Humana: ACA exchange enrollment down 24% Y/Y; may exit some states

Humana Inc. just released their Q1 2016 financial report, which includes this section:

As previously disclosed, in the fourth quarter of 2015 the company recorded a PDR associated with its 2016 individual commercial ACA‐compliant offerings. Historically, this business has reported a profit in the first quarter of the year due to the related benefit designs. Because the company continues to anticipate a loss associated with this business for the full year 2016, the seasonal earnings generated in 1Q 2016 are offset by an increase in the PDR, resulting in a higher benefit ratio year over year. This first quarter seasonality was anticipated as the company developed its estimate of the full‐year PDR recorded in the fourth quarter of 2015.

Financial results associated with the wind‐down of the non‐ACA compliant (legacy) business, including the related release of policy reserves, as well as indirect administrative costs associated with ACA‐compliant offerings are included in the company’s 1Q 2016 financial results.

Consistent with data evaluated as the company established the PDR in the fourth quarter of 2015, early indications for ACA‐compliant business effective in 1Q 2016 include:

- New members enrolling in off‐exchange plans had higher admissions per thousand members (APT) than renewing members.

- Renewing members in both on and off exchange plans from 2015 to 2016 were higher utilizers based on APT and pharmacy statistics than those terminating coverage.

The company will continue to evaluate the performance of this business for 2016 as it further develops and the corresponding impact on the PDR, if any, over the coming quarters.

Humana is in the process of finalizing plans for its ACA‐compliant individual commercial medical market offerings in 2017. Humana anticipates proposing a number of changes to retain a viable product for individual consumers, where feasible, and address persistent risk selection challenges. Such changes may include certain statewide market and product exits both on and off exchange, service area reductions and pricing commensurate with anticipated levels of risk by state.

In other words, they may be pulling out of the individual market in some states, and do plan on jacking up rates in the states they're staying in.

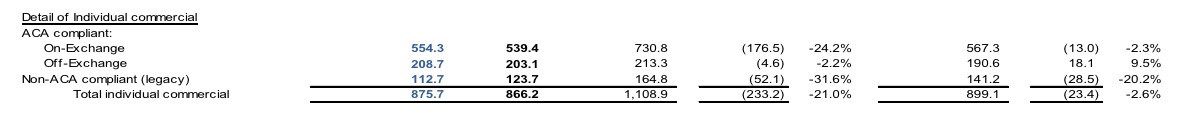

In terms of the actual enrollment numbers, here's the relevant table:

This is probably difficult to read, but the first column is the effectuated enrollment as of 3/31/16: 554.3K exchange-based; 208.7K off-exchange; and 112.7K non-ACA compatible (off-exchange). The second column is the average for the first quarter; the third is where things stood as of 1 year ago, followed by the net and percentage changes.

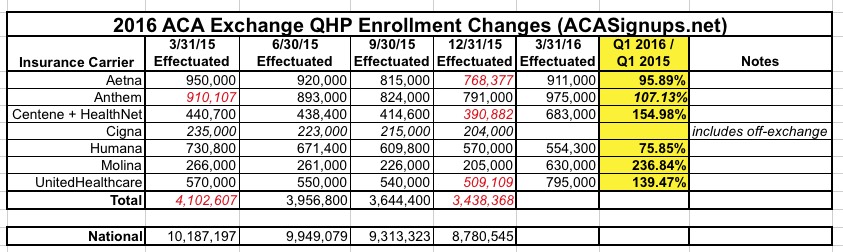

This means that Humana has seen a 24% drop in their ACA exchange enrollment year over year, along with a slight drop in their off-exchange ACA compliant enrollment:

The other noteworthy tidbit: Note that grandfathered and grandmothered/transitional policies have dropped another 32% since a year ago, and over 20% just since December. This is significant since unlike ACA-compliant policies, where market share can ebb & flow from one carrier to another, the GF/GM number can only move in one direction: Down. Anyone who drops one of those plans can only replace it with an ACA-compliant one, so this is actually a good benchmark to use for determining the rate at which GF/GM plans are dropping.

Last month I assumed that GF/GM enrollment had dropped by at least another 25% over the past year or so, to perhaps 2.5 million total nationally. Assuming that Humana's 32% drop in GF/GM enrollment is representative of other carriers, that 25% drop may be conservative.