EXTREMELY early preview of *2019* premiums suggests...20% on average, 2/3 via Trumpcare

Last month, Covered California issued an extensive analysis of the individual market landscape for 2019 and concluded that the recent actions taken by Donald Trump and Congressional Republicans (especially, of course, the repeal of the individual mandate) will collectively cause rates to spike by up to 30% even without taking into account the normal medical inflation one would normally expect every year anyway. I didn't see a whole lot of reporting on this report other than my post and Michael Hiltzik's story on it at the L.A. Times, but I might've missed others.

In any event, here's another extremely early look at 2019. A couple of weeks ago I attended the Families USA Health Action Conference in Washington D.C. This week it was time for an even wonkier variant: The National Health Policy Conference, which I believe was sponsored by AcademyHealth. I didn't attend this one, but my friend and occasional collaborator David Anderson of Balloon-Juice did, and he gave me a heads up about some critical info presented this afternoon:

#NHPC18 last session of the conference .... Individual market--- what's next

— David Anderson (@bjdickmayhew) February 6, 2018

#nhpc18 California experience is very different than rest of nation. pic.twitter.com/Q4wWi2PTjQ

— David Anderson (@bjdickmayhew) February 6, 2018

#NHPC18 good point on Exchange enrollment as counter cyclical to job market

— David Anderson (@bjdickmayhew) February 6, 2018

#nhpc18 premium drivers are diverse based on 7% trend@charles_gaba

— David Anderson (@bjdickmayhew) February 6, 2018

#nhpc18 lack of mandate biggest change on 1st time buyers not on renewers so 1 time 10% bump with recurring smaller increases

— David Anderson (@bjdickmayhew) February 6, 2018

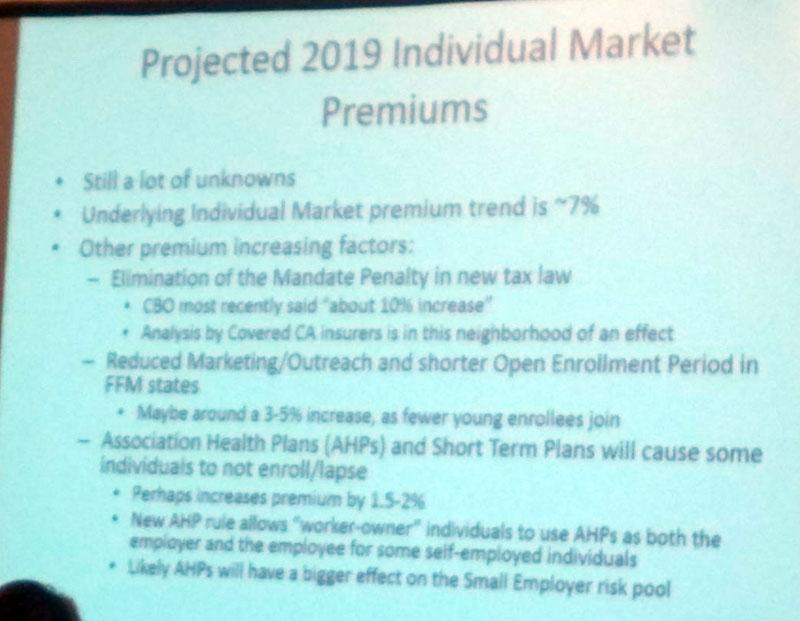

OK, the slide image is pretty blurry, but the gist is this, according to whoever was giving this presentation (who I presume understands risk pools and the general lay of the land of the individual market going into the next year better than I do):

- Underlying Individual Market premium trend for 2019 is around 7% (that is, "normal" medical inflation, morbidity, etc.)

- The CBO, of course, is projecting roughly a 10% one-time hit from the repeal of the Individual Mandate.

- This is similar to Covered California's own estimates, which they peg at anywhere from 8-13%

- Assuming the Open Enrollment Period is slashed in half again for HC.gov states, along with a similar anemic level of marketing/outreach as this year, they figure another 3-5% tacked on for that (vs. 4-9% according to Covered California's analysis)

- Finally, they figure the addition/expansion of #ShortAssPlans (non-ACA compliant Short-Term and Association plans) per Trump's executive order would tack on perhaps another 1-2%.

Anderson did go on to remind me that the Continuing Resolution bill from a couple of weeks back did put the kibosh on the Insurer Carrier Tax for another couple of years starting in 2019, so that should knock premiums back down perhaps 2-3%.

Add it all up and according to this analysis, it looks like they're projecting somewhere in the neighborhood of 20% rate hikes on the individual market for 2019 in the absence of any significant changes/action on the part of the federal (or state) governments.

This is a lower than the 16-30% range projected by the Covered California analysis without the "underlying trend" (around a 23% mid-range), but it's still not pretty.

Obviously there's any number of crazy things (good or bad) which could happen between now and this November, and some of the above projections are pretty speculative anyway, but assuming this is in the right ballpark, it means that once again, literally 2/3 of next year's premium hikes can be pinned specifically on utterly unnecessary, harmful actions/policies implemented by Donald Trump and Congressional Republicans.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.