Texas: Approved avg 2018 rate hikes: Somewhere between 20-32%???

And finally...

I've saved Texas for last because, frankly, I haven't been able to make heads or tails out of their actual average rate increases for next year (and unlike smaller states which might not move the needle on the national average anyway, Texas has one of the largest populations in the country, so a substantial error here can also impact the national numbers significantly).

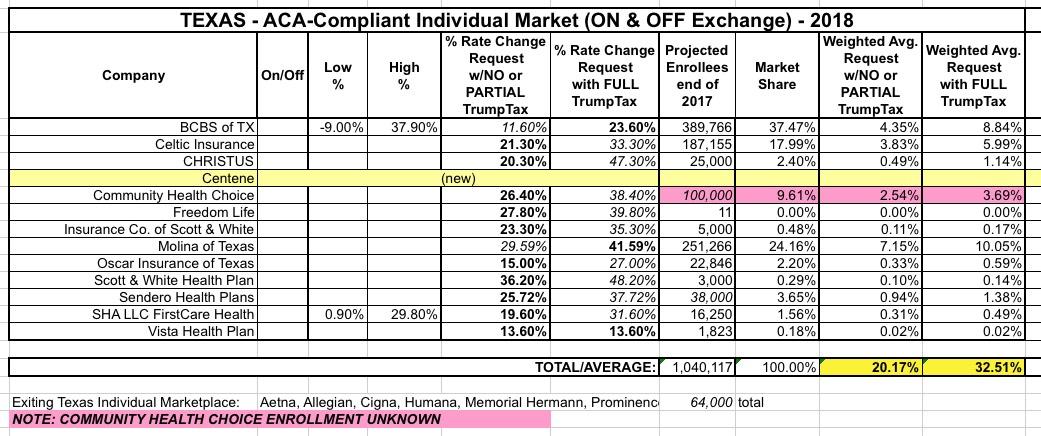

Back in early August, I pieced together a rough average of the requested rate increases for the Lone Star State of around 20% if CSR payments are made or 32.5% if they aren't:

There were several caveats, but the vast majority of the increases assumed that CSR payments would be made. The biggest unknowns were the actual market share of Community Health Choice and just how much pulling the CSR coverage would bump up the averages.

According to the 2017 CMS Public Use File, 73% of exchange enrollees in Texas chose Silver plans, slightly higher than average...and 61% of enrollees are receiving CSR assistance, which is higher than the 57% national average. Based on this, the Kaiser Family Foundation estimated that Silver plans in Texas would be bumped up by about 19 points based on CSR costs alone, which translates into roughly 14 points spread across all on exchange plans, or around 12-13 points across the entire ACA-compliant individual market.

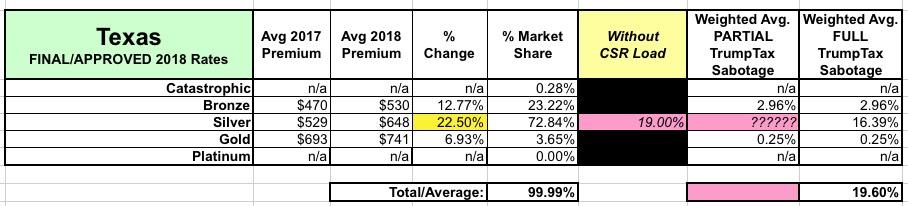

However, look what happens whan I try plugging in the data from Avalere Health, which worked perfectly for 4 other states:

Um...no. That doesn't work at all. Aside from the fact that I guarantee you Silver plans would not have dropped by 3% if Texas CSRs were paid (especially not when Bronze and Gold are going up), notice that even the CSR load average is only 19.6%...that's even lower than I estimated the no CSR load this summer.

So what's going on in Texas?

Well, it's possible that the Texas DOI ordered carriers to slash rates...except that Texas is among the states which doesn't do rate review; the federal government does, and I don't think they're able to demand any changes.

It's possible that the carriers refiled their requests to be significantly lower...but I think I would've heard about that, and it would've had to be quite a few of them.

Louise Norris came up with the most likely scenario: Notice that Ambetter/Centene is expanding it's presence in Texas significantly. Since Avalere Health is looking at the average premiums year over year, as opposed to the market share, it's conceivable that Centene swooped in with a bunch of low-priced Silver plans which significantly lowered the average premiums for 2018 even though they don't currently have any actual enrollees in many counties.

If so...fine...but that just means that I can't rely on Avalere's numbers for Texas. And of course it also means I have no idea how big a chunk of the Texas rate hike is actually being caused by the CSR factor either.

So...it sounds like Texas is raising rates an overall average somewhere between 20-32%....but that's a wide gap, and TX is too large to plug into the spreadsheet without having a better idea, so I'll leave it out for the moment.

How big of a difference can it make? Well, if I plug 32.5% into my spreadsheet, it makes the national weighted average for all 50 states 29.7%...but if I plug 19.6% in, the average drops down to 28.5%. That's a 1.2 percentage point difference.

Stay tuned...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.