2017 Rate Request Early Look: Arizona

There are only 2 things I'm certain of when it comes to the requested rate hike filings in Arizona's individual market:

- It's a confusing mess.

- Regardless of #1, Arizona's requested rate hikes are jaw-dropping even when weighted by carrier.

The data below is drawn from two sources: The RateReview.HealthCare.Gov database and Arizona's Health Filing Access Interface (HFAI) SERFF database.

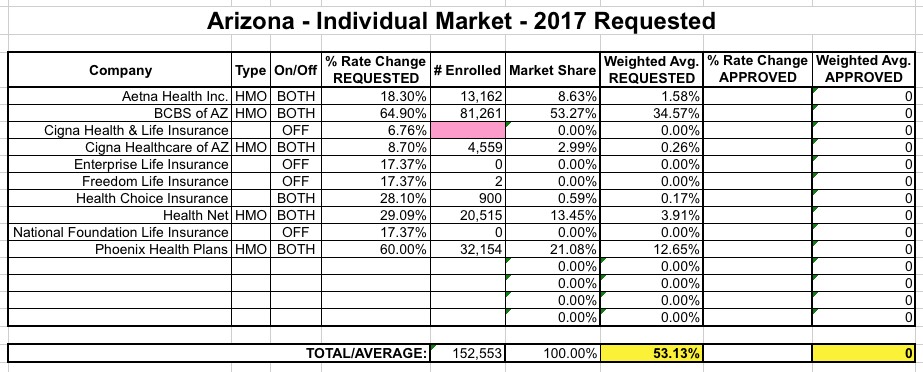

As you can see, there's some confusing and contradictory numbers, but I'll try to muddle through each:

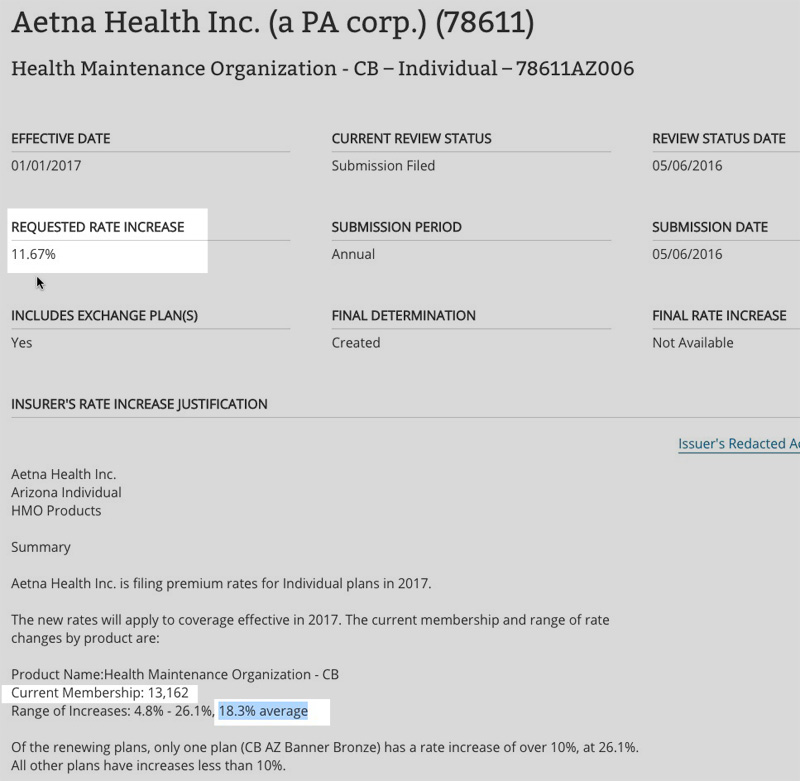

AETNA:

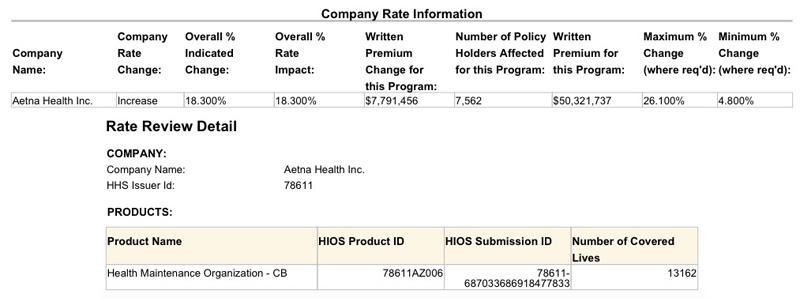

As you can see, Aetna's membership is pretty cut and dry: 13,162. However, while the "requested rate increase" is listed as 11.67% at the top, in the details it lists it as 18.3%. I checked the HFAI database as well, and that uses the 18.3% figure, so that's what I'm going with. Where did 11.67% come from? Beats the hell out of me.

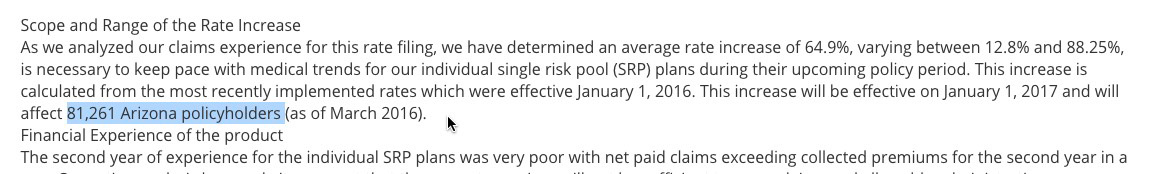

BLUE CROSS: Blue Cross Blue Shield of Arizona has 3 separate listings for three different product lines; the average rate hikes requested are (gulp) 74.41%, 30.26% and 64.29% respectively...for a blended average of 64.9%, which will obviously be shockingly high if approved. I believe this is also the single highest carrier-specific rate hike request I've seen so far:

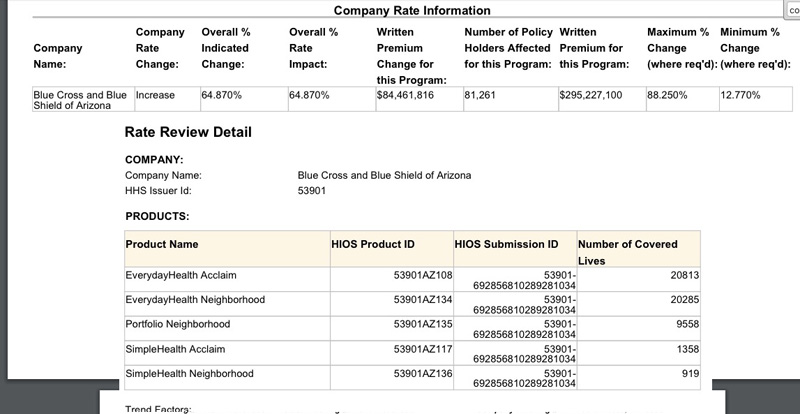

HOWEVER, the enrollment number is listed as 81,261 policyholders. Given the mistake I made last night with Colorado, I made sure to double-check the HFAI database to see what the number of covered lives is, and came up with a headscratcher:

Yup, the rate impact is correct (64.87%) and the number of policyholders matches (81,261)...but look at the number of covered lives. This should obviously be at least as high as the policyholders, but should actually be somewhat higher, since each policyholder represents a household. Generally the covered lives should be around twice as high as the policyholder number...yet here they only add up to 52,933 people.

How can there be 28,000 fewer covered lives than policyholders? I haven't a clue. For the moment I'm using the 81K figure.

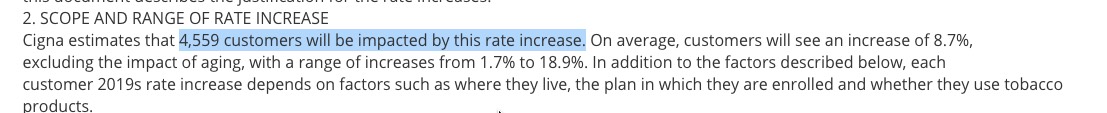

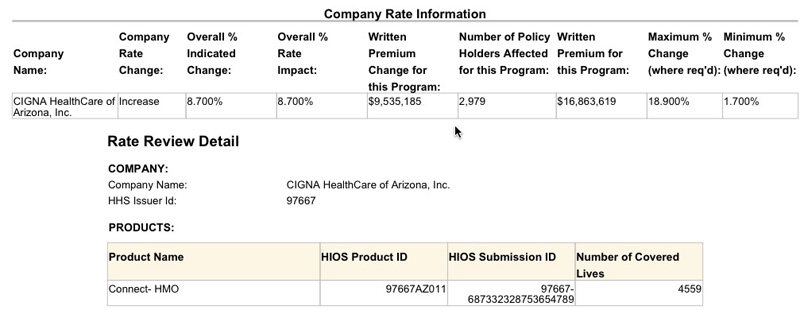

CIGNA: Cigna has listings under 2 names: "Cigna Healthcare of AZ" which includes their HMO plans only (and which is pretty straightforward...8.7% for 4,559 enrollees)...and "Cigna Health & Life Insurance" which is only requesting an increase of 6.76%...but which doesn't list their current membership anywhere. HOWEVER, their (redacted) filing memo does stated that "CHLIC" is only offering a single Bronze plan next year anyway, which means that there are likely a pretty small number of current enrollees who would be eligible to renew their current policies anyway. I'm sure the number is greater than zero, but without knowing what it is, I have to leave that field blank...which is a shame, since it's the lowest rate hike request in the state, and given how eye-popping some of the other numbers are, anything to lower the weighted average would be much appreciated. Ah, well...

ENTERPRISE, FREEDOM & NATIONAL FOUNDATION LIFE INSURANCE:

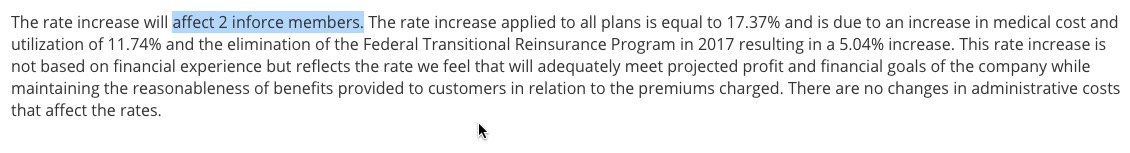

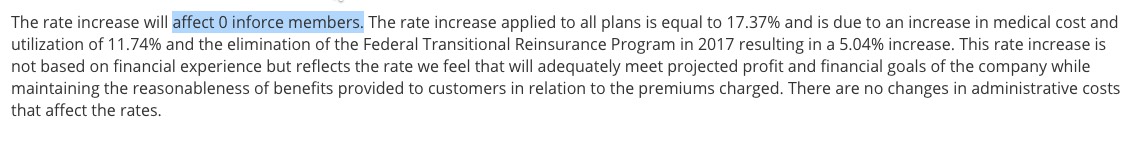

As I keep noting, these three are all the same parent company, and once again, they're all requesting exactly 17.37% increases on virtually nonexistent membership (exactly 2 people across all 3 divisions). Still no clue what's going on with "Freedom Life" but it's a non-factor here:

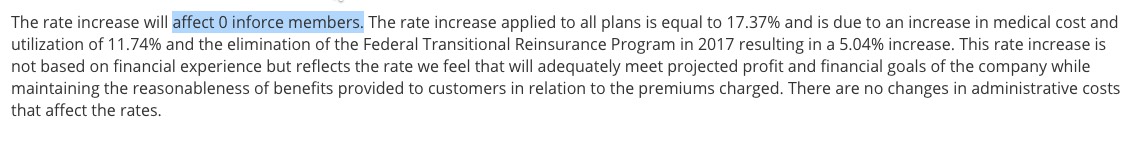

HEALTH CHOICE: Again, the RateReview.HealthCare.Gov site claims a 25.71% average, but the filing itself lists it as 28.1%. Not a huge difference, but odd:

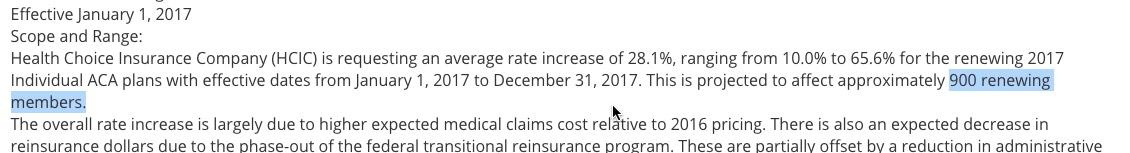

HEALTH NET: The HC.gov site doesn't give any indication of the membership, but the HFAI filing does: 20,515 people, with a 29.1% average request.

PHOENIX HEALTH PLANS: Like Blue Cross, Phoenix has multiple filings...and like Blue Cross the blended average requested increase is ugly as hell: 60%:

Obviously there are a LOT of weird variables and questionable numbers across some of the above filings, so take all of this with a huge grain of salt...but as best as I can figure, given the limited and conflicting data I have on hand, carriers in the Arizona individual market are asking for an average of 53% rate hikes for 2017:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.