UPDATE: North Carolina: BCBSNC confirms 14.1% avg. rate hikes; NEARLY ALL due specifically to CSR sabotage

Way back in May, Blue Cross Blue Shield of North Carolina submitted their initial 2018 rate requests to the state insurance department, and noted at the time that they'd normally only be requesting an 8.8% average rate increase...but that due specifically to Donald Trump's threat to cut off CSR reimbursement payments, they were asking for a 23.3% increase instead. I noted that this meant that about 60% of their increase request was caused by Trump's CSR threat.

Then, in August, they gave a somewhat more positive news update: They were lowering their requested rate hike to 14.1%. Basically, their latest numbers had come in and the balance sheet was doing quite a bit better than they had previously thought:

Blue Cross said May 25 that the 22.9 percent rate increase was based on the subsidies ending, along with claims data from the first quarter of 2017. It projected an 8.8 percent rate increase with the subsidies remaining in place.

...Spokesman Lew Borman said the 8.8 percent rate increase proposal from May "basically goes away" with the amended request.

"We think this (14.1 percent) increase will allow our ACA plans to be financially viable, while being more affordable for our customers," Tajlili said.

In other words, it appeared that every dime of the remaining 14.1% rate increase was tied to the CSR payments. However, I wasn't 100% certain about that; it was possible, after all, that what they meant was that the CSR issue was smaller than they had prevoiusly thought, not the non-CSR factors.

Well, it turns out that I was right in the first place. North Carolina apparently issued their approved rate increases for 2018, and sure enough, practically every dime is due to Trump cutting off the CSR reimbursements:

DURHAM, NC – Blue Cross and Blue Shield of North Carolina (Blue Cross NC) announced today that the North Carolina Department of Insurance has approved the company’s reduced premium rate request for 2018 Affordable Care Act (ACA) plans. The approved average rate of 14.1 percent was lowered from the initially requested 22.9 percent in August due to the stabilization of the state’s individual market. Blue Cross NC will remain the only insurer to offer ACA plans in all of North Carolina’s 100 counties.

“Blue Cross NC is proud to be offering ACA plans in all 100 counties next year – and to offer them with a lower premium increase than we initially thought would be required,” said Gary Bolt, Vice President of the Individual Under 65 Segment for Blue Cross NC. “But the fact remains that health care costs too much. We understand that a premium increase of any amount is difficult for many of our customers. That is why we are working with our partners across the health care industry to slow down rising costs. Higher quality, more affordable health care remains our ultimate goal.”

Blue Cross NC currently insures 502,000 people through ACA plans. The 14.1 percent rate increase is an average across all ACA plans. Some customers may be impacted more than others. Federal tax credits known as premium subsides will also increase to help customers pay for the increased rates. Customers purchasing their own coverage with income levels between 100 percent and 400 percent of the Federal Poverty Level qualify for subsides. Roughly 90 percent of Blue Cross NC customers who are enrolled in individual ACA plans receive a subsidy.

Unfortunately, I can't really tell from that "average across all plans" quote just how they're spreading the 2018 CSR cost; it could be an even 14.1% across all metal levels, or it could be ~20% tacked onto Silver plans and nearly 0% on all other plans. I've asked for clarification.

Customers with expiring grandfathered plans could see significant premium increases. In most cases, the ACA plans will cover more services than the grandfathered plans, but this coverage will be more expensive. However, people transitioning from grandfathered plans to ACA plans may now qualify for premium subsides to help offset the increased cost.

Blue Cross NC has about 50,000 customers with expiring grandfathered plans in the individual market, down from more than 330,000 in 2010. Those with expiring plans can shop for a new ACA plan at www.bcbsnc.com/RenewBlue. Grandfathered plans are plans that people had before the ACA was enacted that do not meet ACA requirements.

As I wrote back in August, BCBSNC is also terminating their remaining Grandfathered policies at the end of 2017. This is unusual (or at least it's the first time I've heard of a carrier publicly announcing the discontinuation of grandfathered policies). Most of them seem to be simply letting the grandfathered enrollment numbers dwindle down to nothing.

Blue Cross NC will continue to offer transitional plans in 2018. Transitional plans are plans purchased by individuals between March 2010, when the ACA was signed into law, and Oct. 2013. These plans do not meet ACA requirements, but are permitted by federal law. The plans cannot be sold to new customers.

Here's the key point, however:

Last week’s executive order from President Trump ending cost-sharing reduction (CSR) payments to insurers does not impact 2018 premiums. However, ending these federal reimbursements will drive up premium costs and make it harder for insurers to participate in the ACA marketplace in the long run. Had CSR payments not been eliminated, Blue Cross NC’s final rate request for ACA customers’ average would have been near zero; however, most customers receiving premium assistance will see that assistance rise in 2018 to offset the higher increase that was needed.

OK, this is the insurance carrier themselves explicitly and unequivocal stating that Trump cutting off CSR payments is directly and fully responsible for nearly 100% of the 2018 rate increase, right?

Well, check out this AP story:

NC's Blue Cross: Trump's Obamacare Move No Impact on Rates

North Carolina's largest health insurer says President Donald Trump's recent move to cut off "Obamacare" payments to insurers won't affect its average 14 percent price increase on individual policies for next year.Oct. 18, 2017, at 2:37 p.m.

By EMERY P. DALESIO, AP Business Writer

RALEIGH, N.C. (AP) — North Carolina's largest health insurer says President Donald Trump's recent move to cut off "Obamacare" payments to insurers won't affect its average 14 percent price increase on the individual policies for next year.

Blue Cross and Blue Shield of North Carolina said Wednesday that the state insurance department approved the company's rate increase for 2018 Affordable Care Act plans.

The only insurer selling the plans in all 100 of the state's counties said in May it wanted to raise premiums by 23 percent, but lowered its request to 14 percent in August after new data showing that North Carolina's ACA market was stabilizing.

About 90 percent of North Carolina Blue Cross's 500,000 "Obamacare" customers get a subsidy. For them, Trump's move could mean a larger subsidy and better coverage.

Holy crap on a stick. This is the complete opposite of what actually happened.

Yes, the last paragraph of the BCBSNC blog post does state "Last week’s executive order from President Trump ending cost-sharing reduction (CSR) payments to insurers does not impact 2018 premiums."...but that's because the 14% increase was already added BECAUSE of the expectation that CSR payments would be cut off!!

I'm going to be fair and give Mr. Dalesio the benefit of the doubt by assuming that he didn't mean to suggest that Trump cutting off the CSR payments has nothing to do with the rate hike, when in fat it has everything to do with it.

UPDATE 10:00pm: OK, it looks like the AP story has been vastly improved/updated since I originally read it, adding (among other updates) the following:

The Durham-based insurer said in a statement that its rate increase "would have been near zero" if Trump and the Republican-led Congress had fully funded the "cost sharing" subsidies. The funds were envisioned by former President Barack Obama's health insurance overhaul law to help insurers hold down customer costs.

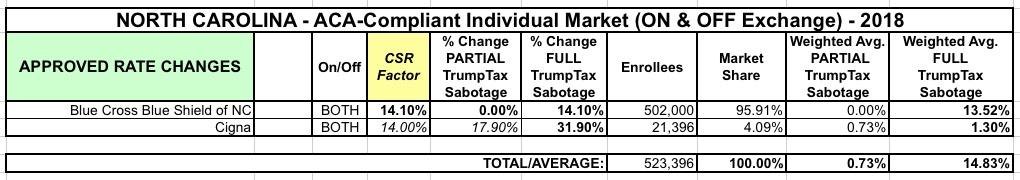

As for Cigna, I haven't seen any word on what average increase they were approved for, but I'm going to assume for the time being that they also received the 31.9% increase they had asked for earlier this year. However, with just 21,000 enrollees statewide, Cigna only has 4% of the NC individual market anyway, so their average doesn't really move the needle much one way or the other regardless. Even if their rates stayed flat (0%), that would only knock the weighted state average down by about 0.6 percentage points; if they're approved for the full 31.9% inrcrease it bumps it up to 14.8%:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.