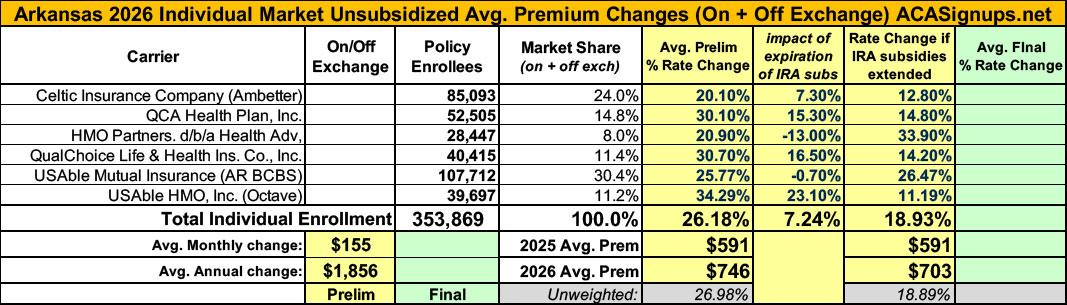

2026 Rate Changes - Arkansas: +26.2%; ~7 pts due specifically to IRA subsidy expiration (preliminary)

From the Arkansas Insurance Dept:

Health Insurance Rate Changes for 2026

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with the Arkansas Insurance Department for review and approval before plans can be sold to consumers.

The Department reviews rates to ensure that the plans are priced appropriately. Under Arkansas Law (Ark. Code Ann. § 23-79-110), the Commissioner shall disapprove a rate filing if he/she finds that the rate is not actuarially sound, is excessive, is inadequate, or is unfairly discriminatory.

The Department relies on outside actuarial analysis by a member of the American Academy of Actuaries to help determine whether a rate filing is sound.

Below, you can review information on the proposed rate filings for Plan Year 2026 individual and small group products that comply with the reforms of the Affordable Care Act.

To review the approved plan filings for Plan Year 2025, click here, Plan Year 2024, click here, Plan Year 2023, click here, Plan Year 2022, click here, Plan Year 2021, click here, Plan Year 2020, click here.

You may also view rate filings for previous years through the federal government's Rate Review website here.

Users will only be able to view the public details of the filing, as certain portions are deemed confidential by law (Ark. Code Ann. § 23-61-103).

Celtic:

Morbidity and Risk Adjustment

This component is 7.3% of the 20.1% total filed increase.

...To account for eAPTC expiration prior to the 2026 benefit year, we have assumed rates will increase due to anticipated reductions in enrollment, both at the issuer and single risk pool level. As eAPTCs expire and enrollees subsequently face increased out-of-pocket premiums, we assume healthier individuals who tend to be more price sensitive will leave the market, worsening the average morbidity of the individual risk pool.

Federal Policy Assumptions:

The proposed rate increase of reflected in this memorandum assumes that:

1. eAPTCs expire at the end of 2025, and

2. CMS’ Marketplace Integrity and Affordability rule, as published in the Federal Register on March 19, 2025, is finalized as proposed.

Both policy changes are expected to materially affect projected enrollment and morbidity for plan year 2026 at the issuer and single risk pool level. Most notably, as eAPTCs expire and enrollees face increased out-of-pocket premiums, we assume healthier individuals who tend to be more price sensitive will exit the market, worsening the average morbidity of the individual risk pool. Shifts in statewide average morbidity, including both above policy changes, are expected to increase the Index Rate by (REDACTED) between the base and projection periods.

HMO Partners/Health Advantage:

Other – Defined as:

The other category includes adjustments for demographic factors, tobacco usage factors, morbidity factors, taxes, fees, and net risk adjustment.

This component is -13.44% of the 20.90% total filed increase.

...Changes to the Exchange User Fee, which will be 2.0% in 2026, based on Scenario #1 assuming the expanded tax credits under ARPA are not extended.

Anticipated impact of ARPA tax credits terminating 12/31/2025, which will significantly reduce On-Exchange enrollment.

QCA Health Plan:

Impact of eAPTC Expiration

To account for eAPTC expiration prior to the 2026 benefit year, we have assumed rates will increase due to anticipated reductions in enrollment, both at the issuer and single risk pool level. As eAPTCs expire and enrollees subsequently face increased out-of-pocket premiums, we assume healthier individuals who tend to be more price sensitive will leave the market, worsening the average morbidity of the individual risk pool.

QualChoice Life & Health:

Morbidity and Risk Adjustment: This component is 16.5% of the 30.7% total filed increase.

Impact of eAPTC Expiration

To account for eAPTC expiration prior to the 2026 benefit year, we have assumed rates will increase due to anticipated reductions in enrollment, both at the issuer and single risk pool level. As eAPTCs expire and enrollees subsequently face increased out-of-pocket premiums, we assume healthier individuals who tend to be more price sensitive will leave the market, worsening the average morbidity of the individual risk pool.

USAble Mutual Insurance:

The morbidity factor for the projection period reflects the higher risk/acuity of the block from the experience period to the projection period, with particular emphasis placed on (1) the ARHOME program instituting work requirements “with an anticipated start date of January 1, 2026” 9 and (2) the termination of APRA enhanced tax subsidies.

Welp. As I warned a couple of weeks ago, the conventional wisdom assumption that "Medicaid work requirements won't begin until after the midterms" is vastly misstated. The actual wording of the language in the "OBBBA" (MAGA Murder Bill) is that they'll begin:

"...the first day of the first quarter that begins after December 31, 2026, or, at the option of the State under a waiver or demonstration project under section 1115 or the State plan, such earlier date as the State may specify."

Since Arkansas is one of the handful of states which had already had such a waiver/demo project approved during the first Trump Administration (it was suspended via court order at the time), they're clearly planning on reinstating their work reporting requirements as soon as possible...which appears to be less than 6 months from today.

If you're wondering why this reference to a Medicaid program is showing up in an ACA individual market rate filing, that's because Arkansas has a unique spin on "Medicaid expansion" under the ACA: Instead of actually enrolling the expansion population into Medicaid itself, they use the federal money earmarked for the program to instead pay the premiums/deductibles/etc for enrolling the same population into ACA exchange plans.

Doing this costs more than simply enrolling them into Medicaid would, but it was apparently the only way to get the expansion provision passed through the state legislature at the time, so here we are.

USAble HMO, Inc:

The other category includes adjustments for demographic factors, tobacco usage factors, morbidity factors, taxes, fees, and net risk adjustment.

This component is 23.13% of the 34.29% total filed increase.

The morbidity factor for the projection period reflects the higher risk/acuity of the block from the experience period to the projection period, with particular emphasis placed on (1) the ARHOME program instituting work requirements “with an anticipated start date of January 1, 2026” 9 and (2) the termination of APRA enhanced tax subsidies.

In any event, the avg. requested 2026 rate increase individual market-wide is a whopping 26.2%, with over 7 points of that connected directly to the IRA subsidies expiring, while while small group carriers are asking for an average 7.9% increase.

It's important to note that Arkansas enrolls Medicaid expansion-eligible enrollees into ACA-compliant individual market policies instead. The official 2025 OEP QHP enrollment was 166,639 people, while ARHOME enrollment was 227,078 as of May 2025, or 393,717 combined. There's also some unknown number of off-exchange QHP enrollees in the state, which means the actual total is likely around 400,000 or more. I don't know what accounts for the missing ~50,000 or so enrollees since no carriers are pulling out of Arkansas in 2026 to my knowledge.