UPDATED: "But How Many Have Actually PAID???" Revisited

SEE UPDATE BELOW!!

OK, the anti-ACA talking point of "How many enrollees have actually PAID???" has been one of the most commonly-made attacks on the exchanges since the first decent numbers started rolling in at the end of November. It seemed awfully silly back then, since at the time, the actual coverage start date was still weeks away. Most people I know don't pay their utility or credit card bills until just before they're due, so it seems disingenuous to assume that a health insurance policy (which could be up to $1,000+ per month for some families) would be any different.

Here's what I said about the issue on January 2nd, right after the first wave of policies kicked into effect:

Looks like I was correct: Out of over 2.1 million enrollees as of 12/31, about half (1.05 million) appear to have paid their January premium as of the end of the year. Presumably the other half are taking care of that this week. If most of them have their billing issues squared away 8 days from now, this talking point should really be dropped. If a significant number still haven't paid by then (and assuming that this is a higher ratio than the healthcare industry typically saw prior to the ACA), then it might have some substance, but again, this is all speculative until after the payment deadline is reached.

So, here we are, over a month later, and new stories from Investor's Business Daily and right-wing outlet NewsMax are gleefully claiming that "Obamacare Enrollment has Slowed to a Crawl!" and that "Only Half Have Paid!" so far. Ironically, both stories cite this website as one of their main sources for these claims, which I find highly amusing:

A spotty payment rate (50% in Washington and 66% in Nevada) creates a risk that the demographics of the paid exchange population may be older — and possibly sicker — than even the national signup data have signaled.

Health care consultant Robert Laszewski wrote that he believes about 20% ofObamaCare enrollees haven't paid. The administration said that exchange signups hit the 3 million mark around Jan. 23 — up from 2.2 million on Dec. 28. Laszewski figures the paid total through Feb. 1 will likely be about 2.5 million...

But January data from New York, Colorado, Maryland and Kentucky (easily accessible via acasignups.net) all suggest that the momentum which carried from December into January substantially faded in the second half of the month.

In Minnesota, Conservative Intelligence Briefing reported that 27,775 households had received private coverage from the MNsure exchange as of January 18. But only 14,500 have paid or have payments pending – a little more than half.

Minnesota, which has a goal of 67,000 sign-ups by March 31, has also been hit by a slow-down in Obamacare enrollments. After having soared by 4,000 a week for five weeks over December and early January, the rate has gone back to the November crawl of just 700 a week.

Investors.com says that the January data from New York, Colorado, Maryland and Kentucky also shows that the Obamacare sign-ups have slowed significantly in the second half of the month.

I'm not even going to address the "Enrollment Slowed to a Crawl" claims, which have been completely blown out of the water by yesterday's official HHS report (as well as my own earlier projections for January).

However, now that we're well into the 2nd month of the actual coverage period, it is worth revisiting the paid/unpaid numbers to see whether it's a legitimate issue or another tired talking point which should be put out to pasture.

First, let's look at the actual numbers that we do have. To my knowledge, there's only 5 states which have broken out their "paid vs. unpaid" enrollment figures. Nevada, Rhode Island and Washington have been doing so for quite awhile, while Vermont just did for the first time yesterday. Finally, Wisconsin hasn't officially done so, but there was a quote from the state Deputy Insurance Commissioner last week which stated that only about 50% of Wisconsin's enrollees from before January had paid so far. In fact, he claims that some insurance companies in Wisconsin are reporting that only 15% of their enrollees have paid so far, which I find very hard to believe; what for-profit company is going to allow 85% of their customers to stiff them? More on this below.

OK, so here's where things stand for these 5 states as of today:

- Nevada: 16,030 paid / 7,656 unpaid as of February 8 (68% paid)

- Rhode Island: 14,086 paid / 2,426 unpaid as of February 6 (85% paid)

- Vermont: 13,514 paid / 3,392 unpaid as of February 10 (80% paid)

- Washington: 90,723 paid / 85,372 unpaid as of February 6 (52% paid)

- Wisconsin: 20,376 paid / 20,376 unpaid who enrolled through 12/28 as of February 6 (50% paid)...plus another 15,684 who enrolled between 12/29 and 02/01. No idea what the breakout is for those.

- Minnesota: (Claim of 50% payment; see below)

Add up the first 5 of these states up (setting aside the 15.6K new enrollments for Wisconsin for the moment) and you get 154,729 paid and 119,222 unpaid (273,951 total), or around 56% paid. This doesn't sound very good, does it? It makes it sound like only 1.85 million "full" enrollments should be counted.

There's a couple of problems with stopping at "56% not paid", however. For one thing, the states are all over the map, ranging from as low as 50% (Wisconsin) to as high as 85% (Rhode Island). Note that aside from special-case Wisconsin, the other 4 are all state-run exchanges (HC.gov isn't equipped to report on paid/unpaid yet).

UPDATE: I forgot about this item from California Healthline which states that 75% of California's enrollees through 12/28/13 had already paid their premiums as of January 22nd, which only makes my point stronger.

If you add California's numbers (625,000) to the mix (only counting the enrollments through December, since we don't know the ratio for January yet), this brings the total across the 6 states up to 623,479 paid / 275,472 unpaid, or around 69%).

For another, let's take a look at the claim about Minnesota in the second quote above. This comes from a "Conservative Intelligence Briefing" which claims that "only 14,500 have paid/had payments pending" as of January 18 out of 27,775 enrollments in the state. They got this from the Jan. 22nd MNsure Dashboard presentation which included detailed info on the state of Minnesota's state exchange at the time. Sure enough, enrollment was 27,775 as of 01/18, and yes, there's a record on Page 14 of the report about payments. HOWEVER, they completely misunderstood this: That's 14,522 transactions, not 14,522 people paid for. A transaction covers a policy, which generally includes more than one person (ie, a family of 3 would only have one payment transaction, not 3). Take Minnesota out of the equation.

More importantly, let's look at the just-released Vermont report, which I already wrote about the other day:

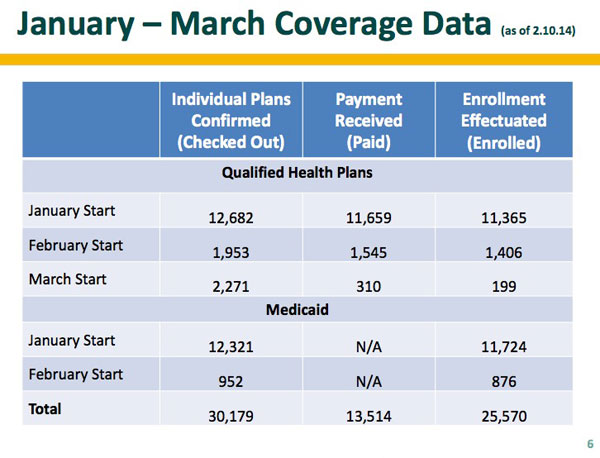

Page 6 has the key data: A total of 16,906 QHP enrollees as of 2/10, of whom 13,514 are paid up. Overall, this points to an 80% paid rate, which is very good--but the monthly breakout is even more interesting: January-start enrollees have a 92% paid rate (which you'd certainly hope for by now, considering that we're into mid-February) and February-start enrollees are at 79% paid. The March-start enrollees (14%) are the ones providing the main drag on the total...but this is hardly shocking since the start date for that coverage is still over 2 weeks away.

THIS, as far as I'm concerned, is the crucial thing to keep in mind, and this goes a long way towards explaining why Washington State, for instance, seems to have consistently "only" around 50-55% of their enrollees paid up: The majority of those "unpaid" enrollees are most likely the newer ones, enrolling in policies which haven't started coverage yet (or only did so recently). Yes, Washington has 85,000 unpaid enrollments...but if most of those are for March coverage, it's once again silly to claim that this is a problem.

The January non-payments are worthy of concern, and the February ones will be if they still aren't paid in another couple of weeks, but the March non-payments are a complete non-issue. Vermont is the only state which has broken out non-payments by month so far, so there's not enough to draw any conclusions, but if the national breakdown is anything close to theirs, this is pretty weak tea. In addition, some insurance companies and/or exchanges have already extended their normal payment deadlines generously to accomodate the transition period; they'd rather get their money a few weeks later than lose the customer completely.

The bottom line is this: Even the industry expert quoted by the anti-ACA sources above are admitting that the actual overall payment levels are currently at around 80% (which is, believe it or not, even higher than I figured). However, if most of the 20% unpaid enrollments don't start until March anyway, this is a complete non-issue.

Finally, let's look at the Wisconsin number. In addition to the low percentage (50%), the claims that it applies to policies which started coverage 43 days ago and that some insurance companies are reporting only a 15% payment rate should be setting off red flags across the board:

Schwartzer tells 27 News that while some of the state insurance companies participating in the federal marketplace have received premium payments for 65 to 70 percent of those policies, others have seen a payment rate of only about 15 percent.

Really? Some companies have 70% paid up while others are only at 15%?? Just how bad at targeting their marketing are the "15% paid" companies, that 85% of the people who sign up with them tend to be deadbeats, while other companies are that much better at convincing fine, upstanding Individuals to sign up with them?

Gee, it's almost as though some companies internal payment systems are working better than others. If that's part of the problem, then that's not the fault of either the person enrolling or the government exchange (in the case of Wisconsin, the Federal HC.gov site), but within the company itself.

The answer to the question of whether the "Unpaid!!" attack has any teeth depends on two things: WHICH payments haven't been made (ie, Jan-start, Feb-start or March-start) and WHY they haven't been paid.

I've addressed the "which" question above.

The Wisconsin situation gets into the why question.

There are several possible reasons why these payments haven't been made yet:

- Payment/data transfer problems between the insurance companies and the customers

- Payment extension policies by insurance companies allowing extended payment deadlines

- Payment/data transfer problems between the exchanges and the insurance companies

- Deadbeat customers

The "OMG!!! HOW MANY HAVE PAID???!!!" crowd seems to be absolutely convinced that the answer to every unpaid policy is #3 or #4, and if they're correct about this, then they may have a legitimate point. Some people are indeed deadbeats, and there are obviously still some serious technical issues with some of the exchanges.

However, I think I've successfully made the case that for the vast majority of non-payments, the reasons are either due to the fact that the payments simply aren't due yet or are because the company itself is having technical problems with their billing system...and if that's the case, then this is the company's fault and problem, not the Health & Human Services Department.

I think it's safe to assume that the breakdown is probably along the lines of:

- 75%-80% Fully Paid

- 10-15% Unpaid because payment isn't even due yet (Feb/March-start dates)

- 4% Unpaid due to internal Insurance Company technical/paperwork issues

- 4% Unpaid due to Exchange technical/paperwork issues (legitimate point)

- 2% Unpaid due to Deadbeat/Procrastinating Customers (possible legitimate point...but what was the industry average for deadbeats pre-ACA?)

If this breakdown is even close to accurate, then this is an utter non-issue. It doesn't mean that the exchanges don't need to fix their technical problems, but it's not exactly a "gotcha!" talking point either.

If you find my healthcare wonkery useful & would like to support it, you can do so in two ways:

1. Make a one-time or recurring donation.

2. Become a paid subscriber via Substack.