Final Touches: APPROVED unsubsidized rate hikes for Washington, South Carolina, Ohio

As noted before, I'm really trying to move onto the actual enrollment part of the 2017 open enrollment period, but I can't resist doing some more final cleanup of my Rate Hike project:

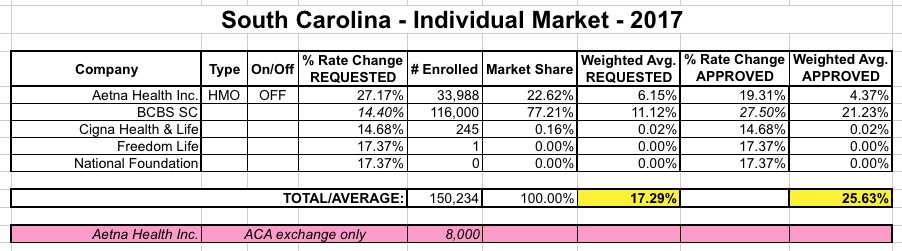

- SOUTH CAROLINA: This is one of the 5 states which I still didn't have approved rate changes for. Today the RateReview.HC.gov site finally added in the final numbers for SC, so here's what it looks like:

Aetna was a bit tricky--the total enrollee number is actually 41,988. They dropped out of the ACA exchange but are sticking around the off-exchange market, so I had to figure out how many of those 42K are on vs. off-exchange. The answer is in this article which notes:

More than 220,000 South Carolinians rely on the federal health care law for insurance. This year, only 8,000 of them are covered by Aetna plans.

That leaves about 34K enrolled in off-exchange Aetna policies. Between that and the approved rate hikes, the final average for South Carolina comes in at 25.6% vs. the 17.3% requested.

- WASHINGTON STATE:

The WA insurance department had previously issued two press releases, each of which included partial approved rate hike data for 2017...but both of them left out some crucial pieces of the puzzle, so I had to plug in 13.1% as a placeholder average.

Today, they issued a final, comprehensive press release; the overall average turned out to be slightly higher, at 13.6%:

Thirteen health insurers have been approved to sell 154 individual and family plans for 2017. Nine insurers will sell 98 plans in the exchange, Washington Healthplanfinder (www.wahealthplanfinder.org), and seven insurers will sell 56 plans outside of the exchange. The average rate change is 13.6 percent.

Search 2017 health plans and rates by county.

How much someone’s premium will change depends on where they live, their age, whether or not they smoke, which insurer and plan they select, and how many people are covered.

“We knew that it would be difficult for the health insurers to initially set their rates without knowing who would sign up for coverage and what services they would use,” said Insurance Commissioner Mike Kreidler. “In fact, we were surprised when rates came in significantly lower than predicted in the first few years of the Affordable Care Act. I do believe this year’s change is a one-time adjustment and that we’ll see premiums level off as insurers gain experience and more people get covered.”

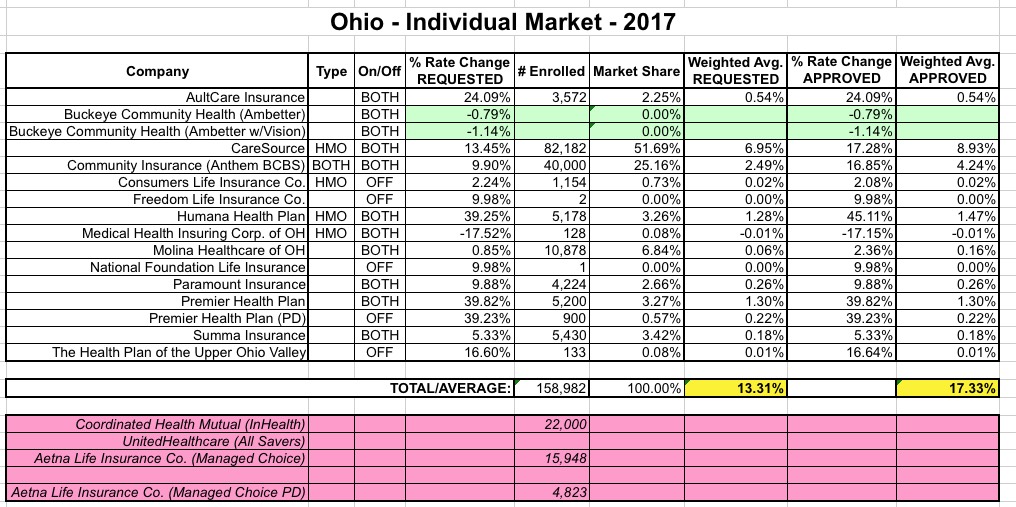

- OHIO: This is another of the 5 missing "approved" states. Unfortunately, there's one key number missing from my Ohio spreadsheet: I have no idea how many people are actually enrolled in Buckeye Community Health plans. This is important because unlike most carriers, Buckeye not only requested rate reductions, they actually received them. If a large number of Ohio residents are enrolled in Buckeye plans, that could lower the statewide weighted average significantly.

However, without that data point, I have to go with what I have: 13.3% requested, 17.3% approved overall:

This leaves just 3 states with unknown "APPROVED" rate hikes: Louisiana, New Hampshire and Virginia (which is ironic, since Virginia was the very first state which I estimated way back in APRIL, if you can believe it.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.