UPDATE: OK, everyone: It's time to shift your focus to IRS FORM 1095-A and 8962!!

Of the estimated 12-13 million people who, in the end, appear to have enrolled in ACA exchange policies for this year, around 10-11 million of them are receiving federal tax credits, either as a monthly subsidy towards their premiums or as a "lump sum" tax rebate the following spring.

Either way, exchange enrollees will have to include two important new forms when filing their federal income taxes this year:

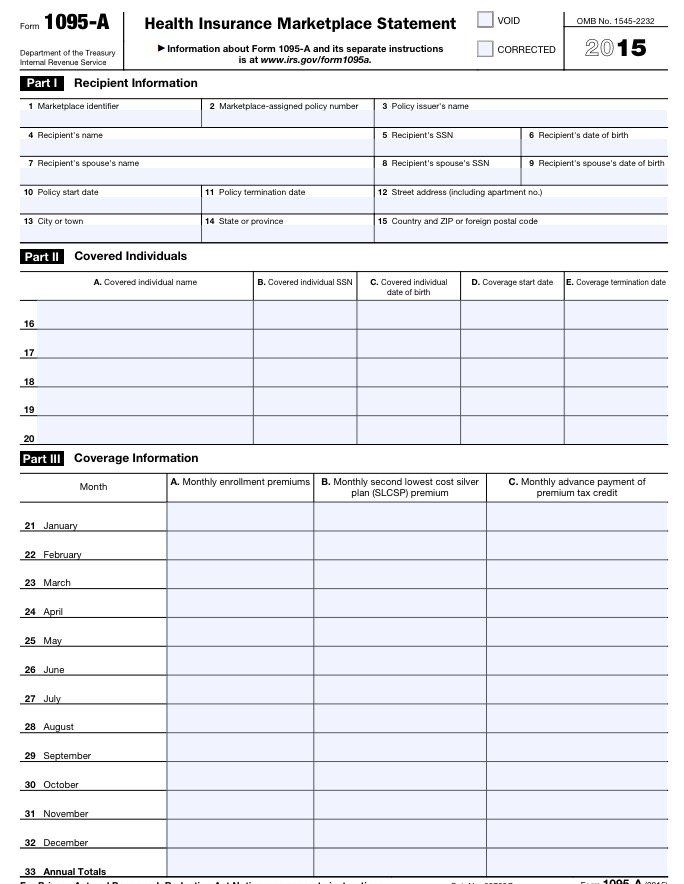

- IRS FORM 1095-A: This one is automatically generated and filled out by the IRS and sent to you by either HealthCare.Gov or the state-based exchange you enrolled through. It's only one page, and aside from your contact information, it will list all people covered by the policy and, most importantly, the actual APTC (advanced premium tax credits) which were applied to your premiums each month.

1095-A is easy; you shouldn't have to actually fill anything out, and it's sent to you automatically. You shouldn't even have to send it back in (though double-check on that). Just in case, here's a direct link to a blank copy of Form 1095-A at IRS.gov, although you should really log into your exchange website account to download it if it doesn't show up in the mail.

HOWEVER, there's also a second form; THIS is the one which hundreds of thousands of people forgot to include last year. It's basically where you have to reconcile the amount of monthly APTC subsidies you received with the amount that you were actually supposed to receive:

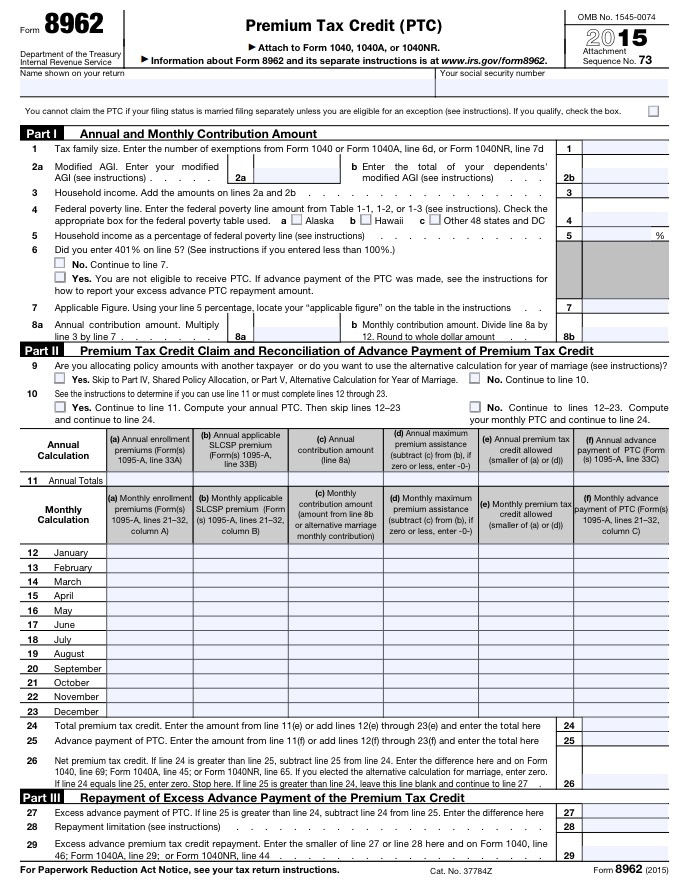

- IRS FORM 8962: This one is not filled out for you, and for some inexplicable reason, they don't even include a blank copy of it with 1095-A, which seems like a no-brainer to me. It seems to me that the fact that over 700,000 households, including mine, forgot about this form should have made it obvious to the IRS/HHS that they should include a blank copy, but whatever. Here's a direct link to Form 8962 at IRS.gov.

8962 is a bit more complicated (2 pages), but isn't really that bad. Again, you're basically comparing your actual income against what you estimated your income would be to figure out whether you owe some/all of your tax credits back to the IRS (or, in many cases, whether they owe you more, which is always a nice surprise).

The thing is, it's really important to fill out and send in BOTH forms, and since both of them are new, a ton of people forgot the second one last year (or didn't know they had to file a tax return at all, which seems pretty obvious to me, since these are federal tax credits, after all). Those who didn't include 8962 were supposed to have their 2016 APTC subsidies cut off, but the Treasury Dept. decided to take mercy on most of these folks this year as a one-time exception, so in the end, only around 60,000 people ended up being penalized.

The IRS claims that they won't be doing so next year, however, so it's really, really important to include them both.

UPDATE: I'm focusing here purely on people enrolled in QHPs via the ACA exchanges. However, there are two other forms which you may have to fill out/send in depending on the type of coverage you have, 1095-B or 1095-C. According to TurboTax...

1095-B: You may receive a copy of Form 1095-B if your insurance provides what the Affordable Care Act calls "minimum essential coverage." This is the minimum level of benefits your insurance must provide for you to avoid paying the penalty. The following types of insurance provide minimum essential coverage:

- Any plan sponsored by an employer. This includes employer-sponsored coverage for retirees and "COBRA" coverage for former employees.

- Government health care plans such as Medicare Part A, Medicare Advantage, Medicaid, the Children's Health Insurance Program, Tricare for military members, veterans medical benefits and plans for Peace Corps volunteers.

- Health coverage purchased through the "Marketplace" -- Web-based federal and state insurance markets set up under the Affordable Care Act.

- Any individual health insurance policy you had in place before the Affordable Care Act took effect.

Your insurer can also tell you whether your plan provides minimum coverage.

1095-C: Every employee of an ALE [Acceptable Large Employer...aka any company with more than 50 full-time workers] who is eligible for insurance coverage should receive a 1095-C. Eligible employees who decline to participate in their employer’s health plan will still receive a 1095-C. The form identifies:

- The employee and the employer

- Which months during the year the employee was eligible for coverage

- The cost of the cheapest monthly premium the employee could have paid under the plan

- If an ALE does not offer its employees insurance, the 1095-C will indicate that fact. ALEs that don't offer coverage may be subject to financial penalties.

Here's what 1095-A and 8962 look like: