Covered California gives a preview of 2019 rate hikes without federal action

via Covered California, yesterday:

- An analysis of potential premium changes in states across the nation shows increases of 16 to 30 percent likely in 2019 if federal steps are not taken.

- While the Patient Protection and Affordable Care Act’s subsidies would largely insulate subsidized consumers from these costs, millions of unsubsidized consumers would pay the full price of these increases. Many would likely be priced out of coverage.

- Continued policy and premium uncertainty risks further carrier withdrawals, leaving more consumers with only one health plan and even the prospect of “bare counties.”

- The analysis reviews three federal policy options that could stabilize markets and mitigate the impact of premium increases in many states.

- Covered California’s open-enrollment period is still underway and consumers have through Jan. 31 to sign up for coverage.

SACRAMENTO, Calif. — Covered California issued an analysis Thursday that examined the potential impacts of the current open-enrollment period — which remains open in California, but ended in federally facilitated marketplace states on Dec. 15 — and of recent federal decisions on premiums in individual markets across the nation. The analysis found that premiums could increase dramatically in 2019, with increases from 16 to 30 percent if no steps are taken to mitigate these increases.

“Recent federal decisions are threatening to dramatically increase premiums for millions of people,” said Peter V. Lee, executive director of Covered California. “This report underscores the fact that health care is local, but also that no state is immune from the impacts of recent federal policies.

“There are immediate steps that can be taken at the federal level to reduce those risks and protect millions of Americans. Absent federal action, the health insurance premiums paid by the over 6 million Americans who do not receive federal subsidies will increase dramatically in 2019, with some states facing 30 percent spikes in premiums.”

The report, “The Roller Coaster for Consumers Continues: The Prospect for Individual Health Insurance Markets Nationally for 2019: Risk Factors, Uncertainty and Potential Benefits of Stabilizing Policies,” was produced by Covered California’s plan management and policy staff, led by Chief Actuary John Bertko and informed by review by outside academic and policy experts. The findings include a review of market factors and impacts on 2018 enrollment, potential premium impacts for 2019 and federal policies that could mitigate those factors. “While California’s open-enrollment period is not yet closed, we are already looking ahead to 2019 and conducted this analysis because the window of time for policymakers to act is short,” said Lee.

The individual marketplace faced several challenges in the past year, and the 2019 plan year has the potential to be just as volatile and uncertain. Three recent federal actions identified by the report that could potentially influence premiums in 2019 are:

- Removing the Penalty: The Tax Cuts and Jobs Act eliminated the penalty for not having health insurance starting in 2019. Independent analysis projects drops in enrollment, and because those dropping coverage are likely to be healthier, premium increases for those who remain that could range from 8 to 13 percent.

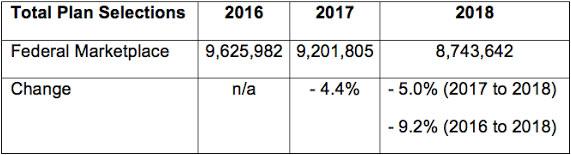

- Reduced Marketing and Outreach: The federal government reduced its marketing investment by 90 percent, from $100 million to $10 million, and its outreach budget from $63 million to $37 million. The reduced investments come on the heels of the administration’s decision to pull its marketing during the last week of open enrollment in January 2017. During that time, the enrollment in the federally facilitated marketplace has dropped nearly 10 percent (see Table 1). While California and other state-based marketplaces are not affected by these decisions, the 39 states served by the federally facilitated marketplace (FFM) could face premiums that are 4 to 9 percent higher in 2019 because of the decision not to promote enrollment.

Table 1: Enrollment in the Federally Facilitated Marketplace – 2016-2018

- Short-Term, Limited-Duration Health Plans and Association Health Plans: The potential expansion of short-term, limited-duration plans, and potentially the impact of association health plans selling across state lines, could siphon healthy consumers from the common risk pool of the individual markets, worsening the risk mix and raising premiums for those who remain covered.

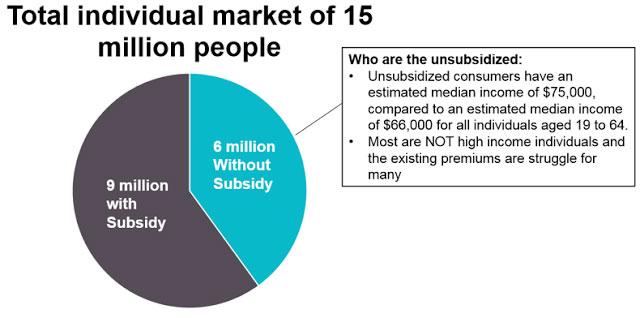

“The 9 million Americans who receive subsidies will be protected from these premium increases, which could be more than 30 percent in some regions, because the federal government will pick up most of the costs,” Lee said. “However, 6 million Americans who do not get any financial help — from an employer or the federal government — will not have any protections and will be faced with paying the entire increase by themselves.”

Covered California’s analysis included a detailed summary of the unsubsidized consumers, who are primarily enrolled off-exchange, who would be most directly affected by the potential rate increases. An estimated 6 million people do not receive any financial assistance to help pay for their health insurance. With an estimated median income of $75,000, many are not high-income earners and would most likely struggle to afford premium increases of this magnitude (see Figure 1).

Figure 1: Premium Increases Directly Affect Unsubsidized Consumers

I've been wondering for awhile now how much unsubsidized individual market enrollees earn. Obviously it's more than 400% of the Federal Poverty Level, and I've assumed that it generally falls in the 400-700% FPL range, but it's nice to have some hard data on that. If you earn more than around 700% FPL (roughly $84K for a single adult or $172K for a family of 4), it's far less of a burden to pay full price, though there are obviously exceptions.

For the record, according to this table from the U.S. Census Bureau, as of 2016 there were roughly 22.4 million households, or around 56 million people, who earn $130,000/year or more. That's only around 17% of the total population, assuming the national average household size (2.54 people per household) is representative across the full income spectrum (which of course it isn't). This also doesn't adjust for things like age (since those over 65 would mostly be on Medicare and so forth).

“Without any action, we are talking about millions of working middle-class families who do not get financial help, and who will get hit hard by the choice of paying the full price or giving up the health insurance they need,” Lee warned.

In addition to the higher premiums, the continued uncertainty could force some health insurance carriers to withdraw from their markets, leaving consumers in more regions with no choice of plans in the individual market.

The report analyzed the potential impact of three federal actions that could stabilize premiums for consumers:

- Funding State-Based Reinsurance: A state-based invisible high-risk pool or reinsurance — run by states or allowing states to “opt-out” of administering the program and rely instead on CMS to run the program — could produce a rate reduction ranging from 9 to 16 percent and encourage health plans to continue their participation. Earlier this month, Covered California issued a report and analysis of the elements needed to make such programs effective: “Reducing Premiums and Maximizing the Stabilization of Individual Markets for 2019 and Beyond: State Invisible High-Risk Pools/Reinsurance.”

This is a no-brainer, since reinsurance has worked wonders in Alaska, Minnesota and other states. It's not really that complicated, either...it basically amounts to the government covering a big chunk of the cost of high-expense enrollees, thus allowing premiums to drop (or at least not go up nearly as much) for everyone else in the risk pool.

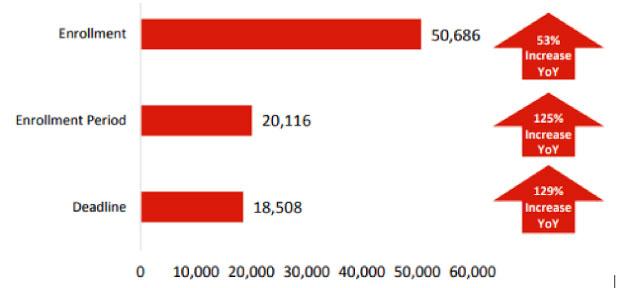

- Marketing Investment to Promote Enrollment in FFM States: The federal government’s promoting enrollment by supporting marketing and outreach investments in 2019 could lead health insurance carriers to reduce rates between 2 and 4 percent. The report details the 9 percent decrease in enrollment in FFM states since 2016, with lower enrollment resulting in higher premiums for those who do not receive subsidies. The combined effect of low marketing in 2018 and that policy continuing for 2019 is estimated to result in premium increases that range from 4 to 9 percent. Covered California also released today a study that found the enrollment drop in 2018 could have been even greater if not for a dramatic increase in the news coverage of the enrollment periods and deadlines. Ogilvy, a global leader in communications and media, was commissioned to examine coverage trends for the 2017 and 2018 open-enrollment periods. The report found that mentions of “enrollment,” “enrollment period” and “deadline” increased by 53 percent, 125 percent and 129 percent respectively year over year (see Table 2).

Table 2: Coverage Nationally of Open Enrollment Increased Dramatically Year Over Year: 2017 to 2018

“Studies clearly document that both news coverage and advertising drive enrollment,” said Lee. “Enrollment nationally benefited from a dramatic uptick in coverage for 2018, but there is no reason to expect the same coverage for 2019.”

I proved this pretty decisively yesterday.

- Reinstituting the Health Insurance Tax Holiday: Providing health insurance carriers with a “holiday” from the health insurance tax could reduce premiums by an additional 1 to 3 percent. A one-year holiday from the health insurance tax is included in a short-term spending bill, currently under consideration in Congress, which aims to avert a federal government shutdown.

Huh. I mean yes, the ACA insurance carrier tax did tack on an extra 2-3% to premiums this year, and I have no problem with Congress eliminating it as long as they replace the funding in a way that doesn't screw regular folks over in other ways. I'm just a bit surprised to hear an ACA exchange officially calling for it to be scrapped, that's all.

“Federal policy clearly makes a huge difference in the lives of millions of consumers — for 6 million, policy choices can mean premiums jumping 30 percent or more. Action is needed in the next months to provide stability and protect consumers from staggering premium increases,” Lee said.

Covered California has long maintained that a robust marketing campaign is key to attracting new consumers to the health exchanges and maintaining a healthy consumer pool that reduces premiums for everyone.

“California has invested heavily in marketing and outreach. These investments, along with other policy choices made in California, have resulted in this state’s having one of the healthiest consumer pools in the nation — this translates directly to lower premiums for those who bear the full cost of their insurance,” said John Bertko, chief actuary of Covered California.

“This analysis uses the best available evidence to assess the potential impacts of a range of policies on premiums across the nation. The report underscores that ‘health care is local’ — the impacts on premiums will vary dramatically by state and by health plan, but it’s clear that many Americans face the prospect of premium increases of 30 percent or more without federal action.”

Covered California also wants consumers to know that while the enrollment deadline for most states was Dec. 15, Californians have through Jan. 31, 2018, to explore their options and select a plan that best fits their needs. Consumers who enroll by midnight on Jan. 19 will have their coverage start on Feb. 1.

A recent Covered California analysis found that the net monthly premiums for the over 1 million Californians who receive financial help are on average 10 percent lower than what new and renewing consumers paid last year. The lower prices are a result of more financial help being available for consumers who qualify for assistance.