UPDATE: 760,000 current ACA enrollees forgot to fill out form 8962. Guess who one of them was?

A couple of weeks ago, I posted the following:

Look, the later part of the article talks about the form in question itself, IRS Form 8962, being overly complicated, and perhaps it is. It's 2 pages, and while it's certainly not as bad as some other federal tax forms, I can definitely see it being intimidating to those who are used to just filling out the 1040-EZ form, as I did years ago. Comic strips and sitcoms have used the "Taxes Are Hard!!" meme as comedic fodder for decades. So no, I'm not going to berate anyone complaining about the form being difficult to fill out.

HOWEVER, complaining about having to file a tax return AT ALL? You're receiving thousands of dollars in tax credits and you didn't think you'd have to fill out a tax form in order to prove your eligibility?

At the time, I was calling out the 710,000 people currently enrolled in exchange-based policies who didn't bother filing a 2014 federal tax return whatsoever, and are now complaining about having to do so. I stand by my assessment.

However, as I referred to above and made special note of in a follow-up post that evening, there are another 760,000 people who did file their taxes this year...but who didn't include form 8962.

I noted at the time that I was sympathetic to those who "forgot" to include this particular form with their taxes...and it's a good thing that I made this distinction, because otherwise, I'd be looking pretty damned foolish today.

Why?

Because, as it turns out, I was among those 760,000 people who didn't include form 8962 when filing my taxes this year.

And no, despite what the IRS claims in the Times article, we never received any notice about the missing form...until a week or so ago.

According to the article:

The I.R.S. sent letters this summer to more than a million people who had received advance payments but had not filed tax returns, including some who had filed for an extension.

Notice that they say they sent letters out to those who didn't file at all, but it says nothing about whether they sent out notices to those who filed their taxes but forgot the extra form...and I can state that no, they never sent my wife or I any such notice this summer. Believe me, I freak out any time I get a letter from the IRS; I would've noticed.

So, what happened? Well, it turns out there are actually two IRS forms which relate to Advance Premium Tax Credits:

- Form 1095-A, which was automatically filled out for us and sent to us last spring, when we filled out our taxes; and

- Form 8962, which you're also supposed to fill out at the same time, using the data from 1095-A.

So, how are you supposed to know about form 8962?

Well, the letter attached to 1095-A does state the following:

"You must file a federal income tax return if you or another member of your household wants to claim the premium tax credit, or if advance payments of the premium tax credit were paid in 2014. When you file your tax return, you must complete and file Form 8962 (Premium Tax Credit). Use the information ion Form 1095-A when you complete Form 8962. If you want more information about Form 1095-A, read the "Instructions for Recipient" section on the back of the enclosed form. If you need Form 8962, visit irs.gov."

You'll note that I didn't include any bold-facing or other emphasis, because the IRS didn't do so either. Also note that Form 8962 was not included with 1095-A; you have to acquire it separately.

We have a very good CPA who does our taxes for us. He's a professional and very good at his job...but it looks like he missed this form, probably because it's brand new; presumably it didn't get included in the latest version of his tax software, or if it was, I presume it didn't get flagged as being required or whatever.

UPDATE 11/06/15: Yup, it turns out that his tax software update this year does include both Form 1095-A and 8962...but it only flags 8962 if you chose to take your credits when filing. In other words, if you already received your 2014 APTC assistance (ie, automatically deducted from your monthly premiums, as we did), the software doesn't recognize that you have to fill out form 8962...assuming that your income turned out to be higher than 400% FPL in the first place.

The good news is that this particular bug should only affect a small number of people: Those who

a) estimated that their income would be under 400% FPL;

b) received their APTC payments up front; and

c) ended up with incomes above 400% FPL.It's actually a very quick, easy thing to fix; we should be able to just file an amended form and be all set by early next week. I mean, we'll have to pay back a few hundred bucks, but that's fine (I honestly thought we had already done so last spring).

The bad news is that there are plenty of other circumstances/reasons why people might forget or not know about Form 8962, as evidenced by the 760,000 other folks who didn't do so...and many of them are likely to not straighten it out by December 15th.

It's worth noting that if a solid CPA using professional tax filing software managed to miss this form requirement, it makes it a hell of a lot easier to understand how 760,000 other people did as well; presumably many of them file taxes themselves.

OK, so how about the IRS? Well, again, they claim to have sent warning/reminder notices out to "more than a million people"...but they didn't send one to my wife or I.

The first we heard about this (at least in relation to our own tax filing status) was on October 30th, when HealthCare.Gov (not the IRS) sent an email warning us that there may be a problem with our tax credits relating to our tax filing status. It reads as follows (emphasis mine):

Important notification about your financial help

Recently, we sent you a notice about your health coverage for 2016. Unfortunately, we reviewed your coverage again and our records show that you may be at risk of losing financial help in 2016, unless you take action soon.

Your financial help might end for 2016 either because your income is too high, you didn’t authorize the Marketplace to check tax data or you didn’t file your 2014 federal income taxes to reconcile the financial help you received in 2014.

Here’s what you need to do:

- Make sure you’ve filed your 2014 taxes if you haven’t already. Visit HealthCare.gov/taxes or IRS.gov/aca for more information on filing your 2014 tax return. When you enroll for 2016 coverage, you’ll be asked by the Marketplace if you’ve filed your 2014 tax return and reconciled any financial assistance you used using “IRS Form 8962 Premium Tax Credit.”

- Visit HealthCare.gov beginning November 1, 2016 to update your 2016 application, see health plans and prices and enroll in a plan for 2016. You must take action by December 15, 2015 to make sure you stay covered.

If you haven’t filed your taxes or updated your 2016 application, you may not be eligible for financial help.

So, today we logged into HealthCare.Gov to take a look. There is no additional notification/warning when you first log in; no "YOU FORGOT TO FILE FORM 8962!!" warning or anything; just your account/profile and application info.

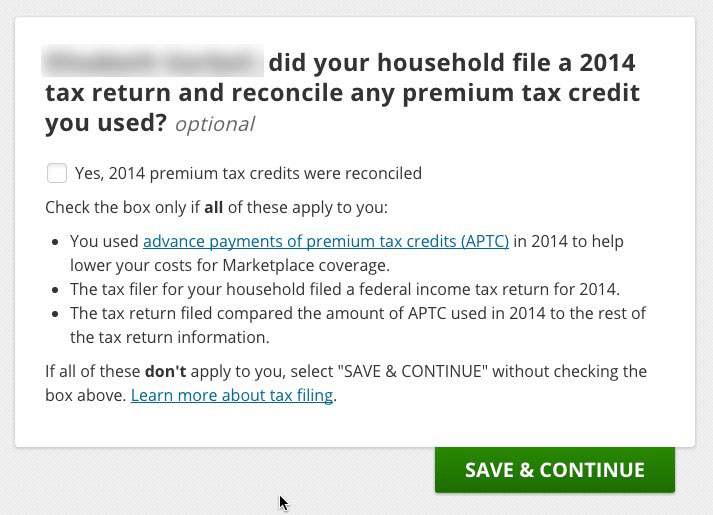

You don't actually see anything about Form 8962 until you go into your application and "Save/Continue" alllllllll the way through until the very last part of the "Other Questions" section (a good 70+ screens into the process), where you're finally presented with the following screen:

If you click the "Learn more about tax filing" link, it takes you here (again, emphasis mine):

Reconciling your tax credit

How do I know if I reconciled my tax credit?

The Marketplace can’t disclose your tax filing status, but you (and the tax filers on your application) are required to file a tax return and reconcile any advance payments of the premium tax credits (APTC) that were used to lower the cost of your monthly premiums, if you haven’t done so already.

You should’ve gotten a notice from the Marketplace—called a “Form 1095-A – Health Insurance Marketplace Statement”—that contains information that should be used to complete “IRS Form 8962.” You reconciled your tax credit if a tax return was filed for each year that you got APTC and you included a complete “IRS Form 8962” with your return. For more information about “IRS Form 8962,” visit IRS.gov.

To get “Form 1095-A,” check your notices in your Marketplace account, or call the Marketplace Call Center at 1-800-318-2596. TTY users should call 1-855-889-4325. Learn more about “Form 1095-A”.

What if I didn’t reconcile my tax credit?

If you had Marketplace coverage and tax credits were paid on your behalf to your plan to lower your premium costs, you must report those payments when you file your taxes for the coverage year in which you were enrolled. You can't get more tax credits through the Marketplace until you do so. For example, if you received tax credits to help pay for your premiums in 2014, you were required to file your taxes and reconcile your tax credits this year to continue receiving tax credits for the 2016 coverage year.

If you have questions about your household’s tax filing status for a previous year, use [Interactive Tax Assistant] (http://www.irs.gov/uac/Interactive-Tax-Assistant-(ITA)-1) or call IRS Telephone Assistance for Individuals at 1-800-829-1040.

Well, we did receive Form 1095-A, but we never received Form 8962.

So now, my wife and I, along with up to 760,000 other people nationally, have to fill out Form 8962 and find out how we're supposed to amend our 2014 tax return to include it...a good 7 months after filing in the first place.

- By the way, here's a direct link to Form 8962 on the IRS's website for anyone else who's in the same predicament.

So, what does this mean for 2016 Open Enrollment renewals?

Well, my wife and I are both college educated. We've both been self-employed for years. We've both been filing full 1040s with Schedule C's and other additional forms for years. Our CPA has decades of experience and is generally quite thorough. In addition, I've made something of a name for myself over the past 2 years as being pretty knowledgable about the Affordable Care Act in general and Advance Premium Tax Credits in particular. Finally, I've even written about this very issue twice in the past 2 weeks.

And my wife and I are still among those who have been nabbed by it.

Now, in our case, we'll talk to our CPA, HealthCare.Gov and the IRS as necessary to straighten it all out.

However, while I realize this sounds a bit condescending of me, I have to say it: If we ran into this problem and have to scramble, how many of those other 760,000 people are likely to sort it all out in time to keep their tax credits?

This is the single biggest reason why I'm no longer confident in my official 14.7 million QHP selection projection. I could easily see up to a half million or more being lost due to people thinking they're all set for APTC subsidies, going to submit their application and being hit with the full-price premiums instead (or, worse yet, not realizing they have to pay full price until the bill shows up from their insurance carrier). If that happens in large numbers, I'd imagine quite a few of them will take a pass on sticking with their policies at all.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.