FOLLOW-UP: Fifteen questions Hillary Clinton would have had to ask Ms. O'Donnell to address her situation

I originally intended this to be an update to yesterday's post about the woman at the Ohio Democratic Town Hall in which a woman asked Hillary Clinton why her family's insurance rates have gone up from $490/month to $1,081/month since the Affordable Care Act was passed. However, that post had already gotten absurdly long and unwieldy, so I've split it off into a new entry.

In the comments yesterday, a man named Danny Robins posted the following. I've broken it up a bit for readability, and have included my responses; both his points and my responses lend some additional insight into both Ms. O'Donnell's dilemma as well as my own point about Clinton's response:

My Columbus Ohio based health insurance practice for the past 7 years has been focused on helping small employers offer more affordable health benefits outside of the employer sponsored health insurance market. It has been widely reported that up to 70% of small employers no longer sponsor a health plan because they can not afford it. As such, I have assisted with over 2,000 people obtain individual or family health coverage.

There are three significant issues that Mr. Gaba needs to be aware of.

First, should both working adults in Mrs. O'Donnell's household historically have worked for small employers who do not sponsor a group health plan and/or they both or one of them are self employed, then employer sponsored coverage is not an option and that would explain why they own an individual policy.

Yes, agreed. I'm not in any way questioning why they would own an individual policy; my own wife and I are both self-employed and have policies via the ACA exchange ourselves.

It is possible that a family rate could have been $490 prior to ACA implementation as Ohio was a preferred risk medically underwritten state for individual polices. yes, 15% may have been declined, but the 85% who qualified due to their good health received very affordable rates.

This is a valid point, but is also a strong argument in favor of the ACA: Until the ACA was enacted, insurance carriers were allowed to cherry-pick the least-expensive enrollees by telling those with pre-existing conditions to go to hell. The blunt version of this is "Well, Mrs. O'Donnell, the reason you were only paying $490/month is because until 2014, your neighbor with leukemia wasn't allowed to get coverage at all."

Ohio was one of the states that allowed existing individually owned preferred risk policies that were in effect prior to January 1, 2014 to remain in force through "transitional relief". This transitional relief will come to an end by January 1, 2017 as all will have to purchase the ACA compliant community rated policies (fair warning, there will be massive rate shock in Ohio just prior to the November election when new cost of coverage information will be released).

Again, I'm well aware of this. However, the odds are that on the individual market there are only perhaps 500K - 1 million people still on transitional policies as of today nationally (Florida, for instance, dropped from over 400K transitional plan enrollees to just 165K from just August 2014 through March 2015). In addition, Mr. Robins has the cut-off date wrong by 1 year for transitional policies; it was 9/30/17, but has been extended further (by 3 more months) until 12/31/17 to finish out the year.

While there will likely still be millions of small business transitional policies in place at that time which will see a significant rate change, the odds are that there will be very few individual market transitional enrollees by the end of next year, as just about everyone would already have shifted over to ACA-compliant coverage by then anyway.

Mrs. O'Donnell did disclose that she went to the Exchange and cost of coverage was more expensive and that she was working with a broker. This leads me to believe that her household income was too high for a meaningful subsidy or any at all. When they go Healthcare.gov, the exact same non-tax subsidized policy they can buy direct from the carrier or through a broker IS more expensive through the "EXCHANGE" because the exchange charges carriers extra fees that are passed onto the insured through rates offered on the Exchange.

Yes, it's possible that the family income is near or above 400% FPL...actually, he said "meaningful", so let's call it 300% FPL, or around $72,000. I don't know what the official definition of "working class" is, but $72K/year seems a bit above that for Ohio (in NYC or San Francisco, of course, that would probably be considered dirt poor). In any event, O'Donnell made a vague reference to both she and her husband having had "unemployment issues" which could mean being out of work for anywhere from 1 day to the full year. Again, she didn't provide this information, which is crucial to understanding her situation.

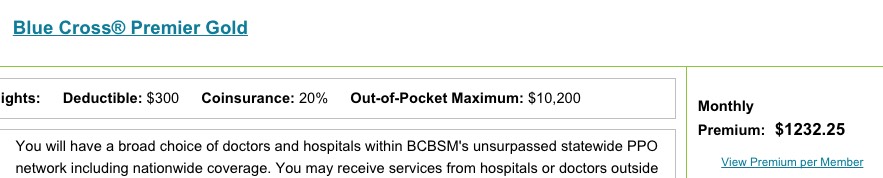

It's true that the exchange does charge 3.5% of the premium costs for exchange enrollees via HC.gov. HOWEVER, it's my understanding that those costs are spread out among the on and off-exchange policies. For instance, when I looked up my own BCBSMI policy here in Michigan (which also uses HC.gov), the on- and off-exchange price is exactly the same for the same policy:

The second issue Mr. Gaba needs to be aware of is that the ACA did not support tobacco users. Rates are 30% higher for tobacco users, which must be financed 100% on the shoulders of the policyholder. So if one or both adults in Mr. O'Donnell's household use tobacco, even with a subsidy, it is highly likley that cost of coverage through the Exchange is higher than her existing policy.

I agree that smokers are charged significantly more; it's one of the very few "medical history/health conditions" which insurance companies are still allowed to charge more for (and with good reason). However, if they're being charged 30% more now, they presumably were already being charged 30% more then (unless one or both of them just happened to start smoking within the past year or two). As an aside, I've never been quite sure how you can prevent someone from simply lying about being a smoker. It's not like the insurance companies have Tobacco Police spying on people, checking their homes for ashtrays or scanning their liquor store receipts (um...at least not yet, anyway...)

So yes, if Mr. & Mrs. O'Donnell happened to start smoking between 2014 and today, that would account for a 30% hike all by itself...but that's hardly the ACA's fault.

Third issue is age. The cost of coverage for people between 60 to 64 is much higher than for people between 40 and 44. No one knows how old Mrs. O'Donnell is or if she married an older man. If her husband if 61 and smokes, that alone could explain why coverage is more expensive on the Exchange. I will do my best to track Mrs. O'Donnell down, offer professional evaluation and provide the media (with her authorization) facts in order to stop any smear campaigns out there. No assumptions should be made one way or the other. This might be Clinton's "Joe the Plumber" moment and FACTS need to rule the roost.

I agree 100% that if her husband is 61 and smokes, that would account for a major increase...but again, that's exactly my point: The question and extremely limited facts as presented to Clinton made it next to impossible for her to give an informed response.

Consider all of the information she would have had to ask about:

- Was your old policy the equivalent of a current Bronze, Silver, Gold or Platinum plan?

- Was your old policy an HMO, PPO or EPO?

- Is your new policy Bronze, Silver, Gold or Platinum?

- Is you new policy an HMO, PPO or EPO?

- Which carrier was your old policy through?

- Which carrier is your new policy through?

- How old are you? How old is your husband?

- Do you smoke? Does your husband smoke?

- If so, what year did you/he start smoking?

- What year were you paying $490/month? (2013? 2014? 2015?)

- What year did you start paying $1,081/month (2014? 2015? 2016?)

- What was your household income whichever year you started the new policy?

- Do you or your husband work for an employer which has offered a policy which you've declined to sign up for ("family glitch")?

That's fifteen questions--some of which are pretty nosey, like age and income--that Clinton would have had to ask and have O'Donnell answer during a live, nationally-broadcast town hall event, without it coming off as an inquisition.

In short, as I noted in the original post, the larger point here is that health insurance is messy and complicated. If you state that this is the exact reason why we should start transitioning towards a simpler, easier-to-understand system, you'll get no argument from me.

However, again, there was no possible way Hillary Clinton could have answered this woman's question under the circumstances in which it was asked.

Think of it this way: Suppose someone came up to you and said the following:

"Our old house cost $75,000. Our new house cost us $300,000. HOW COME??"

Wouldn't you need to know how many bedrooms each house had? What the square footage of each was? What area each is located in? One or two-car garage? Is the garage attached garage? A swimming pool? Are the appliances old or brand new? Energy-efficient windows?

It's certainly possible that Ms. O'Donnell has been screwed by the ACA, or by her broker...but there's no possible way to know any of that without the answers to the list of questions above.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.