2017 Rate Request Early Look: New Mexico

Unlike most states, New Mexico uses their own, in-house rate review database.

The good news is that it's easy to use, and lists all of the carrier rate hike requests in a clearcut manner...except, oddly, for CHRISTUS, which I'm pretty sure is being offered this year.

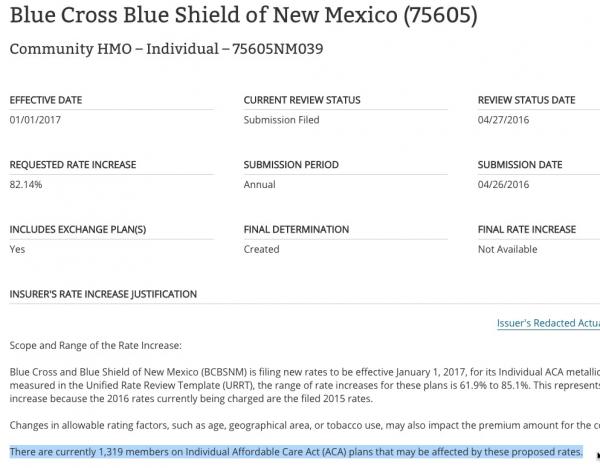

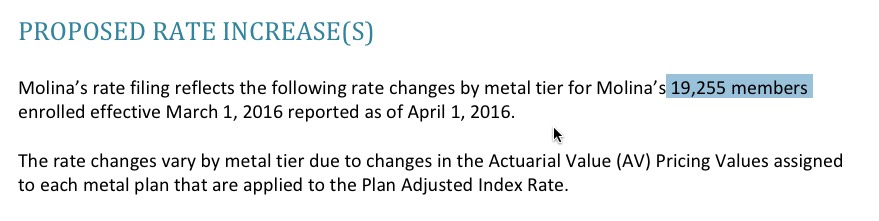

The bad news is that it doesn't include any of the actual market share/enrollment numbers, making it impossible to come up with a weighted average. Some of these are available via redacted filings over at the federal RateReview.Healthcare.Gov site, but not all of them. I have New Mexico Health Connections estimated at 48,000 based on this report, but I have no idea how many CHRISTUS or Presbyterian enrollees there are.

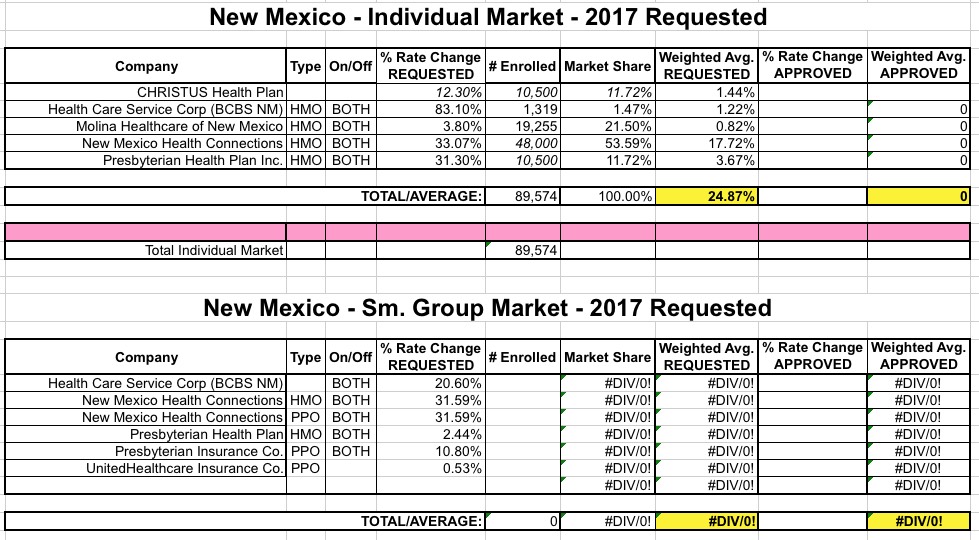

The RateReview site lists CHRISTUS as ranging from 9.4 - 15.2%, but without market share numbers I can't even come up with a proper rate hike request, so I've split the difference for now at 12.3%.

New Mexico's total individual market was roughly 70,000 people in 2014. Since then, the national individual market has grown from roughly 15.6 million to around 20 million, or a 28% increase. Assuming this is the case in New Mexico, their indy market should be up to around 90,000. They didn't allow transitional plans, and grandfatehred policies should be pretty nominal, so 90K should be about right.

In the absence of market share data for either one, I'm evenly splitting the remaining 21,000 enrollees between CHRISTUS and Presbyterian in order to come up with a rough estimate of the weighted average rate hike.

There are a lot of big assumptions here, but if I'm close, this is about what it should look like:

Again, lots of assumptions, but it looks like roughly a 24.9% average requested rate hike for New Mexico for 2017. I'll adjust this as appropriate as more hard data comes in for the guesswork numbers.