UPDATE: 2018 Open Enrollment is NOT over yet for 18% of the population!

UPDATE 1/13/18: Colorado's deadline passed last night, so we're now down to 5 states + DC: 79.9 million people, or roughly 24.5% of the population.

UPDATE 1/15/18: Minnesota's deadline passed last night, so we're now down to 4 states + DC: 74.3 million people, or roughly 23% of the population. (Note: I had a miscalculation in an earlier version of this post)

UPDATE 1/16/18: Washington State's deadline passed last night, so now we're down to 3 states + DC: 69 million people or roughly 20.6% of the population.

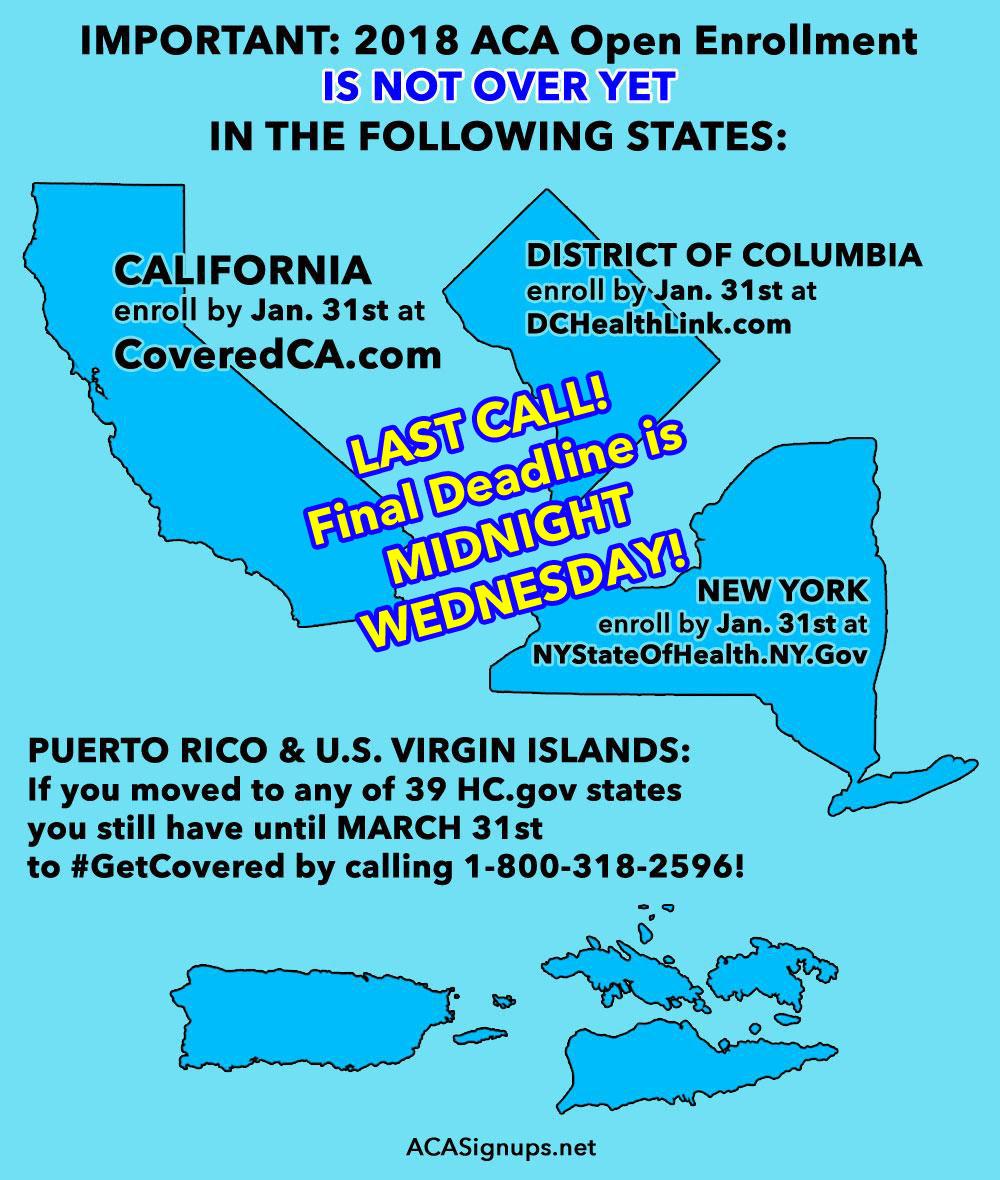

UPDATE 1/19/18: I've added Puerto Rico & the U.S. Virgin Islands to the graphic below to note the SEP added for those who've moved to the mainland.

UPDATE 1/24/18: Massachusetts' deadline passed last night, so now we're down to California, New York and DC: 60 million people or roughly 18% of the population.

Happy New Year!

2018 Open Enrollment has officially (and unofficially) ended for 44 47 states.

HOWEVER...there are 6 3 other states, as well as the one in the District of Columbia, which have deadlines later than December 31st:

Colorado: Jan. 12th for coverage starting Feb. 1st.Minnesota: Jan. 14th for coverage starting Feb. 1st.Washington State: Jan. 15th for coverage starting Feb. 1st.Massachusetts: Jan. 23rd for coverage starting Feb. 1st.- California: Jan. 31st (enroll by Jan. 15th for Feb. 1st coverage; enroll by Jan. 31st for Mar. 1st coverage)

- District of Columbia: Jan. 31st (enroll by Jan. 15th for Feb. 1st coverage; enroll by Jan. 31st for Mar. 1st coverage)

- New York: Jan. 31st (enroll by Jan. 15th for Feb. 1st coverage; enroll by Jan. 31st for Mar. 1st coverage)

Collectively, these states/DC represent over 85.5 million people, or 26% of the entire U.S. population.

But wait, there's more!

Well over 200,000 Puerto Ricans have moved out since Hurricane Maria devastated the island. Most have transferred to Florida, along with a smaller number from the U.S. Virgin Islands, with others scattered across other states. I'm assuming it's closer to a quarter million by now. The vast bulk of them are eligible for a 60-day Special Enrollment Period (SEP) from the date they moved...not necessarily because of the hurricane itself, but because they legally moved.Of course, anyone who moves to a different rating area anytime throughout the year qualifies for an SEP anyway, but I felt I should call special attention to these folks. Of course, some of these 200K transferees have likely already enrolled in Florida/etc. during the normal Open Enrollment Period anyway.

But wait, there's more!

As happens every year, a bunch of insurance carriers dropped out of the ACA exchanges in various states/counties nationally...my guess is perhaps 1.5 - 2 million people are currently enrolled in policies which are being discontinued on New Year's Eve. Most of these folks are going to be automatically "mapped" to a different plan or even a different carrier...but many can't be for one reason or another. All of them are eligible to take advantage of the 60-day SEP as well if they'd like to, even if they're mapped:

If your health plan will terminate at the end of 2017 and you don’t pick a new plan by the end of open enrollment (December 15, in most states), your special enrollment period continues until March 1, 2018. (That’s 60 days after your previous plan ended.)

Insurers in numerous states are leaving the exchanges at the end of 2017 or shrinking their coverage areas. If your insurer will no longer be offering plans in the exchange in your area, you’re eligible for a special enrollment period. This is true even though the exchange will map you to a plan from another insurer if you don’t select a plan during open enrollment. CMS confirmed in October 2017 that people whose plans are discontinued would be eligible for the special enrollment period, despite the fact that the exchange would automatically match these consumers to a new plan if they didn’t pick one themselves.

CMS confirmed that the special enrollment period applies in cases where an insurer exits the market in a particular area (on or off-exchange, or both), but it also applies in situations where an insurer replaces all of its PPO plans with HMOs, for example. But more minor adjustments, like changes to the deductible or copay, would not result in a special enrollment period.

Anyone who's automatically mapped, but then switches plans, has already been accounted for in the official tally already, and many of these people live in states with later deadlines anyway, but that should still leave up to perhaps 500,000 people who could potentially take advantage of the 60-day SEP.

But wait, there's more!

Under the ACA, Native Americans and Alaska Natives are not subject to the normal Open Enrollment Period time window:

There are rolling monthly open enrollment periods throughout the year for Native Americans who wish to enroll in the exchanges. They are not limited to enrolling during open enrollment. As long as they enroll by the 15th of the month, their coverage will be effective the first of the following month (there are three state-run exchanges – Massachusetts, Washington, and Rhode Island – where enrollments can be completed as late as the 23rd of the month for coverage effective the first of the following month).

There's at least 5.2 million Native Americans in the U.S. Some of them presumably live in the states listed above anyway, so there's likely some overlap...but I have to imagine that this adds at least 4 million or so to the total.

All in all, as of January 1st, aside from the "normal" Special Enrollment Periods for Qualifying Life Events, there's around 90 million Americans, or over 27% of the U.S. population who are still eligible to #GetCovered for 2018.