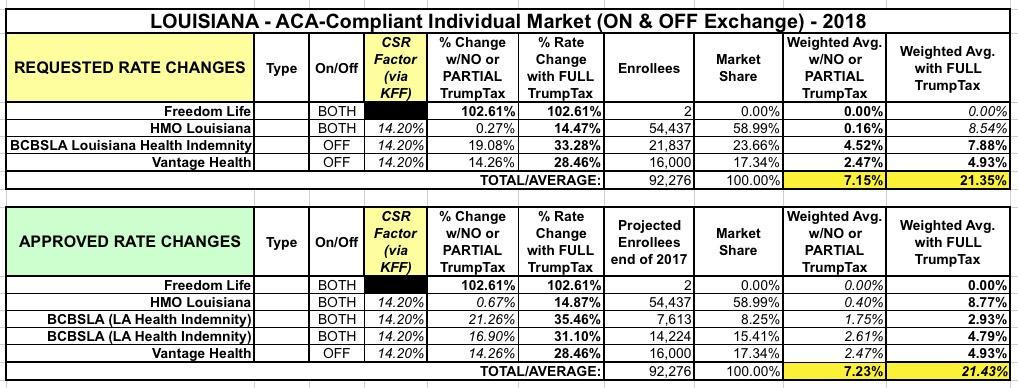

Louisiana: APPROVED rate hikes: 7.2% if CSRs *are* paid, 21.4% if they *aren't*

Louisiana was one of the last states I ran rate hike analysis on just a month ago: Three carriers on the exchange (plus the "Freedom Life" phantom carrier), averaging around 21.4% rate increases on the assumption that CSR payments won't be made. According to the Kaiser Family Foundation, loading CSRs onto Silver plans only would bump them up by an additional 20 points; this translates into roughly 14.2 points if spread across all metal levels on & off the exchange. Based on that, I estimated LA's rate increases at 21.4% without CSRs but only 7.2% if they actually are paid.

Thanks once again to Louise Norris for doing the grunt work regarding the approved rate changes, which are...pretty much identical to what was requested by the carriers:

Proposed 2018 rates much higher than they would have been if CSR funding had been appropriated early in 2017

- Blue Cross Blue Shield of Louisiana: 35.46 percent for Blue Saver (7,613 members as of April 2017) and 31.1 percent for Blue Max (14,224 members as of April 2017). Total BCBSLA individual ACA-compliant membership is under 22,000 in 2017, down from more than 59,000 in 2016.

- HMO Louisiana: 14.87 percent. HMO Louisiana had 54,437 members as of early/mid-2017.

- Vantage Health Plan: 28.46 percent. Vantage Health Plan has roughly 16,000 members.

All three insurers have based their rate proposals on the assumption that cost-sharing reductions will not be funded by the federal government in 2018. This has become the primary issue for consumer advocates, insurers, and governors as open enrollment draws closer, and they have been calling on Congress to appropriate funding for cost-sharing reductions (CSRs) as soon as possible.

...The anticipated lack of enforcement of the individual mandate is another factor that is driving rates higher in 2018; if the Trump Administration had committed to enforcing the individual mandate, the rate changes for 2018 would also be more modest.

One other noteworthy item: While everything below is exactly what folks like Norris, myself and other healthcare wonks have been expecting all along, this is the first time I've heard an insurance dept. representative state it outright:

If CSR funding is allocated, rate overcharge will be reimbursed starting in 2019, via MLR rebates

...The Department of Insurance noted that if the proposed rates are implemented and CSR funding is provided throughout 2018 by the federal government, the situation would be worked out via the medical loss ratio rebates. If CSR funding continues, the rates for 2018 would be too high in Louisiana, and would result in the insurers spending less than 80 percent of premiums on medical costs. To fix the problem, the amount that was overcharged is rebated to enrollees, although rebate checks based on 2018 coverage wouldn’t start to be sent to plan members until the fall of 2019 (rebates sent in the fall of 2019 would be based on insurers’ average medical loss ratios from 2016-2018).

...although the difference would eventually be sorted out if CSR funding continues, consumers would be on the hook for the higher premiums throughout 2018, and wouldn’t see a rebate until well into 2019.

This is almost certainly the perspective being taken by many insurance departments: Since the 80/20 MLR requires carriers to pay back any overcharges anyway, for the most part they're letting carriers jack up rates significantly for 2018 knowing that if CSRs do end up being paid, they'll have to pay the balance back later on regardless. It's a bit of a sloppy way of handling it, but under the circumstances it's the most reasonable workaround (and a strong argument in favor of keeping the MLR rule!)

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.