UPDATED: Iowa: Wellmark asks to raise ACA-compliant rates 40%...in large part due to a single patient's care

The dominant carrier on the individual market in Iowa is Wellmark BCBS, which had 137,000 enrollees (something like 75% of all the market) last year.

However, there were two important caveats to that: First, Wellmark isn't currently participating on the ACA exchange; all of those enrollees were off-exchange only. Secondly, at the time I had no idea how many of them were ACA-compliant and how many were "grandfathered" or "transitional" policies, which aren't ACA compliant and which, more significantly, aren't part of the same risk pool.

Well, Wellmark just announced that they will finally be jumping onto HealthCare.Gov for 2017. This is great news, not just because they're the dominant carrier in the state but also because it'll help fill the hole created by UnitedHealthcare dropping out.

HOWEVER, I suspect that today's news may also help explain their reasoning (I'll get to that later):

Wellmark plans 38% to 43% increases for some customers

Tens of thousands of Iowans who buy their own health insurance are about to receive a shock in the mail.

Wellmark Blue Cross & Blue Shield is sending letters this week telling about 30,000 customers it plans to raise their premiums by 38 percent to 43 percent next year.

Wellmark sells about three-quarters of individual policies in Iowa’s health-insurance market. The steep increases will affect people who bought relatively new plans that comply with rules of the Affordable Care Act.

Another 90,000 Wellmark customers who hold older individual insurance plans are expected to face smaller increases, which will be announced in June. The increases being proposed this week also don’t affect the hundreds of thousands of Wellmark customers who obtain coverage via their employers. Their premiums are expected to rise less, because they are in larger, more stable pools of customers.

OK, between this data and the filings from last year, I can break down Iowa's total individual market pretty well:

- Wellmark has about 120,000 individual enrollees total, which in turn makes up 75% of the individual market.

- The only other carrier in the indy market of any significance appears to be Coventry, which had around 47,000 enrollees last year (presumably down to around 40,000 this year)

- Officially, the on exchange participants include Coventry (a subsidiary of Aetna), Gundersen (which only had a handful of enrollees last year), UnitedHealthcare (which is dropping out next year) and Medica.

So really, this massive 38-43% rate hike officially impacts 30,000 people, or roughly 19% of Iowa's entire individual market. The hikes for the other 130,000 people (90K grandfathered/transitional, 40,000 via Coventry/etc) are still unknown.

More importantly are the reasons for the massive hike...and the Des Moines Register article gives one jaw-dropping example:

Wellmark Executive Vice President Laura Jackson said poor health and rising medical costs forced the company to seek state permission to raise premiums so aggressively on the plans in question. She said the company spent $1.27 on health care last year for every dollar in premiums it took in for those customers. The company says it lost $99 million on those customers in the past two years.

She said about 10 percentage points of the increase stem from the costs of a single, extremely complicated patient who is receiving $1 million per month worth of care for a severe genetic disorder.

Note: That's not 10% of the increase (which would be 3.8 - 4.3% of it. It specifies 10 percentage points...that is, 10 out of 38-43, or fully 25% of the statewide increase...for one person's treatments. A million dollars per month...$12 million per year.

That figure adds up, too--If they lost $99 million on this particular group of 30,000 people over the past 2 years, that's about $50 million lost per year. $12 million is 24% of that.

Jackson noted many insurers nationally are planning large premium increases, for similar reasons. About two-thirds of the costs are for treatment of chronic diseases, many of which are preventable, she said. Many of the problems are related to factors such as smoking, unhealthful eating and lack of exercise. “It’s a whole lot of lifestyle, with a little bit of genetics thrown in,” she said.

This, by the way, is another reason why moving to single payer in the U.S. could prove to be more difficult: We're a pretty fat, lazy, unhealthy bunch as a whole, and we don't like changing our lifestyles. I have no idea how we rank "healthy lifestyle-wise" compared to countries with single payer (or similar) systems, but I'm guessing it isn't very well. Here's one list (not necessarily definitive) of the top 10 "healthiest lifestyle" nations. Note who's listed and who isn't.

Medica, a much smaller health insurance carrier, is seeking an increase of nearly 20 percent on individual policies in Iowa. A spokesman declined to say how many Iowans would be affected. Coventry, which also sells individual health insurance plans in Iowa, declined to comment on how much it plans to increase premiums next year. The companies had to file their proposals with the state insurance division by Wednesday, but the division is not yet releasing the information publicly.

As noted above, Medica likely only has perhaps a few hundred individual enrollees if my math above is correct, while Coventry probably has around 40,000.

So, a very rough state-wide estimate for the ACA-compliant market (on + off exchange) should be something like:

- Wellmark: 75% market share x 40% rate hikes = 0.300

- Medica: 1% market share (?) x 20% rate hikes = 0.002 = 30.2% for 76% of the market, plus...

- Coventry: 24% market share x ?? rate hike = ??

Again, this still only relates to the 70,000 or so ACA-compliant policies state-wide. (About 55,000 Iowans enrolled via the exchange this year, which means another 15,000 or so off-exchange). There's still another 90,000 or so grandfathered/transitional enrollees with unknown rate hikes.

As for what this has to do with Wellmark's decision to finally join the exchange, here's the key point:

Gary Claxton, a vice president for the Kaiser Family Foundation, noted that many of the Wellmark customers in question could receive federal subsidies to help them pay premiums in 2017. Wellmark in the past has declined to offer policies that qualify for the Affordable Care Act subsidies, which are tied to consumers’ income. But the company will offer such policies for 2017. Claxton said even with the premium increase, some of the customers might wind up spending less on health insurance next year because of the change.

Remember, ACA subsidies are only available if you enroll in policies via the exchange. Wellmark's enrollees would have to pay full price if they didn't join the exchange, even if they qualified for them financially. By joining HealthCare.Gov, Wellmark is allowing many of their customers a way to continue to be customers of theirs, even with the massive "official" rate hikes.

UPDATE 5/31/16: Hmmmmm...according to the official RateReview.HealthCare.Gov database, the situation is a little different:

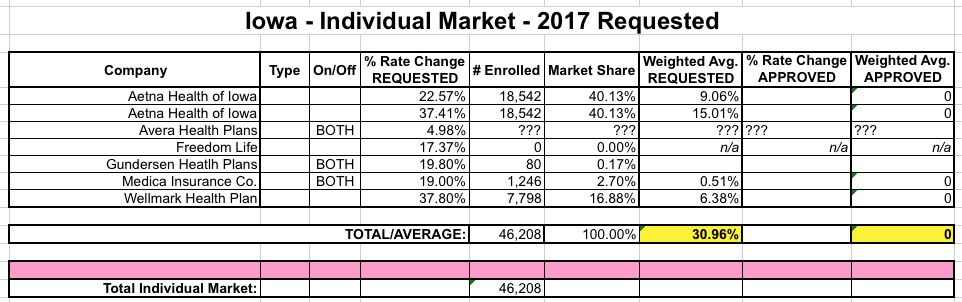

First comes Aetna...which actually means Coventry, since the two companies merged awhile back:

So far, so good; my 40K estimate was pretty close to the 37K actual. Unfortunately, they don't break that number out between the 22.6% POS and the 37.4% HMO, so I'm assuming a 50/50 ratio in the absence of that info, for an overall Aetna/Coventry request of 30% even.

Freedom Life doesn't have anyone enrolled anyway...

...while Gundersen only has 80 enrollees:

Medica, as expected, only has around 1,200 people:

The good news is that Avera Health Plans is only asking for a 5% rate hike. The bad news is that their filing is completely redacted, so I haven't a clue how many enrollees that refers to.

And finally, Wellmark's filing, which claims that their 38% rate hike will only impact around 7,800 current enrollees...as opposed to the 30,000 noted in the article:

Between Aetna/Coventry's 30% and the 7,800 vs. 30K discrepancy for Wellmark, the statewide average comes in at around 31%:

...which is a bit lower than the 35% average I've been assuming until now. If I assume 30K for Wellmark, the overall weighted average moves up to 33.2%. Add the unknown Avera quantity and it looks like Iowa's weighted average is likely more around 32% than 35%, although that's pretty shaky as well.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.