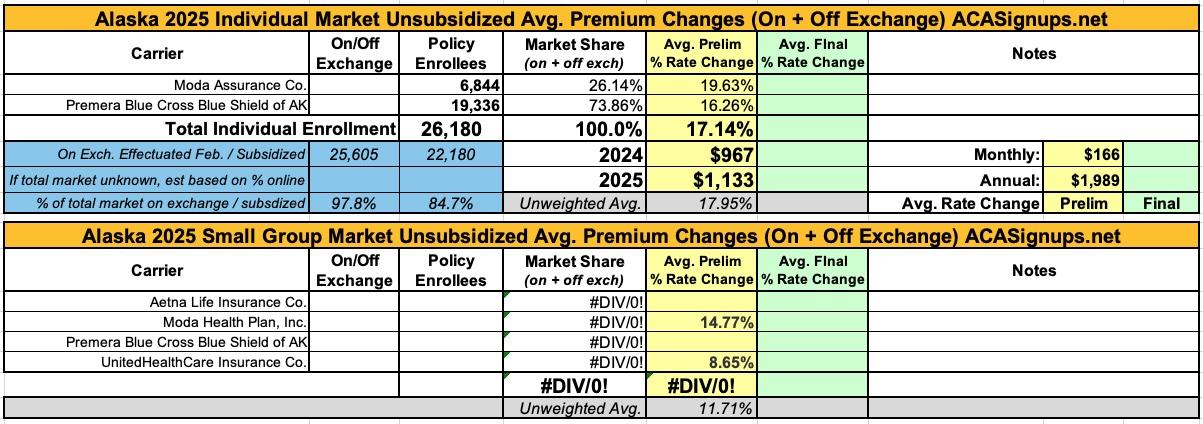

Alaska: Preliminary avg. unsubsidized 2025 #ACA rate changes: +17.1%

Alaska is a sparsely populated state with only two carriers on their individual market and four on their small group market. Alaska's insurance department website is useless when it comes to getting rate filings or enrollment data; I had to use the federal Rate Review site to even get the requested rate changes.

Fortunately, both carriers (Premera Blue Cross and Moda Health Plan) include summaries which list their current enrollment data. Unfortunately, the average rate increase being requested by the carriers for 2025 is up another 17%. While nearly all ACA exchange enrollees receive financial subsidies, this is still pretty steep for the few who aren't.

From Premera's summary:

The rate increase is primarily due to medical and pharmacy costs and utilization inflation and renewal claims experience that is running more adversely than assumed in the current rates. Shown at the end of this document is the 3-year financial results. In 2023, Premera reported a financial loss of -$12.3M for this block.

The rate increase would have been -6.2% higher if not for the removing of the 80% UCR requirement for out-of-network (OON) providers. The savings assumed the proposed out of network reimbursement of 300% of CMS for ESRD claims and 185% of CMS for all other OON services. This matches the current reimbursement rates provided to out of network providers for our Washington book of business (outside of Alaska).

The other main contributors to the rate increase are the med/Rx claims trend of 9.6% and an 8.8% adjustment for the change in morbidity of members that choose to renew or purchase coverage with Premera.

From Moda's summary:

The proposed rate change varies by product and plan. The minimum is 17.27%, and the maximum is 24.22%. The current members impacted by the proposed rate change is 6,844, and the projected average members impacted by the proposed rates in 2025 is 7,000.

...The annual expected change in medical and pharmacy service costs is 8.1%. The annual expected change due to cost inflation is 6.7%, and the annual expected change due to increased utilization is 1.3%.

On the small group market, the unweighted average increase is 11.7%...for the two carriers which appear on the federal rate review site. For some reason neither Aetna nor Premera show up in the AK small group market at all. Not sure if they're both pulling out or if they just haven't been uploaded to the database yet.

Update 9/19/24: I've cleaned up the spreadsheet with the correct 2024 average unsubsidized premium, as well as adding the February 2024 effectuated enrollment data. Based on this data, a whopping 98% of Alaska's individual market appears to be exchange based, and 85% of it is subsidized.