New Hampshire: Requested 2016 avg. rate hikes: Likely around 13.8%

Louise Norris has again done some of the heavy lifting for me over at healthinsurance.org, this time for New Hampshire:

In 2015, New Hampshire’s exchange had five carriers, up from just one in 2014. There will still be five carriers in 2016, although there’s one swap: Assurant/Time is exiting the market (nationwide), but Ambetter (offered by Celtic) is joining the exchange in New Hampshire.

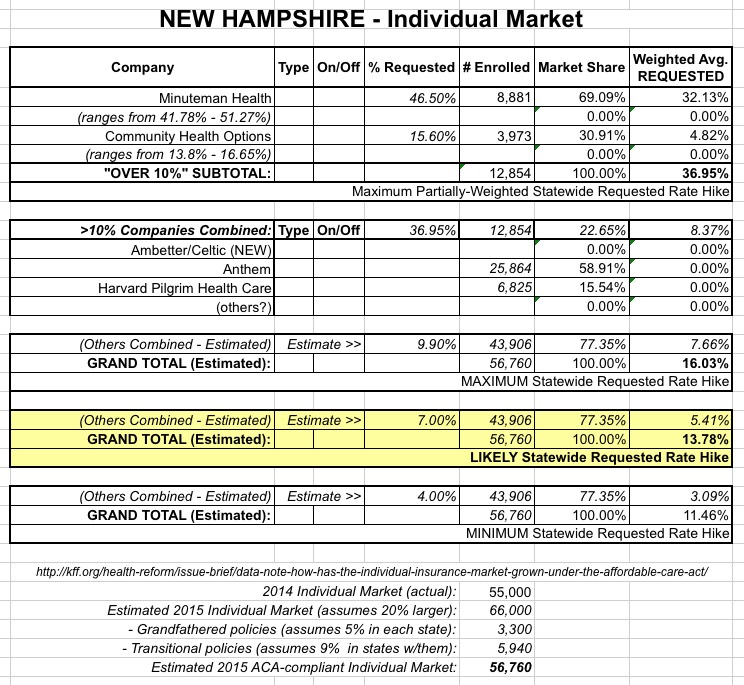

...Two carriers in the exchange – Minuteman Health and Community Health Options – have requested double digit rate increases, although they have not yet been approved. Both carriers are CO-OPs created under the ACA, and both expanded into New Hampshire at the start of 2015, so their claims data for the state is very limited.

...The other two returning carriers in the exchange have proposed rate changes of less than 10 percent, although their rate filings have not yet been made public. The New Hampshire exchange provides market share data that’s updated monthly; 45,543 people had in-force private plan coverage in the New Hampshire exchange as of September 2015. For now, we have the following market share and proposed rate increase data for the five individual market carriers in the New Hampshire exchange (Assurant had 189 enrollees in the New Hampshire exchange as of January 2015, but enrollment had dropped to zero by September):

Ambetter (Celtic) – new to New Hampshire exchange for 2016.

Anthem: proposed rate increase less than 10 percent. 25,864 in force enrollees as of September 2015

Community Health Options (previously known as Maine Community Health Options): proposed rate increase of 13.8 percent to 16.7 percent. 3,973 in-force enrollees as of September 2015.

Harvard Pilgrim Health Care: proposed rate increase less than 10 percent. 6,825 in force enrollees as of September 2015.

Minuteman Health: proposed rate increase of 42 percent to 51 percent. 8,881 in force enrollees as of September 2015.

As for the off-exchange market, according to Louise, it's the same 5 companies, and only those five companies:

The same five carriers will be offering individual policies outside the exchange in 2016, and there are no additional carriers in the state that only sell off-exchange products.

Community Health Options' 2016 filing claims that the total individual NH market is around 50,000 people (on+off), but their 2014 market was around 55,000, according to the Kaiser Family Foundation, and almost certainly has grown year over year. After knocking off the "grandfathered" and "transitional" policy enrollees, I estimate that it's likely around 56,000 at the moment.

It's important to note that New Hampshire has exactly 45,543 effectuated enrollees on the exchange as of September, so that leaves only around 10,000 people or so enrolled in off-exchange policies. Since all of those have been accounted for between the 4 existing companies, and Ambetter/Celtic won't start until next year, that leaves only those 10K off-exchange enrollees unaccounted for. It's also safe to assume that neither Minuteman nor Community Health have much interest in the off-exchange market at all, since they're both CO-OPs created specifically to target ACA exchange enrollees.

Louise uses a "worst-case" scenario which could mean up to an 18.5% weighted average rate hike for the NH market, but I'm a bit more hopeful. By splitting the high/low difference for Minuteman and Community, and by assuming a 7% average hike for the other 2 current companies (Anthem and Harvard Pilgrim), I come up with an estimated weighted average requested hike of around 13.8%:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.