Hmmmm...CMS bumps 2018 filing deadline out to Sept. 5th...

This strikes me as rather ominous...

Date: August 10, 2017

Title: Information on Risk Adjustment Methodology and Rate Filing DeadlinesQuestion: What changes will be made to the risk adjustment methodology to account for recent rating practices that assume issuers of silver-level QHPs facing increased liability for enrollees in cost-sharing reduction plan variations?

Answer: At this time, there have been no changes regarding HHS’s ability to make cost-sharing reduction payments to issuers. The HHS risk adjustment methodology currently assumes that plans that provide cost-sharing reductions receive compensating cost-based payments from the Federal government. Many state departments of insurance (DOIs) have permitted issuers to increase rates for their silver metal level plans for the 2018 benefit year in order to account for uncompensated liability that issuers may face for cost-sharing reductions provided to eligible insured individuals. As a result, CMS intends to propose a modification to the HHS risk adjustment methodology in future rulemaking for states in which all marketplace issuers increase silver metal plan rates to account for cost-sharing reduction payments in this manner.

The HHS risk adjustment methodology currently assumes that plan liability for cost-sharing plan variations reflects actuarial value of 70 percent. We intend to propose adjustments to the methodology for the individual market to reflect the assumption of greater plan liability in states that make this rating change. Beginning for the 2018 benefit year, we intend to propose to apply the platinum metal tier risk adjustment model coefficients for the 87 percent and 94 percent cost-sharing reduction plan variants. For the risk adjustment transfer formula, we intend to propose considering the 87 percent and 94 percent silver plan variants (as well as the limited cost-sharing and zero cost-sharing variants) to have plan metal level actuarial values of 0.9 in order to account for the higher relative actuarial risk associated with these plans. We would also propose to apply the platinum level induced demand factor of 1.15 for these same variants in the transfer formula. Additionally, we would propose to not apply the CSR adjustment factors to the risk score calculations for enrollment periods beginning on and after January 1, 2018, because the platinum plan coefficients already account for the induced utilization associated with the platinum level of benefit. We would propose to continue to use the silver model coefficients and transfer formula factors for enrollees in 73 percent CSR plan variations and treat these as basic silver plans. We would propose to apply this policy to all risk adjustment covered issuers in the individual market in States where HHS operates risk adjustment.

This may all sound like gibberish, but it sounds to me like CMS is basically saying that for 2018, they're going to effectively treat CSR Silver plans as if they're Platinum plans for risk adjustment program purposes, which makes sense if the total cost of the missing CSR funding is loaded onto silver plans only.

In short, it sure sounds like CMS is smoothing the way for CSR reimbursement payments to be killed this month, which would set the stage for California (and hopefully other states) to attempt to implement the Silver Switcharoo gambit.

Failing that, as long as they at least load all CSR costs onto Silver plans only, this would at least mostly mitigate the damage. Bronze, Gold and Platinum enrollees would only see the normal rate hikes, and subsidized Silver enrollees shouldn't see much change at all. The ones who would be screwed by the rate hikes would be unsubsidized Silver enrollees both on & off the exchange...which unfortunately would still be several million people.

Question: Given these requests from the States, will CMS provide further flexibility on filing deadlines to permit issuers to account for these rating changes?

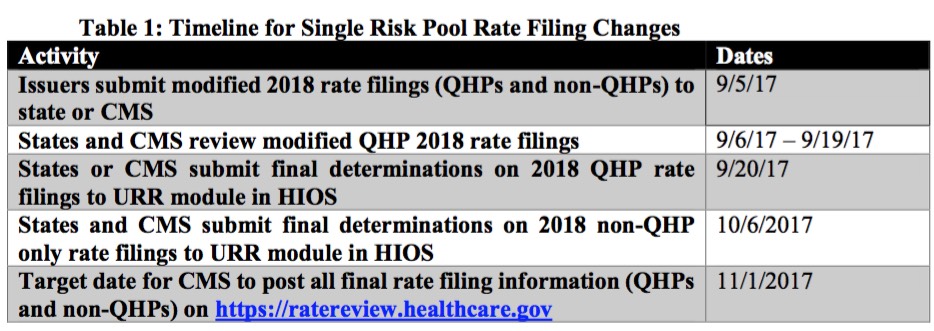

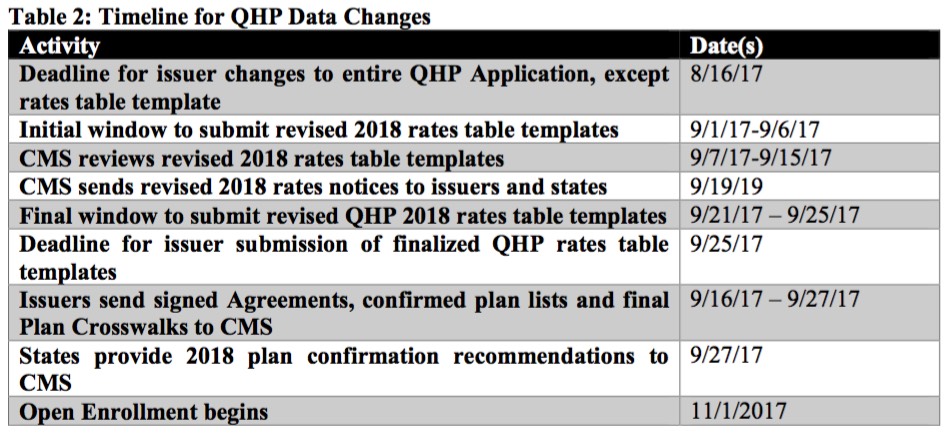

Answer: Yes, in order to provide consistency to such requests, the updated filing deadlines for single risk pool coverage are set forth below. All applicable parts of the Rate Filing Justification should be submitted as outlined in Table 1, including the Unified Rate Review Template (URRT), the Actuarial Memorandum and, if any of the plans have a rate increase of 10 percent or more, the Consumer Justification Narrative. These new timelines do not apply to standalone dental plan (SADP) issuers.