REVENGE OF THE THREE-LEGGED STOOL: Graham-Cassidy Edition

It's time to once again dust off the Three-Legged Stool visual aid to help explain just what the Graham-Cassidy bill would do to the individual insurance market. It's important to note that none of this has anything to do with Medicaid (expansion or traditional), the group market, Medicare and so forth; just the individual market.

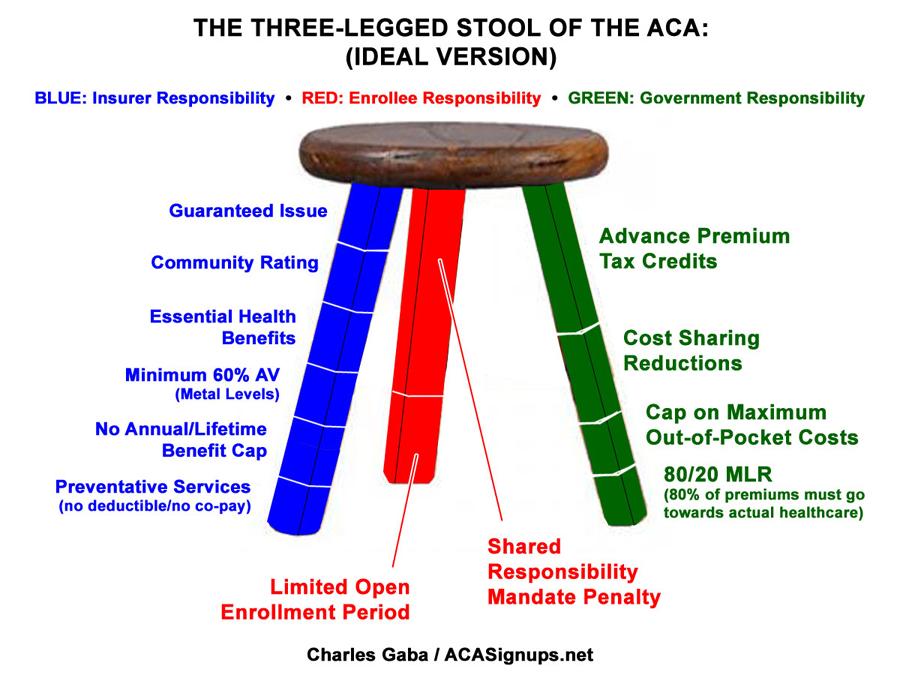

Once again, here's what the "3-Legged Stool" was supposed to look like under the Affordable Care Act:

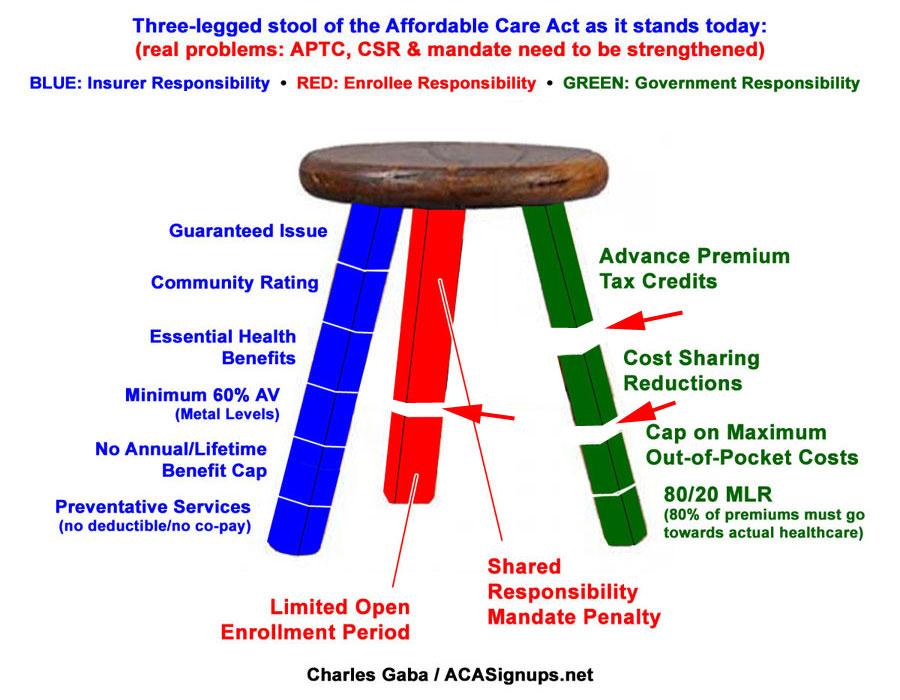

Here's what it actually looks like today, with some rather obvious gaps in the red (enrollee responsibility) and green (government responsibility) legs:

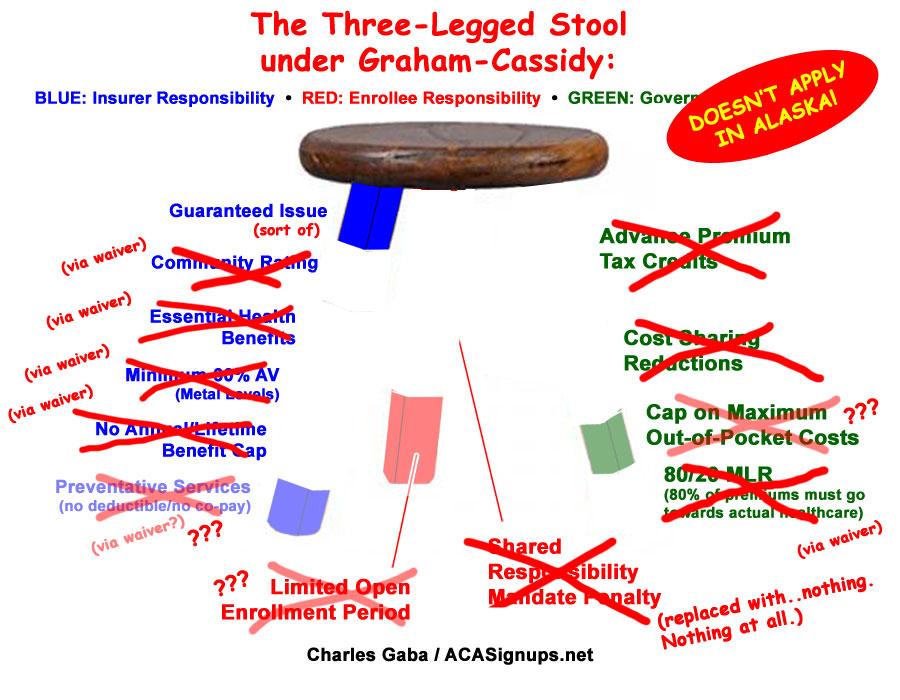

Instead of doing the obvious (beefing up and raising the eligibility cap for the tax credits and perhaps raising the individual mandate penalty), here's what Graham-Cassidy, as best as I can figure, would do instead:

There's a few items I'm not 100% clear about. I don't see any mention of the 80/20 Medical Loss Ratio in the actual legislative text, and while there's a reference or two to "out-of-pocket costs", I can't tell whether it does anything to remove the maximum caps on them. In addition, I think the ACA's list of free mandatory Preventative Services (annual checkups, blood screenings, etc) would be subject to the same state waivers that Community Rating, EHBs and so forth are, but I'm not sure about that, so these items are half-faded. I'll update the graphic as appropriate if I'm able to confirm them one way or the other.

UPDATE: Thanks to Richard O over at Daily Kos who found the 80/20 MLR reference in the legislative text after all, in Section 106:

(B) WAIVERS.—

(i) IN GENERAL.—Subject to clause (ii), the Secretary shall waive the requirements of the following Federal statutory provisions with respect to health insurance coverage in a State for a plan year during which the State has an application approved under this subsection and to the extent that such application includes a request for such a waiver and the information described in subparagraph (A)(iv):

...

(IV) Any provision that requires a health insurance issuer offering a coverage plan in the individual or small group market to provide a rebate to each enrollee under such coverage if the ratio of the amount of premium revenue expended by the issuer on the costs of providing such coverage for a plan year to the total amount of premium revenue for the plan year is less than a certain percentage.

In other words, all a state has to do is request that the 80/20 MLR rule be waived and presto!, it's waived. Scratch that one off the list as well. I've updated the graphic above to reflect this.

The two biggest differences between Graham-Cassidy and the GOP Senate's #BCRAP bill earlier this summer are 1) it completely kills off tax credits (it doesn't just reduce them, it wipes them out altogether) and 2) it completely wipes out the individual mandate...without replacing it with anything at all.

This is an eyebrow raiser because even the GOP's earlier plans (both the House's AHCA and the Senate's BCRAP bill) replaced the ACA's mandate penalty with a different type of mandate requirement (a one-year 30% premium surcharge for the AHCA, a 6-month lockout period for BCRAP). Graham-Cassidy? Nothing whatsoever.

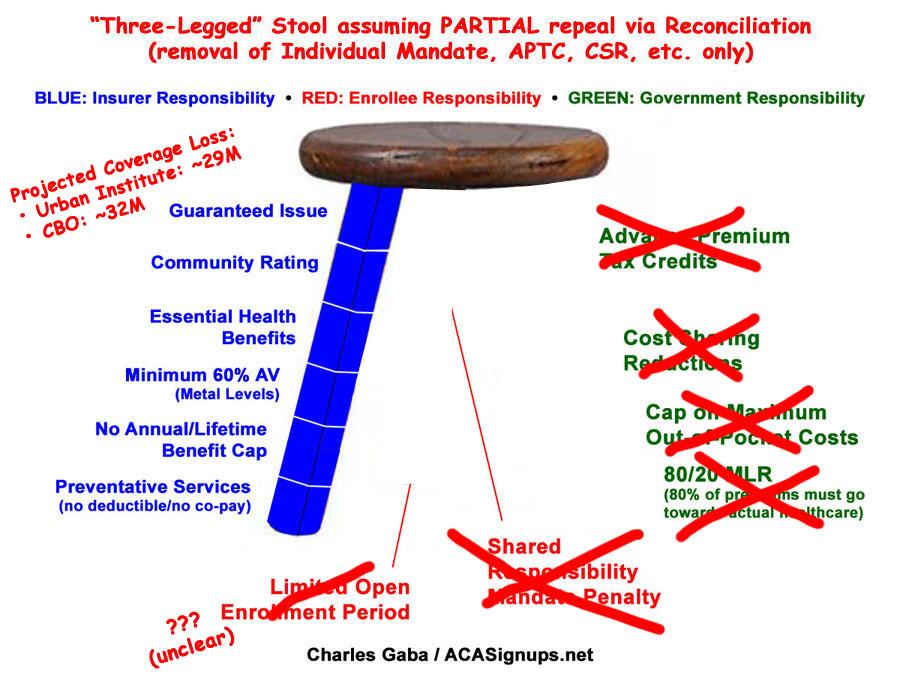

Of course, there's a very good chance that the "flexibility waivers" which would allow states to wipe out Community Rating, Essential Health Benefits and so forth will be stripped from the bill by the Senate Parliamentarian, in which case the end result would likely look very much like the ORRA (Obamacare Repeal & Reconciliation Act), otherwise known as "Utter F*cking Disaster":

Of course, that 29-32 million coverage loss projected by the Urban Institute and CBO for "ORRA" assumed that non-ACA Medicaid wouldn't be changed...whereas under Graham-Cassidy, funding for non-ACA Medicaid would be slashed massively as well, which means that 32 million is probably the best-case scenario.