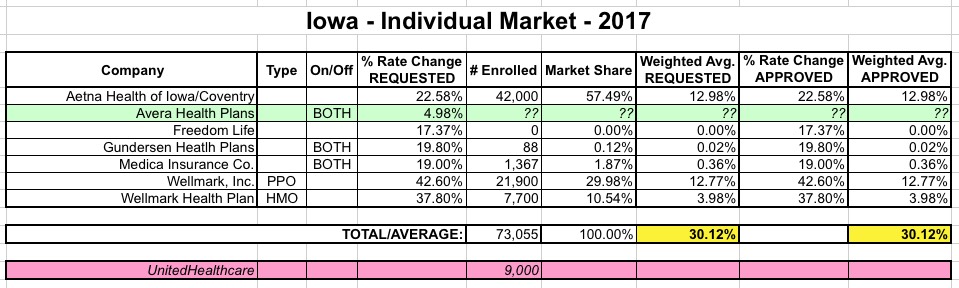

Iowa: *Approved* 2017 avg. rate hikes: 30.1% (+ some rare *transitional* plan data)

Thanks again to contributor "M E" for the link to this Des Moines Register article, which lists most of the approved 2017 individual market rate hikes:

More than 75,000 Iowans will see their insurance premiums rise next year.

Iowa Insurance Commissioner Nick Gerhart has approved rate increases sought by four companies who provide health insurance in the state, Gerhart's agency announced Monday. The increases include plans covered by Wellmark Blue Cross & Blue Shield, the state's dominant health insurer.

However, the article was a little vague about some of the data, so I visited the IA DOI website and sure enough, they have separate entries for every one of the carriers (with one exception):

The Iowa Insurance Division (the “Division”) received an annual individual health insurance premium rate (“rate”) filing for Medica Insurance Company plans compliant with the federal Patient Protection and Affordable Care Act (“ACA”) in May, 2016. Medica proposed an average rate increase of 19%, with variations by plan, effective January 1, 2017, for approximately 1,367 policyholders. After review and analysis, the Division approved a rate increase of 19%.

The Iowa Insurance Division (the “Division”) received an annual individual health insurance premium rate (“rate”) filing for Gundersen Health Plan plans compliant with the federal Patient Protection and Affordable Care Act (“ACA”) in May, 2016. Gundersen Health Plan proposed an average rate increase of 19.8%, with variations by plan, effective January 1, 2017, for approximately 88 policyholders. After review and analysis, the Division approved a rate increase of 19.8%.

The Iowa Insurance Division (the “Division”) received an annual individual health insurance premium rate (“rate”) filing for Aetna Health of Iowa plans compliant with the federal Patient Protection and Affordable Care Act (“ACA”) in May, 2016. Aetna Health of Iowa proposed an average rate increase of 22.58%, with variations by plan, effective January 1, 2017, for approximately 42,000 policyholders. After review and analysis, the Division approved a rate increase of 22.58%.

The Iowa Insurance Division (the “Division”) received an annual individual health insurance premium rate (“rate”) filing for Wellmark, Inc. plans compliant with the federal Patient Protection and Affordable Care Act (“ACA”) in May, 2016. Wellmark proposed an average rate increase of 42.6%, with variations by plan, effective January 1, 2017, for approximately 21,900 policyholders. After review and analysis, the Division approved a rate increase of 42.6%.

The Iowa Insurance Division (the “Division”) received an annual individual health insurance premium rate (“rate”) filing for Wellmark Health Plan of Iowa (HMO) plans compliant with the federal Patient Protection and Affordable Care Act (“ACA”) in May, 2016. Wellmark Health Plan of Iowa proposed an average rate increase of 37.8%, with variations by plan, effective January 1, 2017, for approximately 7,700 policyholders. After review and analysis, the Division approved a rate increase of 37.8%.

In all 5 cases, the IA DOI approved the requested rate hikes as is, for a weighted average approved hike of 30.1% statewide. Even though the approved rates are identical to those requested, the weighted average still comes in slightly lower than my original estimate of 31.0% because the enrollment numbers are slightly different from what I thought they were (plus, Aetna's merged average request is a bit different from the split requests I originally had, while Wellmark actually broke their enrollment numbers into 2 separate filings). In any event, the final approved average is pretty much what the carriers were asking for. Here's what the corrected table looks like:

The table above also updates two other points: Thanks to Louise Norris, I also now know the number of UnitedHealthcare enrollees who will have to shop around for new plans (9,000), as well as the status of Avera Health (I knew they were requesting a 5% rate hike for an unknown number of enrollees, but didn't know that they were entering the ACA exchange market for the first time this year). Unfortunately, I still have no idea how many people they currently have enrolled OFF-exchange; if it's a decent-sized number, it could drop the statewide weighted average significantly...but without that number there's nothing I can do.

Even with the United enrollees, there's still only around 82,000 people accounted for here...but Iowa's total individual market was around 190,000 people as of 2014, and has presumably grown up to 25% since then (nationally, the indy market is up to around 20.5 million from 15.6 million in 2014). However, that includes grandfathered and transitional policies, which presumably account for a good chunk of the remaining 107,000 people, right?

Well, here's where things get interesting. Prior to the ACA, Wellmark was supposedly the big kahuna in Iowa's individual market, with a whopping 84% share of the market (over 151,000 enrollees). Yet, according to one more IA DOI rate filing approval, Wellmark only has 2,300 people still enrolled in NON-ACA compliant, transitional policies as of today:

The Iowa Insurance Division (the “Division”) received an annual individual health insurance premium rate (“rate”) filing for Wellmark Health Plan of Iowa’s (HMO) transitional individual plans from prior to the federal Patient Protection and Affordable Care Act (“ACA”) in May, 2016. Wellmark Health Plan of Iowa proposed an average rate increase of 42.6% for transitional individual plans, with variations by plan, effective January 1, 2017, for approximately 2,300 policyholders. After review and analysis, the Division approved a rate increase of 42.6% for transitional individual plans.

If you add these into the mix, that's still only a total of 104.3K people. Where are the remaining 90K+?? The only place I can think they would be are Wellmark grandfathered plans. In 2013, besides Wellmark, Aetna and United, every other carrier had only around 9,000 enrollees combined, so grandfathered Wellmark seems to be the only category left.

If so, this is fascinating, because it means that while grandfathered plans likely make up only about 5-10% of the individual market nationally, they may still comprise up to 45% of the indy market in Iowa even today.

UPDATE: D'oh!! As "M E" points out, at the end of the Des Moines Register article it even confirms this with a link to another article:

Wellmark Blue Cross and Blue Shield, which dominates Iowa’s health insurance market, plans to raise premiums by about 6 percent next year for 88,800 Iowa customers who bought individual policies before 2014. That proposed increase, filed with state regulators Wednesday, is much less than the 38 percent to 43 percent increases Wellmark proposed last month for 30,000 Iowa customers who bought newer health insurance policies.

Actually, the article is still a bit confusing because they're mixing together grandfathered and grandmothered (aka transitional) enrollees. That 88,800 figure appears to refer specifically to grandfathered plans, NOT including the 2,300 transitional plans noted above.

So, in short, Wellmark was approved for:

- ACA-Compliant PPO: 42.6% increase

- ACA-Compliant HMO: 37.8% increase

- Transitional (all): 42.6% increase

- Grandfathered (all): 6.0% increase

That's right...grandfathered plans are only going up nominally, but transitional plans are going up as much as "Obamacare compliant" plans, which cuts against the conventional wisdom.

Since Wellmark has such an overwhelming market share, this also gives a very good breakout of Iowa's total individual market.

- ACA-Compliant: 82,000

- Transitional (Wellmark): 2,300

- Grandfathered (Wellmark): 88,800

- Grandfathered + Transitional (all other carriers): 29,000 at most

- Total: 202,100 at most

That means that ACA-compliant plans make up around 40% of the total market; grandfathered plans are around 45% and transitionals are perhaps 15%. This is very different from the country at large.

Furthermore, only around 49,000 Iowans were enrolled on exchange as of 3/31/16, and of those only 42.5K were subsidized, so the full breakout is something like:

- 42.5K: Exchange based, ACA-compliant, subsidized

- 6.5K: Exchange based, ACA-complaint, unsubsidized

- 33K: Off-exchange, ACA-compliant, unsubsidized

- Grandfathered+Transitional: somewhere between 89K - 118K

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.