HHS Dept: Vast majority of exchange enrollees will be protected from premium hikes*

*(some caveats apply...see below...)

With the growing concerns over expected large premium rate hikes next year, combined with the Big Announcements that major exchange players like UnitedHealthcare, Humana and Aetna are dropping out of most of the ACA exchange markets they're currently participating in, the HHS Dept. has obviously been under quite a bit of pressure to reassure exchange enrollees (both current and potential) to stay the course and not panic.

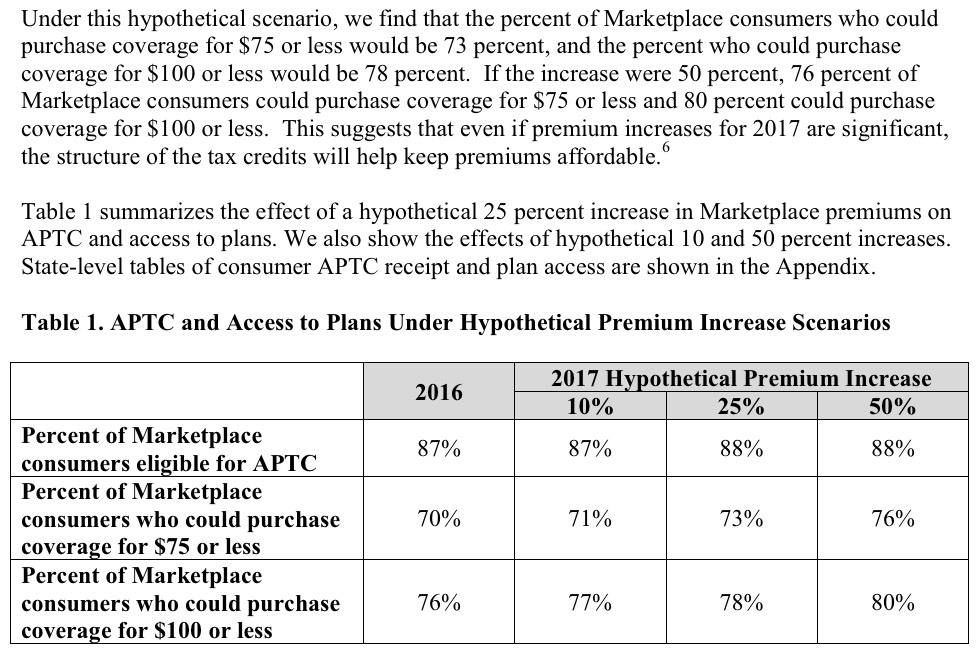

Thus, it's not surprising at all that an hour or so ago they released a new report which reminds people that nearly 4/5 of current ACA exchange enrollees will still be able to find an exchange-based Qualified Health Plan for $100 or less per month (and 3/4 could find one for $75 or less per month) after applying APTC assistance in the event of an across-the-board 25% premium rate increase in 2017:

Previous ASPE analyses have shown that both advance payments of the premium tax credits (APTC) and consumer shopping behavior work to mitigate increases in net premiums experienced by consumers in the Health Insurance Marketplace from year to year. For example, last year, some observers suggested based on rate filings that consumers would experience double-digit increases in 2016. But, after taking into account shopping, the increase in the average premium among HealthCare.gov consumers was 8 percent between 2015 and 2016. Meanwhile, among the 85 percent of HealthCare.gov consumers with APTC, the average monthly net premium increased just $4, or 4 percent.

In this brief, we examine how the combination of tax credits and the opportunity to shop around for coverage through the Marketplace would protect consumers in a hypothetical scenario with much higher premium increases in the Marketplace than occurred last year. Our analyses (and impacts of hypothetical rate increases) are restricted to consumers who purchase insurance through the Marketplaces, with a particular focus on the majority of these consumers who receive APTC. Focusing on a hypothetical scenario of a 25 percent increase in premiums for all Marketplace qualified health plans (QHPs) in HealthCare.gov states from 2016 to 2017, we show that the overwhelming majority of Marketplace consumers would be able purchase coverage for less than $75 per month, just as they could in 2016.

In fact, due to the unusual formula used to calculate the APTC amount (based not only on the enrollee's income, location, age and household size, but also on the 2nd lowest-priced Silver "benchmark" plan available on the exchange), this not only holds true but actually increases slightly even when the hypothetical rate hike is higher (say, a whopping 50%):

They even break this out by state, at all 3 hypothetical average rate hikes (10%, 25%, 50%).

Some important points to keep in mind here:

- First, it is important to give full credit to HHS for making this valid point: The vast majority of exchange enrollees will not see much of a rate hike next year, mostly due to APTC assistance, partly due to shopping around. This is a valid point for them to call attention to.

Having said that, there are some important caveats to keep in mind here:

- First, as I've said numerous times (most recently just yesterday):

The problem, as always, is that those 9.4 million people only make up around half of the total individual market. The other half (around 1.7 million on the exchanges and another 7-8 million off of the exchanges) have to pay full price for their individual policies; those folks are bearing the full brunt of the rate hikes, nor do any of them qualify for CSR assistance. That's the reason why I do my best to include all ACA-compliant policies (both on and off-exchange) when I estimate the annual rate hike averages, and I do so assuming the full, unsubsidized premium amounts.

- Second: As ACA critics are always quick to point out, none of this has anything to do with the other financial problem people have been increasingly concerned about: High deductibles and co-pays. Cost Sharing Reduction (CSR) assistance is very helpful in cutting this down to size for those below 250% FPL (on Silver plans only), but again, are meaningless for anyone above that income threshold.

- Third: In addition to the APTC factor, the other major reason HHS estimates so many people will be able to keep their costs down is that it assumes shopping around for the best deal next year. Again, this is a valid point to call attention to...and one which I've pushed for people to do myself...but there IS a downside to doing so: Lack of stability and continuity of service. Switching plans may save you money, but it may also mean changing networks, having to choose a different primary physician and so forth. Like everything else, there are tradeoffs involved here.

- Fourth: While I'm on the "shop around!" topic, this paragraph...

Prior ASPE research has illustrated that shopping by consumers during open enrollment plays a very important role in keeping premiums affordable for consumers.2 Among 2015 consumers who re-enrolled in the Marketplace for 2016 coverage, 43 percent chose to switch plans and realized substantial savings by doing so. Compared to what they would have paid if they had remained in their 2015 plan, consumers who switched plans saved an average of $42 per month in premium costs, equivalent to over $500 in annual savings.

...actually made me roll my eyes a bit, as I explained back in March:

This last data point is a bit silly to make hay of in my opinion. Part of the reason so many people "changed issuers", of course, is because a dozen Co-Ops melted down and were no longer on the exchanges, meaning that a good 800,000 people (or 10.2% of all 7.8 million renewing) HAD to switch issuers, assuming every one of them stayed on the exchange (not all did, of course).

In other words, about a quarter of those who "chose to" switch plans weren't kind of had that "choice" forced upon them. Don't get me wrong, many of them may have ended up with better/just as good deals in the end after all, but it's a bit disingenuous to say they "chose" to do so. This will be even more the case this fall, since the number who will have to switch plans/carriers will be even higher (up to 2 million or so, or about 18% of all current enrollees).

- Fifth: The other usual caveats/disclaimers apply: The percentages above only apply to the 38 states on the federal exchange (HC.gov), so about 25% of enrollees aren't counted; it also is based on the 12.7 million people who selected QHPs as of 2/01/16, not the 11.1 million who were still enrolled as of 3/31/16; the ratios and demographics may have shifted somewhat over the months, and will continue to shift around a bit more between now and November.

Having said that, I strongly suspect that plugging in the missing states (California, New York, Colorado, etc) probably wouldn't change the overall point much one way or another...nor would adjusting their calculations to reflect the lower number of currently effectuated enrollees. The adjusted percentage who can find an exchange plan for under $100/mo will probably still be pretty close to 78%.

- Sixth, and finally: I have to admit to being a bit flattered when I saw that the HHS Dept. chose to use an "across the board, 25% average rate hike" as their hypothetical example. They could have gone with the 10% example, or 20%, or 40%...but they went with 25%. Huh.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.