump-created sabotage), a study by the Urban Institute projects them to increase another 18% next year due specifically to Trump/GOP sabotage efforts. Add that to the "normal" 7% or so medical inflation trend and a Covered California study projects that unsubsidized premiums on the individual market could end up as much as 94% higher by 2021 than today depending on the state and plan.

With all this as backdrop, John Tozzi has an excellent piece up today over at Bloomberg News which looks at 3 real-life case studies of families stuck in this predicament: The Buchanans, the Bobbies and the Owens.

I decided to gather the info I have on these three families to see how they might fare under the ACA 2.0 bills just proposed by Democrats in both the House and Senate compared to their current siutations. The House and Senate bills are very similar, with identical subsidy formulas but one critical difference: In the Senate version, the formula would be based on Gold plans while the House version remains based on Silver plans. I'm going to look at the Senate (Gold benchmark) version here.

First, let's get the key details for each family. Here's the basics:

In tiny Marion, North Carolina, the Buchanans decided that $1,800 a month was too much to pay for health insurance, and are going without it for the first time in their lives.

In Harahan, one bend of the Mississippi river up from New Orleans, the Owenses looked at their doubling insurance premiums and decided no, as well. “We’re not poor people but we can’t afford health insurance,” Mimi Owens said.

And in a Phoenix suburb, the Bobbies and their son Joey will go uninsured so the family can save money to cover their nine-year-old daughter Sophia, who was born with five heart defects.

...and here's the details for each family:

...No one had to tell the Buchanans about the risk. Dianna, 51, survived a bout with cancer 15 years ago. Keith, 48, has high blood pressure and takes testosterone shots. They live in Marion, North Carolina, and make more than $127,000 a year...

...But their insurance premium was $1,691 a month last year, triple their mortgage payment—and was going up to $1,813 this year. They also had a $5,000 per-person deductible, meaning that having and using their coverage could cost more than $30,000.

...Instead of insurance, they’re paying $198 a month for membership in a local doctors’ practice. They get unlimited office visits and discounts on medications and lab tests. They also signed up for Liberty Health Share, a Christian group that pools members’ money to help pay for medical costs. Liberty costs $450 a month, including a $150 surcharge based on the couple’s blood pressure and weight.

...The couple doesn’t have children.

OK, so the Buchanans are currently paying $800/month for their patchwork doctors' practice/health sharing ministry coverage, $1,000/month less than they would be under an unsubsidized but far more comprehensive ACA exchange plan.

So this is a 51-year old woman and a 48-year old man, no kids, earning $127,000/year living in Marion, NC. Under the current ACA, they don't qualify for subsidies because they earn 780% of the federal poverty line ($16,240 for 2 people). I plugged this into HealthCare.Gov and it looks like they were on a Gold BCBSNC PPO plan. I don't see any HC.gov plans whch have a $5,000 per person deductible (there's one with $5,000 for the whole family and a Silver plan with an $8,000 family deductible), but fair enough; perhaps they were looking at a slightly different off-exchange variant, or perhaps this referred to the 2017 version. In any event, they apparently have a $10,000 total deductible right now.

What would their situation be under ACA 2.0 if it were to magically become law in time for the 2019 Open Enrollment Period?

Well, depending on whether you're talking about the House or Senate version, they would only have to pay 8.5% of their total income. Under the Senate version, this would be based on the benchmark Gold policy. Using the plans currently available on HealthCare.Gov, that would mean:

- $900/month for a Gold plan with a $5,000 total deductible and a $14,700 maximum out of pocket cost

In the case of the Buchanans, they'd be paying about the same as they are now but for far more comprehensive coverage, including the all-important maximum out of pocket cost (MOOP) cap, which means that as long as they stay in-network, the most they'd ever have to pay for all their medical expenses wold be $25,500 per year ($10,800 in premiums + $14,700 in deductibles/co-pays/etc) even under the most catastrophic of situations (chemotherapy, hit by a bus, etc).

Next up: The Owenses:

In Harahan, Louisiana, outside New Orleans, Mimi Owens learned this year that her family's $750-a-month plan with Humana Inc. was being discontinued. A new plan for her two daughters and husband on the ACA market would cost close to $1,600. Their family makes about $147,000 from a small business selling class rings and gowns to schools.

Owens said they go to the doctor “for a sniffle, for a flu,” and have a few regular prescriptions, so they looked into short-term health plans and tried out a Christian health-sharing ministry for a few months. The best solution she’s found so far is paying $130 a month to join a direct-primary-care group, which she calls “the best care we’ve ever had.”

It doesn’t cover the big things, though. An accident like a car crash could wipe out their finances.

“We were raised to have insurance,” Owens said. “This is crazy to us.”

I don't know the ages of any of the Owenses, so I'll assume the parents are 40 each and their daughters are, say, 12 and 14. I found a Gold plan on HC.gov which would run $1,600/month with a $3,000 family deductible for a family of 4 at those ages, so I'll assume that's roughly what they were looking at.

Under the Senate ACA 2.0 proposal:

- $411/month for a Bronze plan with a $14,700 total deductible and a $14,700 maximum out of pocket cost

- $558/month for a Silver plan with a $9,600 total deductible and a $13,200 maximum out of pocket cost

- $1,041/month for a Gold plan with a $3,000 total deductible and a $14,700 maximum out of pocket cost

For the Owenses, the benefit might not be quite as obvious--they'd still be paying 3x what they do now for a Bronze plan, and they're unlikely to hit that $14,700 deductible in a typical year anyway. HOWEVER, again, they'd never have to pay any more than $19,600 total in a given year no matter what. In their case it's that MOOP which is the critical selling point. Remember, if they went with the Bronze plan they'd still only be paying 3.4% of their income in premiums.

Finally, how about the Bobbies?

Their daughter Sophia was born with serious heart defects, and the organs inside her tiny abdomen were in all the wrong places. She spent the first two weeks of her life in a neonatal intensive care unit. On her six-month birthday, she had open-heart surgery. At nine months, doctors operated on her stomach.

Sophia qualified for Arizona’s Medicaid program. But when she turned 2, the Bobbies were told they made too much money for her to get low-cost state coverage. Her father Joe Bobbie, who co-owns a Philly steak shop with his brother, reduced his take-home pay so Sophia would still qualify.

She had another heart operation just before she turned 3. In just a few short years, her parents were told, Sophia's medical costs had come to well over $1 million. Before the ACA, no private insurer was willing to cover Sophia’s pre-existing conditions.

“Every door, every option, everything was just slammed in our face,” Sophia’s mother, Corinne, said. Medical costs that insurance didn’t cover piled up. The family skipped vacations and nights out, and lost their house and car because they couldn’t make the payments.

...When Obamacare coverage became available in 2014, the Bobbies, who made about $55,000 last year, bought a policy for Sophia that now costs $217 a month.

Adding Sophia’s seven-year-old little brother Joey, who’s healthy, would have cost another $160 per month, with a $6,000 deductible. So he’s uninsured, and so are Joe and Corinne. The money they save risking their own medical and financial health goes to paying Sophia’s bills.

The Bobbies appear to be included specifically as a counterexample. In their case, the ACA appears to be the only reason Sophia is alive today. Again, the ages of the parents aren't mentioned, but the kids are 7 and what looks like 10 from the photo in the article, so I'll asume the parents are perhaps 35 and 37.

At the same time, they have a confusing situation judging from the article. It says they earn $55,000/year, which is around 223% of the poverty line. This means that even under the ACA as it currently stands, they could have a Silver plan covering all four of them for as little as $203/month...$14 less than the plan it says they currently have Sophia on by herself. There'd be a $10,500 deductible, but again, also a $10,500 MOOP. If the parents are a few years older than I thought the premiums would jump up a bit, but should still be able to cover all 4 for around the same price as Sophia by herself today.

I'm assuming she isn't on a Gold plan because of the $6,000 deductible reference; the way it's worded makes it sound like that's per person, which strongly suggests a Bronze plan ($13,600 family deductible)...but again, at 233% FPL, all 4 could be covered on that Bronze plan for a mere $5 per month!

On the other hand, it's possible that Sophia is on a Gold plan...but the parents were considering placing their son on a Bronze plan by himself (thus the $6,000 deductible). Putting all four family members on the Ambetter Gold plan would cost about $600/month, which might've been too steep for them? Hard to say without more details.

The only reason I can think of why they'd be paying $217/month for a plan which only covers Sophia is that Ambetter/Health Net is the only carrier available on the ACA exchange in Maricopa County, Arizona, and perhaps their hospital/doctors/specialists aren't part of the Ambetter network, forcing them to use an off-exchange-only carrier?

I'll update this if I can track down more details.

In any event, assuming all 4 wanted coverage, how would this change under the Senate ACA 2.0 proposal?

- $243/month for the Gold plan with a $2,800/year deductible...except that since they only earn 233% FPL, they'd be bumped up to a 90% Actuarial Value PLATINUM plan instead, which would drop the deductible down even further. According to HealthPocket, in 2018 the average family deductible for a Platinum plan is around $571, with a $4,539 maximum out of pocket total. And again, this would be for all 4 members of the family, as opposed to just Sophia herself.

In short, all three families above would be better off under the ACA 2.0 proposal than they are today. The Bobbies and Buchanans would be much better off in either normal or catastrophic situations; the Owenses would have a tougher call under normal circumstances but would again be infinitely better off if catastrophe struck.

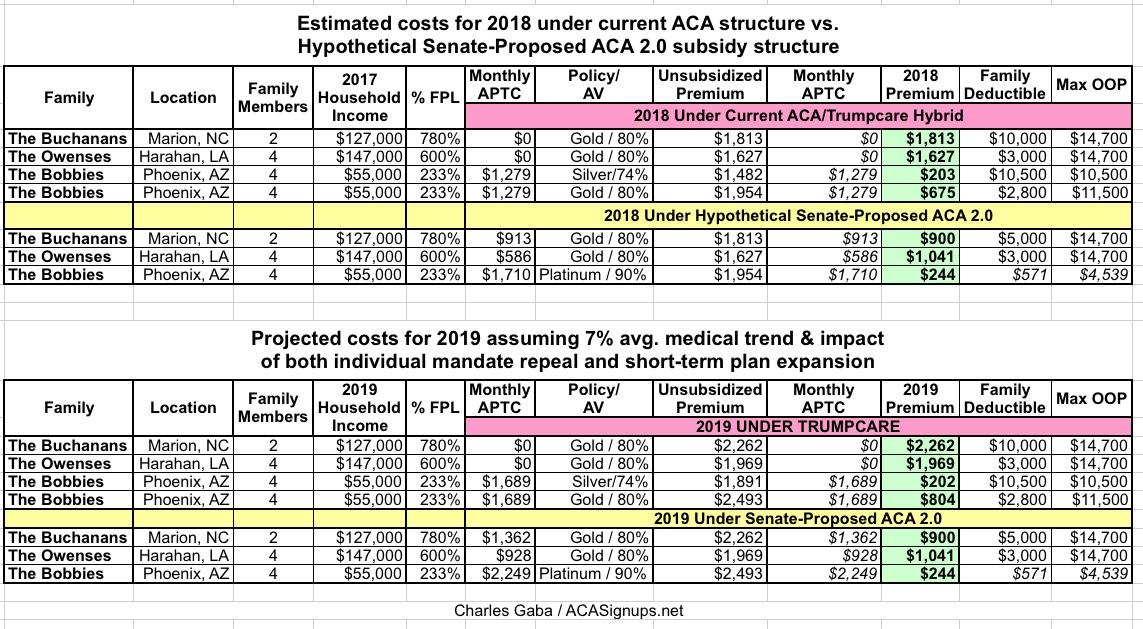

Here's a table summarizing the situation for all 3 families. It's important to note that the numbers shown in the frist table assume 2018 premiums, deductibles and MOOP figures...which means that the impact of the Mandate Repeal and proposed #ShortAssPlan sabotage is not reflected in either scenario (nor is the expected ~7%/year normal medical inflation trend).

The second table shows the 2019 pricins assuming the Urban Institute's projections of the mandate repeal/short-term plan impact are accurate and an average 7% medical trend. The costs for the Buchanans and Owenses under the Trumpcare structure would be considerably higher (likely 20-24% or so), while under the proposed ACA 2.0 structure, the out of pocket costs for all three families would likely stay almost identical:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.