2018 Rate Hikes: Colorado (early look)

The Colorado Dept. of Regulatory Agencies has made it pretty simple for me:

Division of Insurance releases preliminary 2018 health insurance information

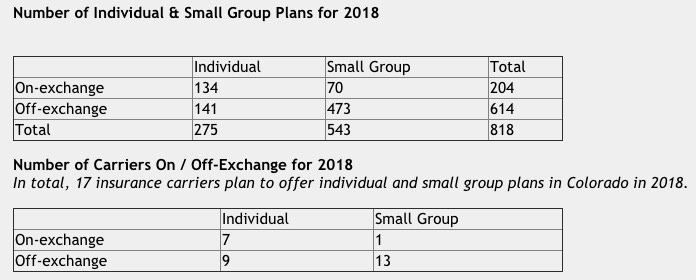

Final approval expected in late September / early OctoberDENVER (July 14, 2017) – The Colorado Division of Insurance, part of the Department of Regulatory Agencies (DORA), today released the preliminary information for proposed health plans and premiums for 2018 for individuals and small groups. From this point until August 4, Colorado consumers can comment on these plans.

All counties in Colorado

As the Division of Insurance noted in its June 21 news release, based on the plans filed, there is at least one insurance carrier planning to offer individual, on-exchange plans in every Colorado county. However, the insurance companies have indicated to the Division that they may be forced to reevaluate their participation in the marketplace if the lack of clarity at the federal level continues.“Because of what is happening at the federal level, there is still a great deal of uncertainty in the marketplace,” said Marguerite Salazar, Colorado’s Insurance Commissioner. “It remains pivotal that the Trump administration stops using people's access to healthcare as a bargaining chip and commits to funding the Cost-Sharing Reductions in 2018.”

One company from 2017 is not continuing into 2018. Golden Rule Insurance Company, a subsidiary of UnitedHealthcare, offered only off-exchange, individual plans in 2017.

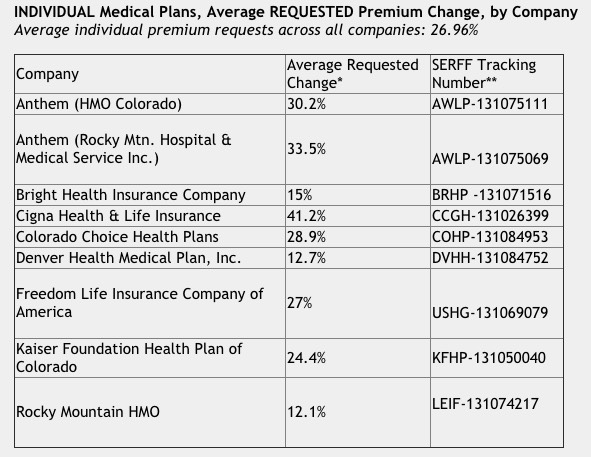

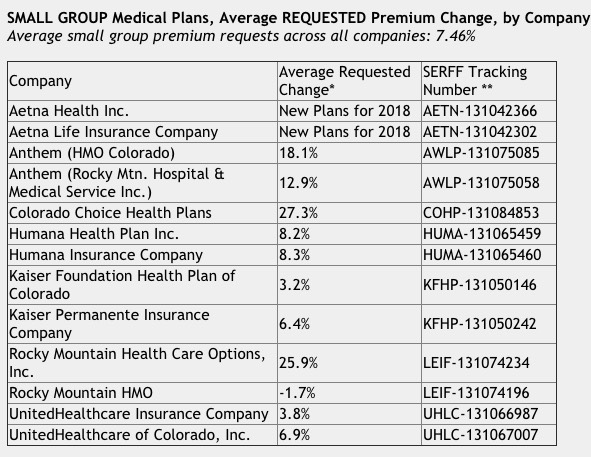

Premium Increases

All of the insurance companies have requested premium increases for their plans in the individual market for 2018. For individual plans, the average premium request across all companies is 26.96 percent. In the small group market, the average premium request across all companies is smaller, 7.46 percent. These are averages across all of the plans a company is offering, across all areas of the state where a company offers plans, and for all ages. These do not represent how one person’s premium could change.“Remember that these are only what the companies have requested and are not the final premiums,” noted Commissioner Salazar “The companies must justify their premiums to the Division of Insurance, and our staff will review those justifications over the summer.

“However, these premium increases are not a surprise,” she continued. “I believe that the dubious situation at the Federal level has contributed to the premium increase requests we’ve seen from the companies.”

Again, the press release has already done the number-crunching for me: 27.0% with the full Trump Tax included on the individual market, and a more typical 7.5% in the small group market.

In order to figure out the no/partial Trump Tax increase, I'll have to dig up the actual SERFF filings. The good news is that the actual tracking numbers are included in the press release. The bad news is that plugging them into the SERFF database isn't bringing up anything yet, so either I'm doing something wrong or they haven't actually uploaded them to the website yet.

Until I find out otherwise, I'll have to go with my standard "50% CSR/mandate uncertainty" factor assumption, or around 13.5%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.