In case you still don't understand the importance of double-checking your subsidy eligibility...

Every year I keep trying to stress the importance of EVERYONE who's considering enrolling in an individual/family healthcare policy making sure to shop around on either HealthCare.Gov or your local state exchange website to see what the situation is each and every year.

I'm not just talking about people who are currently uninsured; I'm also talking about those already enrolled. I'm talking about those who plan on keeping the same policy. I'm talking about those who enrolled in an off-exchange plan because they think they don't qualify for subsidies (or they assume the subsidy would be nominal at best).

As I noted a month ago, and as the HHS Dept. has since confirmed, up to 2.5 million people currently enrolled in OFF-exchange policies could potentially qualify for federal tax credits for 2017 even if they didn't this year. I personally suspect that's a highball number; there's numerous caveats and unique circumstances which whittle that number down. Still, I'm guessing that perhaps 1 - 1.5 million really would be better off shifting from an off-exchange plan to an on-exchange one.

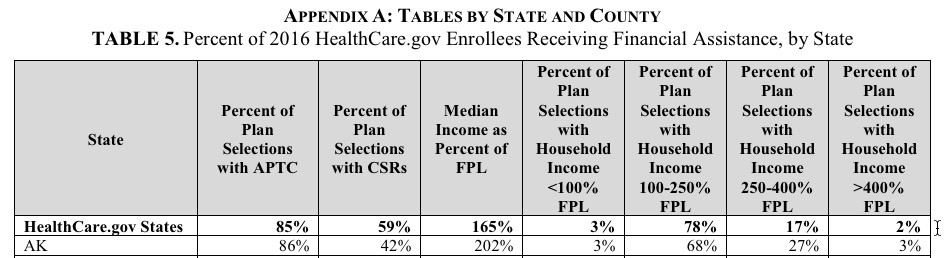

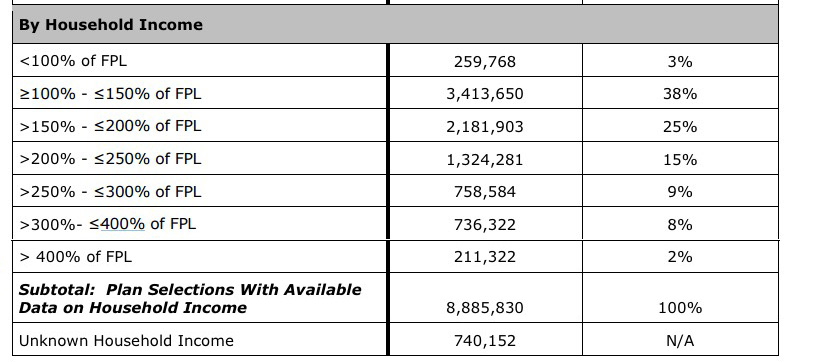

However, there's another category as well: You know how whenever an ACA story is written about rising premiums, they always mention that ~85% of exchange enrollees receive tax credits? Well, that means, of course, another 15% who don't qualify (in addition to the off-exchange enrollees).

Now the assumption is that the reason these people don't qualify is because they all earn over 400% of the Federal Poverty Line, and for many that's true. However, that's actually not the case for quite a few of them.

I've mentioned this before in passing, but two tweets from Kevin Griffis (the Assistant Secretary for Public Affairs) and Cynthia Cox (Associate Director of the Kaiser Family Foundation) inspired this entry:

.@leonardkl @charles_gaba Caveats: We estimate 20% of roughly 1.5M in Mktplace w/out '16 tax credits will qualify in '17.

— Kevin Griffis (@KevinCGriffis) November 1, 2016

Wow! That's interesting...20% of 1.5 million = roughly 300,000 people who are already enrolled in ACA exchange plans who aren't currently receiving tax credits but who apparently will qualify in 2017...assuming they stick with an exchange plan, that is.

So what's going on with them? If you're over 400% FPL you don't qualify anyway, so how are these 300K gonna pull it off?

That's where Cynthia Cox's reminder comes into play:

.@charles_gaba @leonardkl @xpostfactoid note: 15% of hix enrollees don't get subsidies but only 2% are over 400% FPL https://t.co/vXTNtkvAYo

— Cynthia Cox (@cynthiaccox) November 2, 2016

Now, an important qualify is needed here: That's 2% of those who reported their income. There's another 740,000 people who enrolled via HC.gov who didn't report their income at all, so you have to add them into the mix (remember, this is for HealthCare.Gov only, so it doesn't include the state-based exchanges):

When you add them to the total, it's more like:

- 2.2% have incomes over 400% FPL

- 7.7% didn't report their income at all

The odds are pretty high that anyone who enrolls via the exchange but doesn't report their income probably earns too much to qualify anyway, so my guess is that it's more like 9-10% of all exchange enrollees who are over the 400% cut-off point.

The most-recent official number known for effectuated exchange enrollees is 10.5 million as of 6/30/16. If you assume that the 13 state-based exchanges have similar income demographics, that means around 1 million exchange enrollees who really do earn over 400% FPL.

HOWEVER...that still leaves another 5-6% (perhaps 600,000 nationally) who earn less than 400% FPL, yet still aren't getting subsidies.

So...Mr. Griffis is saying that about half of those (20% of 1.5 million, or 300,000 people) are likely to be eligible for subsidies in 2017 even though they weren't this year. What's going on there?

Well, remember, the point of the ASPE assistance, as currently set up, isn't to give financial aid to anyone under 400% FPL; the point is to help bring premiums below a certain percentage of their income. In some cases, the benchmark premiums in their area just happens to fall below that percentage cut-off point, which means they could earn, say, 350% FPL but still not quailfy this year.

But what about next year? That's where Kevin Griffis's tweet comes into play: If the benchmark premiums in those enrollees' areas increases enough to push them over the percentage threshold, voila...they do qualify for ASPE assistance next year, even if their own income stays the same or even goes up slightly as well.

The bottom line? Visit HC.gov or your state exchange website and plug in your info every year just to be certain. You may be pleasantly surprised.