The Dead Pool revisited: JD Vance wants to Concentrate those w/Pre-Existing Conditions into separate camps.

I've spent the past couple of weeks up to my ears in 2025 annual healthcare policy rate filing analysis, so I haven't gotten around to addressing JD Vance's recent appearance on NBC in which he finally explained exactly what Donald Trump's "concept of a plan" for healthcare is:

When Donald Trump stammered at the recent presidential debate that he had “concepts of a plan” for Americans’ health care, he came across like a child who had forgotten his homework. But thanks to his campaign and his running mate JD Vance, we know now the Republican ticket really does have some “concepts.” Those concepts are bringing health care into the election — and presenting a tremendous opportunity to Vice President Kamala Harris.

Last Sunday, Vance raised the eyebrows of anyone familiar with health care policy when he told NBC’s Kristen Welker about Trump’s “deregulatory agenda.”

“A young American doesn’t have the same health care needs as a 65-year-old American,” he told Welker. “We want to make sure everybody is covered. But the best way to do that is to actually promote some more choice in our health care system and not have a ‘one size fits all’ approach that puts a lot of people into the same insurance pools, into the same risk pools, that actually makes it harder for people to make the right choices for their families.”

(sigh) Hoo boy. Here we go again. To review...

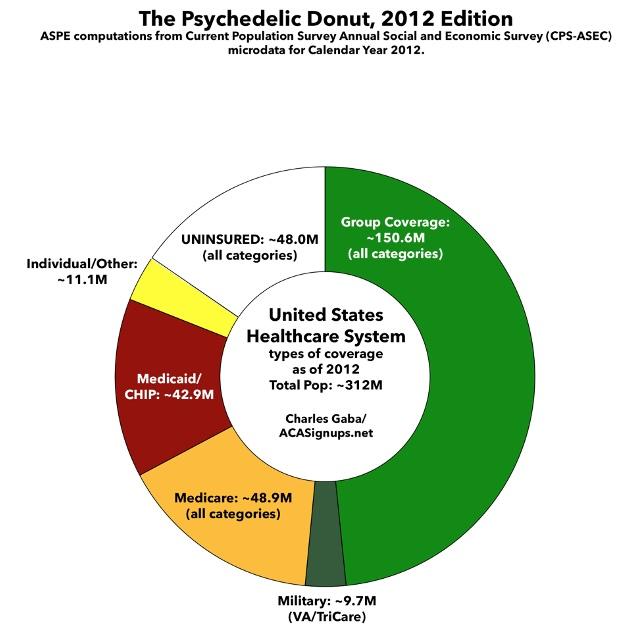

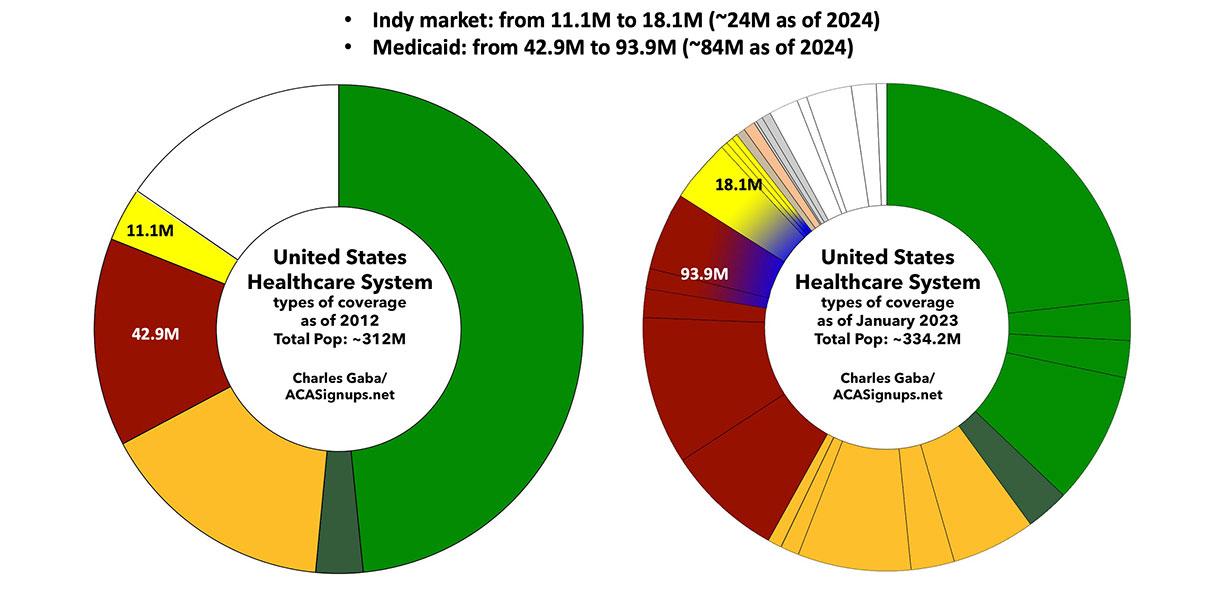

This donut graph represents the types of healthcare coverage the entire US population had as of 2012. This was shortly before most ACA provisions went into effect:

Around half the population was enrolled in some sort of employer-based coverage, including the U.S. military. Another 30% were enrolled in either Medicare, Medicaid, or the Children's Health Insurance Program (CHIP).

Perhaps 11 million were enrolled various types of "non-group" or "individual market" plans directly through insurance carriers...and around 48 million Americans, over 15% of the total population, had no healthcare coverage at all.

The ACA had two main goals: First, to reduce the number of uninsured Americans as much as possible by making coverage less expensive and more accessible; and second, to provide consumer protections from industry abuses to everyone, but ESPECIALLY those in the individual market, where the abuses were the worst.

Before the ACA, the individual market was basically the Wild West. Much of the coverage was "junk plans,", covering very little. There were some exceptions, but it was mostly a crapshoot, with few standards and very little regulation in most states.

Pre-ACA nongroup plans were a hodge-podge, including an array of patchwork policies known as Mini-Meds, Short-Term Plans, Farm Bureau Plans, Association Plans, Sharing Ministries and so on...some of them not even legally defined as health insurance.

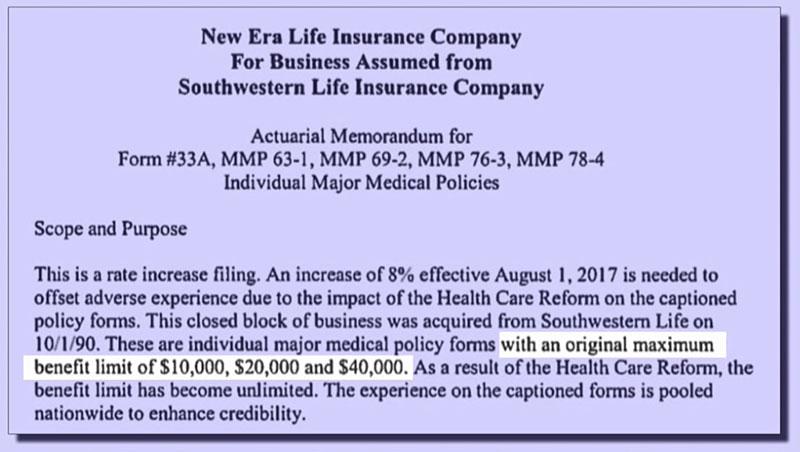

To give you an idea of how stingy some of these plans were, here's a few examples from before most ACA individual market regulations went into effect:

For example, McDonald’s”McCrew Care" benefits requires employees to pay $56 per month for basic coverage that provides up to $2,000 in benefits in a year and $97 per months for a Mid 5 plan that provides up to $5,000 in benefits. Ruby Tuesday charges workers $18.43 per week...for coverage that provides up to $1,250 in outpatient care per year and $3,000 in inpatient hospital care. Denny’s basic plan for hourly employees in 2010 provided no coverage for inpatient hospital care and capped coverage for doctor office visits at $300 per year.

Even many so-called "major" medical plans often had extremely skimpy benefit limits, like this one which capped coverage at no more than $40,000 per year.

The maximum cap was more typically in the $1 - $2 million range, which sounds like a lot...but that was often your LIFETIME cap, and if you had to undergo chemotherapy, or gave birth to a preemie who had to stay in a neonatal unit for a few weeks, you'd find out how quickly that could add up. Not that it mattered since many of these policies didn't cover maternity or neonatal care anyway.

The biggest issue with individual market coverage prior to the ACA was that insurance carriers could cherry pick who they'd allow to become enrollees, what they'd be covered for, and how much of the claims they felt like paying for, if anything.

That brings us to risk pools.

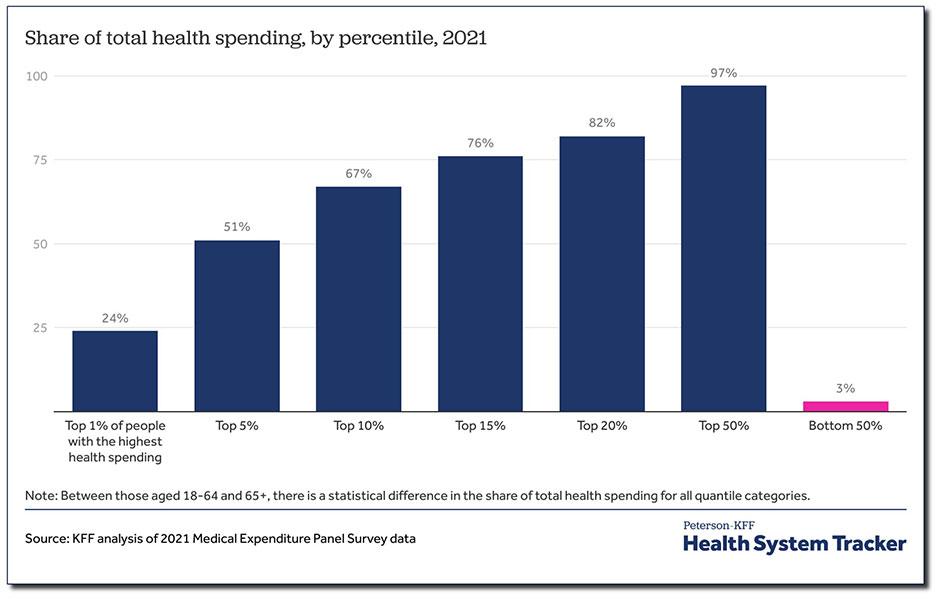

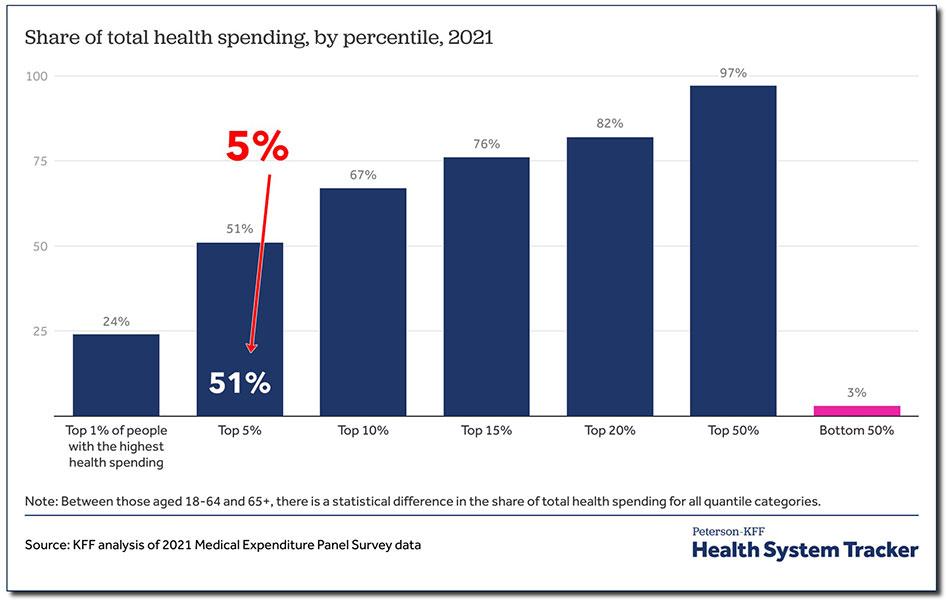

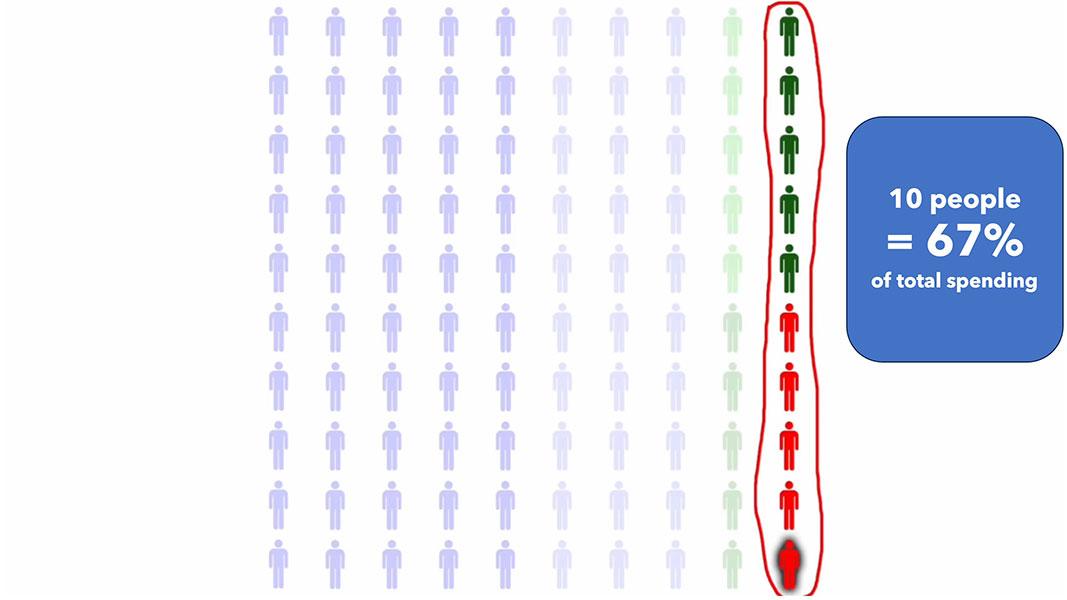

According to KFF, this is the breakout of total healthcare spending among the U.S. population. The proportions change slightly from year to year, but it's been remarkably consistent for decades.

Generally, the unhealthiest 1% of the total population accounts for around a quarter of total healthcare spending. When I say TOTAL, I mean doctors, nurses, hospitals, clinics, prescription drugs, medical equipment...everything, regardless of who's paying the bill.

5% of the population accounts for over half of total healthcare spending; and 50% of the population accounts for full 97% of all healthcare spending.

Total healthcare spending in the United States reached $4.5 trillion in 2022. Again, when I say total I mean everything: Medicare, Medicaid, the ACA, the VA, the IHS; all private insurance, all premiums, deductibles & co-pays...everything. All of it came to $4.5 trillion, or an average of $13,500 apiece.

Let's suppose we boil the entire population down to exactly 100 people. At $13,500 apiece, the total aggregate healthcare spending for all 100 would come to around $1.35 million.

Some of them won't require anything more than an annual physical. Some may come down with a nasty flu. Some may break their finger and require a splint or physical therapy. Some of them may require complex surgery like a coronary bypass. And finally, a few will come down with serious, expensive medical issues like cancer or diabetes.

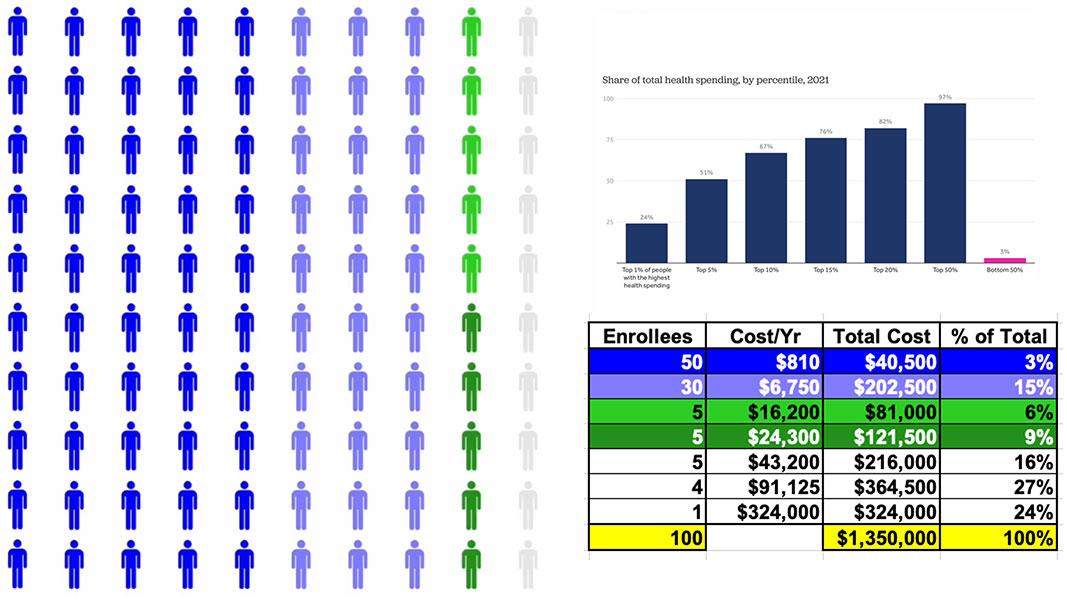

Using the KFF graph, this is how that $1.35 million breaks out across all 100 people. Half only need around $800/year in medical spending; another 30 would run $6,700 apiece, and so on.

90% of them would only add up to 1/3 of the total.

That leaves the remaining 10% racking up the other 2/3, including one poor soul who would require hundreds of thousands of dollars in healthcare spending per year.

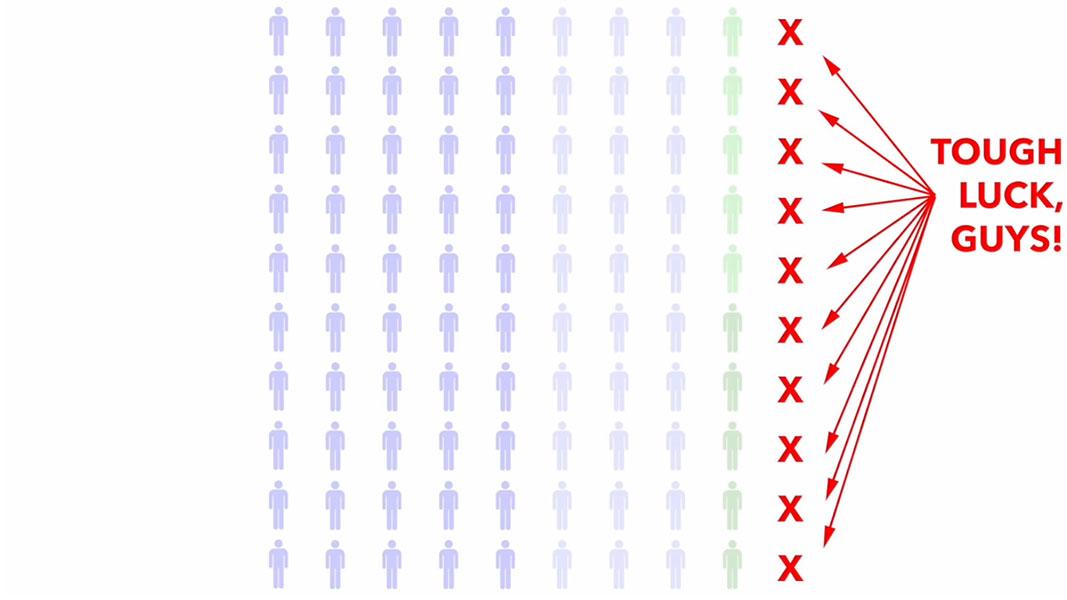

So, let's suppose that all one hundred of these people want to buy health insurance directly from a carrier.

Before the ACA, the carrier would stop them and say: First you need to tell me, in explicit detail, your entire medical history. That's every medical diagnosis; every hospital visit; every prescription; every lab test; every surgery; every x-ray; EVERYTHING.

Then, an actuary would pore over all of your records and decide whether to allow you to enroll...or kick you to the curb.

Basically, they were weeding out the 10% of the population which eats up 2/3 of total healthcare spending. This is called Medical Underwriting, and it was the single biggest reason why people were told "no dice," denied coverage & had to try elsewhere.

By cutting off the most expensive enrollees, they were left with 90 people at 1/3 the claims cost. For those 90, the average healthcare costs just dropped from $13,500 each to under $5,000.

This is why, ON THE SURFACE, pre-ACA individual market premiums were relatively inexpensive...for those deemed healthy & low-risk enough to be allowed to enroll at all.

But what about the other ten? They were often deemed "uninsurable at any cost" and effectively blacklisted by the insurance industry for having "Pre-Existing Conditions."

So, what counted as a "Pre-existing condition" which might mean you got kicked to the curb? Well, here's a list of the most common ones...

- AIDS/HIV

- Alcohol abuse/ Drug abuse with recent treatment

- Alzheimer’s/dementia

- Arthritis (rheumatoid), fibromyalgia, other inflammatory joint disease

- Cancer within some period of time (e.g. 10 years, often other than basal skin cancer)

- Cerebral palsy

- Chronic obstructive pulmonary disease (COPD)/emphysema

- Congestive heart failure

- Coronary artery/heart disease, bypass surgery

- Crohn’s disease/ ulcerative colitis

- Diabetes mellitus

- Epilepsy

- Hemophilia

- Hepatitis (Hep C)

- Kidney disease, renal failure

- Lupus

- Mental disorders (severe, e.g. bipolar, eating disorder)

- Multiple sclerosis

- Muscular dystrophy

- Obesity, severe

- Organ transplant

- Paralysis

- Paraplegia

- Parkinson’s disease

- Pending surgery or hospitalization

- Pneumocystic pneumonia

- Pregnancy or expectant parent

- Sleep apnea

- Stroke

- Transsexualism

...but guess what? You could also be be denied coverage for having had acne, "back problems," high cholesterol or clinical depression.

But that's not all! There was also an extensive list of occupations which could be denied coverage entirely--air traffic controllers, meat packers, pilots, scuba divers, taxi drivers (which I'm guessing would include Lyft or Uber drivers today).

Essentially, a "pre-existing condition" was really defined as "whatever the hell the insurance carrier felt like calling one."

In some cases carriers WOULD offer coverage...at several times the normal rate. In other cases they'd offer a policy which covered everything EXCEPT the one condition they were in most desperate need of the policy to cover in the first place.

Finally, many policies simply flat-out didn't cover services like maternity care, prescription drugs or mental health services.

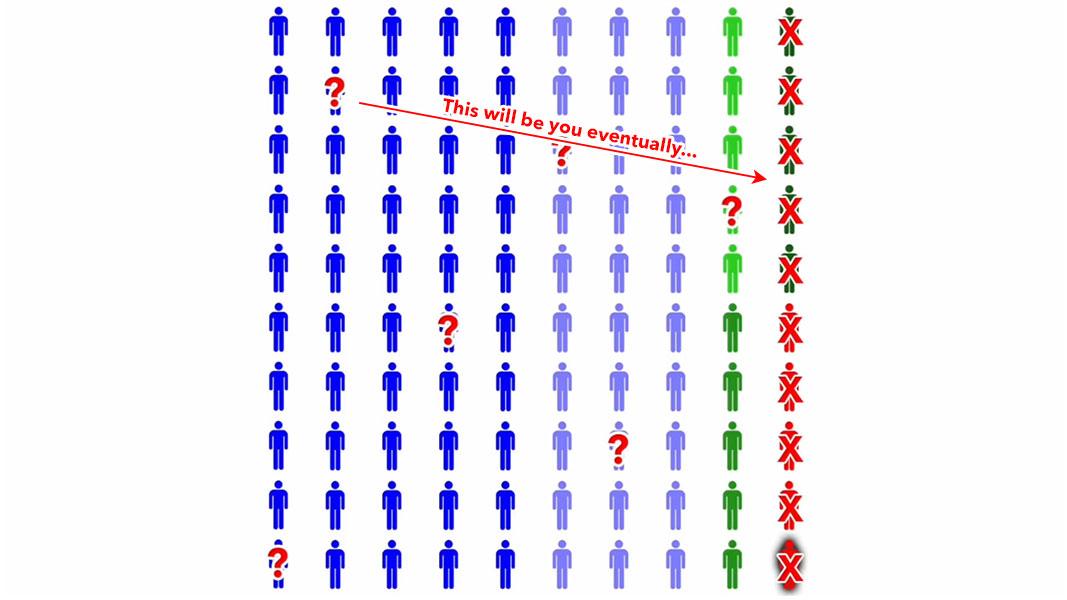

Now, if you're healthy and don't have a soul, you might not give a shit about sick people being thrown under the bus as long as it cuts your healthcare costs down...but there's still a big catch even for the amoral:

People who are healthy today get sick & injured too. On a long enough timeline, pretty much EVERYONE develops one or more serious medical conditions, putting them into the other 10%.

Again, there WERE some options for folks who were denied comprehensive coverage by legitimate insurance carriers, but they ranged from so-so to practically useless, and in many cases were run by fly-by-night outfits participating in outright fraud.

Now that I've explained the problems in the individual market before the ACA, here's how the law attempted to fix them.

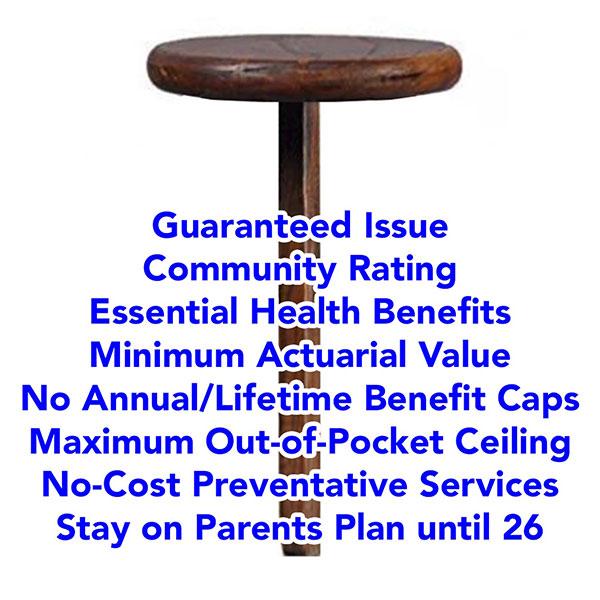

1. Guaranteed Issue

First, it required that all major medical policies be given guaranteed issue status. This means insurers have to offer them to anyone who wants to enroll, regardless of health condition, medical history or other factors. They can't even ASK about health or medical history.

2. Community Rating

Next, all major medical plans have to be Community Rated, which means premiums, deductibles, copays & coinsurance can't vary based on anything other than how age, where they live, and whether or not they smoke.

3. Essential Health Benefits

Next: The ACA requires all major medical plans to include coverage for ten essential health benefits, or EHBs, including: Outpatient services, emergency care, hospitalization, maternity & newborn care, mental health & substance abuse, prescription drugs, rehab services, lab services, preventative services, & pediatric services.

4. Minimum Actuarial Value

ACA-compliant plans also have to have a minimum Actuarial Value, or AV. This refers to what percent of average healthcare expenses the plan pays for, in aggregate. ACA plans generally have to have AVs between sixty to ninety percent, with metal level designations--Bronze, Silver, Gold or Platinum. Generally, Bronze plans, which have a 60% AV, have the lowest premiums but the highest deductibles, while Platinum plans, at 90% AV, have the highest premiums but minimal deductibles.

5. No more Annual/Lifetime Benefit Limits

6. Maximum Out of Pocket Ceiling

Next: ACA plans eliminate both the annual & lifetime benefit caps. At the same time they have to INCLUDE a cap on out-of-pocket expenses for in-network care. This is called Maximum out-of-Pocket or MOOP, which includes the deductible, co-pays & coinsurance. Anything over the MOOP for in-network care has to be paid for by the carrier.

7. No-Cost Preventative Services

ACA plans have to cover a long list of preventative services at no out-of-pocket cost to the enrollee, as long as they performed by an in-network provider.

This includes things like annual physicals, mammograms, blood screenings, immunizations, colonoscopies and so forth.

8. Stay on Parents Plan until 26

Under the ACA, Insurance carriers must allow Young Adults to stay on their parents plans up to age 26.

When you add all of these together, you create a 1-Legged Stool.

However, when you require policies to be comprehensive, but also DON'T have any restrictions on who can enroll or when they can do so, healthy people tend not to enroll at all until they get sick or injured.

This causes premiums to shoot up for those who do enroll, which in turn causes more low risk enrollees to drop out, which in turn causes premiums to increase even more, causing more people to drop out and so on.

It's like waiting until you crash your car to get auto insurance, or waiting until after your house catches on fire to buy homeowner's insurance.

It's the reason why you can't drive a car without auto insurance and you can't get a mortgage without homeowners insurance.

The flip side of this is that putting healthy people into the same risk pool as unhealthy people--which is kind of the entire point of health insurance in the first place--means that yes, some people would have to start paying more than they otherwise might have until their situation changes (ie, until they get sick or injured themselves...which, again, is the entire reason health insurance exists)...which is why the ACA also includes financial assistance to help make the dramatically more comprehensive coverage affordable for enrollees, on a sliding income scale.

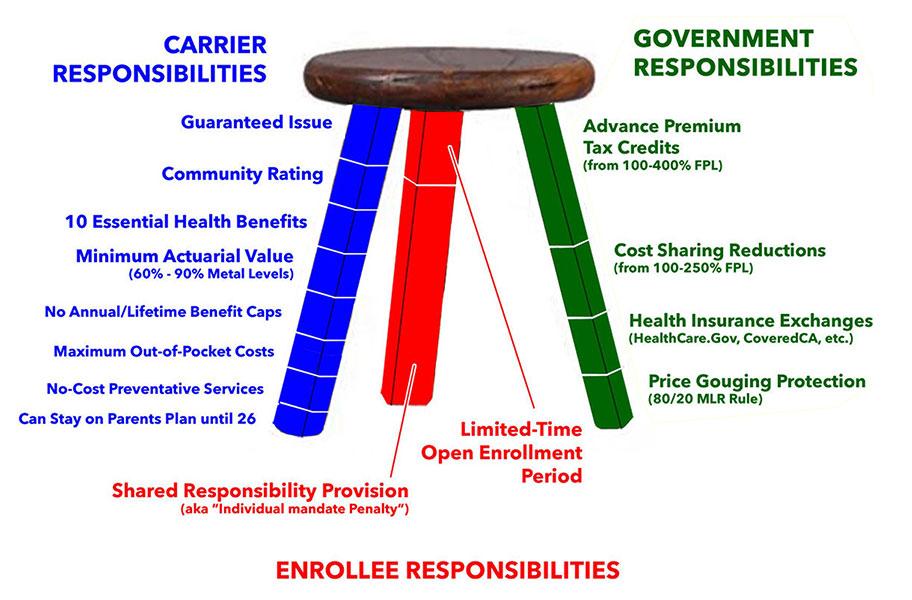

In short, the ACA uses a THREE-Legged Stool instead, based on the Massachusetts model:

The first leg, Carrier Responsibilities, includes everything I just talked about: Guaranteed Issue, Community Rating, Essential Health Benefits, Minimum AV, Elimination of Annual or Lifetime Caps, Maximum Out-of-Pocket costs, Zero-Cost Preventative Services, Young Adult on their Parents Plans until 26 & some other requirements.

The other two legs include carrots & sticks.

The red leg--the sticks--included the controversial Individual Mandate Penalty, along with a limited-time Open Enrollment Period which currently runs 75 days, from November 1st - January 15th in most states.

The green leg--the carrots--mostly consists of the Financial Subsidies, but also includes the Health Insurance Exchanges as well as Price Gouging Protections.

There's two types of subsidies: Premium Tax Credits for people earning up to 400% of the federal poverty line, and Cost Sharing Reduction, or CSR, subsidies which can dramatically reduce deductibles, co-pays and so on for families earning up to 250% FPL.

The healthcare marketplaces, or exchanges, are website platforms designed to let people easily compare and shop for private health insurance policies on an unbiased, level playing field.

Most states use the federal exchange, Healthcare.Gov...but 19 states have their own, State-Based Exchanges instead, and two more, Georgia and Illinois, are scheduled to do so this fall as well.

The Anti-Price Gouging provision is one of the most successful, but least known parts of the ACA. Insurance carriers have to spend at least 80% - 85% of their premium revenues on actual medical claims in both the Individual AND Group markets. This is called the MEDICAL LOSS RATIO rule.

When you put all of this together you get what was envisioned as the three legged stool. In practice it's MOSTLY worked out, but there have also been some gaps and problems, some of which have been fixed.

There have also been several significant changes in the law. Three of the most significant are:

- First, in 2017, Congress zeroed out the individual mandate penalty, effective January 2019. They technically didn't REPEAL the penalty; they just changed the amount of it to nothing. This led to unsubsidized premiums increasing by around 8%, or roughly $580 per enrollee per year on average nationally. A handful of states have since reinstated the penalty at the state level.

However, since the vast majority of ACA exchange enrollees are subsidized, in practice this means that federal subsidies increased by several billion dollars per year to match the premium increase, which I've labeled the "World's Most Expensive Shim®."

The truth is that regardless of the merits of the individual mandate penalty as a cost saving measure, now that it's been repealed (pardon me...changed to $0), there's virtually no chance of it ever being reinstated in the future at the federal level, even under a Democratic trifecta. It was just too controversial for too long that I can't imagine anyone in Congress will ever want to touch it again.

- Also in 2017, as a result of a long-winding lawsuit, the Trump Administration discontinued reimbursement payments for the Cost Sharing Subsidies. Most insurance carriers responded to this by dramatically raising their premiums starting in 2018 in order to capture the revenue they were losing due to CSR reimbursement payments being cut off.

However, some carriers realized that if they raised premiums ONLY on Silver plans, which are the only type eligible for CSR subsidies, this would actually result in premium subsidies increasing to match the rate hikes, which in turn resulted in lower net premiums for many enrollees.

This is known as "Silver Loading." Unfortunately, its use is still pretty scattershot and misunderstood by some carriers and state regulators.

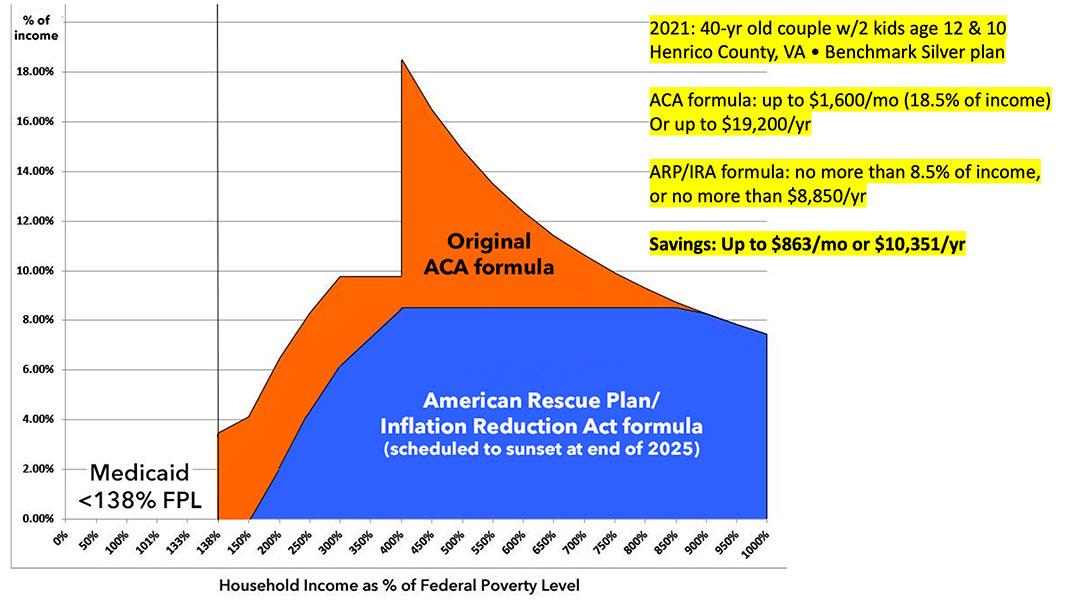

Finally, there was the much-hated "Subsidy Cliff."

While the original subsidy formula was decent for lower-income enrollees, they were increasingly stingy as you moved up the income scale, and they cut off entirely for anyone earning more than 4x the poverty level. This meant that middle-class enrollees were hit from both sides: They earned too little to be able to afford to pay full price but too much to receive financial help.

So, in 2021, the Democratics in Congress made the premium subsidies significantly more generous, while also expanding them so that NO ONE has to pay more than a maximum of 8.5% of their household income in premiums. The Inflation Reduction Act extended these enhanced subsidies, but only through the end of 2025.

The end result of all of this is that enrollment in ACA exchange policies have increased 2.8-fold since 2014, from 8 million people to over 22 million this year. At the same time, ACA Medicaid expansion to all adults who earn less than 138% of the Federal Poverty Level has increased from fewer than 6 million people to 23 million.

In the end, thanks to the ACA, the uninsured rate in the U.S. has been cut in half from 48 million to 26 million, even as the total population has grown from 312 to 334 million people.

These side by side donut graphs illustrate this...although the second one only runs through 2023; as of 2024, the individual market has grown even more to around 24 million people, while Medicaid enrollment has shrunk due to the ongoing post-pandemic "unwinding" process:

Now, JD Vance is proposing to go completely the opposite direction of the ACA, and his end goal is something called "High Risk Pools."

The whole idea behind High Risk Pools is exactly what it sounds like: Separate out the most expensive, say, 10% of the population (give or take) from everyone else and enroll them in a different insurance program funded by...the government.

As noted above, in theory this would reduce the costs for the other 90% of the population by around 2/3. Voila! Problem solved, right?

Well...not so much.

First, notice that reshuffling the deck like this in and of itself doesn't do a damned thing to reduce the overall cost of healthcare for the total population involved; it just means that instead of a single group of 100 people costing $1.35 million, it's now two groups of 90 and 10 people apiece costing $450K and $900K respectively...or $1.35 million total. All that changes is how and where the funding for it all comes from.

Let's assume Vance's proposal would cover the same ~24 million people currently in the ACA-compliant individual health insurance market. Using the example above, you'd have 21.6 million enrollees averaging $4,500/yr apiece and 2.4 million High Risk Pool enrollees averaging $90,000/yr apiece. If you assume the HRP enrollees paid the same $4,500 portion that everyone else does, that means the federal government would still have to shell out a whopping $205.2 billion per year.

And remember, even that simplified $13.5K/year average cost estimate was as of 2022. I'd imagine it'll be more like $15K/year by 2026, the earliest that any such policy overhaul could be implemented by a theoretical Trump/Vance administration. That'd put the government's portion of the bill at more like $228 billion the first year.

On the flip side, that $13.5K average includes people on Medicare, which skews higher...but it also includes Medicaid, which skews much lower, so it's probably still about right.

For what it's worth, $228 billion is nearly twice as much as total ACA premium & CSR assistance this year (around $125 billion)...and that includes the upgraded subsidies provided for by the Inflation Reduction Act, which are scheduled to expire at the end of 2025 and which Congressional Republicans have no intention of extending.

How likely do you think it is that a Trump/Vance Administration (or a GOP Congress) would be to propose nearly doubling that amount?

As it happens, during the 2017 ACA Repeal/Replace saga, then-Speaker of the House Paul Ryan proposed a federal HRP budget of $25 billion over a 10-year period...or $2.5 billion/year on average. Even if that kept pace with inflation it would still only be perhaps $3.2 billion/year today...or 1/70th as much as would actually be required.

In fact, many states already had HRPs prior to the Affordable Care Act...and instead of properly funding them, states implemented all sorts of restrictions and exclusions in order to keep them operational, as KFF pointed out in 2017:

Pre-existing condition exclusions – Nearly all state high-risk pools excluded coverage of pre-existing conditions for medically eligible enrollees, usually for 6-12 months. This made coverage less attractive for people who needed coverage specifically for their pre-existing conditions.

(Yes, that's right...even the high-risk pools, designed specifically for those with pre-existing conditions...denied those with pre-existing conditions from enrolling for up to a year. Tough luck if you've been diagnosed with a type of cancer which will kill you in less than a year without treatment).

Lifetime and annual limits – Thirty-three pools imposed lifetime dollar limits on covered services, most ranging from $1 million to $2 million. In addition, six pools imposed annual dollar limits on all covered services while 13 others imposed annual dollar limits on specific benefits such as prescription drugs, mental health treatment, or rehabilitation.

...A small number of states capped or closed enrollment to limit program costs, though enrollment caps were not allowed for HIPAA-eligible individuals. Limiting enrollment, directly or indirectly, was a key strategy to limit the cost of high-risk pools to states. By design, all state high-risk pools experienced net losses – that is, expenses greater than premium revenue.

There’s a simple reason why GOP loves high risk pools: Even if the total dollar amount remains the same, they can cut funding to HRP, sentencing those 10% to their doom without raising rates on everyone else. Isolate ‘em from the herd. It’s clever if you have no soul.

This leads to another important point: We're assuming that the total cost for all ~24 million people would remain the same, meaning the other 21.6 million would see their costs drop from $13.5K to $4.5K...a 67% reduction, right?

Well...not necessarily. The ACA includes the 80/20 Medical Loss Ratio provision which requires insurance carriers to spend at least 80% of premiums on actual healthcare costs, as opposed to CEO bonuses, marble floors for their headquarters or exotic corporate junkets to Tahiti. Given that Trump & Vance love to crow about eliminating industry regulations and letting the "invisible hand of the free market" take over, you can bet that the MLR would be among the first to go, in which case there's no federal guarantee that there'd be anywhere close to that much in savings for the "lucky" 90%.

Back in 2017, ACA historian Steven Brill was interviewed by Lawrence O'Donnell regarding High Risk Pools. Crooks & Liars has the video & full transcript, including this key point about High Risk Pools:

BRILL: It's ridiculous. Besides the issue with health care, as Dr. Dean knows, is not the insurance companies because they pay for health care, the issue is the price of health care that we pay as patients and that insurance companies pay.

The other thing I think they're gonna do and I think we need to educate everyone in the country though, beware of three words "high-risk pools." That's what they are going to sell. They are going to provide "insurance for everybody" by putting people who are sick and with pre-existing conditions into high-risk pools. That's exactly what was done before Obamacare.

There were waiting lists. There were caps on coverage, $50,000 a year, $100,000 lifetime, depending on the state. Everybody had to pay premiums of 150, 200% more than everybody else. If you take all the sick people and put them into one pool and the healthy people in another pool, the healthy people get lower premiums because they are in a pool with just healthy people but sick people suffer and that's the opposite purpose of insurance which is to spread the risk. That's the scam of high-risk pools. It never worked.

There's one more thing to keep in mind about the "High Risk Pool" concept, whether at the state or federal level:

Even if they were fully & properly funded on a continuous basis (which everything in history tells us they wouldn't be), keep in mind that the only way to be able to "separate out the sick from the healthy" would be to go right back to individual medical underwriting...ie, having to provide your complete medical history & healthcare status to both the insurance carriers AND the federal government.

Even setting aside HIPAA and other medical data privacy concerns, I can't imagine that anyone wants to have to go back to doing all the legwork on that again.

I dunno...maybe JD Vance does. He sure does seem interested in knowing what every woman's menstrual cycle is, anyway.