UPDATED: Here's the most important things to remember for 2018 Open Enrollment...

1/2/17: I've updated these a bit...

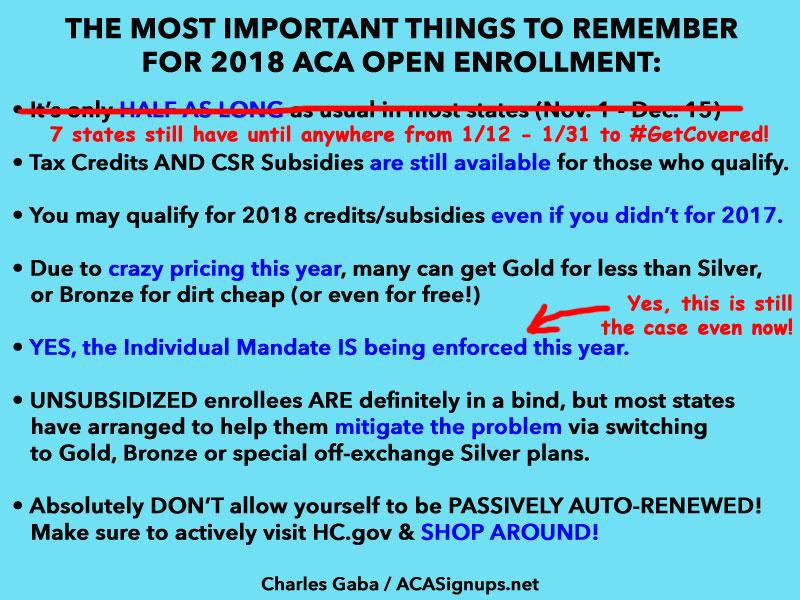

#1: The 2018 Open Enrollment Period is only half as long as usual in most states!

In the 39 states run via HealthCare.Gov, as well as in Maryland, Idaho and Vermont, Open Enrollment runs from Nov. 1, 2017 to Dec. 15, 2017, for coverage starting January 1, 2018...period.

- In the other 11 states (+DC), the deadline to enroll for 2018 coverage is later...but the final dates range from Dec. 22nd (CT) to as late as Jan. 31 (CA, DC & NY).

UPDATE: As of January 2nd, 2018, there are 7 states where Open Enrollment is still ongoing:

- California: Jan. 31st

- Colorado: Jan. 12th

- District of Columbia: Jan. 31st

- Massachusetts: Jan. 23rd

- Minnesota: Jan. 14th

- New York: Jan. 31st.

- Washington State: Jan. 15th

#2: BOTH types of Tax Credits/Subsidies ARE STILL AVAILABLE for those who qualify!

- Yes, Donald Trump pulled the plug on reimbursing insurance companies for "Cost Sharing Reduction" (CSR) payments, but enrollees who qualify for CSR help will still receive it.

- The insurance companies are therefore raising premiums to cancel their CSR losses out, which is bad if you don't receive tax credits, but...

- If you do receive tax credits, those are increasing as well to cancel out the increased premiums, which means...

- If you receive tax credits, you'll probably end up paying about the same or you could end up saving money in the end.

#3: You may qualify for Tax Credits in 2018 even if you didn't in 2017...and it can make a BIG difference:

- ACA tax credits are based on the Federal Poverty Line, which is increasing by several hundred dollars in 2018.

- Since the threshold for tax credits is 4x the FPL, the income cut-off for tax credits is actually increasing by up to $1,000 or more.

- That means that if your household income is only a little over the 400% FPL line in 2017 and doesn't change much, you may end up qualifying in 2018 after all.

- This year in particular, this could potentially mean the difference between paying $1,200 less or $2,100 more for the exact same policy!

- Therefore, it's vitally important that everyone visit HC.gov (or their state exchange website) & plug in their projected 2018 info to see whether they qualify or not.

#4: Because of the wacky CSR payment situation above, you may get a Gold plan at a bargain or a Bronze plan at a steal!

- As I explain here, most states have loaded the full CSR cost onto Silver plans only. This means that Bronze & Gold plans will only go up the normal amount, while Silver plans will go up a lot...

- ...but the tax credits (for those eligible) will also go up a lot to match the Silver increase, and those credits can be applied to any exchange plan...

- ...which means subsidized enrollees may end up getting a Gold plan for less than Silver, or a Bronze plan dirt cheap (or even free!).

- SHOP AROUND!

#5: Yes, the Individual Mandate *IS* being enforced this year.

- Within hours of taking office back in January, Trump made a big show of signing an Executive Order which basically told the entire executive branch of the federal government to blow off enforcing various ACA provisions, including the individual mandate penalty for not having qualifying healthcare coverage.

the I.R.S. will reject your tax return when filed electronically if you do not complete the information required about whether you have coverage, including whether you are exempt from the so-called individual mandate or will pay the penalty. If you file your tax return on paper, the agency said it could suspend processing of the return and delay any refund you might be owed.

- The financial penalty for not having adequate coverage in 2018 is the same as this year: Either $695/person ($347.50 for kids) or 2.5% of your household income, whichever is larger.

- There's an exception to the penalty if the lowest-cost Bronze plan available costs more than 8.16% of your income after tax credits are applied.

UPDATE: YES, the mandate is still in place for 2018 even with the new tax bill (which included mandate repeal) being signed into law. The mandate repeal doesn't go into effect until 2019.

#6: Unsubsidized enrollees are in a bind...but there's ways of mitigating the problem for most.

- If you earn more than 400% FPL, you're likely going to have to pay either 16% or 30% more on average for the same policy next year, depending on whether or not you have to pay the extra CSR surcharge due to Trump cutting off payments.

- However, 20 states have taken special measures so unsubsidized enrollees in Silver plans can avoid the extra CSR hit by switching to special off-exchange Silver plans (or switching to Bronze or Gold)

- In addition, 18 more states have set things up so unsubsidized Silver enrollees can avoid the CSR hit by switching to Bronze or Gold.

#7 Whatever you do, DON'T allow yourself to be PASSIVELY AUTORENEWED!

- Again, the plans, pricing and tax credit formula are gonna be all over the place this year, resulting in some Gold plans being cheaper than Silver, some Silver plans being crazy-expensive, and some Bronze plans being dirt cheap or costing nothing at all.

- That means that anyone who doesn't actively log into their account at HealthCare.Gov, CoveredCA.com, etc. and actively pick the plan they want next year could end up missing out on hundreds or thousands of dollars in financial help, a better-value plan, or both.

- Therefore, I'll say it again: SHOP AROUND!

I'll add a few more things to this list throughout the day, but in the meantime, it's once more into the breach...