Indiana: Approved 2016 weighted avg. rates could be LOWER than 2015?

Last year, while most state-wide average premium rates increased somewhat (averaging around 5.5% overall nationally, give or take), there were a few states which actually saw rate decreases from the year before: Arkansas, Mississippi and New Mexico saw overall decreases on their individual markets, while the District of Columbia and Hawaii saw decreases on their Small Business markets.

This year, so far at least, while many states are reporting rate hikes in the low single-digits, and many individual insurers are requesting rate drops, I haven't found any entire states where the weighted overall average is decreasing from 2015 to 2016. The lowest increase I've found so far is Maine, which is looking at a mere 0.7% overall hike (although this could change depending on the final approved rates).

That may change today...in an unexpected state: Indiana.

The good news is that Indiana's insurance dept. website lists every company in both the individual and small group market, whether they operate on or off of the ACA exchange, and includes not only their requested and approved rate increases, but even throws in the 2016 average premium as a dollar amount, which is a nice touch.

The bad news is that they don't include any actual enrollment numbers for any of the plans to allow a weighted average to be calculated. Links to the SERFF filings are included, but that would be a nightmare to slog through; many of those SERFF filings are 100 pages or more, and not all of them include the number of current members impacted anyway.

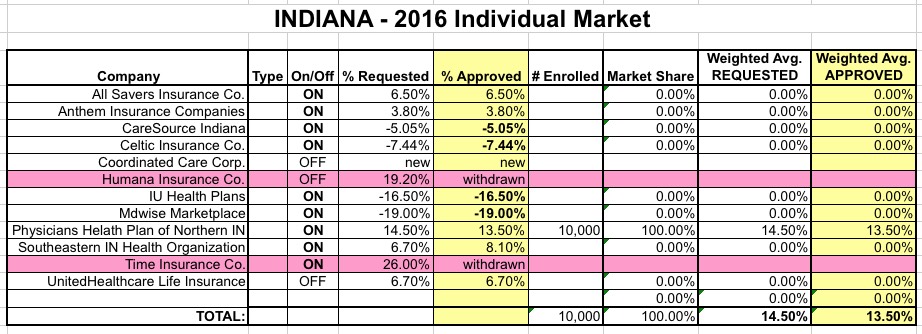

Normally, at this point I'd turn to the RateReview.Healthcare.Gov website, where I can usually at least track down the number of current enrollees for the companies requesting hikes greater than 10%...except that only 3 of the 12 companies operating in Indiana are seeking >10% hikes...and two of those have since withdrawn their requests anyway (Time Insurance, aka Assurant, has gone out of business, and i'm not sure what happened with Humana). In addition, one company (Coordinated Care) is brand-new and therefore irrelevant to the "rate hike" calculation this year.

As a result, I only know both the rate hike and enrollment for 1 of the 9 remaining companies: Physicians Health Plan of Northern Indiana has 10,000 enrollees, requested a 14.5% hike and had 13.5% approved.

HOWEVER, those 10,000 people likely only make up around 4% or so of the 230,000 people enrolled in Indiana's individual market this year (that market has actually likely grown about 20% this year, but that growth is likely cancelled out by the portion of enrollees on non-ACA compliant "grandfathered" or "transitional" policies).

Here's what it looks like in the spreadsheet:

As you can see, out of the 8 remaining companies, 3 are requesting hikes of 5-10%, 1 is requesting a 3.8% hike...and the other 4 have been approved for rate reductions of anywhere from 5 to 19%!

What does this mean? Again, without knowing the relative market share of these 8 companies, I have no way of knowing what the overall rate change will be...but I do know that it's somwhere between an 8% increase and a 19% decrease.

If All Savers, Anthem, Southeastern and UnitedHealthcare hold the lion's share of 2015 enrollees, the weighted hike will likely be somewhere in the low single digits.

However, if most of the enrollees are subscribed to CareSource, Celtic, IU Health Plans and MDwise Marketplace, it's conceivable that the weighted average could be as low as -10% or so!

Until I find out the current enrollment for at least a few of these companies, I'm going to assume that they cancel each other out and go with a flat, 0% rate change overall...the first one I've recorded this year.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.