New York: *Final* avg. unsubsidized 2025 #ACA rate change: +12.7%; CSR expansion to 400% FPL confirmed!

Originally posted 6/13/24

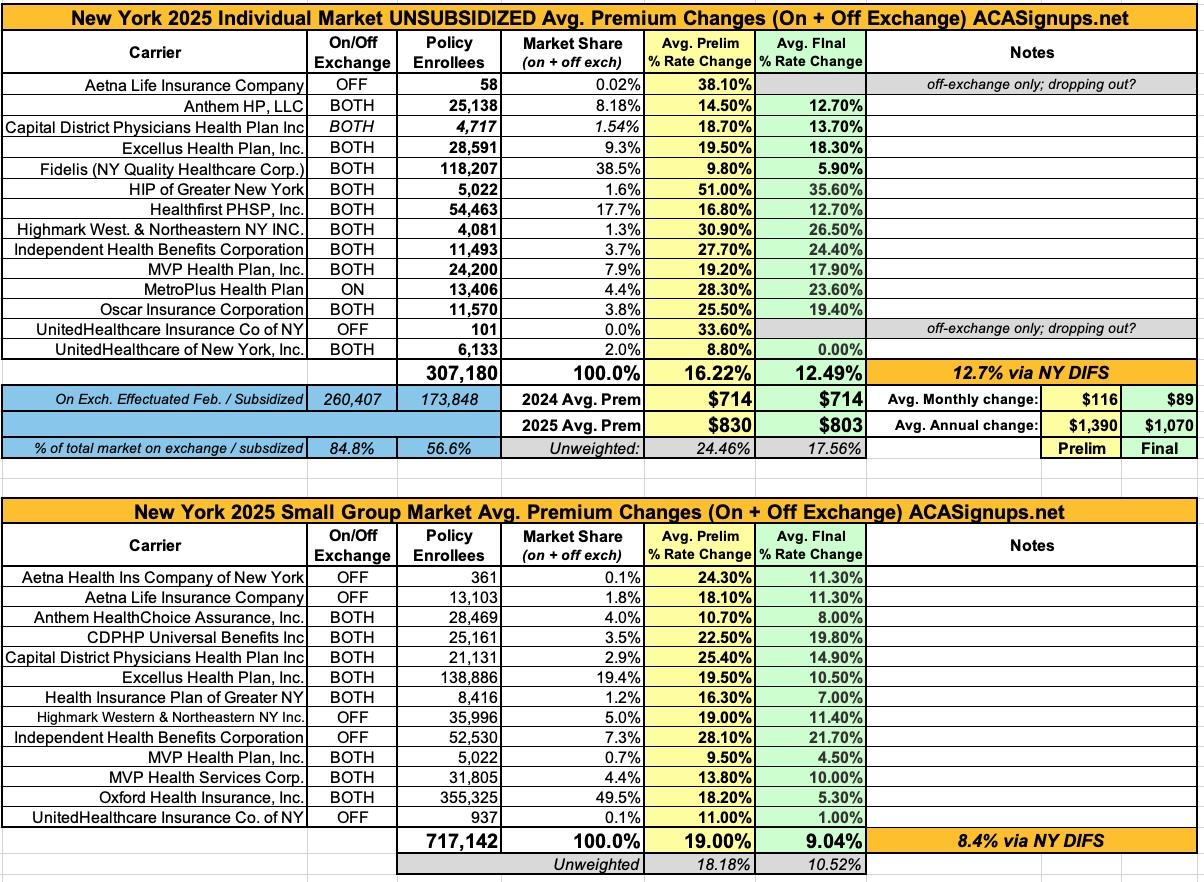

Via the New York Dept. of Financial Services, the preliminary, weighted average rate increases being requested for individual market health insurance policies for 2025 sound bad: 16.6% overall according to DIFS. I get a slightly lower weighted average of 16.2%, but it still ain't pretty.

Two of the highest increases are for carriers which are only offering policies off-exchange next year and which have fewer than 100 enrollees each anyway (Aetna and UnitedHealthcare Insurance Co. of NY); I assume they're both winding down their operations in the state.

As for the rest, they range from requested average increases of "only" 8.8% for the other UHC division to a stunning 51% rate hike by Emblem (HIP). The justification summaries are below the table.

It's important to remember that these are not final rate increases--New York in particular has a tendency to slash the requested rate hikes down significantly before approving them.

NY's Small Group market is looking at high preliminary rate hikes as well, averaging 19% overall. Again, these are preliminary only.

UPDATE 9/23/24: NY DIFS has published the final, approved rate changes for unsubsidized premiums for 2025, and as usual, they've dramatically reduced the often sky-high increases initially requested by the carriers (although the final hikes still aren't pretty in most cases):

Individual Market

Insurers requested an average rate increase of 16.6% in the individual market, which DFS cut by 23% to 12.7% for 2025, saving consumers $87 million. These rates will be further reduced for many consumers who are eligible for federal tax credits available through NY State of Health. Approximately 65% of individuals who are currently enrolled in a Qualified Health Plan through NY State of Health receive the federal premium tax credits to lower the costs of premiums. Approximately 260,000 New Yorkers are currently enrolled in individual commercial plans. These rate decisions do not include the Essential Plan, available through NY State of Health, which is available at no premium to lower-income New Yorkers who qualify. Currently, more than 1.3 million New Yorkers are enrolled in the Essential Plan.

This is kind of interesting, because the actual total policy enrollment numbers according to NY DIFS's own records show total NY individual market enrollment at over 307,000...although 260K of that is on the NYSoH exchange, which is what I assume they're referring to. This also jibes with the 65% subsidized figure, which is indeed very close to the 66.8% of on-exchange enrollees who are subsidized.

Small Group Market

Over 700,000 New Yorkers are enrolled in small group plans, which cover employers with up to 100 employees. Insurers requested an average rate increase of 18.6% in the small group market, which DFS cut by 55% to 8.4% for 2025, saving small businesses $766 million. A number of small businesses also will be eligible for tax credits that may lower those premium costs even further, such as the Small Business Health Care Tax Credit.

I have slightly different calculations here as well...19% requested, 9.0% approved, but whatever.

From some of the individual carrier narrative summaries:

FACTORS CONTRIBUTING TO THE PROPOSED RATE INCREASE

Escalating Health Care Costs

The cost of health care services and equipment continues to be the primary reason for rate increases. A report by Mercer shows health care cost grew by 5.2% in 2023 and projects another sharp increase for 2024 as the impact of inflation continues to phase in with healthcare provider contract renewals.

Health care cost and spending trends reflect underlying changes in the demographics and health status of America’s population. The aging population is driving some of the increase – as people age, they typically utilize more health services. Between 2010 and 2050, the population aged 65 and older is expected to double, as the “baby boomer” population ages and life expectancy continues to rise . Indeed, the first baby boomers have now turned seventy and the percentage of workers over 65 is greater than at any period in history. As this population ages it will correspond to a further escalation of costs. Moreover, the country’s general declining health and the increase in obesity and other health concerns, even at younger ages, forces average costs upward.

Hospital

Hospitals (inpatient and outpatient care) account for the largest share of the health care premium dollar in New York, a percentage that continues to grow. Factors driving this growth include increasing demand for care, rising costs to hospitals of the goods and services needed to provide care, and the growing intensity of care needs.

Prescription Drugs

Specialty drugs account for one of the biggest health benefit cost drivers. A report by Mercer explains that in 2023, the pharmacy benefit cost jumped 8.4% on average. 2023 shows sharp increases in cost and utilization of diabetic and weight loss drugs. Additionally, specialty drug trends are expected to increase as more breakthrough gene and cellular products enter the market.

FACTORS CONTRIBUTING TO THE PROPOSED RATE INCREASE

Escalating health care costs

The cost of health care services, equipment and products continues to be the primary reason for rate increases.

Medical cost “trend” is a very important consideration in determining the need for a premium rate adjustment. This “trend” is the anticipated change in the cost to treat patients year over year. Upstate New York is not immune to national trends in health care costs given our state’s population and demographics. The trend forecast below takes into account projected increases in costs attributed to what Excellus Health Plan pays out in claims expenses for hospital inpatient and outpatient care, professional services, pharmacy benefits, and other goods and services. The health plan’s anticipated changes in annualized medical benefit spending are summarized as follows:

- Hospital inpatient, small group: 10.5% / individual: 11.5%

- Hospital outpatient, small group: 14.1% / individual: 12.5%

- Professional services, small group: 6.4% / individual: 7.8%

- Pharmacy, small group: 11.6% / individual: 8.4%, including:

- Specialty Rx, small group: 14.3% / individual: 10.6%

- Diabetic Rx, small group: 14.0% / individual: 13.7%

- Other medical goods and services, small group: 5.8% / individual: 8.7%

Rising drug prices are having a significant impact on overall medical spending trends. Substantial savings have been achieved over the years with broad acceptance of competitively manufactured generic medicines. However, the savings trend associated with generics is being eclipsed by another trend around the rising cost and utilization of specialty medications including biologics. Every year more and more highly complex specialty medications are approved by the FDA to treat both rare and sometimes more common diseases. Specialty medications are used by approximately 2 percent of our members, but they account for more than 50 percent of total drug spend. Drug trend is a result of both increased utilization and increased unit cost.

Local hospital systems have been challenged financially due to both economic inflationary pressures as well as staffing shortages. Excellus Health Plan has responded to these provider challenges through additional contractual cost increases for our provider systems, resulting in more spending for hospital services. The impact for drug rebate credits and non-system claims’ trends is applied to the base trends above. This further reduces the base trend by 1.0 percent for small group and 1.4 percent for individual.

New York Quality Healthcare Corporation (Fidelis):

Why are rates changing?

Each year, Fidelis Care is required to review its experience and determine whether a change in premium rates is necessary. Fidelis Care files suggested premium rates with the DFS for evaluation.

When deciding how to change premium rates, Fidelis Care assesses its recent experience and current situation, and estimates how much medical costs will change in the future.

Having recently completed this evaluation, Fidelis Care is requesting the premium increases that appear in the attached Exhibit 13a. If approved, the increases will be added to the 2024 premium starting January 1, 2025. The rate increase affects 87,378 policyholders and 118,207 members.

It is important to note that your final premium increase or decrease will likely differ from the initial letter you received, which represents a requested but not yet approved premium adjustment. Please contact us to confirm your final rates. Most Fidelis Care members receive premium subsidies from the Federal government which lower their overall cost. These subsidy levels depend on family income, size, and premium rates of other issuers.

Fidelis Care’s rate filing is driven by six primary considerations:

- Adjustment from actual to expected experience

- Anticipated higher medical and pharmacy costs and greater use of services by our members

- Risk Adjustment transfer payment that considers the level of illness of our members

- Various new initiatives from Fidelis Care to reduce claims cost

- Changes in the age and gender of those we cover as well as their level of health and wellness

- Initiatives to improve operational efficiency

Based on the drivers of the premium changes listed above, we will increase the rate by approximately 9.8% from 2024 to 2025. Rate increases may also vary by metal plan and region. Plan variation is based on differences in cost-sharing, not differences in health status. For both plan and region, the variation is based on actual Individual Market experience.

Fidelis also includes an interesting tidbit related to New York's expansion of their Basic Health Plan program (the Essential Plan) to people earning 200 - 250% FPL:

The following items are not included in the 2025 rate development since insurers will be reimbursed for these items either directly from federal pass-through funds or via the Insurer Reimbursement Implementation Plan (IRIP):

1. The migration of the 200-250% FPL population from the Individual Market to the Essential Plan (EP).

2. The elimination of cost sharing associated with insulin (Applies “On” and “Off” the Exchange to all income levels.

3. New subsidies that eliminate cost sharing associated with diabetes benefits (Applies to Individual “On” Exchange only to all income levels)

4. New subsidies that eliminate cost sharing associated with maternity benefits (Applies to Individual “On” Exchange only to all income levels).

5. Revised income limits (up to 400% FPL) for the purchase of existing silver CSR plan variations (i.e., 87% Silver CSR and 94% Silver CSR – Applies to Individual “On” Exchange only).

Whoa...this last bullet caught my eye, as it certainly seems to confirm the story I wrote back in April:

Having said that, this buried lede in a Politico Pulse article (thanks to Andrew Sprung for the catch!) about the just-enacted BHP expansion should raise some eyebrows:

To further increase affordability using those pass-through funds, New York plans to implement cost-sharing subsidies for enrollees in qualified health plans earning up to 400 percent of the federal poverty line starting next year, New York State of Health Executive Director Danielle Holahan said in an interview.

Whoa. That's another BFD if it actually happens. CSR assistance is generous for enrollees earning up to 200% FPL and nominal for those earning up to 250% FPL...all of which is irrelevant in New York due to the current BHP expansion.

Around 100,000 of New York's on exchange QHP enrollees earn 250 - 400% FPL. I'm assuming the breakout will be 250 - 300% FPL for 94AV and 300 - 400% FPL for 87AV.

According to KFF, as of 2023, the average 94 AV CSR plan cut down deductibles by nearly $5,000, while the average 87 AV CSR plan cut them down by around $4,200, so this will be a pretty Big F*cking Deal for those New Yorkers!

Healthfirst is applying for a rate adjustment to account for marketplace trends and to reflect actual and anticipated claims costs. While several market forces continue to drive health care costs higher more generally, Healthfirst continues to strengthen the effectiveness of its care management and quality improvement programs and robust network.

Healthfirst is requesting a higher rate for 2025 because several market forces continue to drive health care costs higher. These forces include:

- Cost and utilization increases for inpatient hospital, outpatient hospital, and physician services of approximately 6%.

- Cost and utilization increases for prescription drugs, including the increased use of expensive specialty prescriptions of approximately 8%.

Healthfirst has requested a rate increase of 16.8% for Region 4, which is composed of the five counties of New York City (Bronx, Kings, New York, Queens, Richmond), Rockland County, and Westchester County and for Region 8, which comprises Long Island (Nassau County and Suffolk County)

Premium rates are changing due to the following reasons:

- The rising cost and utilization of medical services and prescription drugs (+8.5%)

- A change in claim projection from the prior year which includes the impact of changes in anticipated payments/receipts in the Federal Risk Adjustment Program (+9.2%)

- A change in non-claim expense items including taxes and fees (+0.5%)

- A change in the covered benefits mandated by the State of New York (+0.1%)