2026 Final Gross Rate Changes - Rhode Island: +21.0% (down from 23.8% requested) (updated)

Originally posted 7/18/25

Neighborhood Health Plan of Rhode Island (if IRA subsidies are extended):

Weighted Average Rate Increase: This represents the average rate increase, including modifications to prior year benefits and other pricing adjustments. The average premium increase to consumers, before reflecting changes in age is expected to be 16.3%.

The range of rate changes, before reflecting changes in age, which consumers will experience, is approximately 15.0% to 17.5%.

Neighborhood Health Plan of Rhode Island (if IRA subsidies AREN'T extended):

Weighted Average Rate Increase: This represents the average rate increase, including modifications to prior year benefits and other pricing adjustments. The average premium increase to consumers, before reflecting changes in age is expected to be 21.2%.

The range of rate changes, before reflecting changes in age, which consumers will experience, is approximately 20.1% to 22.2%.

Blue Cross Blue Shield of RI (if IRA subsidies are extended):

This filing is being made to establish new rates to be used effective January 1, 2026 for BCBSRI’s portfolio of plans in the Individual market. The proposed weighted average rate change for the Individual market is 19.2%. The actual rate impact on any given individual currently enrolled in an individual plan, however, will depend on the age of the enrollees, the plan selected, and whether the subscriber is eligible for federal subsidies.

...Enhanced Premium Tax Credits

This filing assumes that the enhanced federal premium tax credits remain in effect in 2026.

Blue Cross Blue Shield of RI (if IRA subsidies AREN'T extended):

This filing is being made to establish new rates to be used effective January 1, 2026 for BCBSRI’s portfolio of plans in the Individual market. The proposed weighted average rate change for the Individual market is 28.9%. The actual rate impact on any given individual currently enrolled in an individual plan, however, will depend on the age of the enrollees, the plan selected, and whether the subscriber is eligible for federal subsidies.

Enhanced Premium Tax Credits

This filing assumes that the enhanced federal premium tax credits expire at the end of 2025, and therefore are not in effect in 2026.

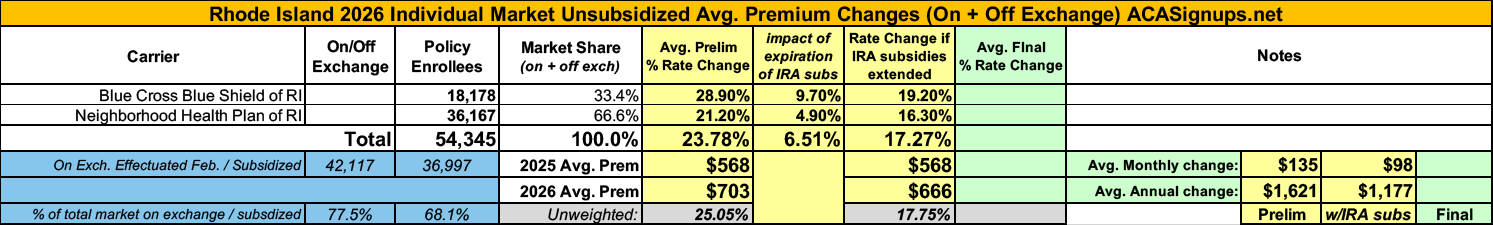

Overall, the weighted average requested premium increase across both individual market carriers is 23.8% if IRA subsidies expire vs. 17.3% if they don't.

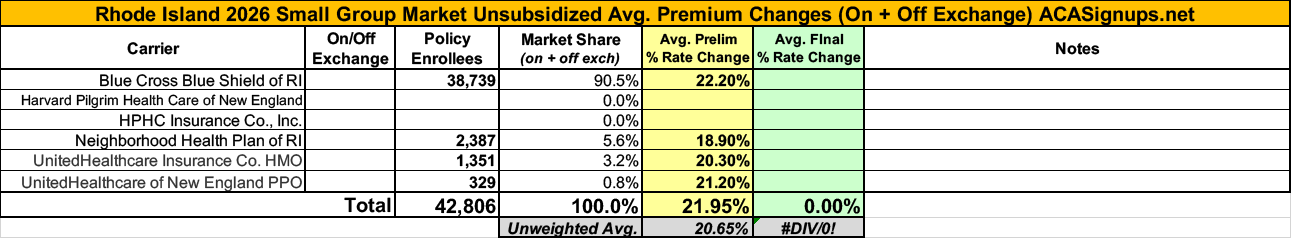

The small group market carriers are asking for an equally-eyebrow raising 22% on average, although two of last years carriers may not be participating this year (?)

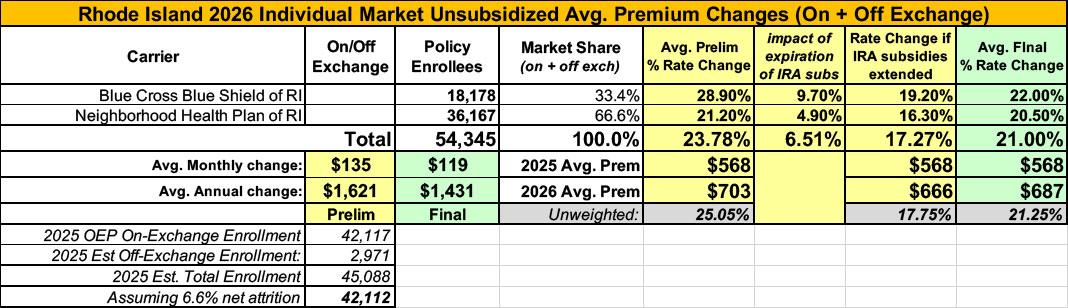

UPDATE 9/19/25: Both BCBS RI and Neighborhood Health Plan have published their final/approved 2026 rate filings.

In both cases the average rate increase was shaved down by a few points, resulting in a weighted average increase of 21.0% instead of 23.8%.